Automotive radar research: installations surged by 49.5% year on year in 2021, and by 35.4% in the first nine months of 2022.

1. The installations of automotive radars sustain growth, and are expected to reach more than 24 million units in 2025

In 2021, the installations of radars in new passenger cars in China reached 12.241 million units, jumping by 49.5% from 8.187 million units in 2020; from January to September 2022, the installations achieved 11.391 million units, a 35.4% surge compared with 8.414 million units in the same period of 2021. As L2.5 and L2.9 autonomous driving come into real commercial use, the automotive radar market will still gain momentum, with more radars per vehicle. It is estimated that the installations will be over 24 million units in 2025.

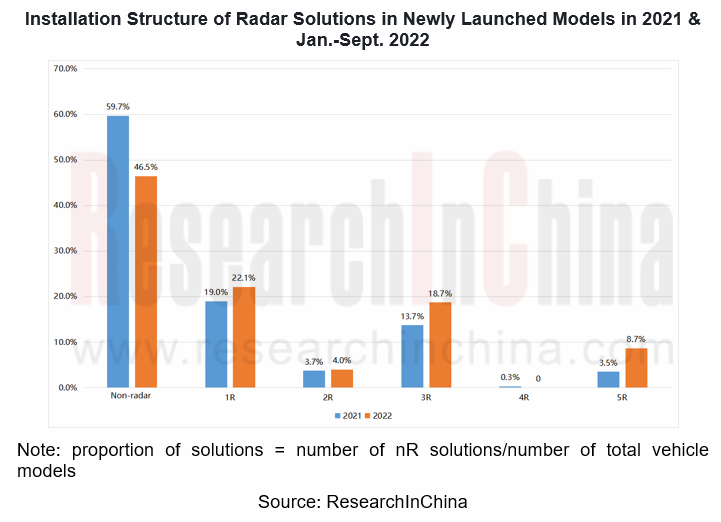

2. In 2022, the proportion of multi-radar solutions in vehicle models on offer increases, of which 3R and 5R solutions grow fastest.

In terms of vehicle hardware solutions, from January to September 2022, there were 678 new passenger car models launched on market in China, of which 22.1% packed 1R solutions, up 3.1 percentage points from the prior-year period; 4% carried 2R solutions, up 0.3 percentage points; 18.7% were equipped with 3R solutions, up 5 percentage points; 8.7% were installed with 5R solutions, up 5.2 percentage points.

Wherein, 3R and 5R solutions sustained the fastest growth, mainly because:

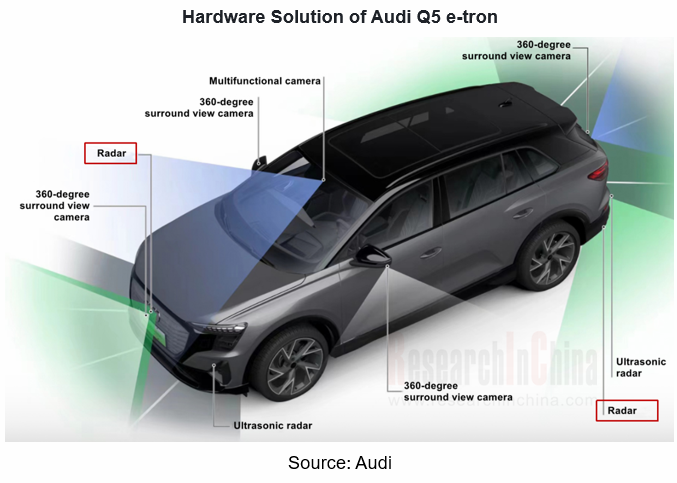

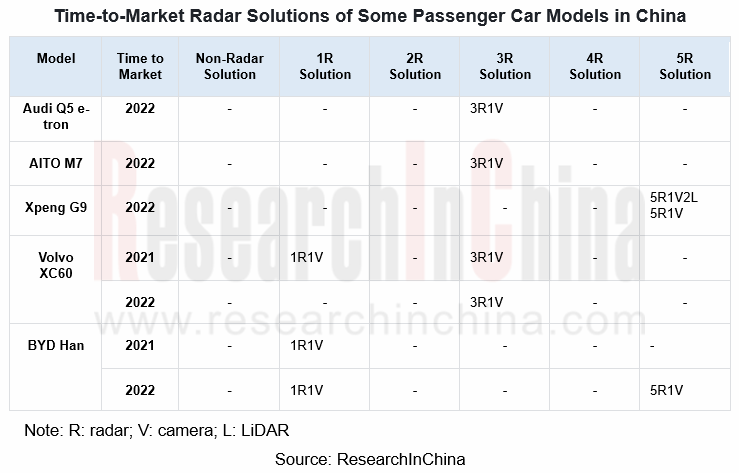

(1) Many of the new models launched in 2022 pack 3R and 5R solutions. Examples include Audi Q5 e-tron equipped with a 3R1V solution, and Xpeng G9 offering two 5R solutions (5R1V2L/5R1V).

(2) The 2022 new models of some cars carry upgraded solutions. For example, the 2022 models of Volvo XC60 pack a 3R1V solution as a standard configuration, while the 2021 models feature a standard configuration of 1R1V and 3R1V is a high configuration; the 2022 models of BYD Han add the high configuration of a 5R1V solution and are equipped with the standard 1R1V solution, also a standard configuration for the 2021 models.

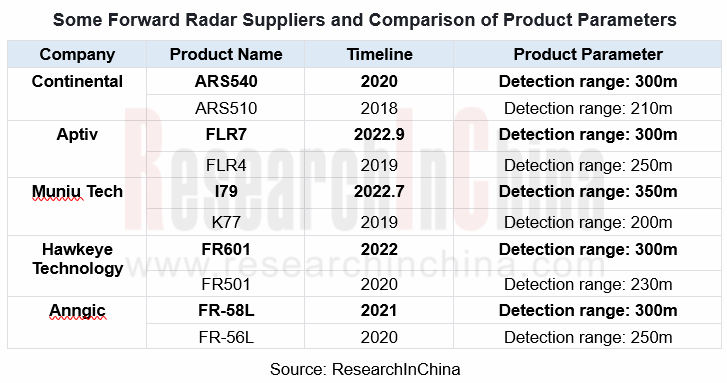

3. The new-generation forward radars deliver a detection range up to 300 meters.

From suppliers, it can be seen that in the first nine months of 2022, foreign forward radar companies still played a dominant role, with installations sweeping over 96% of the total. Suppliers were led by Bosch, Denso, and Continental.

As radar technology keeps iterating, the parameters are also being improved. The latest generation of forward radars launched by suppliers during 2020-2022 offers a common maximum detection range of 300m, about 50-100m longer than the previous generation.

For example, FLR7, a forward-facing radar launched by Aptiv in 2022, features 4D imaging and a detection range of 300m (50m longer than the previous generation product). As Aptiv's seventh-generation radar (Gen7), it incorporates air-waveguide antenna technology based on proprietary intellectual property and a unique design.

Hawkeye Technology, established in 2015 and headquartered in Nanjing, specializes in research and application of 76~81GHz automotive radars for passenger cars and transportation. FR601 Hawkeye Technology introduced in 2022 delivers a detection range of 300m (70m longer than the previous generation product), HFOV of 100° and VFOV of 20°, and detects as many as 1,024 targets.

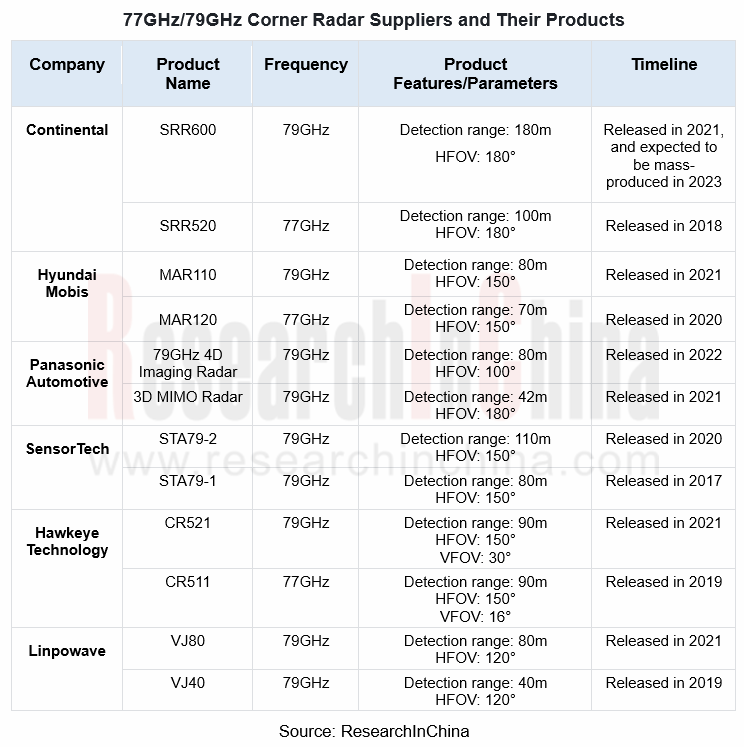

4. 77GHz is the current mainstream of corner radars, and 79GHz is the future trend.

79GHz corner radar well outperforms 77GHz and 24GHz radars. 77GHz radar with limited bandwidth below 1GHz (76-77GHz) fails to enable high resolution. 79GHz corner radar with bandwidth of 4GHz (77-81GHz) is a better option in the case of high resolution required. Compared with 24GHz radar, 79GHz radar allows for design of more transceiver arrays in the same size to form a larger transmit aperture and narrower beams, thus offering higher angular resolution.

At present, among the foreign suppliers of corner radar products, Continental and Hyundai Mobis have turned to 79GHz from 77GHz. Continental unveiled 79GHz corner radar SRR600 in 2021, with a detection range of 180m (80m longer than the previous-generation product), and HFOV of 180°; Hyundai Mobis released 79GHz corner radar MAR110 in 2021, with a detection range of 80m (10m longer than the previous generation product), and HFOV of 150°.

Panasonic Automotive launched a 4D 79GHz corner radar in 2022, with a detection range of 80m and HFOV of 100°. In 2021, it announced a 3D MIMO 79GHz corner radar with a detection range of 42m and HFOV of 180°.

Among Chinese suppliers, Hawkeye Technology has turned to 79GHz corner radar products from 77GHz. In 2021, it introduced CR521, a 79GHz corner radar with a detection range of 90m, HFOV of 150°, and VFOV of 30°.

Wuhu SensorTech and Linpowave have launched their second-generation 79GHz corner radars. Wherein, SensorTech released the second-generation 79GHz corner radar STA79-2 in 2020, with a detection range of 110m and HFOV of 150°; in 2021, it introduced STA79-1, the first-generation 79GHz corner radar with a detection range of 80m and HFOV of 150°.

Linpowave released the second-generation 79GHz corner radar VJ80 in 2021, with a detection range of 80m and HFOV of 120°; in 2019, it announced VJ40, the first-generation 79GHz corner radar with a detection range of 40m and HFOV of 120°.

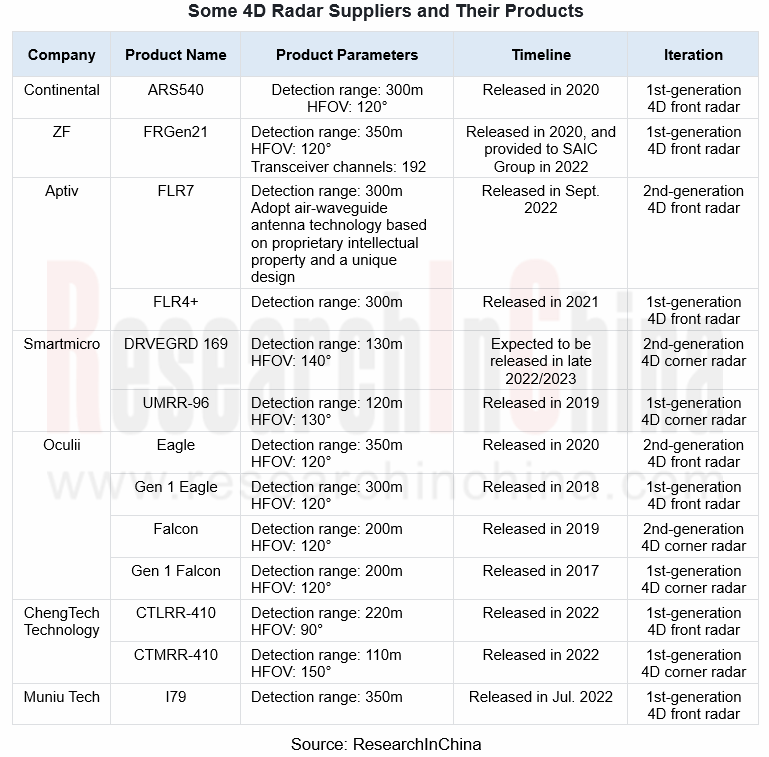

5. Chinese suppliers work to deploy 4D radars, having announced the first-generation products.

In addition to the distance, azimuth, and speed that can be detected by conventional 3D radars, 4D radars can also detect height. Moreover, 4D radars feature a high angular resolution and the ability to classify static obstacles. There are three key 4D radar technology routes: multi-receiver and multi-transmitter chip, synthetic aperture imaging + antenna design, and metamaterials.

Among current foreign suppliers, Aptiv and Smartmicro have released second-generation 4D radars. Aptiv has introduced the second-generation 4D forward-facing radar FLR7 in 2022, with a detection range of 300m; in 2021, it announced FLR4+, its first-generation 4D forward-facing radar that delivers a detection range of 300m.

Smartmicro, a radar technology company established in 1997 and headquartered in Germany, mainly provides traffic radars and Automotive Radars. The company is expected to announce its second-generation 4D corner radar with a detection range of 130m and HFOV of 140°, in late 2022 or 2023. Its first-generation 4D corner radar UMRR-96 was introduced in 2019, with a detection range of 120m and HFOV of 130°.

Chinese suppliers follow suit. In 2022, ChengTech Technology launched 4D front radar CTLRR-410, with a detection range of 220m and HFOV of 90°, and the 4D corner radar CTMRR-410, with a detection range of 110m and HFOV of 150°. Muniu Tech released 4D front radar I79 in July 2022, which is its third-generation front radar, and also its first-generation 4D front radar, with a detection range of 350m.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...