China Driving Recorder Market Research Report, 2022

-

Sept.2022

- Hard Copy

- USD

$4,000

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,800

-

- Code:

ZXF006

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,700

-

- Hard Copy + Single User License

- USD

$4,200

-

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology stipulated: "Each passenger car should be equipped with an event data recorder (EDR) that complies with GB 39732. The passenger car equipped with an automotive video driving record system (driving recorder/ digital video recorder) that complies with GB/T 38892 should be deemed to meet the requirements." The regulation has been applied to newly produced vehicles from January 1, 2022. As EDRs has become the standard configuration of new cars, the OEM installation rate of driving recorders/digital video recorders (DVRs) has also risen.

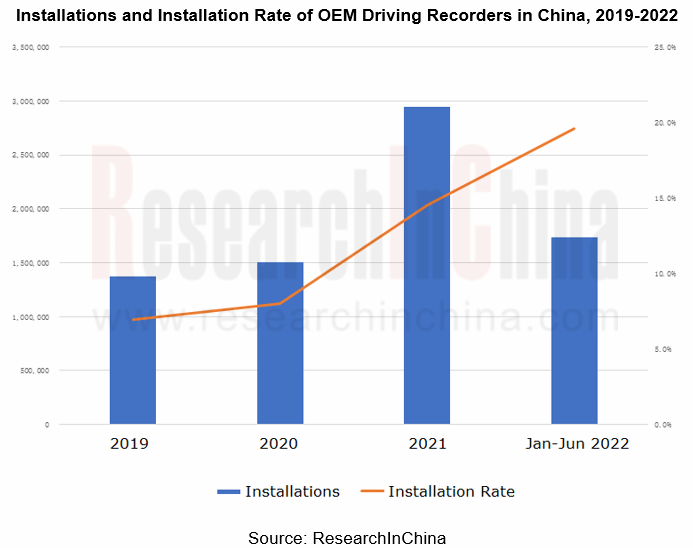

In 2022H1, the sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year

From a monthly trend, the OEM installation rate of driving recorders in passenger cars (note: the sales proportion of passenger cars with driving recorder as standard configuration as a percentage of the total passenger car sales volume) jumped from 8.9% in April 2021 to 21.9% in June 2022.

On annual basis, the OEM installation rate of driving recorders in passenger cars hit 7.0% in 2019, 8.0% in 2020, 14.5% in 2021, and 19.6% in 2022H1. It is expected to be 22% in the entire 2022.

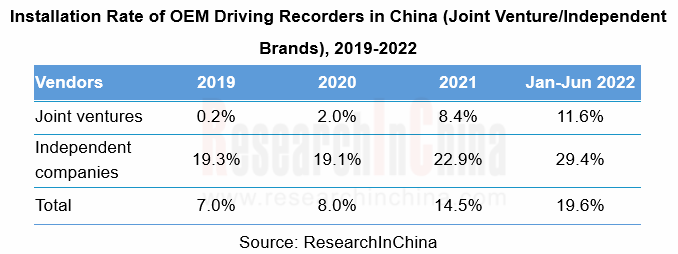

Independent brands and new energy vehicles are the main roles that include driving recorders into standard configuration

The installation rate of driving recorders as standard configuration for independent brand models has been at a relatively high level, reaching 19.3% in 2019 when joint venture brands only secured 0.2%. In 2022, independent brand models will achieve installation rate of 29.4% as the main force in the standard configuration of driving recorders.

However, since 2021, the installation rate of joint venture brands has made progress quickly, from 2.0% in 2020 to 8.4% in 2021 and 11.6% in 2022H1. Compared with 2019, it increased by 11.4 percentage points, higher than 10.1 percentage points gained by independent brands.

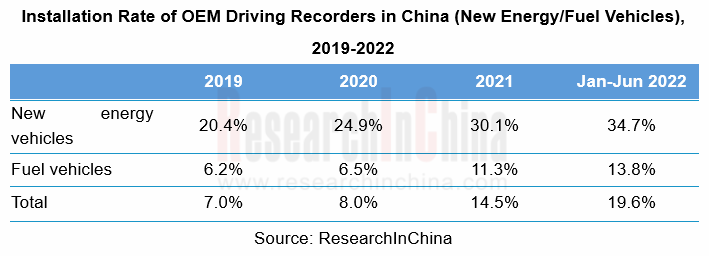

The installation rate of OEM driving recorders for new energy vehicles swelled by 14.3 percentage points from 20.4% in 2019 to 34.7% in 2022H1. For traditional fuel vehicles, the installation rate rose by 7.6 percentage points from 6.2% in 2019 to 13.8% in 2022H1. The growth in the sales volume of new energy vehicles also led to the growth of OEM driving recorders.

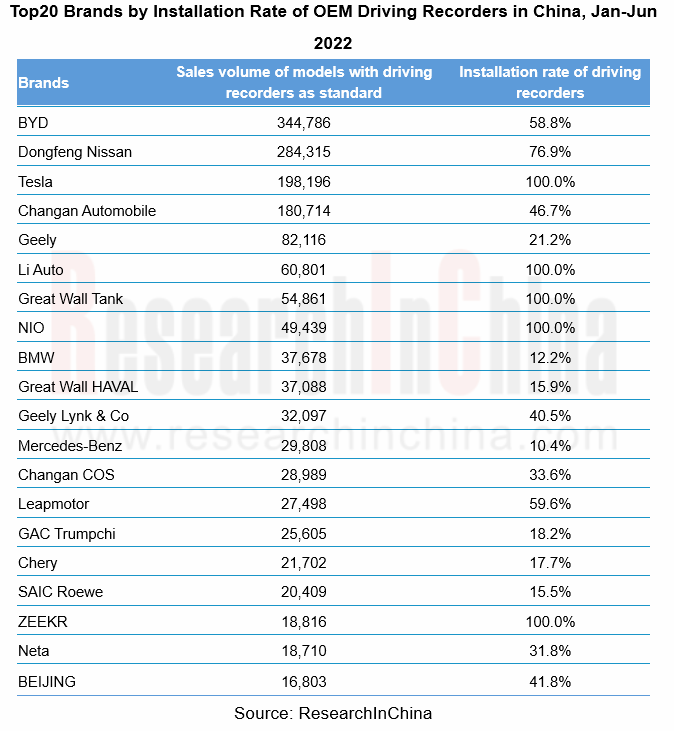

By the sales volume of models with driving recorders as standard in 2022H1, the top five brands included BYD (345,000 units), Nissan (284,000 units), Tesla (198,000 units), Changan Automobile (187,000 units) and Geely (82,000), with the respective installation rate as standard configuration of 58.8%, 76.9%, 100.0%, 46.7% and 21.2%. Chinese local new energy vehicle brands Li Auto and NIO regard driving recorders as standard, while traditional brands BMW and Mercedes-Benz only install OEM driving recorders on 12.2% and 10.4% of their vehicles respectively.

Driving recorder technology integration: ADAS, streaming media and intelligence

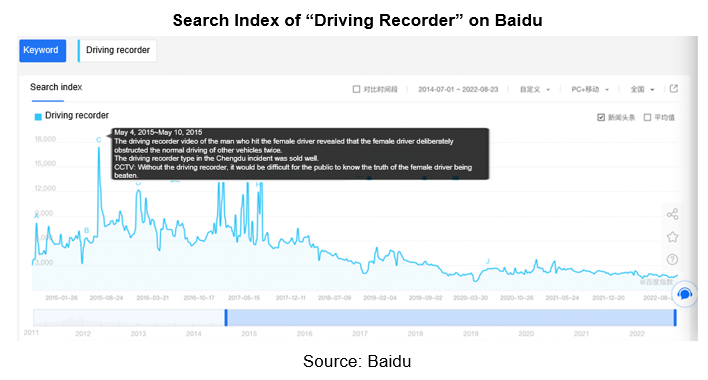

Driving recorders are undoubtedly indispensable for Chinese car owners. In 2015, the driving recorder video incident directly spurred the driving recorder aftermarket where 10 million driving recorders were sold that year as the best-selling automotive electronic products on Double 11, a Chinese unofficial e-commerce holiday and shopping festival similar to Black Friday in the U.S.

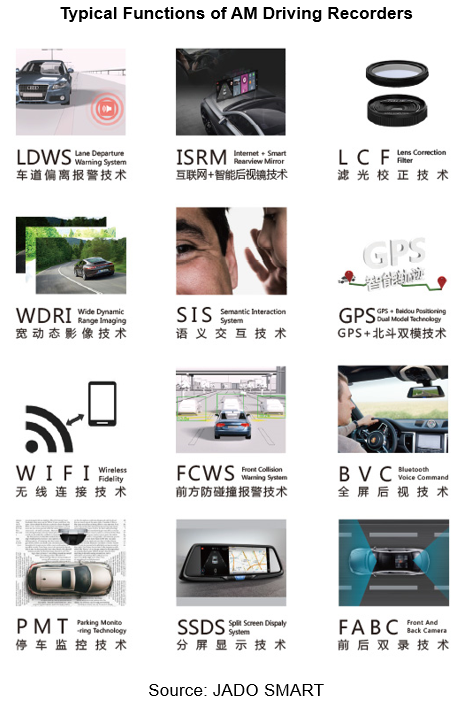

In addition to navigation, preventing accident frauds, assisting in handling traffic accident disputes and electronic violation disputes, driving recorders offer more and more functions. With the development of automotive intelligent connectivity, functions such as electronic fence, parking monitoring and alarm, and even ADAS functions like LDWS and FCWS have become standard for driving recorders, but AM driving recorders only integrate the most basic ADAS functions due to limitations of hardware, software and vehicle data acquisition.

With a higher installation rate, driving recorders can share the inputs (cameras) and outputs (displays) with other smart cockpit devices, which not only saves costs, but also better realizes integration of intelligent connection functions.

1. Driving Recorder Market Overview

1.1 Definition and Classification

1.2 Composition

1.3 Development History

1.3 Driving Recorder Baidu Index

1.4 Development Trend

2 Driving Recorder Technology Integration and Industry Trends

2.1 Fusion I: ADAS

2.1.1 Built-in ADAS of Driving Recorder Starts from AM

2.1.2 There are Inherent Deficiencies in Built-in ADAS of AM Driving Recorder

2.1.3 Driving Recorder fusion ADAS from OEM to AM

2.2 Fusion II: Streaming Rearview Mirror

2.2.1 Streaming Rearview Mirror

2.2.2 Industry Chain

2.2.3 Regulations Related to Streaming Rearview Mirror

2.2.4 Product Structure and Characteristics

2.2.5 Installation Rate of Streaming Rearview Mirror Models

2.2.6 OEM Streaming Rearview Mirror Solution

2.2.7 Suppliers and Product Solutions

2.2.8 Advantages and Future Development Trends

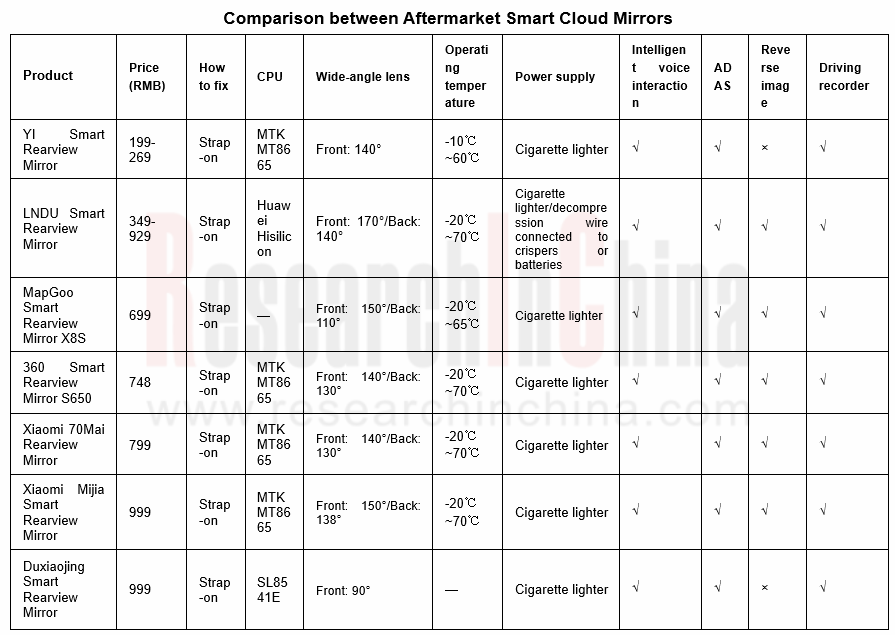

2.3 Fusion III: Intelligent Cloud Mirror

2.3.1 Industry Chain

2.3.2 Market Products

2.3.3 Development Trend

2.4 Fusion IV: Electronic Exterior Rearview Mirror

2.4.1 Development History

2.4.2 Product Advantages

2.4.3 Product structure and Characteristics

2.4.4 Market Status

2.4.5 Industry Chain

2.4.6 Models Equipped with Electronic Exterior Rearview Mirror (1)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (2)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (3)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (4)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (5)

2.4.7 Suppliers and Product Solutions

3 Driving Recorder Market Size and Forecast

3.1 Quantity and Installation Rate of OEM Driving Recorders in China, 2019-2022

3.2 Monthly Trend of Installation Rate of OEM Driving Recorders in China, 2019-2022

3.3 OEM Driving Recorder Market Size in China, 2021-2026E

3.4 AM Driving Recorder Market Size in China, 2021-2026E

3.5 Installation Rate of OEM Driving Recorder in China (by Model Price Range), 2019-2022

3.6 Installation Rate of OEM Driving Recorder in China (Joint Venture/Independent; New Energy/Fuel Vehicle), 2019-2022

3.7 Installation Rate of OEM Driving Recorder in China (by Brand), 2019-2022

3.8 Installation Rate of OEM Driving Recorder in China (by Automakers) , 2019-2022

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

4 Major Driving Recorder Enterprises

4.1 Gentex

4.1.1 Profile

4.1.2 Driving Recorder - Full-screen Display Rearview Mirror

4.1.2 Driving Recorder - Electronic Rearview Mirror

4.1.2 Driving Recorder - Camera Monitoring System (CMS)

4.1.3 Financials

4.1.4 Customer Supporting Relationship

4.1.5 Application Solution

4.1.6 Development Planning

4.2 Magna

4.2.1 Profile

4.2.2 Smart Rearview Mirror Products

4.2.3 Development Planning

4.3 Ficosa

4.3.1 Profile

4.3.2 Intelligent Rearview Monitoring System (IRMS)

4.3.2 Electronic Exterior Rearview Mirror

4.3.3 Application Solution

4.4 ADAYO Group

4.4.1 Profile

4.4.2 Product Layout

4.4.3 Product Roadmap

4.4.4 Application Solutions

4.5 LongHorn

4.5.1 Profile

4.5.2 Product Layout

4.5.3 Product Revenue

4.5.4 Major Customers

4.6 Aoni Electronics

4.6.1 Profile

4.6.2 Product Layout

4.6.3 Product Revenue

4.7 Coligen

4.7.1 Profile

4.7.2 Product Layout

4.7.3 Product Revenue

4.8 Shanghai Yuxing Electronics

4.8.1 Profile

4.8.2 Product Layout

4.8.3 Application Solutions

4.9 Mobvoi

4.9.1 Profile

4.9.2 Product Layout

4.9.3 Core Technology

4.9.4 Smart Rearview Mirror Products

4.10 Banya Technology

4.10.1 Profile

4.10.2 Smart Cloud Mirror Product Solution

4.10.3 Streaming Media Rearview Mirror Product Solution

4.11 Teyes

4.11.1 Profile

4.11.2 Smart Rearview Mirror Product Solution

4.12 Shenzhen Roadrover Technology

4.12.1 Profile

4.12.2 Smart Rearview Mirror Products

4.13 Yuanfeng Technology

4.13.1 Profile

4.13.2 Business Layout: 1 + 3 + N Business Architecture

4.13.3 Product Structure Process

4.13.4 Mass Production Customers

4.13.5 Application Solutions

4.14 Willing Tech

4.14.1 Profile

4.14.2 Product Layout

4.14.3 Application Solutions

4.15 DDPAI

4.15.1 Profile

4.15.2 Product Introduction - Car Smart Screen

4.15.2 Product Introduction - X5 Pro

4.16 Haikang Automotive Electronics

4.16.1 Profile

4.16.2 Product introduction

4.16.3 Business Analysis

4.17 JADO

4.17.1 Profile

4.17.2 Product Introduction

5 OEMs' Driving Recorder Solution

5.1 Models with Driving Recorder as Standard Configuration

5.1.1 Dongfeng

5.1.2 BYD

5.1.3 Changan

5.1.4 Geely

5.1.5 Great Wall Motor

5.1.6 Chery

5.2 OEMs' Driving Recorder Solutions

5.2.1 Dongfeng Aeolus

5.2.2 Chang'an UNI-K

5.2.3 Great Wall Mocha DHT-PHEV

5.2.4 FAW E-HS9

5.2.5 FAW HS5

5.2.6 SAIC Buick GL8

5.2.7 GAC Toyota Wildlander

5.2.8 GAC Honda e

5.2.9 BAIC Mofang

6 Key Enterprises in Driving Recorder Industry Chain

6.1 Allwinner Technology

6.1.1 Profile

6.1.2 Product Layout

6.1.3 Product Solutions

6.2 Rockchip

6.2.1 Profile

6.2.2 Product Solutions

6.3 Spreadtrum Communications

6.3.1 Profile

6.3.2 Product Solutions

6.4 Qualcomm

6.4.1 Profile

6.4.2 Product Solutions

6.5 Novatek

6.5.1 Profile

6.5.2 Product Solutions

6.6 Ambarella

6.6.1 Profile

6.6.2 Product Layout

6.6.3 Product Solutions

6.6.4 Electronic Rearview Mirror Solution Based on Ambarella Chip

6.7 MediaTek

6.7.1 Profile

6.7.2 Product Solutions

6.8 Xilinx

6.8.1 Product Layout

6.8.2 Product Solutions

6.9 Camera Solutions

6.9.1 Automotive Camera Industry Chain

6.9.2 Camera Module Summary

6.9.3 OFILM Product Layout

6.9.4 Sunny Product Layout

6.9.5 Q Tech Product Layout

6.9.6 Product Layout of Lianchuang Electronic Technology

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...