Smart Surface Research: As an important medium for multimodal interaction, smart surfaces lead the trend of smart cockpits.

Smart surfaces represent the development trend of automotive interiors and exteriors.

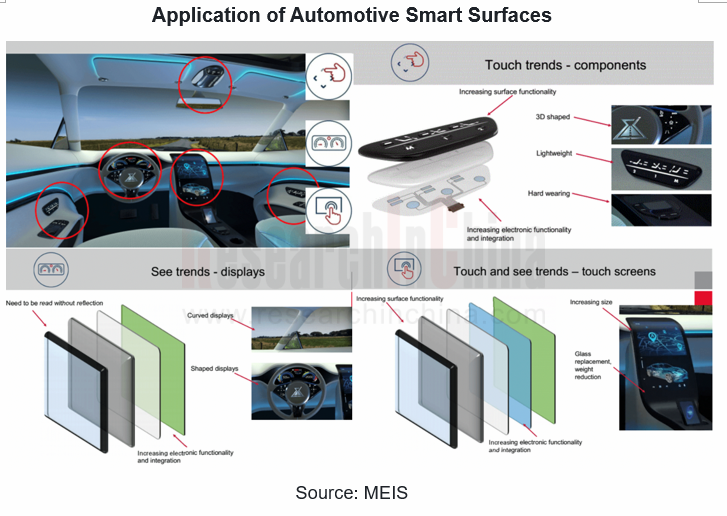

Smart surfaces represent the development trend of automotive interiors and exteriors, as an important part of smart cockpits and a crucial medium of multi-modal interaction. On center consoles, steering wheels, doors, windows and other automotive interior parts, smart surfaces upgrade traditional interactive media such as buttons or knobs in traditional automotive interiors to touch interactive media made of surface materials such as plastic or fabric.

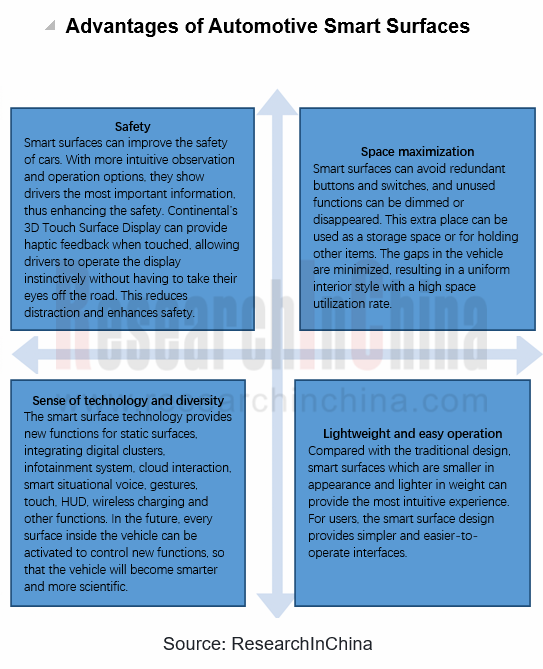

Compared with traditional automotive interiors, smart surfaces feature lightweight, intelligence and functionality.

Lightweight: The weight is reduced by 60%-80%, the thickness is cut by 90%, the PCBA area drops by 25%, and the number of parts is slashed by 95%.

Intelligence: The integration of intelligent components such as electronic switches, lighting, and sensors provides a medium for multimodal interactions.

Functionality: With more design freedom and higher functional integration, smart surfaces can provide more functions for drivers and passengers in a more convenient way.

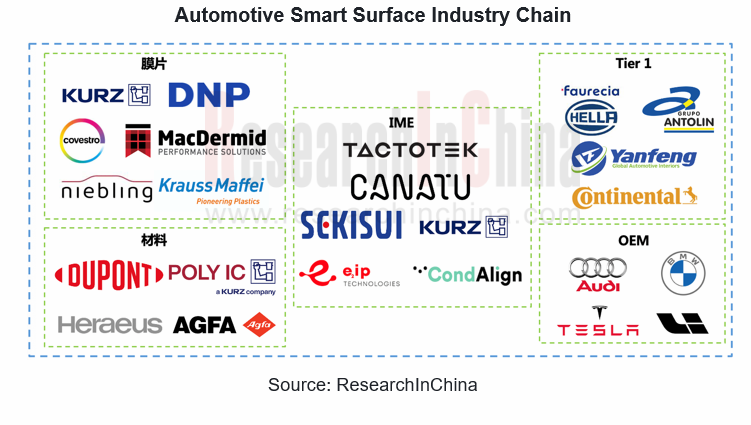

Professional IME enterprises and Tier1 interior enterprises jointly promote the development of automotive smart surfaces.

In-Mold Electronics is the main smart surface technology at present, featuring excellent bending and tensile properties, supporting 3D molding, requiring no new molds and enabling more free modeling design. Moreover, environmentally friendly and economical printed conductive ink solutions can meet the growing demand for model facelifts.

At present, there are not many companies that focus on automotive IME technology. Most companies take into account consumer electronics or industrial electronic components, such as Tactotek, Canatu, Sekisui, Kurz, e2ip, etc. At the same time, most automotive interior Tier1 companies are paying more and more attention to the application and development of smart surface components.

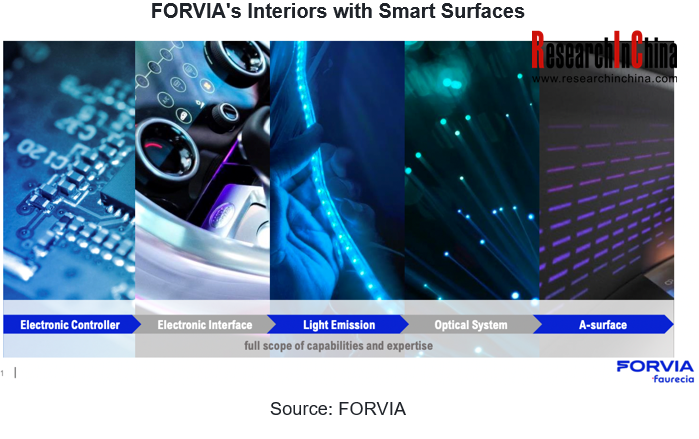

Faurecia envisions the cockpit of the future as a multifunctional, connected and intelligent space. The smart surface developed by Faurecia draws on the Group's experience in many professional fields: cockpit architecture, system integration, kinematics and mechatronics. In 2021, Faurecia and Immersion announced a multi-year license agreement, providing Faurecia with access to Immersion's patented technology as well as haptic technology solutions for automotive touch screens and control systems. In 2022, Faurecia completed the acquisition of Hella, and named the newly combined Group “FORVIA”. Smart surface products will also integrate more smart lighting functions.

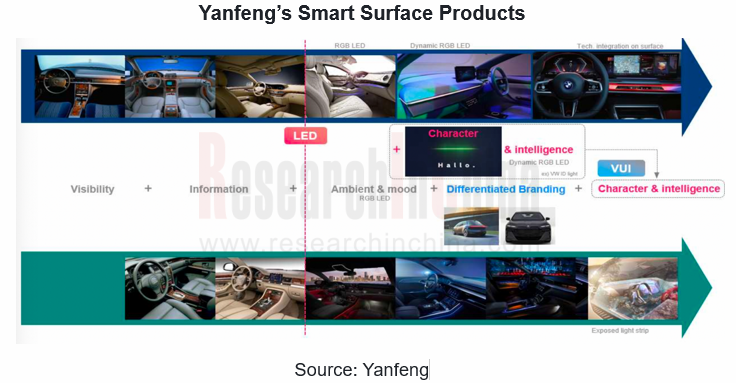

The smart interior surface being developed by Yanfeng Automotive Interiors (YFAI) combines automotive interior aesthetics with HMI technology, and seamlessly integrates control, information display, lighting and heating onto the same surface. In February, 2020, Yanfeng demonstrated its latest smart surface technology through a "smart surface model” which includes seven HMIs and is seamlessly integrated on various interior surfaces. In March, 2022, Yanfeng and SemsoTec signed a Memorandum of Understanding (MOU) for collaboration in display and sensor technologies, components and products for automotive application. The cooperation between the two parties aims to accelerate the seamless integration of HMI onto all interior surfaces of future cars, thereby offering unique in-car user experience.

Smart surfaces provide more possibilities for the smart cockpit strategies of OEMs

More and more OEMs apply smart surfaces to smart cockpits of both luxury cars and entry-level cars. Touch center consoles, touch door control modules and touch window control modules are very common, and even touch modules appear on steering wheels.

In Porsche's new interactive interface design, the 8.4-inch inclined screen at the lower part of the center console mainly displays the power, charging status, air conditioning control, writing pad, etc., with tactile feedback and error-proof operation functions.

Li L9 cancels the cluster in front of the driver, and instead adds a small TouchBar above the steering wheel. The combination of 5-screen touch control, 6 microphones, 3D ToF sensors, and the multi-modal 3D interactive technology developed by Li Auto based on deep learning exalts the audio-visual and entertainment experience of the smart car to a new level.

In order to embody a sense of science and technology and a simple design style, WM M7 not only removes all physical buttons, but also creates a touch gearshift mode integrated into the steering wheel. WM's "i-Surf Technology Skin" adopts superfine blended knitting technology, so that the texture feels like wool blend. At the same time, it features transparency. Combined with a flexible screen, it supports custom text or pictures.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...