Automotive CMOS Image Sensor (CIS) Chip Industry Research Report, 2022

Automotive CIS research: three major segmentation scenarios create huge market space

It is known that the biggest application market of image sensor is smartphone field. As the smartphone market becomes saturated, image sensor chip vendors are turning to booming intelligent vehicle market. The development of automotive intelligence has led to a sharp increase in demand for cameras, with the installation volume of passenger car cameras in Chinese market expected to exceed 100 million by 2025. The huge demand also drives the growth of automotive image sensors and gives rise to more market segments.

ICV TANK forecasts that the market for automotive CIS will reach $7.4 billion by 2027.

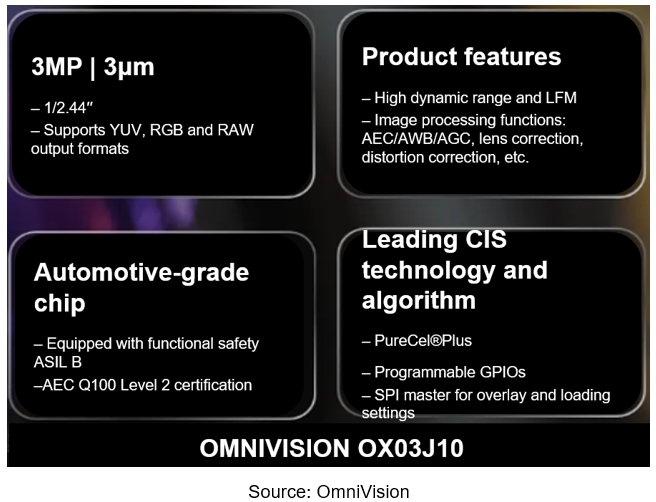

The requirements of CIS chips for intelligent vehicle are much higher than those of mobile phone CIS. Take OmniVision OX03J10 chip as an example, as an automotive-grade chip it has passed AEC-Q100 Level 2 certification and ASIL B functional safety certification; it also has high dynamic range and LFM (LED Flicker Mitigation) function.

By application scenario, automotive CIS can be subdivided into three categories: CIS for ADAS, CIS for cockpit, and CIS for image (mainly for human eyes, such as surround view & rear view). According to Yole's forecast, by 2026, CIS for ADAS will reach 100 million pieces, CIS for automotive images (e.g., surround view & rear view) will reach 182 million pieces, and CIS for cockpit will reach 82 million pieces.

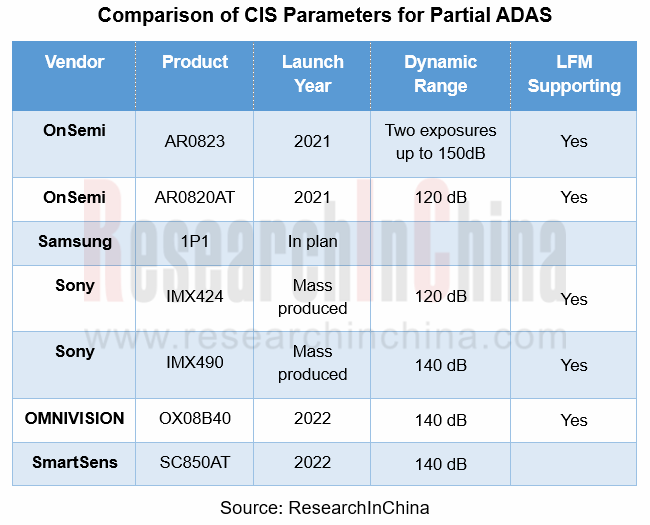

The latest CIS for ADAS in general has reached 8 megapixels and the dynamic range is starting to reach 140 dB, as shown in the following figure:

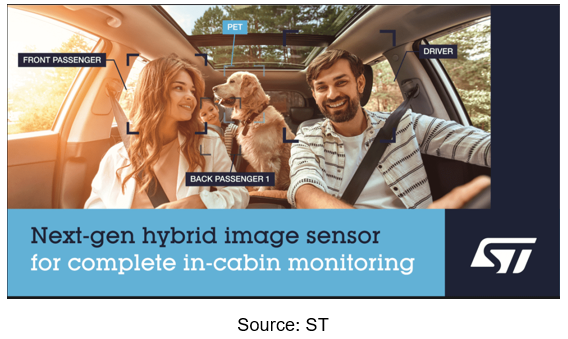

CIS for cockpits generally has a high frame rate (60fps or more), often with a global shutter, and integrated technology allows the driver monitoring and occupant monitoring system to operate effectively with one camera instead of two.

In 2022H2, ST introduced Vx1940, a next-generation hybrid dual-shutter image sensor that builds on VB56G4A, the first-generation cockpit CIS product, to monitor the entire vehicle interior, covering the driver and all occupant spaces. New target applications for this new image sensor include driver monitoring, video calling, occupant seat belt detection, vital signs monitoring, child presence detection, gesture recognition and high-quality video recording and photography, with a single sensor covering all DMS and OMS applications.

The CIS of surround view & rear view (image) category is generally 1-3 MP, with the dynamic range of 120 dB for most and 140 dB for a few. OMNIVISION released the new 1.3 MP image sensor OX01E20 for 360 ° Surround View System (SVS) and Rear View Camera (RVC) at CES 2023.

OMNIVISION says the OX01E20 meets ASIL-B safety standards and will be in mass production by June 2023 with the following key features:

?140dB HDR and LFM simultaneously.

?Good HDR and LFM performance over the entire temperature range of the vehicle.

?Advanced ISP, including DC/PC and OSD.

?Small size solutions with a-CSP technology.

?Low power consumption.

?Based on OMNIVISION's PureCel Plus architecture, which offers good low light sensitivity.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...