Emerging carmaker strategy research: NIO is deploying battery swap and sub-brands for the knockout match in 2023.

In 2022, the sales surged by 32.3% year on year, being concentrated in first-tier cities.

In 2022, NIO sold 120,134 cars, up by 32.3% on an annual basis, specifically:

ES6, ET7 and EC6 were the top three models by sales, of which 42,319 ES6 cars were sold, accounting for 35.2% of the total sales. As ES7, ET7 and ET5 (“775”) were delivered, they saw a rising share of sales. Among them, the sales proportion of ET7 grew fastest, up to 19.1%.

By province, Zhejiang (26,747 units), Jiangsu (18,105 units) and Guangdong (15,626 units) ranked top three by sales.

NIO's cars are largely sold in first-tier cities. In 2022, the first three cities by sales were Shanghai (15,467 units), Hangzhou (10,890 units) and Beijing (6,776 units); users in first-tier cities swept 69.9%, down 5.9 percentage points on the previous year.

Strategy 1: lay out the construction of Power Swap stations

To boost sales in third-and fourth-tier cities, NIO has doubled down on the layout of battery swap infrastructure, and has planned to add 1,000 swap stations in 2023 instead of the originally planned 400, of which: about 400 stations will be built at highway service areas or intersections; another 600 stations will be deployed in urban areas, especially in third- and fourth-tier cities and counties where there is a certain user base but without battery swap stations. NIO intends to offer more convenient Power Swap services, alleviate the anxiety about energy replenishment, and encourage potential car owners in third- and fourth-tier cities to enjoy NIO’s services, so as to push up its car sales.

NIO’s Power Swap stations having iterated to the third generation (launched in December 2022) so far not only support the Summon & Swap feature for cars but also allow for Navigate on Pilot + Summon & Swap. In March 2023, the first third-generation Power Swap stations will land in Nanxiang Town in Jiading District, Shanghai.

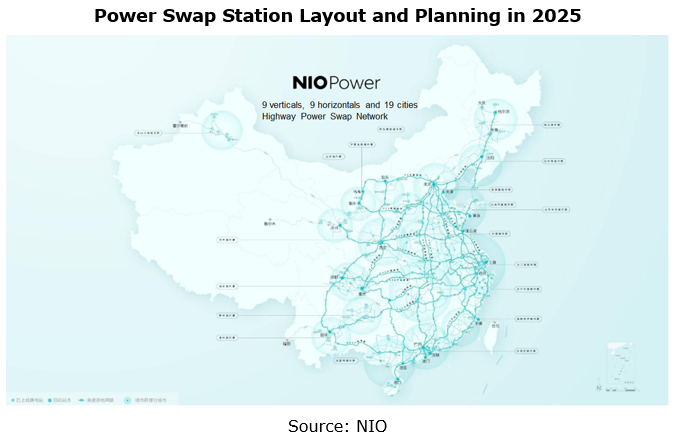

According to its plan, NIO will lay out more than 2,300 Power Swap stations (including 700+ highway Power Swap stations) in 2023; in 2025, NIO will build a 9-vertical, 9-horizontal highway battery swap network with about 3,000 Power Swap stations.

Strategy 2: establish sub-brands to explore the lower end of the market, and enable cockpit and driving integration in the models under the third brand.

In 2022, NIO delivered ET7, ES7 and ET5, three models based on the NT2 platform, and switched from NT1 (the perception system includes cameras, ultrasonic radar, etc.) to NT2 (the perception system adds LiDAR, and upgrades cameras to the high-definition for L4 autonomous driving).

In the first half of 2023, NIO plans to deliver five new NT2-based models and a total of 200,000 cars, and develop the NT3 platform (supporting battery swap and 800V fast charging technology, and carrying batteries made by NIO).

At present, all the cars delivered by NIO are positioned as high-end models priced at higher than RMB300,000. NIO plans to cover the mid-to-high-end and low-to-mid-end markets on the basis of the original high-end brand. In the market of mid-to-high-end cars worth RMB200,000-300,000, NIO will launch "ALPS", a NT3.0-based brand. In the market of low-to-mid-end cars valued at RMB100,000-200,000, NIO will unveil “Firefly", a small-sized car brand to debut in Europe, supporting battery swap and L2+ driving assistance.

NIO’s EEA has evolved from the distributed architecture NT1 to the domain centralized (5*DCU) architecture NT2. In the future, the cockpit and driving integration will be available to the models under the third brand "Firefly". In February, 2023, NIO partnered with KEBODA, a provider of automotive intelligent and energy-efficient components, systems and solutions. KEBODA will provide cockpit and driving integrated domain controller solutions for Firefly, covering autonomous driving domain control, cockpit domain control and gateway functions.

Strategy 3: phase in Navigate on Pilot (NOP) and Power Swap Assist features.

In terms of the evolution of driving assistance functions, NT1-based models feature NOP (pushed with the NIO OS 2.7.0 in October 2020), and NT2-based models support NOP+ (NOP+beta was pushed in December 2022). In the first half of 2023, NT2-based models will gradually introduce the NOP and Power Swap features via OTA updates, specifically: allowing cars to complete the route planning for battery swap on highways; intelligently navigating cars to a Power Swap station in a highway service area; supporting cars to automatically drive away from the service area after automatic battery swapping, and re-enter highways.

Compared with NOP, NOP+ offers improvements in both software and hardware. In terms of software, NOP+ has a global unified architecture and a brand-new algorithm framework. The fusion of data from vehicle cameras, LiDAR and HD maps assists the system in decision and planning. For hardware, the front view camera is replaced by a 360° fisheye camera-based sensing system, 1,550nm LiDAR is added, and radar and ultrasonic sensor (USS) constitute a two-layer sensor. As for computing platform, four Orin SoCs are installed on the 1,016 TOPS ADAM supercomputing platform.

In terms of perception architecture, NIO will update the NOP+ perception architecture to a BEV model architecture in the first half of 2023; meanwhile, the planning and control logics of NOP+ and NIO Pilot (NP) will be integrated, that is, NOP+ will shift the current map-heavy route to the perception-heavy route.

As concerns charging mode, NOP+beta is currently free of charge in a bid to cultivate users' habits. The later official version may charge fees.

Strategy 4: highlight immersive cockpit experience and build smartphone and IVI integration.

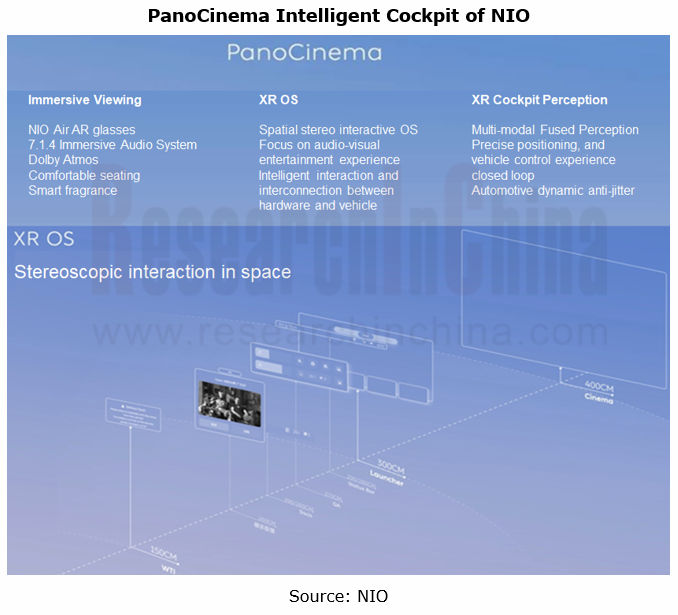

In terms of cockpit experience, NIO’s PanoCinema Intelligent Cockpit comes with the standard configuration of 23 speaker units, which are laid out according to the 7.1.4 channel scheme with 20-channel 1000W power amplifier outputs. Active tuning algorithms and Dolby Atmos bring immersive listening experience.

Based on XR OS, NIO's self-developed exclusive automotive AR operation interface, users can control AR and cockpit functions via NOMI voice assistant, NIO Air Ring and the dedicated smartphone App, when wearing AR glasses. In the future, AR glasses are expected to be combined with HUD or AR HUD. According to the latest patent of AR glasses from NIO in January 2023, its next-generation AR glasses can realize display of vehicle information.

In addition to AR glasses, NIO has also developed the mobile phone business. It aims to offer smartphone and IVI integrated experience, build a people-vehicle-smartphone closed loop, share data and make mobile phones a part of NIO’s automotive ecosystem. Its selling point may be software, offering differentiated smartphone and IVI integrated experience. In February 2023, NIO applied for the trademark "NIO PHONE". It will start close beta test in Q2 2023, and begin official release in Q3 2023.

According to its recent 2022 financial report, NIO was still in the red, with the full-year net loss of RMB14.4371 billion, up by 259.4% year on year. To achieve CEO Li Bin's goal of "break even in Q4 2023 and make profit in 2024", NIO, which persists in long-termism, has to face a last-ditch battle in 2023.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...