Chassis domain controller research: full-stack independent development, or open ecosystem route?

Chassis domain consists of transmission, driving, steering and braking systems. Conventional vehicle chassis fail to fit in with the development of vehicle intelligence and autonomous driving, and need chassis-by-wire transformation. Vehicle chassis tend to be electronic, modular and intelligent. Mechanical decoupling is a prerequisite for chassis technology upgrade. Yet in conventional chassis, braking and steering are mechanically coupled, that is, their power source is the mechanical force from drivers who control terminals with the force amplified by hydraulic pressure. In the process of intelligent evolution, the key to chassis electronics however is to enable the decoupling of the mechanical force and replace it with motor drive, so as to improve the control accuracy and also realize better combination of human and systems.

In addition to mechanical decoupling, chassis also need software and hardware decoupling. Conventional electronic chassis systems are divided by components such as electronic stability control system (ESC), electric power steering system (EPS) and electronically controlled suspension system. Each subsystem is from different suppliers or different development departments of OEMs, and has an independent vehicle power control system and vehicle dynamic control model. In the development of chassis controllers, all of which triggers such problems as strong coupling relationship between software and hardware, repeated research and development and high development cost, and countervailing negative effect between subsystems, making optimal vehicle control unreachable.

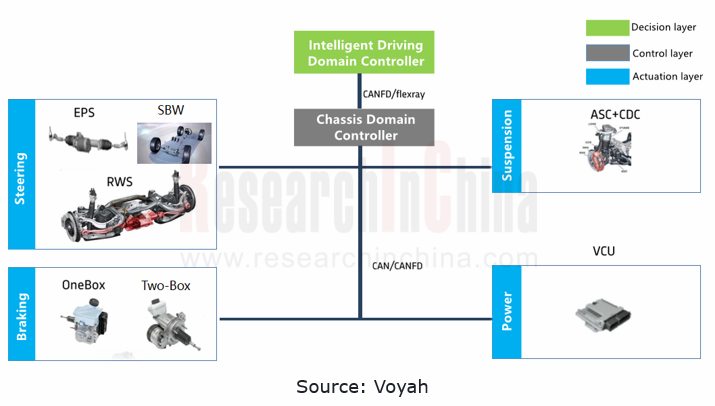

To answer the current needs for new vehicle technologies and new functions, intelligent chassis domain controllers come into being. In the field of highly automated driving, chassis domain controller products are more needed to enable the centralized control of steering, braking, suspension and even power systems, and separation of software and hardware, as well as the transverse, longitudinal and vertical coordinated control of vehicles, better serving intelligent driving.

There are two chassis domain controller technology development routes: the full-stack self-development route of some OEMs, and open ecosystem route of represented by Tier 1 suppliers.

Volkswagen MEB platform uses three controllers to control the whole vehicle and enable functions. The ICAS1 vehicle control domain controller combines many functions including body control management, drive system management, driving system management, power system management, and comfort system management, and integrates body, power and chassis domains into one domain controller.

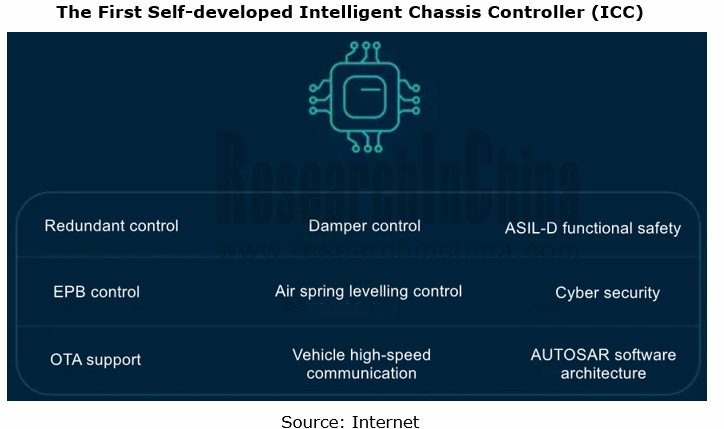

In 2022, NIO introduced its Intelligent Chassis Controller (ICC) when launching ET7. The ICC enables design and adjustment of chassis in all aspects of comfort, maneuverability and drivability and integrates control functions such as "redundant parking, air suspension and shock absorber". This controller also supports cross-domain integrated high-level automated driving scenarios. FOTA updates allow its flexible, quick iterations. The controller of NIO can uniformly adjust and control air spring leveling, shock absorber damping, electronic parking brake and other capabilities.

As concerns the open ecosystem route, chassis domain controllers pose high technical barriers, and there are few mass-produced solutions. At present, Tier 1 suppliers work on single/multi-subsystem development (domain) controllers for chassis subsystems. For example, Keboda Technology has shipped in batches its DCC (dynamic chassis control) that supports Xpeng Motors. This controller is designed to enable the dynamic control of suspensions. The two mainstream products of Suzhou Gates Electronics, i.e., continuous damping dynamic suspension electrically controlled system and air suspension electrically controlled system, are also used for suspension control.

In terms of integrated control of chassis systems, Chinese suppliers still need to learn from world-renowned Tier 1 suppliers.

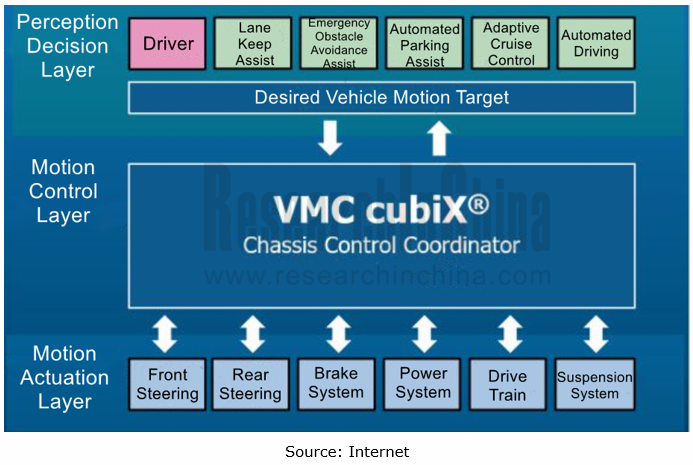

ZF's Integrated Brake Control (IBC), a brake-by-wire system, combines the brake-by-wire active rear axle steering Active Kinematics Control (AKC) and the active damping system (sMotion), bringing longitudinal, transverse and vertical safety and comfort experience. Recently, ZF’s front-axle steering, the most important component for vehicle steering systems, has also enabled drive-by-wire decoupling of software and hardware. All actuation systems are uniformly controlled by cubiX platform. cubiX is an integrated software suite for vehicle motion control, coordinating all the aforementioned actuators and sensors related to vehicle motion.

ZF's VMC cubiX gathers sensor information from the entire vehicle and environment, and prepares it for an optimized control of active systems in the chassis, steering, brakes and propulsion. Meanwhile, following a vendor-agnostic approach, cubiX can support both ZF and third-party components.

In the disruption of intelligent vehicle industry, the only constant is change. Either full-stack independent development or open ecosystem route has its own market space. There is still a wide gap between Chinese chassis (domain controller) Tier 1 suppliers and their foreign counterparts. Fortunately, chassis intelligence is bound up with vehicle electrification. Chinese OEMs have a leading edge in electrification, providing a golden opportunity for these Chinese players and drawing talents who serve Tier 1 suppliers at abroad back into domestic companies.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...