Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous Heavy Truck Industry Report, 2022", which combs through and summarizes R&D testing, product implementation and commercial operation of autonomous heavy trucks of current domestic leading autonomous driving solution providers and heavy truck OEMs.

AD heavy truck solution providers successively enter the actual operation and pre-installed mass production stage

ResearchInChina also released a research report on autonomous heavy trucks in August 2021. At that time, most autonomous heavy truck-related companies were busy in pulling investment, looking for logistics and OEMs while promoting road testing and technology iterations. On the one hand, the solution needs huge funds to maintain technology R&D and expand scale of test vehicles; on the other hand, they also expect their own technology to be implemented in OEMs and logistics fleets, and to really run on the road through a scaled fleet. By August 2022, the solution providers and OEMs are more advanced in autonomous/ takeover-free testing and commercial operations, and the focus gradually shifts from R&D testing to actual operations and pre-installed mass production.

Autonomous/ takeover-free testing

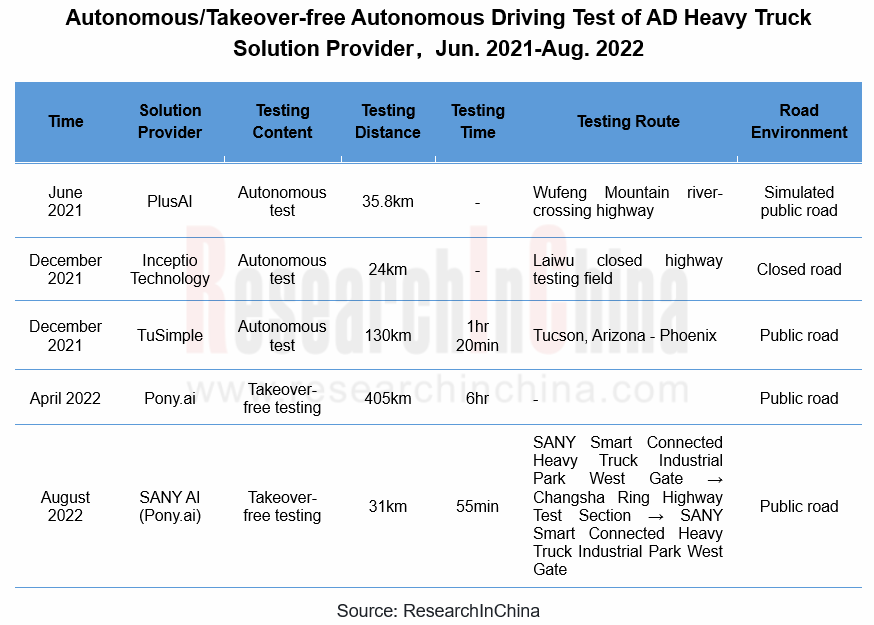

Starting in June 2021, the AD heavy truck solution providers gradually attempt to conduct autonomous or takeover-free public road testing for true real field autonomous/takeover-free technology validation. By August 2022, PlusAI, TuSimple, Pony.ai, etc. have all completed autonomous/takeover-free tests on public roads.

Among autonomous/takeover-free autonomous driving tests in the table above, TuSimple and Pony.ai are the most eye-catching.

According to the official statement, the fully autonomous test of TuSimple autonomous heavy truck on the public road took place at night, with no safety officers on duty or any human intervention throughout. The test was 80 miles long, including scenarios such as traffic signals, on and off ramps, emergency lane change vehicles and lane changes, and took 1 hour and 20 minutes. The entire test was conducted in close cooperation with Arizona Department of Transportation and law enforcement, with three safety and security vehicles in front of and behind the test vehicle to ensure safety of fully autonomous test operation.

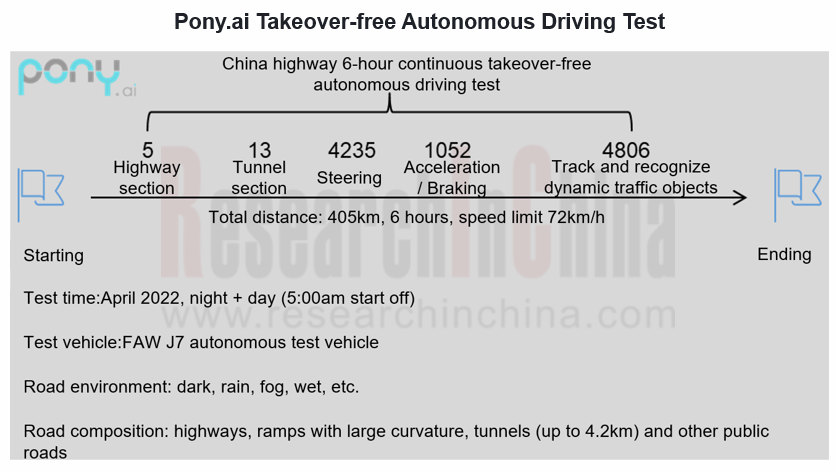

In April 2022, Pony.ai completed 6 hours of continuous, takeover-free autonomous driving tests in China's highway scenarios, going from night to day, through long tunnels, experiencing heavy rain and fog, and encountering real scenarios such as occupying accident cars, low-speed cars and special-shaped trailers. According to the official statement, in 6 hours, the driving distance exceeded 405 km, experienced 5 different highways and 13 tunnels, executed 4,235 turns, 1,052 accelerations/brakes, and tracked and recognized 4,806 dynamic traffic objects.

Commercial operations

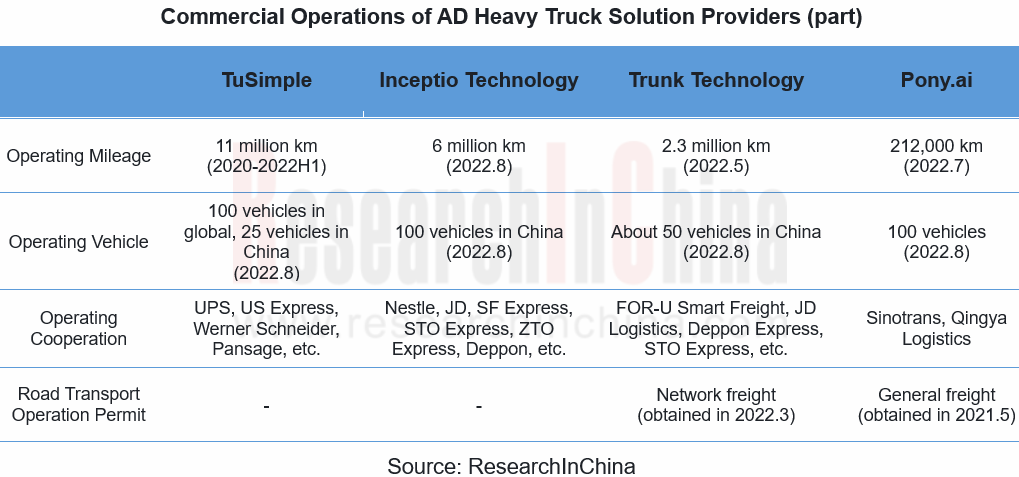

With the deepening of cooperation with logistics providers, solution providers have begun to show their strengths in actual road freight, allowing autonomous heavy trucks to earn freight. Trunk Technology and Pony.ai have obtained road transport operation permits and built their own fleets for transportation. Public data shows that the accumulated mileage of road transportation by TuSimple, Inceptio Technology, Trunk Technology and other solution providers have reached million-kilometer level, of which it has reached the most leading 7 million miles (about 11 million kilometers) during 2020-2022H1.

Pre-installed mass production

For capital, solution providers or logistics providers, what they are most looking forward to is the mass production and implementation of autonomous heavy trucks. Thus, the vehicle function, technical certification, vehicle sales and after-sales service and other related responsible parties can carry out road transport business activities.

The US RAND has estimated that an autonomous driving system needs to be validated for at least 11 billion miles (17-18 billion km) to reach mass production conditions. With a heavy truck driving 2000km in 24 hours, it would take 100 heavy trucks to drive about 240 years without stopping.

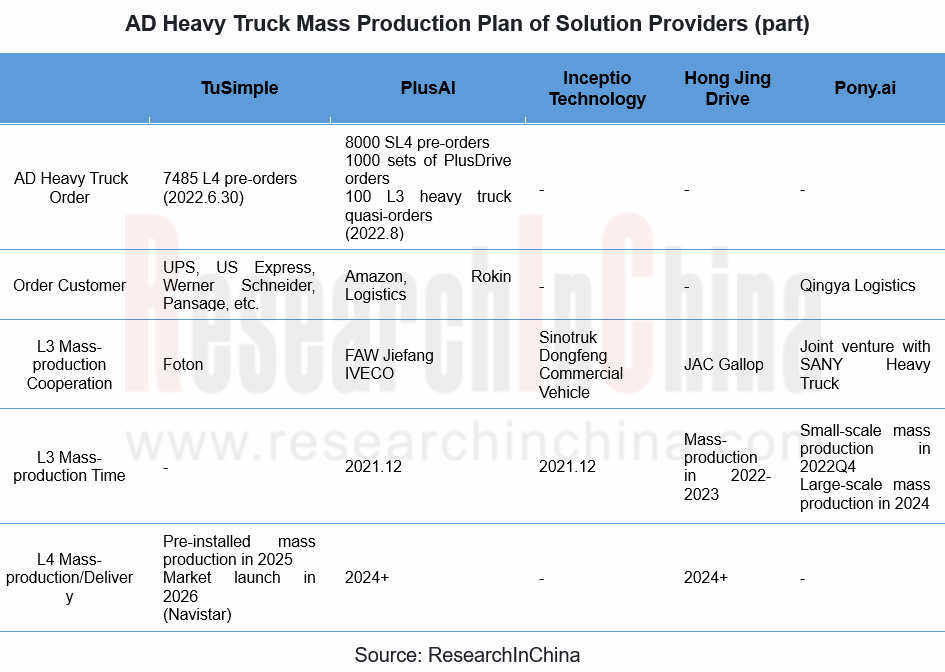

To obtain enormous real road test mileage, the only solution is pre-installed mass production and scaling to the market. At this stage, except for TuSimple, which insists on mass production of L4 heavy trucks, most solution providers are targeting L3 heavy trucks for mass production. They hoped that with mass production of L3 heavy trucks, autonomous driving system will run in large quantities on actual roads, thus obtaining massive road data, feeding back autonomous driving system and eventually realizing L4 autonomous driving.

PlusAI and Inceptio Technology, which are at the forefront of mass production, have each cooperated with heavy truck OEMs to produce L3 heavy trucks in late 2021 and have achieved some delivery results. In August 2022, PlusAI delivered five L3 FAW Jiefang J7 to its partner Rokin Logistics (with a total order of 100 vehicles, and the remaining 95 vehicles will be delivered within two years).

Big changes in autonomous heavy truck market

Emerging forces exist in passenger vehicle market, as well as in heavy truck market. Solution providers believe that the current traditional heavy truck manufacturers have many problems such as slow technical follow-up and unharmonious cooperation, which directly drag down the speed of mass production of autonomous heavy trucks. Therefore, in order to achieve better adaptation of software and hardware for autonomous driving and promote rapid implementation of autonomous heavy trucks, emerging forces such as DeepWay and Xingxing Technology have been established one after another. The biggest feature of heavy truck emerging forces is that they are built for autonomous driving, including fully redundant by-wire chassis, powertrain and cabin designed to meet needs of L4 autonomous driving.

Dynamics of some heavy truck emerging forces:

In September 2021, DeepWay released concept vehicle DeepWay-Xingtu, which is expected to be delivered in mass production in 2023.

In September 2021, DeepWay released concept vehicle DeepWay-Xingtu, which is expected to be delivered in mass production in 2023.

In April 2022, Xingxing Technology released Apebot I, an L4 autonomous pure electric van-type heavy truck for logistics, with mass production expected in 2023Q1.

In April 2022, Xingxing Technology released Apebot I, an L4 autonomous pure electric van-type heavy truck for logistics, with mass production expected in 2023Q1.

In June 2022, Hydron, a hydrogen-fueled heavy truck company founded by TuSimple co-founder Chen Mo, is expected to deliver its first-generation products in 2024Q3.

In June 2022, Hydron, a hydrogen-fueled heavy truck company founded by TuSimple co-founder Chen Mo, is expected to deliver its first-generation products in 2024Q3.

Some time ago, Ministry of Transport released "Autonomous Vehicle Transport Safety Service Guide (trial)" (draft for comment), proposing that "under the premise of ensuring transport safety, encourage the use of autonomous vehicles to engage in road general cargo transportation business activities in scenarios such as point-to-point trunk road transportation and relatively closed roads." The document will provide greater space for autonomous heavy truck road transport services, facilitate technical verification testing of autonomous heavy trucks, and directly promote them from test vehicles to mass production vehicles.

Dimension reduction for L2+/L3 pre-installed mass production, becoming a practical choice for autonomous heavy truck solution providers

Solution providers all target long-term goal of L4/L5 autonomous driving, while most enterprises adopt a progressive development strategy, such as PlusAI, Inceptio Technology, Hong Jing Drive, etc. They reduce dimension of L4 solutions accumulated and verified over the years, enter the vehicle R&D and mass production process as Tier 1 or Tier 0.5, and enable heavy truck OEMs to jointly mass produce L2+/L3 models by packaging software and hardware solutions. For example:

Based on the R&D of L4 full-stack autonomous driving technology, PlusAI joined forces with FAW Jiefang to create a supervised autonomous driving heavy truck (L2 +/L3), and at the same time used the commercialization of mass-produced autonomous heavy trucks to carry out technical iterations.

Based on the R&D of L4 full-stack autonomous driving technology, PlusAI joined forces with FAW Jiefang to create a supervised autonomous driving heavy truck (L2 +/L3), and at the same time used the commercialization of mass-produced autonomous heavy trucks to carry out technical iterations.

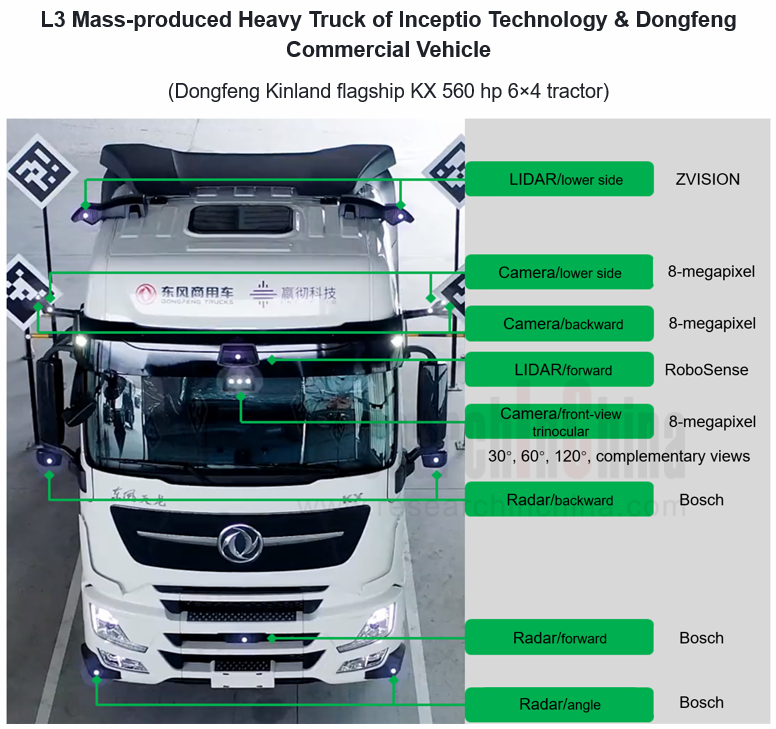

Inceptio Technology cooperated with Dongfeng Commercial Vehicles and Sinotruk to achieve mass production of L3 autonomous trucks, and a total of more than 200 vehicles of the two mass-produced models were rolled off the production line (as of August 2022).

Inceptio Technology cooperated with Dongfeng Commercial Vehicles and Sinotruk to achieve mass production of L3 autonomous trucks, and a total of more than 200 vehicles of the two mass-produced models were rolled off the production line (as of August 2022).

For autonomous heavy truck solution providers, mass production is the most practical choice in the near future. On the one hand, reducing product purchase/modification costs can also obtain certain income; on the other hand, it can realize data closed loop through large-scale operation of mass production vehicles and drive technology iteration.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...