Research on Emerging Automaker Strategy: the strategic layout of Li Auto in electric vehicles, cockpits and autonomous driving

Li Auto will shift from the single extended-range route to the “extended-range + high-voltage battery-electric” route of in 2023.

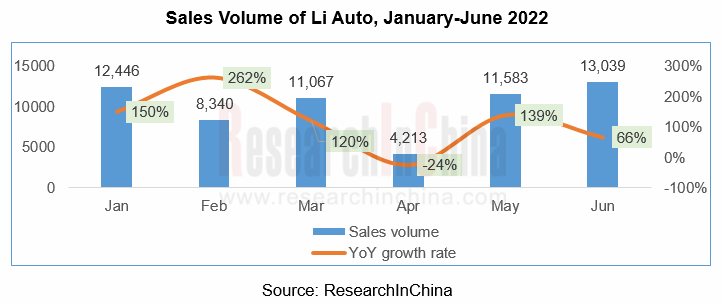

In the first half of 2022, Li Auto sold 60,801 vehicles, up 99.1% year-on-year. In terms of models, Li ONE still played a main role in the first half of the year. With the launch of L8 in September 2022, Li ONE will be gradually withdrawn from the production line, while L8, L7 and L9 will be the focus of production and marketing in the future.

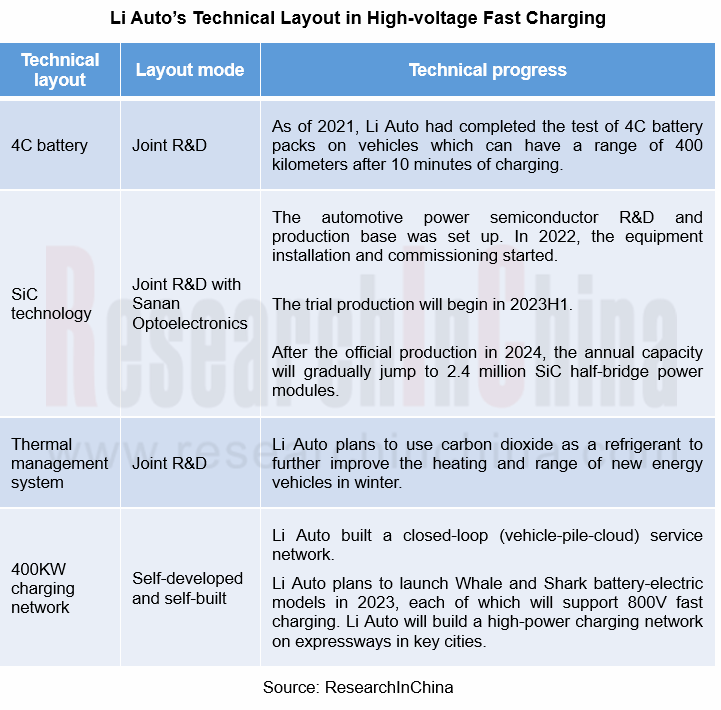

As for product planning, all the models currently being sold by Li Auto are extended-range electric vehicles. However, Li Auto plans to launch at least two high-voltage battery-electric vehicles every year from 2023 onward. For the purpose of high-voltage super-fast charging, Li Auto deploys the following four aspects: First, 4C batteries. Second, application of SiC technology. Third, thermal management system. Fourth, 400KW charging network.

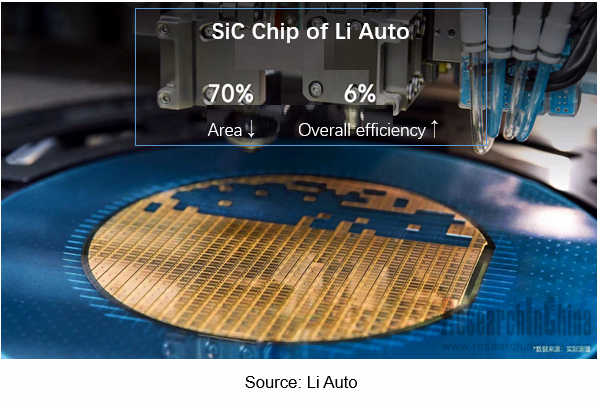

According to its plan, Li Auto will produce the third-generation semiconductor SiC power chip in 2024. At the same current of the high-voltage platform, this chip is 70% smaller than an IGBT chip, with the comprehensive efficiency being improved by 6%. The layout of Li Auto’s 800V high-voltage battery-electric technology reveals that one of the selling points of new cars in the future will be reflected in the charging speed.

Li Auto has self-developed AEB and NOA and laid out autonomous driving chips to progress on intelligent driving

As for the progress of intelligent driving, Li Auto has developed AEB system by itself as a "latecomer". In the future, Li Auto will provide all open source codes of its AEB system to improve traffic safety.

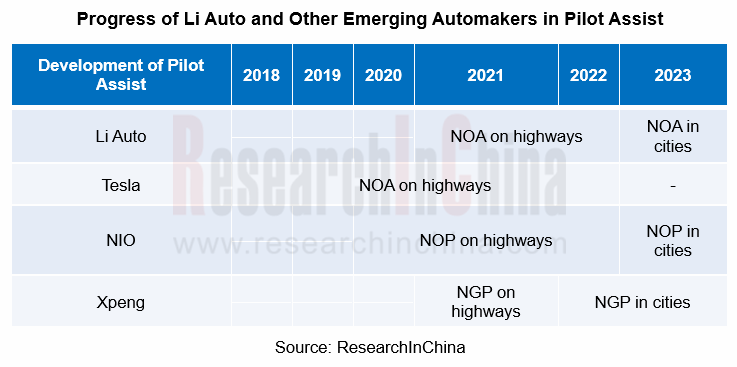

In addition, Li Auto added NOA to 2021 Li ONE in December 2021, improved the performance of AEB, and optimize the detection and fusion of cameras and radar. Since 2022, all new cars have been equipped with Li Auto’s self-developed hardware compatible with L4 autonomous driving as standard. Li Auto plans to make urban NGP functions available in Li L9 through OTA in 2023, and install L4 autonomous driving capability on production vehicles via OTA around 2024.

Regarding the core underlying technology layout of intelligent driving, Li Auto established Sichuan Lixiang Intelligent Technology Co., Ltd. in May 2022 to design chips. In August 2022, Xie Yan, the former vice president of Huawei Software, joined Li Auto as the head of system R&D division. The system R&D division is mainly responsible for R&D of some underlying intelligent technologies, including Li Auto's self-developed operating system and computing platform. Li Auto's computing platform business also includes its self-developed intelligent driving chip project.

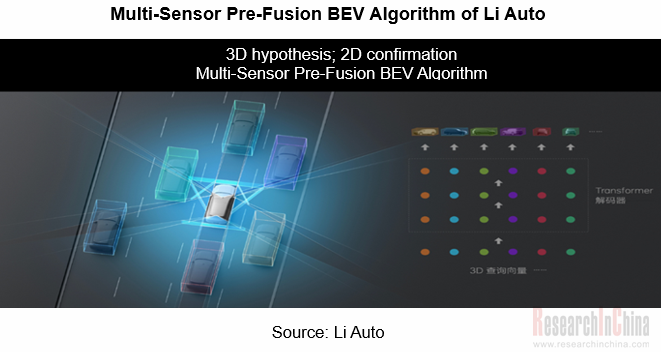

For the intelligent driving algorithm, Li Auto uses BEV framework similar to that of Tesla, that is, it utilizes pure vision for motion perception prediction. On the basis of BEV visual information, Li Auto exploits additional LiDAR and HD map information input to implement the BEV fusion algorithm, and adds a visual security module and a LiDAR security module which are redundant with BEV framework model for the sake of an extra layer of protection.

The cockpit of Li Auto upgrades from 2D interaction to 3D interaction.

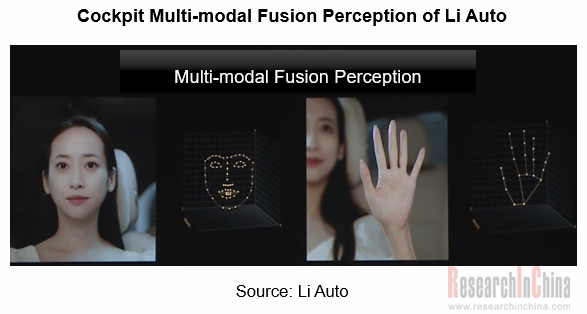

The cockpit multi-modal interaction represents development trend of human-machine co-driving era. As per three new cars launched in 2022, Li Auto upgrades the past four-screen 2D interaction in Li ONE to current five-screen 3D interaction, and realizes “voice+gesture” multi-modal interaction.

For example, the five screens of Li L9 include a safe driving interactive screen, a W-HUD with a projected area of 13.35 inches, a 15.7-inch integrated center console screen and co-driver screen, and a 15.7-inch rear entertainment screen. The in-vehicle 3D ToF sensor perceives the cockpit environment in real time. Plus, 6 microphones, 7.3.4 panoramic sound layout, 5G dual-operator automotive communication network, and multi-modal spatial interaction technology developed by Li Auto based on deep learning enable the three-dimensional interaction in the cockpit.

In terms of perception, Li AI, the intelligent cockpit space, imitates the coordination of human ears and eyes to attain the three-dimensional information perception inside the vehicle under the influence of multi-modal attention technology by a distributed hexasilicon microphone, an IR 3D ToF sensor, MIMO-Net six-vocal-range enhancement network and MVS-Net multinocular & multi-view visual fusion network.

As for understanding and expression, Li AI restores the multi-source heterogeneous data sensed by fusion perception to concrete events in the network, and fulfills further abstract understanding. Ultimately, knowledge linking, knowledge completion and logical reasoning form an event graph, allowing machines to have their own understanding and decision-making capabilities.

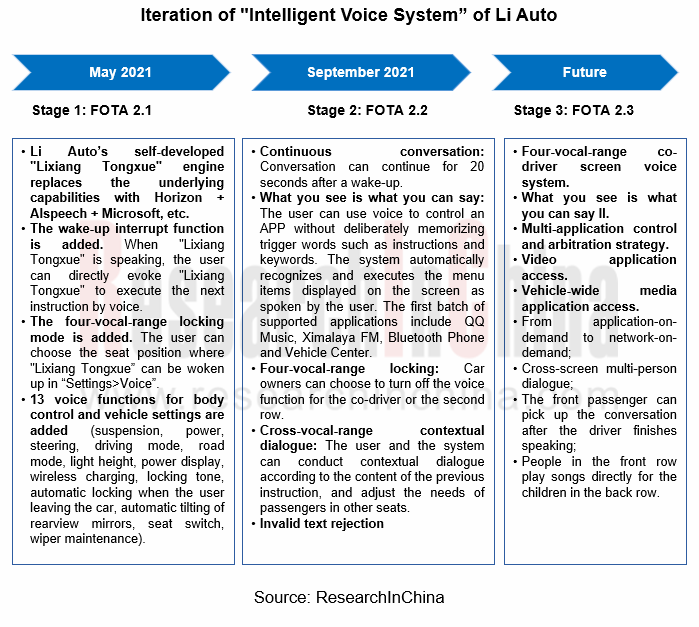

Regarding voice technology, Li Auto defines its voice assistant "Lixiang Tongxue" as the user's housekeeper (current stage) and family (future goal), and plans a three-stage product upgrade. At present, the goals of the first two stages have been achieved through OTA: The first stage: Li Auto’s self-developed "Lixiang Tongxue" engine replaces the underlying capabilities with Horizon + AIspeech + Microsoft, etc.

The second stage: "what you see is what you can say", four-vocal-range locking and other functions.

In the future, the voice system will offer functions such as "from application-on-demand to network-on-demand", cross-screen multi-person dialogue, and "the front passenger can pick up the conversation after the driver finishes speaking".

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...