Chinese in-vehicle terminal PKI market will be worth RMB1.89 billion in 2025.

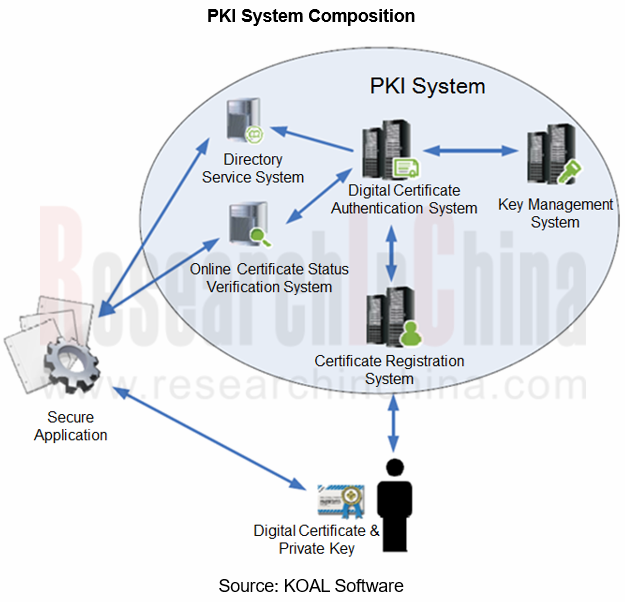

The working principle of PKI (Public Key Infrastructure) is: the infrastructure that provides security services established by leveraging public key cryptography technology, and provides users with certificate management and key management, etc., in a bid for identity authenticity, information confidentiality and other goals.

China's automobile cybersecurity is protected mainly by the PKI system by far. The asymmetric encryption technology based on PKI is applied to various links such as onboard devices, Internet of Vehicles operation, and network communication, and plays a core role in the security protection at all levels of cloud, communication, and terminals. As for in-vehicle terminals, various terminal devices need to be embedded with security chips to manage keys and encryption operations; all communications with the outside world also require to be encrypted, driving the robust demand for PKI.

Facilitated by the factors like the expanding demand for automotive cybersecurity protection and the rapid rise in the penetration rate of Internet of Vehicles, Chinese PKI market size of in-vehicle terminals will expectedly reach RMB920 million to RMB1,890 million from 2022 to 2025, with an average annual growth rate of 27%.

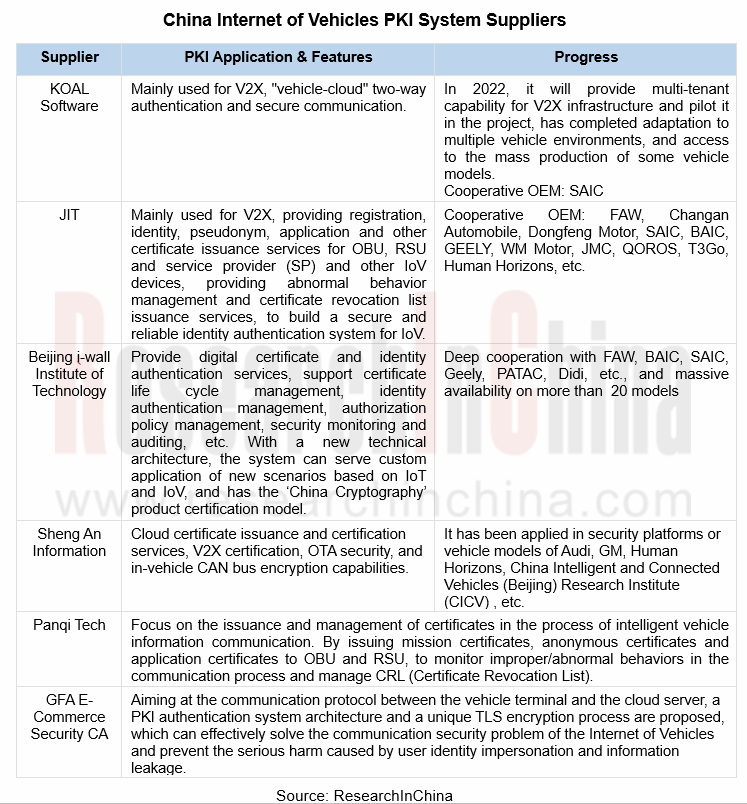

Of the PKI application scenarios, V2X is the focus of major suppliers. The use of PKI system to on-board unit (OBU), roadside unit (RSU), service provider (SP), and secure communication and identity authentication between cloud platforms will be the mainspring of future development.

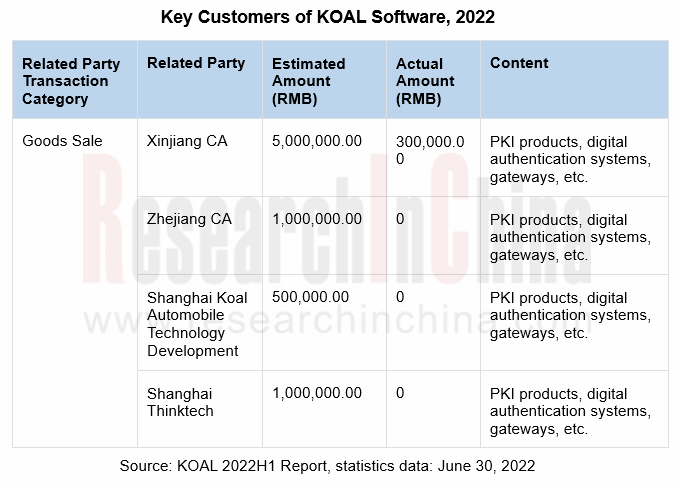

KOAL Software is one of the early developers of PKI products in China, and has formed three major product systems: PKI infrastructure products, PKI security application products, and general security products.

KOAL's PKI solution for intelligent vehicle connectivity is centered round the V2X-PKI security service system, integrates IEEE1609.2 international standards and GB/T 37374 national standards, meets ITS standards and Ministry of Transport standards, and also supports GM (China Cryptography) algorithms.

In the automotive sector, KOAL Software has SAIC as its main customer and has built a security certificate management system for the wireless communication technology of the Internet of Vehicles for SAIC Prospective Technology Research Department, including V2X and V2N security certificate systems. In addition, it also built a comprehensive certificate management system, digital certificate authentication system, and signature verification system for SAIC Cloud Data Center mobile office project, and built a cloud PKI system for SAIC Motor Overseas Intelligent Mobility Technology Co., Ltd.

In 2022, KOAL Software's products in automotive field expand from identity authentication system to data security system of the Internet of Vehicles. The "Guidelines for the Application of Internet of Vehicles Transmission Security Protection Based on Domestic Cryptography" has been successfully approved, becoming the first group standard to pass the expert review of Shanghai Business Cryptography Association.

Changchun Jilin University Zhengyuan Information Technologies Co., Ltd. (hereinafter referred to as JIT) is the main member and sub project convener of WG3 (cryptography Working Group), WG4 (Authentication and Authorization Working Group), WG5 (Cybersecurity Assessment Working Group), WG7 (Cybersecurity Management Working Group) and SWG-BDS (Special Working Group on Big Data Security Standards) of National Cybersecurity Standardization Technical Committee. JIT is also one of the main constitutors of standards about PKI electronic certification products in China.

JIT has developed product lines such as password security, identity and access security, data security and security applications, and formed six star products: PKI, V2X PKI, identity and access management (IAM), password comprehensive service management platform, secure blockchain platform and data security solutions.

In respect of V2X PKI, based on the digital certificate format specification of GM/T 0015 SM2 cryptographic algorithm, JIT combines various application scenarios of transportation information systems, and focuses on the requirements of ITS (Intelligent Transportation System) application on the length, computing efficiency, etc. of digital certificates. The format of the ITS equipment certificate has been redefined, and JIT developed the ITS digital certificate product independently to provide technical and product support for intelligent transportation.

China Automotive Cybersecurity Software Research Report, 2022 highlights the following:

Automotive cybersecurity system architecture and key software product range;

Automotive cybersecurity system architecture and key software product range;

The application of cryptographic technology and PKI system in the Internet of Vehicles system, main enterprises and products;

The application of cryptographic technology and PKI system in the Internet of Vehicles system, main enterprises and products;

The application of IDPS in automotive cybersecurity defense system, main enterprises and solutions;

The application of IDPS in automotive cybersecurity defense system, main enterprises and solutions;

Status quo of China's automotive cybersecurity testing, major companies and testing platforms;

Status quo of China's automotive cybersecurity testing, major companies and testing platforms;

Development trends and suggestions for automotive cybersecurity.

Development trends and suggestions for automotive cybersecurity.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...