Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automakers reshape their vehicles, a third living space in which technology, intelligence, comfort and emotion are the main themes. Automotive intelligent lighting components such as intelligent headlights and ambient lights will better meet the personalized needs of consumers. Intelligent and emotional automotive lighting systems open up a new space for vehicle intelligence.

Automotive lighting intelligence is not only reflected in the upgrade of people-vehicle interaction enabled by headlights and taillights, but also in the rapider penetration of automotive ambient lights and the intelligence of interior lighting for delivering better driving experience. This report aims to analyze the development trends of automotive lighting intelligence in China through introducing the intelligence routes of major automotive lighting manufacturers and the features of intelligent lighting systems for key vehicle models of OEMs.

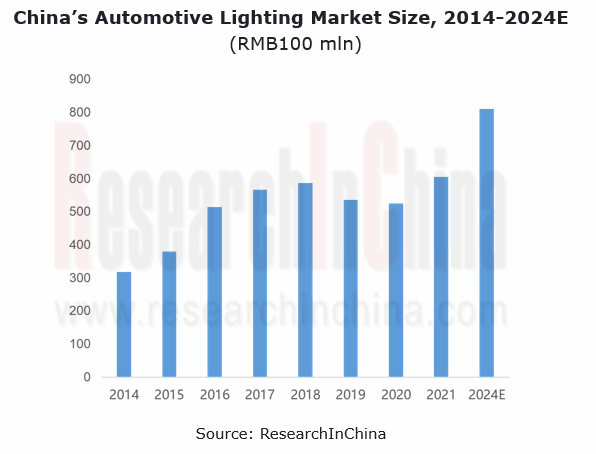

China’s automotive lighting market was worth RMB60.45 billion in 2021, jumping by 15.2% year on year. As the pace of automotive lighting intelligence accelerates and the value of intelligent lighting per vehicle rises, we predict that China’s automotive lighting market will be valued up to RMB80.9 billion in 2024.

Global market: Chinese lighting companies have a long way to go overseas

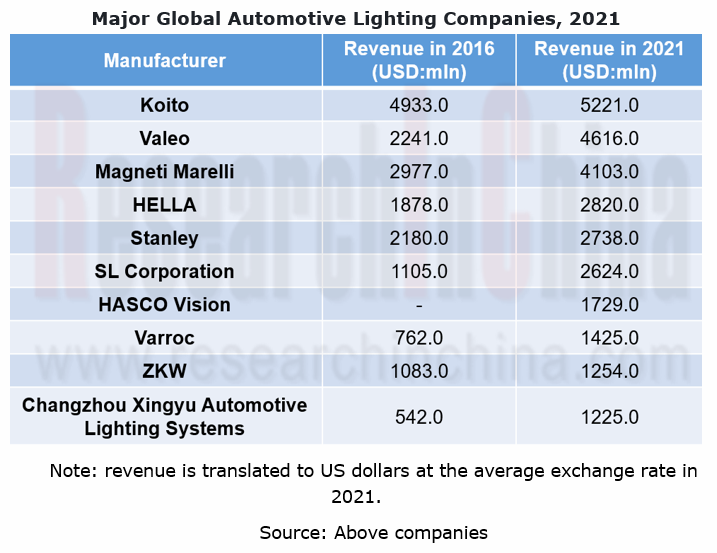

In the global auto parts industry, automotive lighting is a highly concentrated segment. Leading manufacturers in Europe, America and Japan dominate the market. In 2021, two Chinese companies, HASCO Vision (a holding subsidiary of SAIC Group) and Changzhou Xingyu Automotive Lighting Systems edged into the club of leading global automotive lighting manufacturers. HASCO Vision grew out of nothing from 2016 to 2021 (Shanghai Koito Automotive Lamp Co., Ltd., a joint venture established by Shanghai Automotive Lamp Factory under SAIC and Japan's Koito. HASCO bought the shares of the company held by Koito in 2018. The company was then renamed HASCO Vision as a holding subsidiary of SAIC Motor); Xingyu's revenue multiplied by 126% during the same period. Yet in 2021 more than 90% of the revenues of the two companies came from the Chinese market, and foreign markets otherwise contributed low revenues, indicating that Chinese lighting companies still have a long way to go abroad.

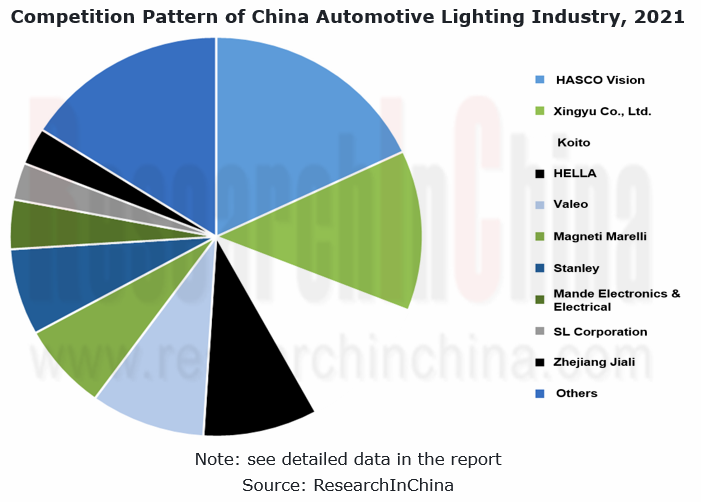

As with the global market, much of China’s automotive lighting market is still commanded by a few industry bellwethers, with the total market share of the top four players exceeding 50%. The difference is that in the Chinese market, HASCO Vision and Changzhou Xingyu Automotive Lighting Systems are respectively positioned first and second, and of the top ten manufacturers, four are Chinese companies, taking a combined share of about 38%.

Lighting manufacturers: automotive lighting evolves from static shaping to dynamic interaction.

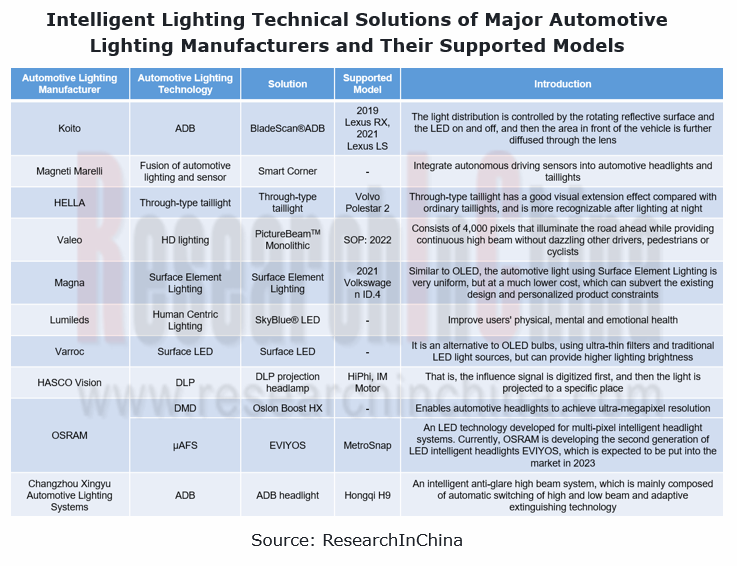

The rise of intelligent vehicles is a technological innovation booster to automotive lighting manufacturers. Multiple technology routes enable the evolution of automotive lighting from static shaping to dynamic interaction, allowing ordinary consumers to experience lighting systems that were once reserved for conventional high-end vehicle models.

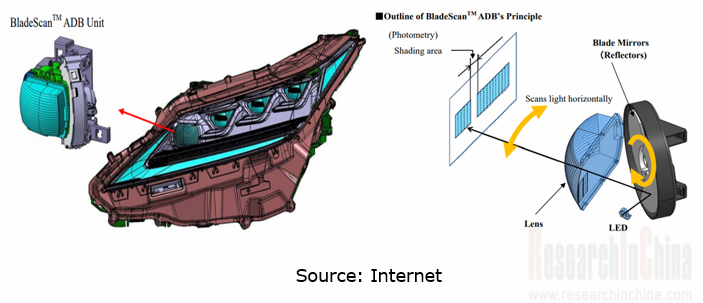

Koito BladeScan?ADB system

The system uses a pair of fast-revolving blade mirrors to change the shape and depth of the beam. Each headlight has 10 LEDs contained in the compact modules at the corners of the joints. The light from the system-controlled LEDs all pass through the mirror blades, the light is then continuously reflected out, and the light distribution is precisely controlled by synchronizing the rotation of the mirror blades and turning on/off the headlight LEDs. BladeScanTM ADB ensures high-resolution light distribution equivalent to the use of 300 LEDs and minimizes the shading area to maximize the lighting area.

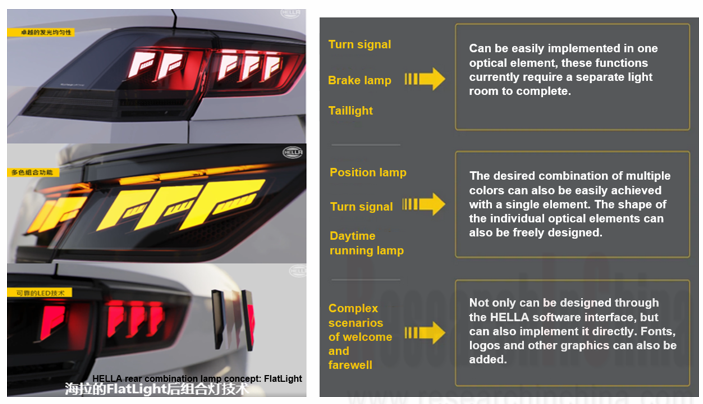

HELLA rear combination lamp concept: FlatLight

HELLA presented an innovative light guide concept based on micro-optics in early 2021. It enables particularly homogeneously illuminated surfaces with an extremely low module depth of only 5 millimeters. The technology will change the known functional characteristics of signal lights, and implement indicator, brake and tail light in just one optical element. The FlatLight concept requires about 80% less energy compared to conventional LED taillights.

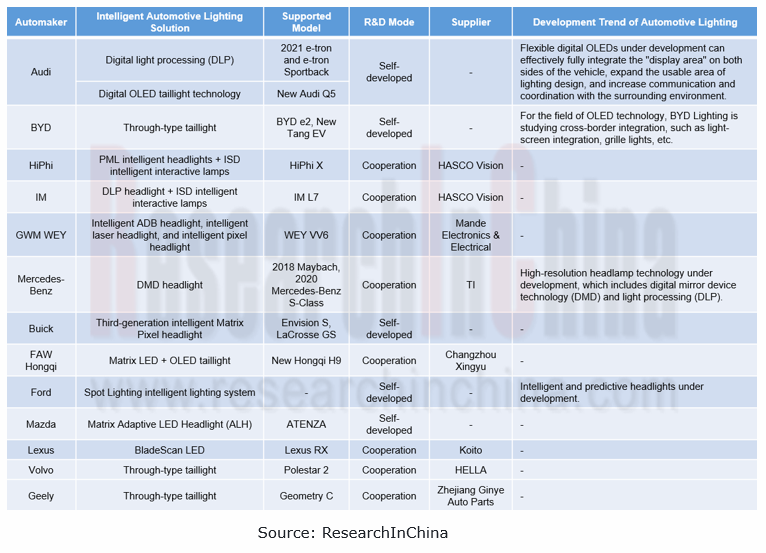

OEMs: the cooperation + self-development dual approach sets the trend for intelligence.

To meet consumers' needs for automotive lighting systems, OEMs enhance automotive lighting intelligence by way of working with lighting manufacturers and independently developing, a dual approach setting the trend for automotive lighting.

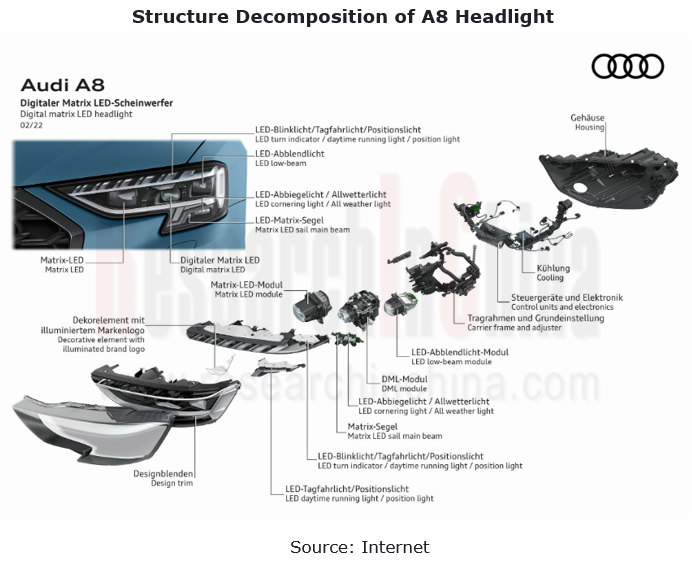

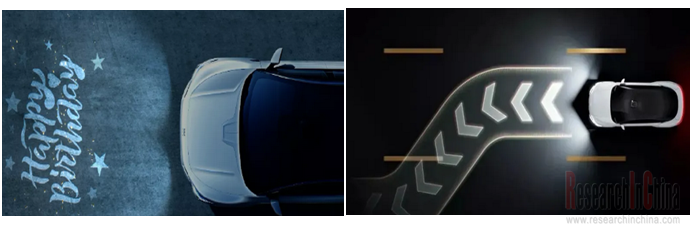

Digital Matrix Headlights for 2022 Audi A8

The new 2022 Audi A8 offers technical upgrades on the headlights. The digital matrix LED headlights use digital micro-mirror device (DMD) technology, similar to video projectors. Each headlight comprises some 1.3 million micromirrors that refract the rays into tiny pixels, thus ensuring high-precision light control. This headlight system also illuminates the driver’s lane in especially bright light, ensuring no departure from the lane. When unlocking and exiting the car, the digital Matrix LED headlights can cast projections onto floors or walls. This is known as the dynamic coming home/leaving home animations.

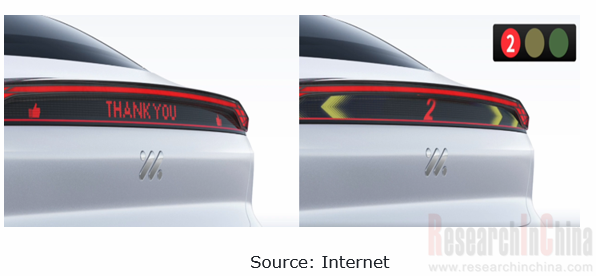

IM Motors’ intelligent lighting system

IM L7 carries HASCO Visio’s intelligent lighting system composed of second-generation 2.6MP DLP and 5,000 LED ISCs. The intelligent interactive signal light system consisting of 5,000 LEDs makes the car a large interactive screen, displaying user-defined information on the rear interactive screen.

The 2.6MP DLP headlights can project clear guidance signs onto the road in navigation mode, so that the driver can more intuitively know where the car goes. When driving at night, the light moves with the driver's line of sight, bringing a clearer view.

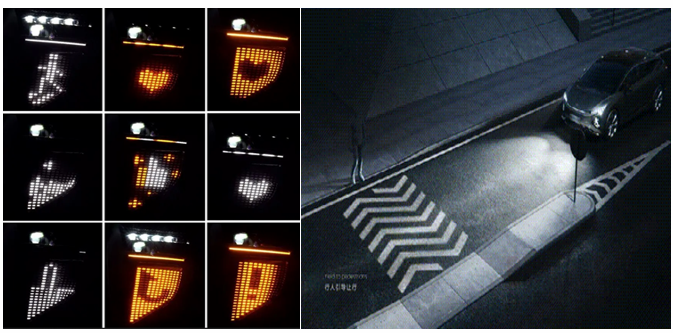

Intelligent interactive lighting system for HiPhi X

Developed by HASCO Vision, the system is comprised of PML intelligent headlights and ISD intelligent interactive combination lights. It can perceive the road environment and make decisions on its own, thus realizing all-scenario adaptive lighting and intelligent tracking and interaction with external people and vehicles. The ISD lights are deployed at the front fog lamps and the area below the taillights. The main body of the ISD intelligent interactive lights is four LED matrix panels with 1,712 LED light sources.

The PML headlight includes 2.6 million independently controllable nanoscale micro-reflectors that deliver stepless deflection every +/-12°. It also bears an infrared night vision camera, an independent customized ECU chip and an intelligent computing platform to ensure computing capacity and speed, judge road conditions, calculate distance, and output images. The PML intelligent headlight allows intelligent light pattern adjustment with speed and can automatically switch 4 driving lighting modes (standard low beam, urban high beam, standard high beam, and centralized high beam). In addition, it can also intelligently recognize driving scenarios and enable 6 intelligent lighting functions (vehicle tracking in obscuration, driving trajectory prediction, lane departure warning, blind-spot lane change warning, low-speed steering assistance, and active horizontal adjustment).

Ambient light: with a penetration up to 31%, it is a promising market.

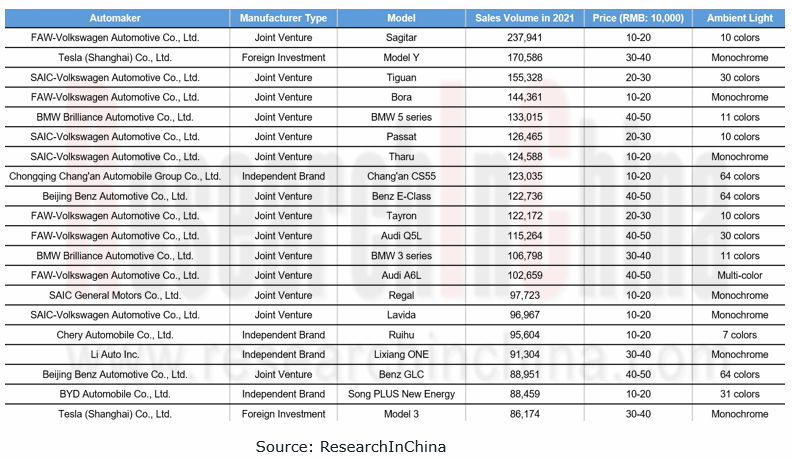

Before 2017, except luxury models of Mercedes-Benz, BMW and Audi which were directly pre-installed with ambient lights, other models packed this function in the aftermarket. Yet since the second half of 2017, OEMs have begun to equip their mid-end models with ambient lights. In 2021, the penetration of ambient lights hit 31%. From the models with ambient lights as a standard configuration in 2021, it can be seen that 36% of them carried monochrome ambient lights, and the 64-color, 7-color, and 11-color followed, accounting for 13%, 8%, and 6%, respectively.

As OEMs are committed to building cars into a third space other than home and workplace and make continuous efforts to improve the intelligence and comfort levels of cars, the penetration of ambient lights will go higher in the future.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...