Chinese Independent OEMs’ Telematics System and Entertainment Ecosystem Research Report, 2022

Vehicle telematics system research 1: the control scope is expected to expand to the entire vehicle.

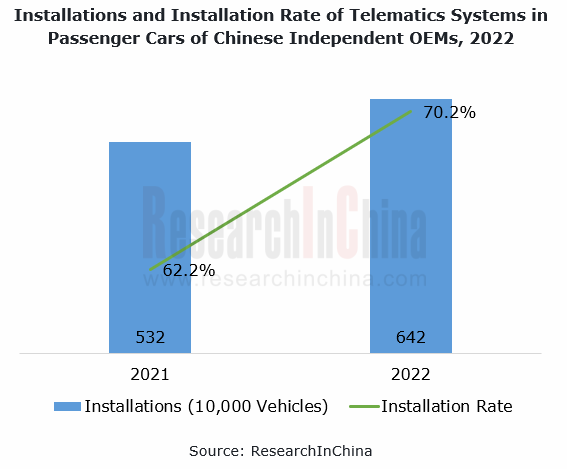

From January to December 2022, Chinese independent OEMs installed telematics systems in 6.42 million vehicles, surging by 20.6% on the previous year, with the installation rate higher than 70%, up 8 percentage points from the prior-year period.

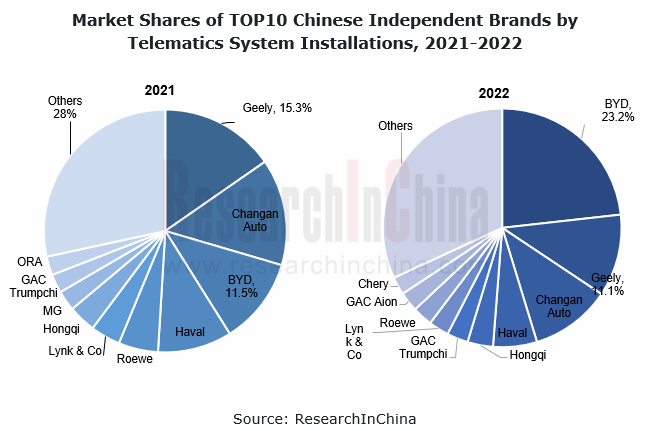

By brand, in 2022, driven by the new energy market (from January to December 2022, BYD’s new energy vehicle sales exceeded 2.2 million units), BYD installed the most telematics systems in the market, accounting for more than 23%, 11.7 percentage points higher than the same period last year; Geely followed, with its share down 4.2 percentage points year on year.

In 2022, the development of Chinese independent brands in telematics systems highlights the following:

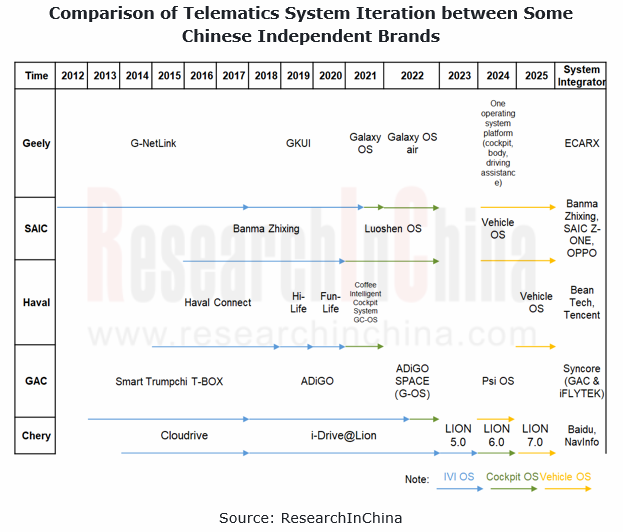

1. Starting from 2024, the control scope of telematics systems is expected to expand to the entire vehicle.

In 2022, the control scope of telematics systems expanded to the whole cockpit. According to the plans of OEMs, from 2024 onwards, they will expand the control scope of their telematics systems to AD/ADAS, body and other domains, that is, the entire vehicle.

Geely’s telematics system has gone through four development phases: G-NetLink, GKUI, Galaxy OS, and Galaxy OS Air. In 2024, its telematics system will realize control over the entire vehicle.

G-NetLink: during 2012-2017, based on Android, and equipped with mainstream functions, e.g., Carlife/Carplay, voice, and remote control

GKUI Era: during 2018-2021, built by ECARX on the E01 platform, introduce WeChat and Alipay account login, and support car-home interconnection, watch control car and other functions

Galaxy OS: applied in vehicles in 2021, built by ECARX on the E02 platform, open more than 1,800 car control signal interfaces, and enable control on more than 200 vehicle functions, ensuring that users can "control what they see" in the car

Galaxy OS Air: seen in vehicles in 2022, add the speech chip-based V01+5G communication on the basis of Galaxy OS. The speech data processing speed is increased by 13 times, and such functions as “see and speak” and sound localization in four sound zones are supported.

According to ECARX’s R&D plan, in 2024 Geely will launch a vehicle operating system platform that integrates cockpit, body, and driving assistance domains.

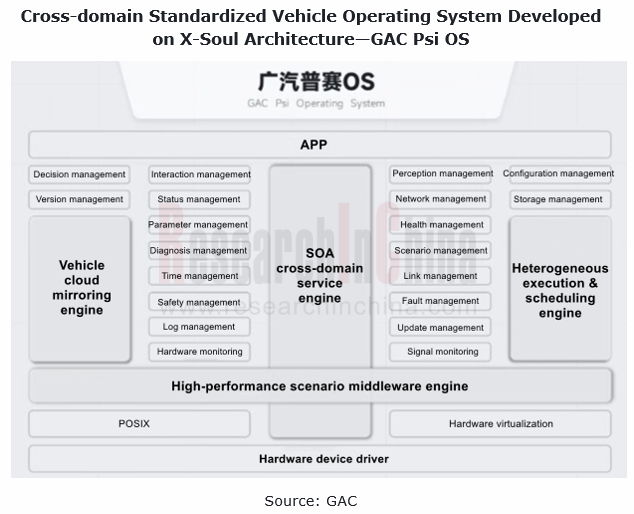

GAC has experienced the three phases: Smart Trumpchi, ADiGO, and ADiGO SPACE. In 2024, it will enable the cross-domain vehicle operating system - GAC Psi OS.

Smart Trumpchi: during 2013-2017, based on WinCE, and equipped with mainstream functions, e.g., 3G and remote control.

ADiGO: during 2018-2022, based on Android, upgrade 4G networks, online navigation, online entertainment, voice and other mainstream functions in deep cooperation with Tencent Auto Intelligence (TAI), and work with Syncore to create G-OS operating system.

ADiGO SPACE: used in vehicles in 2022, enhance voice interaction, and add user-defined voice command and “see and speak” functions; enrich the car entertainment ecosystem by introducing applications, e.g., Mango TV, Kugou and Car Vinyl Music.

Psi OS: expected to be available on vehicles in 2024. It will control the three major domains of driving assistance, infotainment, and smart car control in a unified way to improve software development efficiency and iteration speed, enabling software iteration in a minute compared with previous iteration every month.

2. Supported by hardware such as AR/VR and holographic projector, cockpit games and metaverse will become a new trend for vehicle applications.

By the end of 2022, the difference between vehicle application ecosystems among brands has been narrowing, and software such as social contact, map, audio and video has found massive application in vehicles. Meanwhile, as technologies like powerful chips, holographic projection, and AR/VR, vehicle games have begun to be available on vehicles. Vehicle games are expected to become a next development direction for vehicle applications.

In December 2022, GAC announced the ADiGO SPACE Intelligent Cockpit Upgrade Plan, and introduced two products: ADiGO PARK Metaverse and ADiGO SOUND, an all-scenario sound interaction ecosystem. Wherein, ADiGO PARK Metaverse carries a VR head-mounted display jointly developed by GAC Group and iQIYI Qiyu VR. This device features 5K-level binocular display resolution, and 16MP exterior stereo camera, an equivalent to a 130-inch display, meeting display requirements of 3A games.

In October 2022, Chery released the Lion Ecosystem 2023, according to which Lion 6.0 (2024) will highlight a "third-space" intelligent cockpit and expansion of scenarios (e.g., game/KTV/video office); Lion 7.0 (2025) will feature "space + metaverse", and enable cockpit connection to AR/VR devices.

3. Powerful chips will further enhance the capabilities of telematics systems.

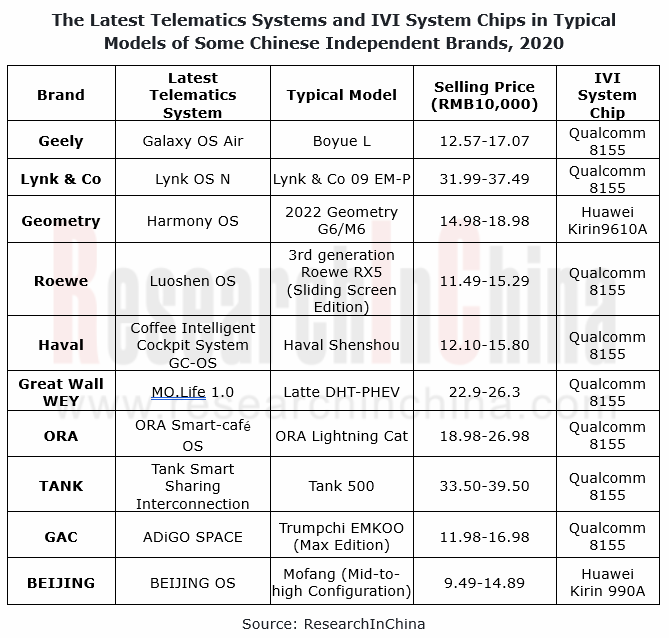

The rapid iteration of telematics systems and the development of vehicle application ecosystems are inseparable from IVI system chips. In 2022, multiple models of Chinese independent brands used high computing power chips like Qualcomm 8155 and Huawei Kirin 990A. Among them, Geely Boyue L, Lynk & Co 09 EM-P and 3rd-generation Roewe RX5 (Sliding Screen Edition) were equipped with Qualcomm 8155 as a standard configuration.

Among the current mainstream cockpit chips, Qualcomm 8155, a 7nm SoC with 1000GFLOPS GPU and 8TOPS NPU, supports up to 6 cameras, 4 2K screens or 3 4K screens. Also it allows different displays to use different operating systems, and supports passenger capacity/passenger recognition, and face recognition & classification/behavior analysis.

The performance of the next-generation cockpit chips will be still ever higher. For example, Qualcomm 8295, a 5nm chip with 30TOPS AI computing power, supports the integration of multiple ECUs and domains, covering dashboard, AR-HUD, center console screen, rear seat displays, electronic rearview mirror, and in-vehicle monitoring. In addition, the chip provides video processing capabilities and supports integration of driving recording function. Higher-performance chips will make telematics systems more capable.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...