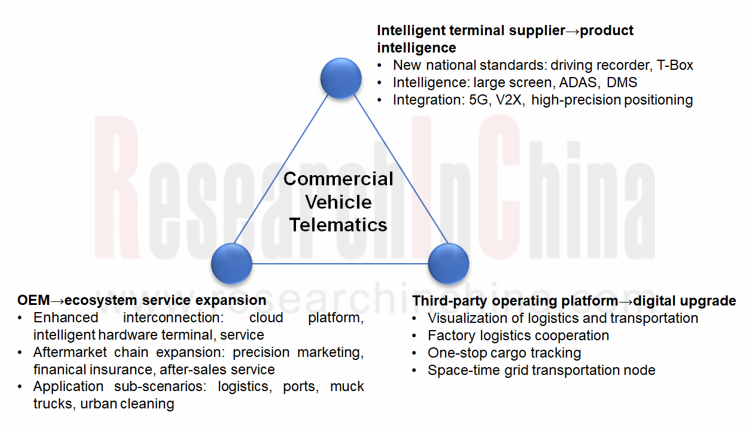

Commercial vehicle telematics research: three parties make efforts to facilitate the industrial upgrade of commercial vehicle telematics.

In 2022, China's commercial vehicle telematics industry continues upgrade. Intelligent terminal suppliers, telematics platforms of OEMs, and third-party operating platforms realize business expansion and digital upgrade on the strength of their own advantages.

1. As terminal product standards are upgraded, leading companies stick with intelligent expansion.

Driven by factors such as upgraded China Phase VI Emission Standards and new national standards, commercial vehicle products like driving recorder and T-Box enter the upgrade phase in 2022. Leading suppliers are the first to launch new products to respond to the update needs of OEMs in a timely manner.

?In addition to meeting China Phase VI Emission Standards, commercial vehicle T-Box is heading in the direction of high computing power, integration, and modularization. Hopechart IoT and Yaxon Network among others have launched products that integrate 5G, C-V2X and high-precision positioning modules to support more abundant telematics applications.

?As concerns commercial vehicle driving recorder, the new national standard "GB/T 19056-2021 Vehicle Travelling Data Recorder" came into effect on July 1, 2022. Compared with the previous generation of products, such functions as audio and video recording, WiFi communication, wireless public network communication, automatic timing, and driver identification are added, and the positioning requirements are also further enhanced. The likes of Hopechart IoT, INTEST and Qiming Information Technology have completed the research and development of the new national standard-compliant products to meet the market demand.

Terminal device bellwethers are expanding their intelligence business centering on intelligent needs of commercial vehicles. For example, for commercial vehicles, Hopechart IoT has built a product system of five major hardware devices: driving recorder, ADAS terminal, center console screen, T-Box and camera. These products keep upgrading in accordance with new standards and requirements. The company completed pre-research and inspection of the new national standard-compliant driving recorder products in the first half of 2022, which are expected to be mounted on heavy duty vehicles first. Its T-Box used for telematics management and heavy truck exhaust monitoring is connected to CAN buses, and supports OTA updates. Its vehicle center console screens are led by 7 to 15-inch large displays.

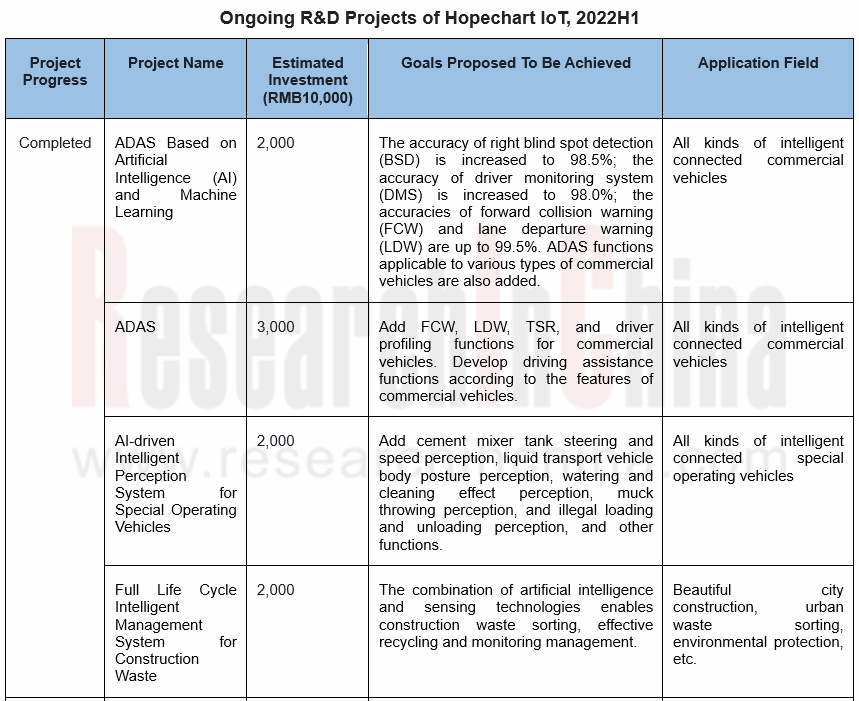

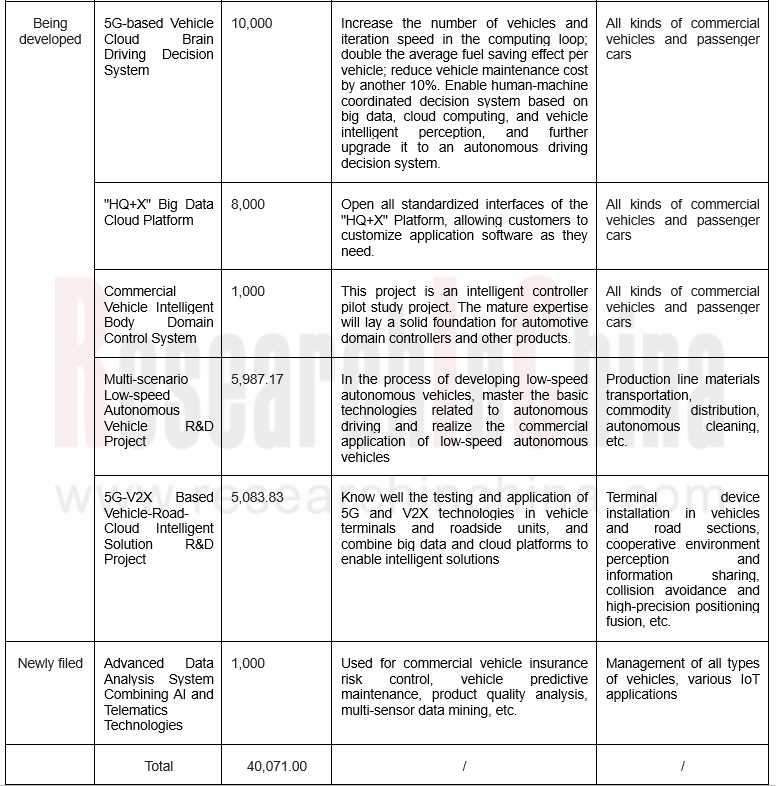

In the first half of 2022, Hopechart IoT developed ADAS, DMS, commercial vehicle controller, big data cloud platform and other projects through a RMB400 million investment plan. The application fields will also extend from commercial vehicles to passenger cars.

2. OEMs expand service scope to create ecosystem solutions.

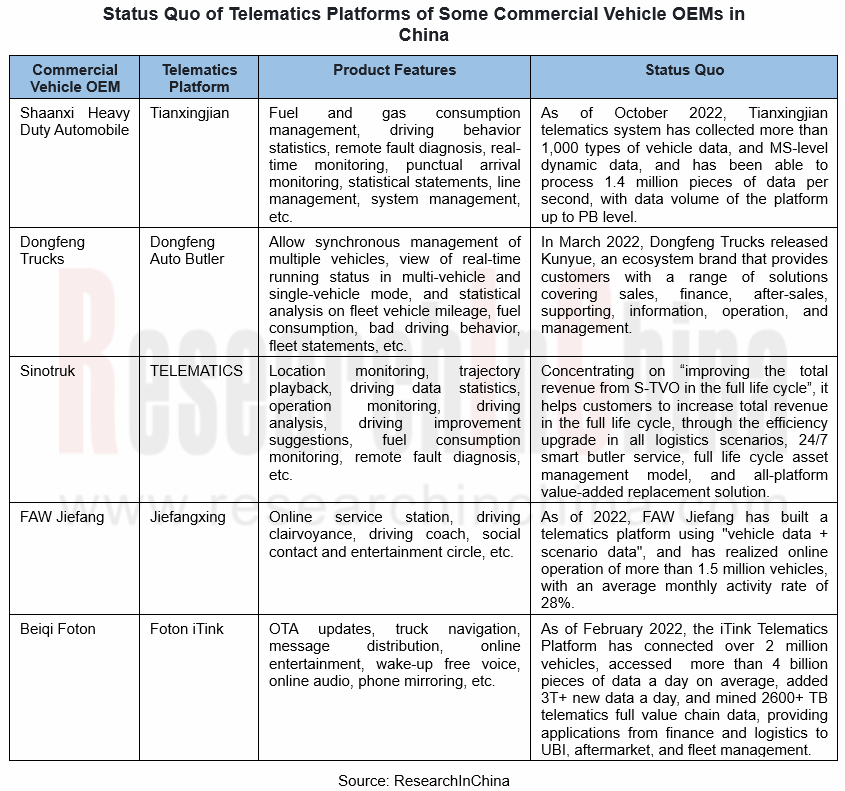

To expand the value chain, commercial vehicle OEMs are integrating ecological resources and building system solutions, with products as the core. Besides such functions as vehicle monitoring, fleet management, and driving behavior analysis, OEMs start extension to the aftermarket chain covering precision marketing, financial insurance, and after-sales service, and realize refined management according to application scenarios.

In Sinotruk’s case, it achieves "higher total revenue from S-TVO in the full life cycle" by starting from the links of logistics efficiency upgrade, butler services, asset management and platform added value.

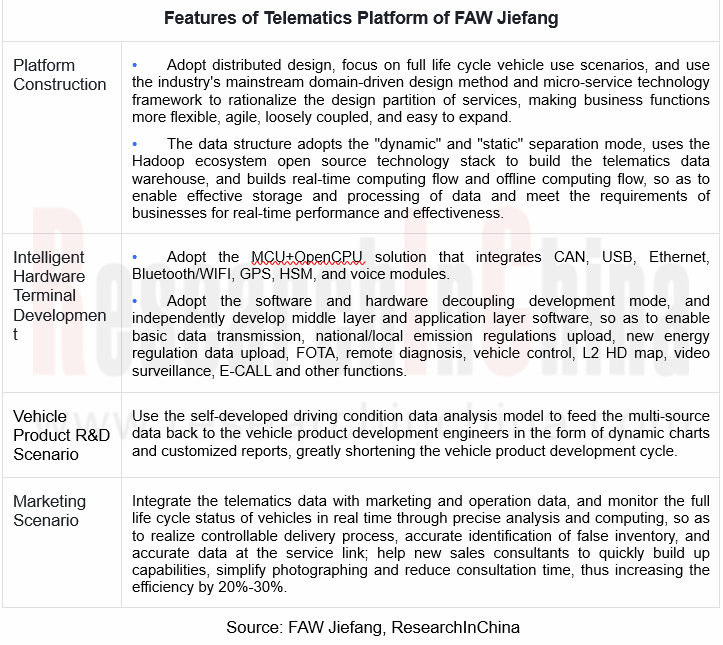

In 2022, FAW Jiefang boasts a telematics installation rate of 100%, and realizes interconnection between cloud platforms, intelligent hardware terminals, and service points of contact. In the next three years, the company will focus its efforts on product competitive edge enhancement, industrial application of big data, and large-scale ecosystem development.

In March 2022, Dongfeng Trucks released the ecosystem brand "Kunyue". In addition to product sales, it provides customers with a range of solutions such as finance, after-sales, supporting, information, operation, and management. The brand has made three breakthroughs:

① Build a big data platform for digital transformation in R&D, supply, manufacture, marketing, and service models, and explore the "product + operation + ecosystem" business model;

② In the operation of application sub-scenario ecosystem, build "battery swap logistics operation solution" and "smart port operation solution";

③ Launch "Sunshine Connection" online freight platform to enable interconnection between online freight platforms.

3. Third-party operating platforms are dedicated to digital upgrade of sub-scenarios.

Third-party operating platforms provide general or customized services for general or specific customers. Their service contents cover multiple functions such as map navigation, logistics tracking, and supervision and management. Third-party operating platforms have matured with their own features.

For example, G7, a platform operated by Beijing Huitong Tianxia Wulian Technology Co., Ltd., has connected 1.8 million vehicles, and a wide range of road logistics production factors like trucks, trailers, gasoline stations and logistics parks. It can obtain all road freight big data such as vehicle trajectories, driving behaviors, energy consumption, and park management, in a bid to achieve economic benefits such as efficiency improvement and cost reduction.

For OEMs, vehicle owners and drivers, logistics companies, aftermarket service providers, financial insurance companies, and carriers, Zhonghuan Satellite Navigation Communication Co., Ltd. facilitates the intensive, intelligent and digital upgrade of the logistics industry. The company has launched intelligent connection service solutions for more than 10 commercial vehicle manufacturers and served more than 1.4 million vehicles.

Taking government supervision as the starting point, Sinoiov cooperates with the Ministry of Communications and the Ministry of Public Security among others to obtain relevant data permissions, and provides related data application services, based on which Sinoiov has established a national road freight platform. While providing regulatory services for governments, it also offers an array of platform services to road freight companies, and provides financial services according to scenarios.

Third-party operating platforms have the ability to integrate information and data of different automakers, companies, and vehicles. Enabling cross-platform services through connected data according to the needs of each sub-scenario has become the key direction of digital upgrade.

For example, in 2022, Sinoiov together with over 3,000 ecosystem partners built digital logistics integrated solutions by relying on the massive logistics big data of "people, vehicles, goods, and companies" and combining its own strengths in Beidou space-time application, logistics AI, and telematics. Its solutions have been used by manufacturers and fast moving consumer goods companies, including HBIS Group, SD Steel Rizhao Co., Ltd., BBMG Corporation, Yili, Mengniu Dairy, and Liby, to achieve the goals of factory warehousing, transportation and distribution integration, whole order fulfillment process visualization, transport capacity resources integration and precipitation, freight cost reduction, and higher settlement efficiency, helping companies realize digital logistics upgrade.

In the future, based on digitization empowering the general forms of road freight, Sinoiov will more deeply participate in restructuring of business formats in certain market segments, and catalyze new products with lower costs and higher efficiency in the industry.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...