AUTOSAR research: CP + AP integration, ecosystem construction, and localization will be the key directions.

AUTOSAR standard technology keeps upgrading, and the willingness to build open cooperation gets ever stronger.

The trend for the boom in intelligent vehicle basic software brings new development opportunities to AUTOSAR. In recent years, new AUTOSAR standards have been continuously introduced to adapt to the fast-growing automotive standard software market.

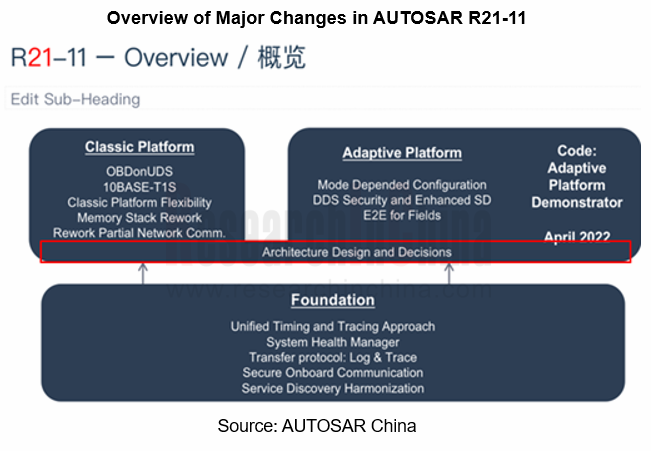

In December 2022, AUTOSAR delivered its latest release R22-11. Compared with the previous releases, the new standard proposed the cross-platform concept for the first time. Moreover, the AUTOSAR Classic Platform (AUTOSAR CP) adds V2X and DDS communication support for China; the AUTOSAR Adaptive Platform (AUTOSAR AP) offers additions or improvements in CAN, firewall, service-oriented vehicle diagnosis and other aspects. In the AUTOSAR AP architecture, compared with R20-11, the releases R21-11 and R22-11 remove ara:rest cluster and add ara:idsm and ara:fw clusters.

As the releases like AUTOSAR R20-11, R21-11 and R22-11 are published, the AUTOSAR AP specification is becoming mature. Some basic functions of the AP platform have been mature enough to be marketed, and the relevant software platforms compatible with the AUTOSAR AP, especially autonomous driving-related products, have been rolled out one after another. The first-generation AP-based vehicle models have come into the market, and the launch of more models equipped with the platform will also follow up.

The future automotive industry will be a fully open ecosystem built by third-party collaborative organizations. This is also AUTOSAR’s future vision and important direction. As an alliance, AUTOSAR is making continuous efforts on cooperation with third parties. For example, in terms of Vehicle API for vehicle-cloud cooperation, AUTOSAR often partners with COVESA; as concerns data exchange formats, it teams up with ASAM; it cooperates with KHRONOS in hardware acceleration and image acceleration.

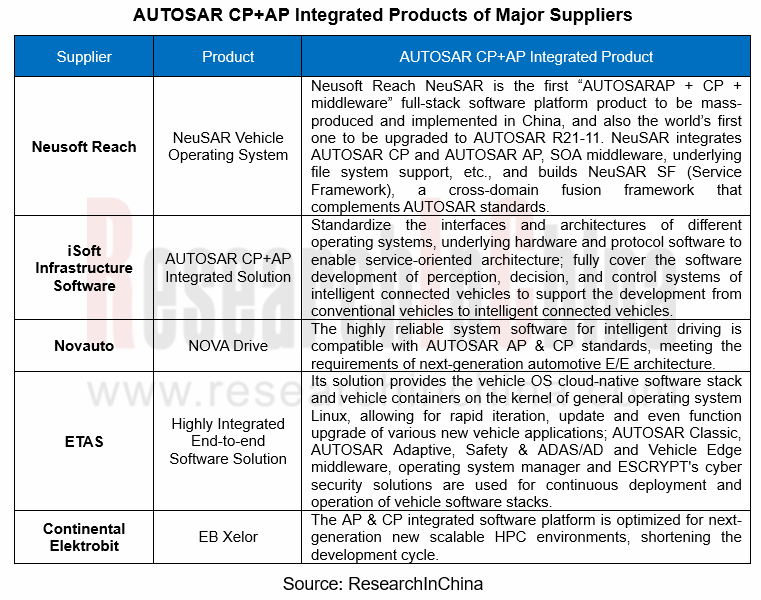

Following the development trend of E/E architecture, much more AUTOSAR CP+AP integrated products tend to be supplied.

Vehicle domain controller and vehicle central computer are developing by leaps and bounds, which is accompanied by the gradual evolution of vehicle E/E architecture towards centralized integration. For new-generation powerful processors, basic software of the two is required to pack both AUTOSAR AP and AUTOSAR CP to meet the requirements of the corresponding security domain and high-performance computing domain. The AUTOSAR CP+AP integrated supply becomes a major trend. While meeting technical performance requirements, it can greatly shorten the development cycle of software applications and reduce costs to achieve rapid iterations. In recent years, major suppliers have raced to launch their integrated solutions.

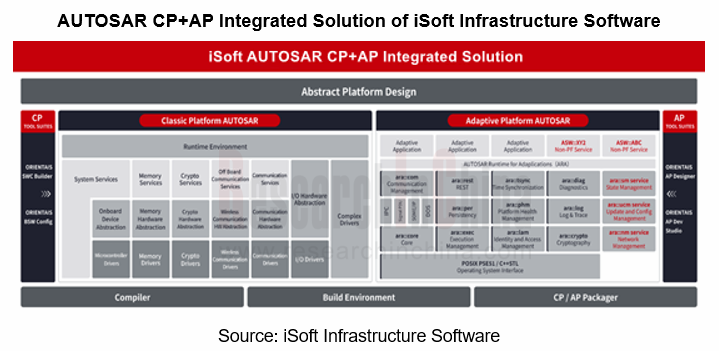

In April 2022, iSoft Infrastructure Software introduced its AUTOSAR CP+AP integrated solution. With features of hard real-time performance, high security, and low energy consumption, the solution meets automotive requirements, supports heterogeneous computing, and builds software system architecture that can be managed flexibly, enabling dynamic communication connection and deployment of applications. It also supports SOME/IP, DDS and other protocols, and can be used in intelligent driving, autonomous driving and Internet of Vehicles, covering such application scenarios as ADAS, intelligent cockpit, T-BOX, and domain controller.

In addition, in the trend for AP+CP integrated supply, the architecture and methodology of the two are tending to integrated, which has started from the release AUTOSAR R21-11. Before R20-11, the architecture and methodology of AP and CP were separated. In the latest release R22-11, the concept of cross-platform is just proposed for the first time.

Chinese suppliers are working hard to deploy, and the localization of AUTOSAR in China is accelerating.

In the context of increasingly high requirements for vehicle development speed and function iteration, conventional software products and software development modes no longer fully adapt to the current market. In the face of the fast-paced intelligent vehicle market, suppliers, especially Chinese local suppliers, make an active response and keep launching new marketable products, answering the needs of customers for rapid iteration.

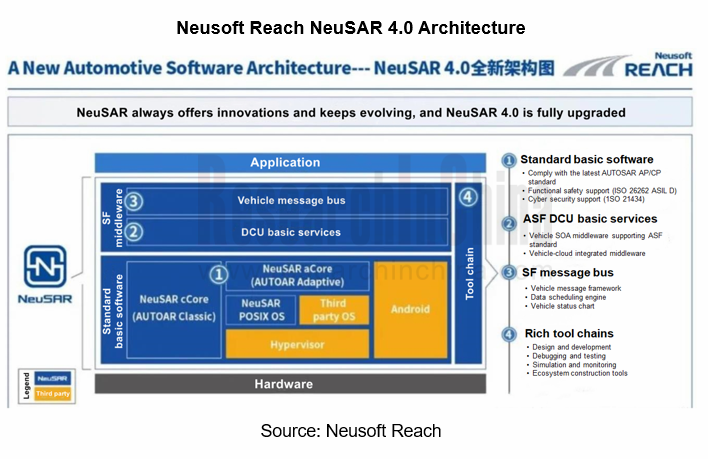

Neusoft Reach joined AUTOSAR in 2017 as a Premium Member. In December 2022, Neusoft Reach announced a new release of basic software - NeuSAR 4.0. As a new automotive software application development framework, NeuSAR 4.0 provides AUTOSAR standard-compliant components, including Classic AUTOSAR - NeuSAR cCore and Adaptive AUTOSAR - NeuSAR aCore. In this upgrade, both cCore and aCore are iterated to the release AUTOSAR R21-11.

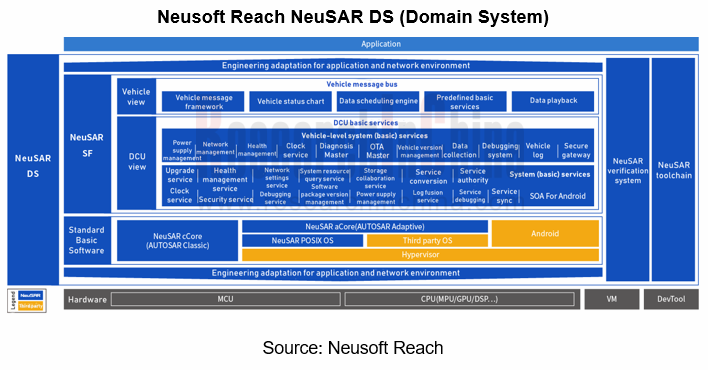

NeuSAR 4.0 not only still offers improvements in AUTOSAR, but also introduces a new automotive software application development framework for the cross-domain integration stage and upgrades the NeuSAR SF (Service Framework) and NeuSAR DevKit tool chain. It moves the development view from the domain controller level to the full vehicle level to solve the problem in software deployment for multi-core heterogeneous domain controllers, and also releases NeuSAR DS (Domain System) for prototype development platforms that integrates the latest AUTOSAR components and SF middleware.

In recent years, in the background of the boom of intelligent vehicles in China and the increasing number of Chinese partners, AUTOSAR has valued the Chinese market more highly. Based on the original AUTOSAR User Group in China, in April 2022, AUTOSAR established the AUTOSAR China Hub, the third regional center outside of Japan and the US, aiming to enhance services and support for Chinese partners and carry out a range of AUTOSAR-related training or popularization activities.

Meanwhile, in 2022, the latest release AUTOSAR R22-11 added the new feature of "V2X Support for China" to the CP to further support China’s V2X technical standards. It is known that this feature is jointly developed by Huawei, Neusoft Reach, Bosch, BMW, Volkswagen Audi, Continental and HingeTech among others.

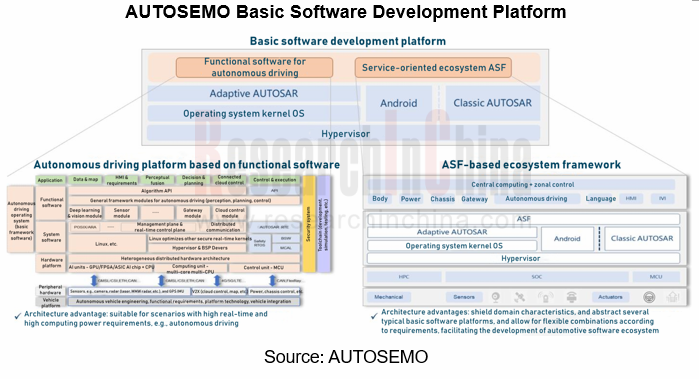

Based on the AUTOSAR architecture standards, China established the China Automotive Basic Software Ecosystem Committee (AUTOSEMO), with the aim of coordinating and organizing members to introduce a range of basic software standards and specifications, for example, providing white papers on the development of automotive basic software, ASF technical specifications, and vehicle-cloud integration technical specifications. Wherein, in the white papers on the development of automotive basic software, the basic software development platform is built on AUTOSAR AP and AUTOSAR CP; the ASF is an expansion of general basic software, and also expands the service management framework of AUTOSAR, facilitating localization of AUTOSAR in China.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...