1. The automotive camera market maintains a pattern of "one superpower and several great powers".

Automotive cameras are used to focus the light reflected from the target onto the CIS after refraction. From the automotive camera industry chain, it can be seen that main upstream companies are: lens, optical filter, and protective film companies which are committed to processing raw materials and making them into basic hardware such as lenses, optical filters and protective films; main downstream players are: Tier1 suppliers and camera module packaging companies.

At present, the automotive camera module market features a pattern of "one superpower and several great powers", that is, Chinese manufacturer Sunny Optical Technology rules the roost, and Japanese, Korean and other Chinese manufacturers compete in the second echelon.

"One superpower" is Sunny Optical Technology, the automotive camera industry bellwether that has grabbed the biggest share of the global market for many years in a row. The company shipped 67.98 million automotive cameras in 2021, and 78.91 million units in 2022, with a stable market share higher than 30%.

"Several great powers" refer to the several leaders in the second echelon, mainly Japanese, Korean and other Chinese manufacturers, commanding 2% to 10% of the market. The traditional "great powers" are led by Japanese, Korean and Taiwanese optics companies, including Maxell (Japan), Nidec Sankyo (Japan), Sekonix (South Korea) and Largan Precision (China Taiwan). Among them, Maxell took an 8% share in the global automotive camera market in 2021.

Meanwhile Chinese companies such as Lianchuang Electronic Technology and OFILM begin to edge into the "great powers" club.

Lianchuang Electronic Technology shipped about 8 to 9 million automotive cameras in 2022, and its major customers were Tier1 suppliers such as Valeo, Continental, Aptiv, ZF and Magna. OFILM set foot in automotive cameras by acquiring Fujifilm in 2018. Up to now, OFILM has mass-produced 5M front view cameras, 3M/8M side view cameras, 1M/2.5M surround view cameras, 2M electronic exterior mirror cameras, and 1M/2M in-cabin DMS/OMS cameras. In 2022, OFILM shipped about 4 million automotive cameras.

In addition, the established optics companies like Phenix Optics and Dongguan Yutong Optical Technology (YTOT) have also made deployments in the automotive market. Among them, Phoenix Optics has launched more than ten types of automotive cameras; YTOT, a leader in the field of security cameras, bought a 20% stake in Jiuzhou Optical in 2022, one of its attempts to step into the automotive camera market. In the future, these old optics companies will take further efforts to seize a share of the automotive camera market.

2. Automotive CIS offers increasing performance, up to 8M resolution and 140dB HDR.

The working process of CIS (CMOS image sensor) generally covers several links: reset, photoelectric conversion, integration, and readout.

In terms of the camera industry chain, the upstream CIS manufacturers include: CIS intellectual property (IP) companies specializing in CIS design and selling IPs to CIS companies; wafer companies providing silicon chips; OSAT companies engaged in cutting and packaging processed wafers. As with the automotive camera industry, downstream manufacturers are Tier 1 suppliers and camera module packaging companies.

In the trend for vehicle intelligence, the increasing camera pixels also pose higher technical requirements for CIS. As automotive cameras tend to be miniaturized and lightweight, pixel size cut and architecture upgrade have become most commonplace.

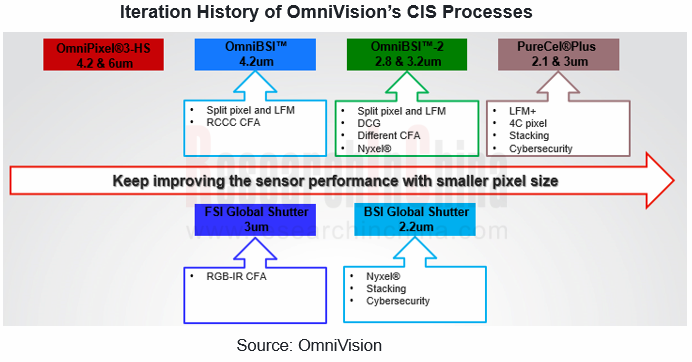

Take OmniVision's CIS process iteration as an example: in the iteration of processes like OmniPixel?3-HS, OmniBSI? and PureCel?Plus, the pixel size has been reduced from 4.2um to 2.1um. By specific products, OX08B40 unveiled by OmniVision in 2021 delivers 8MP resolution and adopts the PureCel? Plus-S pixel architecture, a technology that uses a stacked architecture for high resolution with a smaller chip size.

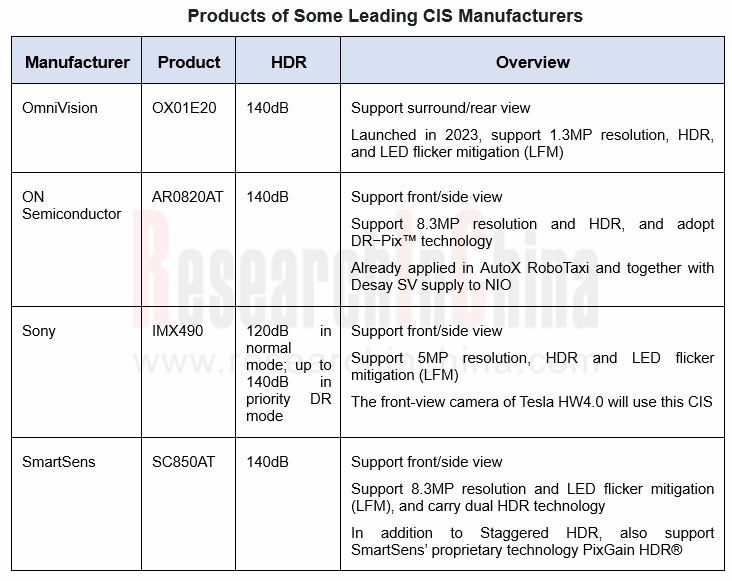

In addition to resolution, HDR is also one of the key technical parameters of CIS. In type’s term, front/side view cameras have begun to pack 140dB HDR CIS, while rear/surround view cameras are still at the 120dB stage.

As core sensors for advanced AD, front/side view cameras need to quickly recognize details in brightness and darkness in different lighting conditions and accurately capture images when driving at high speeds. 120dB HDR therefore is the basic requirement, and 140dB HDR is the current trend. Some manufacturers have also laid out 140+dB HDR. One example is ONSemiconductor which announced the launch of a 150dB HDR vehicle CIS in October 2022 and planned to start producing it in 2024. In the future, CIS for ADAS may reach 150+dB HDR.

Rear/surround view cameras generally still offer 120dB, and will evolve to 140dB in the future. For example, CIS OX01E20 for surround/rear view, announced by OmniVision in 2023, supports 140dB HDR, 1.3MP resolution, and LED flicker mitigation (LFM).

3. Automotive ISP solutions tend to be diversified, and AI ISP will become a development trend.

Among automotive camera component modules, ISP (image signal processor) is a core component for adjusting images. To achieve ideal imaging effects, ISP Tuning is an essential step.

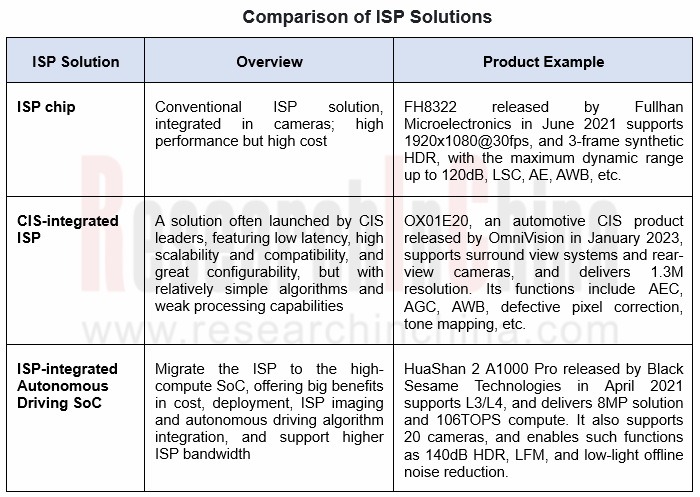

In addition to conventional ISPs, there are also another two types of mainstream ISP solutions: CIS integrated ISP, and ISP integrated autonomous driving SoC. The solutions become diversified.

The diversity of ISP solutions and the necessity of ISP Tuning make ISP seen in multiple links of the camera industry chain.

The importance of ISP and its low requirement for fixed hardware architecture make itself a high ground leading manufacturers from various fields contend to gain. Players often deploy 1 or 2 solutions.

For example, Fullhan Microelectronics specializes in ISP products; SmartSens has launched several ISP-integrated CIS products; OmniVision makes layout of "ISP + ISP-integrated CIS"; NXP and Nextchip deploy "ISP + ISP-integrated autonomous driving SoC”. Moreover, autonomous driving SoC companies like Mobileye, Nvidia and Black Sesame Technologies have also rolled out ISP-integrated autonomous driving chips.

Besides diversity of solutions, AI ISP is also an important development direction of ISP.

ISP covers dozens of image signal processing algorithms, but the coordination of so many algorithms requires a lot of debugging efforts. At present, the development of visual ADAS systems still relies on manual ISP Tuning. OEMs like Tesla and NIO are still recruiting a large number of image quality tuning engineers. Yet manual tuning takes a long time and requires very specialist ISP Tuning engineers.

In recent years, using AI for image enhancement has gradually become a new research hotspot in the industry, having made remarkable progress. Applying AI for real-time tuning, especially the efficient implementation of AI ISP functions in the computing environment on the terminal side, can achieve better results than conventional ISP Tuning.

For example, Ambarella announced an artificial intelligence image signal processor (AISP). Ambarella’s new AI based ISP architecture uses neural networks to augment the image processing done by the hardware ISP integrated into its SoCs. This approach enables color imaging with low light at very low lux levels and minimal noise, a 10 to 100X improvement over state-of-the-art traditional ISPs, and new levels of high dynamic range (HDR) processing with more natural color reproduction and higher dynamic range.

Ambarella's CV3 AI domain controller family already packs AISP, with up to 500 eTOPS of AI compute. The ISP can simultaneously support more than 20 cameras connected through MIPI VC, and can meet the requirements for high-performance stereo and dense optical-flow engines.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...