China Charging / Battery Swapping Infrastructure Market Research Report, 2022

Research of charging / battery swapping: More than 20 OEMs layout charging business, new charging station construction accelerated

From January to September 2022, the sales volume of new energy vehicles in China was 4.567 million, with a market share of 23.5%, Thus ownership of new energy vehicles in China has exceeded 10 million units. In terms of charging infrastructure, according to statistics of Charging Alliance, as of September 2022, the ownership of charging infrastructure in China was 4.488 million sets, with a year-on-year increase of 101.9%; Based on this calculation, the overall car-to-pile ratio is close to 2.2:1, which has basically reached the national expected development goals.

In January 2022, National Development and Reform Commission and other 10 departments jointly issued "Fourteenth Five Year Plan" for Public Service, which specifies that by 2025, China will form a charging infrastructure system to meet the needs of more than 20 million electric vehicles. According to the 14th Five Year Development Plan of the State Council, by 2025, the car-to-pile ratio will increase to 2:1, which is equivalent to two cars equipped with one charging pile.

Market and technology trend of charging/ battery swapping infrastructure

In 2022, China's charging/battery swapping infrastructure industry ushers in further development and expansion, and the market pattern of 7-11kW AC charging piles is basically stable; The leading enterprise in 80-240kW DC charging pile market has begun to take shape. At the same time, new charging technologies/stations are developing rapidly, including high-voltage fast charging, battery swapping, orderly charging, PV-storage-charging integration, hydrogen-PV-storage-charging integration, mobile charging robot, etc.

Trend 1: High-voltage fast charging

In terms of charging power, there are two main solutions to improve fast charging power: high-voltage fast charging and high-current fast charging. Judging from the current development, high-voltage fast charging is popular, mainly because high-current fast charging has a huge challenge to thermal management system, and there is a ceiling for single vehicle charging power, which cannot reach 480KW charging efficiency.

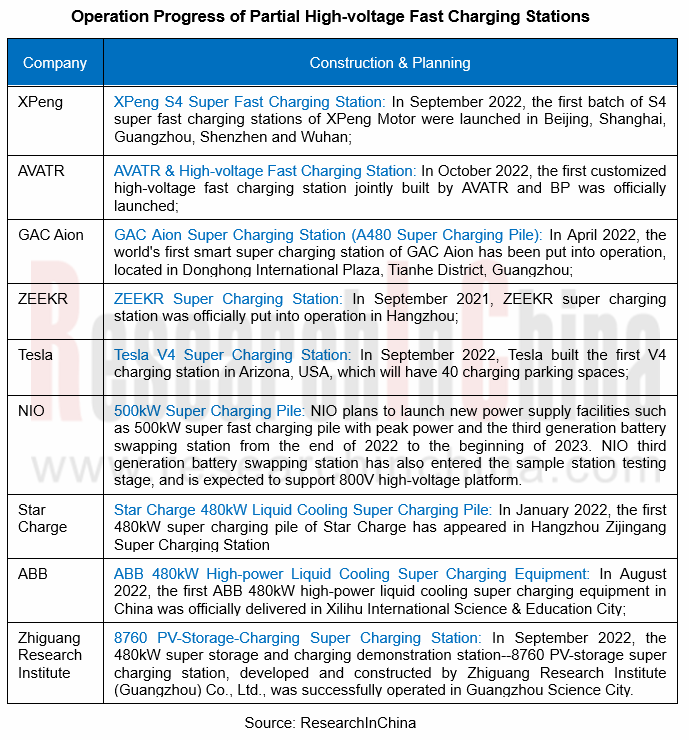

At present, high-voltage fast charging has become the most popular choice in the industry. In 2019, Porsche Taycan launched the first 800V high-voltage electrical architecture in the world, equipped with an 800V DC fast charging system and supporting 350kW high-power fast charging; In 2022, XPeng Motor launched its G9 model based on 800V SiC platform in mass production, while Geely and Mercedes Benz launched the SEA architecture and MMA architecture supporting 800V.

At the same time, OEMs, charging operators and energy enterprises have laid out high-voltage fast charging stations successively. GAC Aion, XPeng, AVATR, ZEEKR, NIO and Tesla all have layout plans for high-voltage fast charging stations. The maximum current of a single XPeng S4 ultrafast charging pile is 670A, and the peak charging power is 400kW; GAC Aion super-charging station (A480 super-charging pile) has a peak power of 1000V, a current of 600A and a liquid cooled charging system; In 2020, the State Grid began to invite bids for 480KW high-voltage fast charging piles, presenting a trend of continuous growth.

Trend 2: Battery swapping

The battery swapping mode is a fast power supplement mode for new energy vehicles. The battery is stored and charged through a centralized battery swapping station, and then the battery swapping service is provided for the car owners to achieve the same speed of battery supplement and refueling. According to the statistics of Charging Alliance, as of September 2022, China has 1762 battery swapping stations (excluding heavy truck battery swapping). In terms of provinces and cities, the top ten charging stations are Beijing, Guangdong, Zhejiang, Jiangsu, Shanghai, Shandong, Sichuan, Hebei, Hubei and Jilin, and top three provinces account for 39.9% of the total.

According to the different battery installation position, size and endurance mileage, the battery swapping methods are divided into passenger car and commercial vehicle, in which passenger car battery swapping is divided into module-in-box and integrated chassis; the commercial vehicle battery swapping can be divided into top-hanging type, overall one-sided type and overall two-sided type.

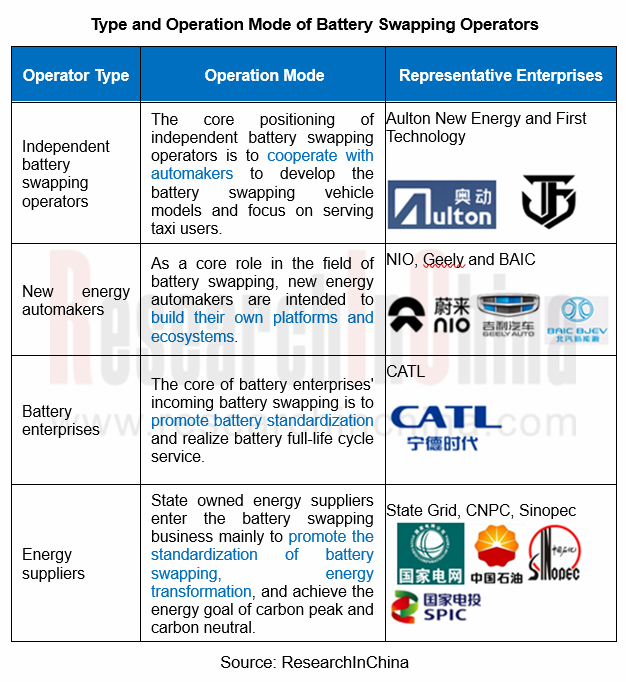

In the passenger car market, the main battery swapping operators in China at present include NIO, Aulton New Energy, Blue Park Smart Energy, First Technology, etc., of which NIO and Aulton New Energy are far ahead in the number of covered battery swapping stations.

The promotion and application of battery swapping mode need not only technical support of enterprises, but also cooperation of national standards, battery standards, vehicle manufacturers and energy enterprises. The "national team" in the field of battery swapping was established in 2022. On September 22, 2022, Shanghai Jieneng Intelligent Power New Energy Technology Co., Ltd. jointly invested by Sinopec, CNPC, SAIC, CATL and Shanghai International Automobile City Group was officially established, The registered capital is RMB 4 billion, and the business scope covers power battery leasing, energy supplement technology R&D and promotion, battery operation management, big data services, etc.

With establishment of "National Team" for battery swapping, 2022 will become the first year of China's battery swapping mode development. In the future, improvement of standardization of battery swapping vehicle model, BaaS mode and cascade utilization of batteries will become three major development trends of battery swapping technology.

Trend 3: PV-storage-charging integrated smart energy station

PV-storage-charging integrated smart energy station takes the electric vehicle charging station as carrier, based on the design concept of energy Internet, integrates photovoltaic, energy storage and other distributed energy systems, realizes the coordinated operation of energy, gird, load and storage, and on this basis, carries out practical demonstration of multiple commercial operation modes of electric vehicle charging and discharging facilities.

At present, the PV-storage-charging integrated station market has accommodated vehicle companies, battery companies, charging operators, energy companies and others, mainly through cooperative construction and operation of various enterprises, and most of them are demonstration stations and new energy practice stations.

China has small proportion of PV-storage-charging integrated stations, and the large-scale promotion is late, mainly because the construction of PV-storage-charging integrated stations needs large investment, and many enterprises are still waiting for the policy trend; as well as low technology maturity. With the launch of super-charged vehicles by OEMs, the cost efficiency improvement of energy storage batteries and the support of national policies, 2025 will be the first year of PV-storage-charging industry development.

OEMs' high-voltage fast charging/battery swapping technology architecture and trend

Taking NIO as an example, NIO has already layout in battery swapping station and ultrafast charging: the second generation of NIO battery swapping station has been put into use, introducing the BaaS mode. NIO also leads the establishment of Wuhan Weineng Battery Assets Co., Ltd. which is responsible for battery management and operation. According to the plan, the third generation battery swapping station and 500kW ultrafast charging station will be released at the end of 2022.

NIO automotive super-charge network: 500kW ultrafast charging is expected to achieve a peak current of 650A, and adopts liquid-cooling gun line design. In addition, NIO also announced 800V high-voltage platform battery pack and supporting battery swapping system, and which will be open to the whole industry in the future.

NIO battery swapping station: the second generation of NIO battery swapping station is the first in the world to realize autonomous parking in mass production. It is a software-defined and end-cloud combined intelligent battery swapping system. A total of 239 sensors and 4 cloud systems are arranged in the second generation battery swapping station to work together, comprehensively deepening the application of visual recognition technology. With the help of science and technology, users can start self-service battery swapping with one button in the car without getting off.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...