Automotive Digital Key Research: the pace of mobile phones replacing physical keys quickens amid the booming market

"China Automotive Digital Key Research Report, 2023" released by ResearchInChina combs through and summarizes the digital key market, supply chain, chip vendors, system integrators and OEMs, and predicts future trends.

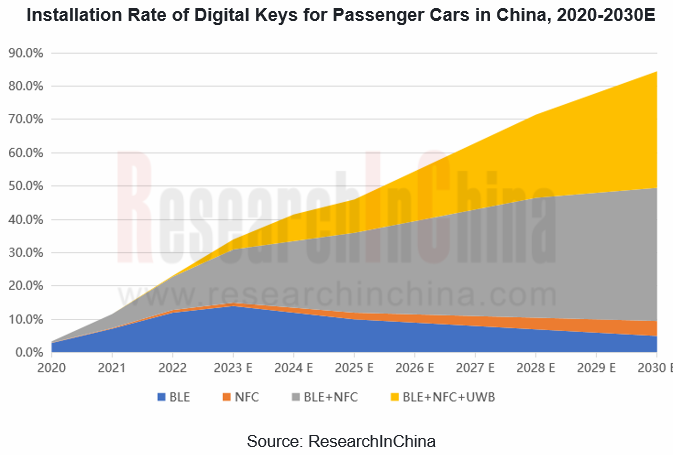

In 2030, the installation rate of digital keys in China will exceed 80%.

In 2022, 4.573 million passenger cars were installed with digital keys in China, a year-on-year upsurge of 93.8%, with the installation rate up to 23.0%, about 11.4 percentage points higher than in the previous year. The overall digital key market is burgeoning.

Thanks to the market demand and the mature BLE, NFC and UWB technologies, the Chinese digital key market is entering a 10-year boom period. It is predicted that the installation rate of digital keys for passenger cars in China will exceed 80% by 2030, and the BLE+NFC or BLE+NFC+UWB integrated solution will prevail in the market.

BLE+NFC and BLE+NFC+UWB will target the low- & mid-end, and high-end markets, respectively.

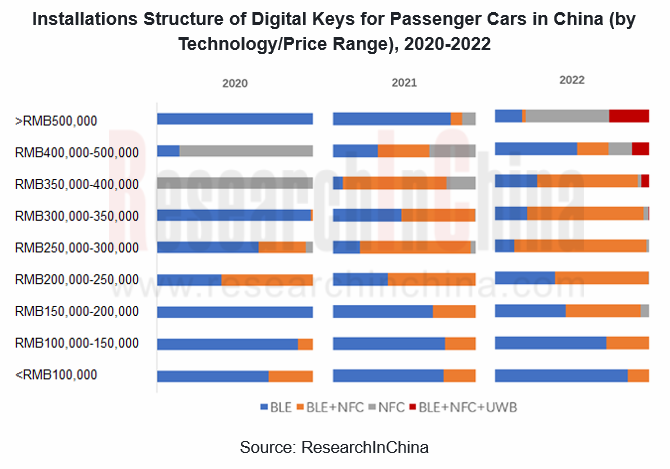

By segments in 2022, the digital key market is characterized by the following.

1. By technology:

- BLE is still the mainstream in the market, but its installations account for a decreasing proportion year by year.

- The installations of the BLE+NFC integrated solution enjoy a fast-growing share of the installations.

- The BLE+NFC+UWB integrated solution is mounted on vehicles.

2. By price range:

- Models worth RMB150,000 or below mainly adopt BLE, while the proportion of the BLE+NFC solution in them is on the rise year by year.

- Models worth RMB150,000-300,000 tend to use the BLE+NFC solution, which has replaced BLE and become the mainstream solution.

- Models worth over RMB300,000 have introduced UWB, and the BLE+NFC+UWB integrated solution has been seen in vehicles.

In the years to come, the market segments are expected to develop in a differentiated way on the premise of prevailing integrated solutions.

The BLE+NFC solution will dominate in the low- & mid-end markets where models are priced below RMB200,000.

- The big advantage of the BLE+NFC solution lies in its high cost performance. On one hand, it does not need a physical smart key required by a PEPS system; on the other hand, costing only tens of yuan more than a BLE or an NFC solution, the solution can just deal with emergencies, for example, mobile phones run out of power, so it is more suitable for cost-effective models valued below RMB200,000.

- It is predicted that the installation rate of the BLE+NFC solution will swell from 10% in 2022 to 40% in 2030 as the most popular automotive digital key solution in China.

The BLE+NFC+UWB solution will be first mounted on intelligent EV models priced at over RMB400,000.

- The BLE+NFC+UWB solution outperforms in security, positioning accuracy and availability, but it costs threefold more than the NFC+BLE solution.

- In 2022, the installation rate of UWB in mobile phones was about 20%, far lower than Bluetooth (100%) and NFC (50%). Only Apple, Samsung Note20 Series and Xiaomi MIX4 were equipped with UWB chips.

- It is expected that the BLE+NFC+UWB solution will be first available to models priced at over RMB400,000, and then to models worth RMB200,000-300,000, especially intelligent new energy vehicles.

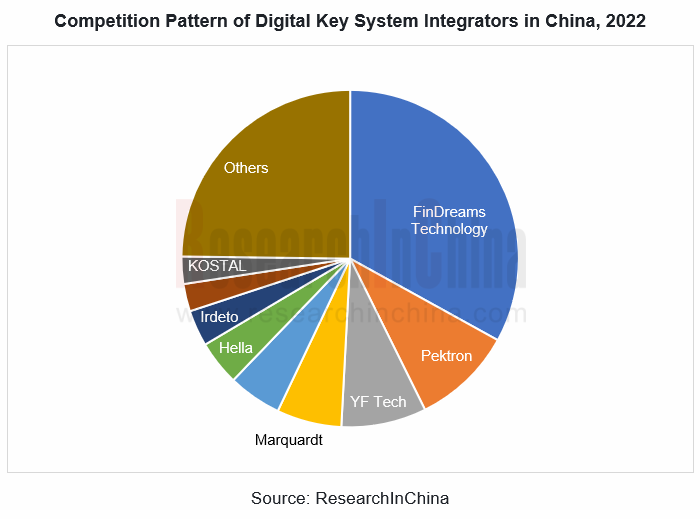

The competition among digital key suppliers intensifies.

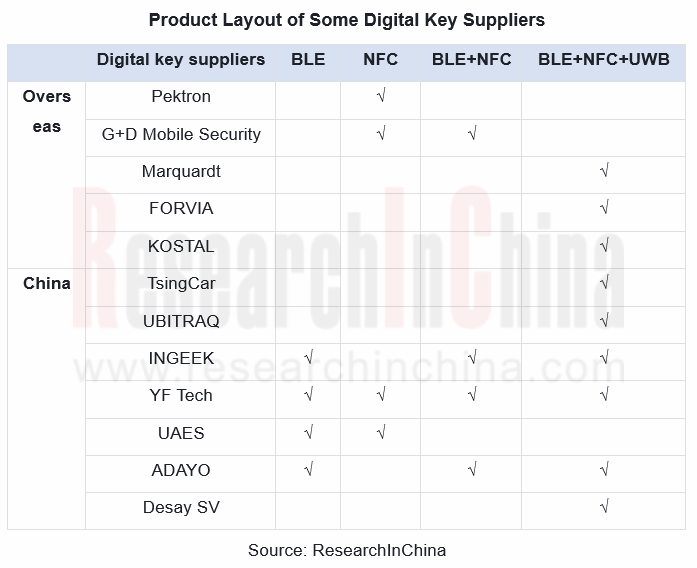

In terms of the supply chain, NXP, ST and TI mainly provide communication chips, G+D Mobile Security primarily offers security chips, and INGEEK is a provider of backend software, while system integrators link upstream software and hardware suppliers and provide digital key systems to OEMs directly.

In 2022, FinDreams Technology, Pektron and YF Tech acted as major digital key system integrators in China.

- FinDreams Technology mainly provided in-house support for BYD, with a far bigger market share than its counterparts.

- Pektron primarily supported Tesla.

- YF Tech was a supporting service provider of GAC Aion, GAC Trumpchi, Li Auto, Dongfeng FX, AITO and HYCAN.

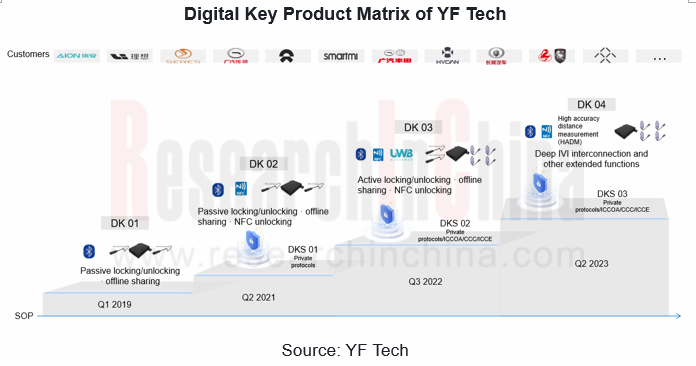

YF Tech focuses on four fields: intelligent cockpits, intelligent driving, body electronics and intelligent electric. It has independently developed integrated digital key solutions covering cloud, mobile phones and cars. It has cooperated with more than 20 automakers on mass production and designated projects, and supported over 50 production models.

In Q3 2022, YF Tech produced its BLE+NFC+UWB solution in quantities. This solution is compatible with private protocols/ICCOA/CCC/ICCE and other industry specifications and enables such functions as active unlocking, offline sharing and NFC unlocking.

In 2023, the digital key of YF Tech is to be added to high accuracy distance measurement (HADM) modules to enable deep integration between smartphones and IVI systems, and other extended functions. It has been designated by a top OEM and an emerging auto brand.

UWB will become the biggest hotspot in the future.

Following BLE and NFC, UWB will become a hotspot in the future market, so Chinese and foreign suppliers are stepping up their layout.

Overseas:

In 2022, KOSTAL mass-produced UWB keys for NIO ET7 and ET5. It will spawn the UWB-based tailgate kick solution in the future.

In 2022, KOSTAL mass-produced UWB keys for NIO ET7 and ET5. It will spawn the UWB-based tailgate kick solution in the future.

Continental's UWB-based CoSmA digital key system has secured orders from three mainstream automakers.

Continental's UWB-based CoSmA digital key system has secured orders from three mainstream automakers.

Marquardt’s PnD3 digital key composed of UWB module, ECU and door handle sensor is a modular solution.

Marquardt’s PnD3 digital key composed of UWB module, ECU and door handle sensor is a modular solution.

Hella, a subsidiary of FORVIA, will launch the UWB-based Smart Car Access system in 2023.

Hella, a subsidiary of FORVIA, will launch the UWB-based Smart Car Access system in 2023.

The BLE+NFC+UWB solution co-developed by Alps Alpine and G+D Mobile Security will be marketed in 2025.

The BLE+NFC+UWB solution co-developed by Alps Alpine and G+D Mobile Security will be marketed in 2025.

Bosch's Identity xtended is a next-generation UWB-based keyless product.

Bosch's Identity xtended is a next-generation UWB-based keyless product.

China:

TsingCar has established two business lines of UWB digital keys and UWB radars, and has forged close partnerships on projects with mainstream OEMs and Tier1 suppliers.

TsingCar has established two business lines of UWB digital keys and UWB radars, and has forged close partnerships on projects with mainstream OEMs and Tier1 suppliers.

UBITRAQ provides digital keys, radars and other products based on UWB, and offers flexible software and hardware cooperation modes to Tier1 suppliers.

UBITRAQ provides digital keys, radars and other products based on UWB, and offers flexible software and hardware cooperation modes to Tier1 suppliers.

YF Tech boasts high, medium and low configuration digital key solutions that support BLE/NFC/UWB positioning modules. In 2023, it will implement mass production projects for several leading OEMs/emerging carmakers.

YF Tech boasts high, medium and low configuration digital key solutions that support BLE/NFC/UWB positioning modules. In 2023, it will implement mass production projects for several leading OEMs/emerging carmakers.

INGEEK’s Intelligent Connected System (ICS) enables "person-vehicle-scenario” digital connection through communication modes such as 4G/5G/BLE/UWB/NFC.

INGEEK’s Intelligent Connected System (ICS) enables "person-vehicle-scenario” digital connection through communication modes such as 4G/5G/BLE/UWB/NFC.

Based on Bosch's technology, UAES has introduced a variety of NFC/BLE/UWB digital key solutions. Wherein, the BLE+UWB digital key was put into production in its Liuzhou factory in May 2022.

Based on Bosch's technology, UAES has introduced a variety of NFC/BLE/UWB digital key solutions. Wherein, the BLE+UWB digital key was put into production in its Liuzhou factory in May 2022.

The UWB digital key solution promoted by ADAYO has been designated by Changan Automobile and Great Wall Motor, and came into mass production in the second half of 2022.

The UWB digital key solution promoted by ADAYO has been designated by Changan Automobile and Great Wall Motor, and came into mass production in the second half of 2022.

Desay SV together with TrustKernel launched a UWB digital key solution, and secured orders from customers in 2022.

Desay SV together with TrustKernel launched a UWB digital key solution, and secured orders from customers in 2022.

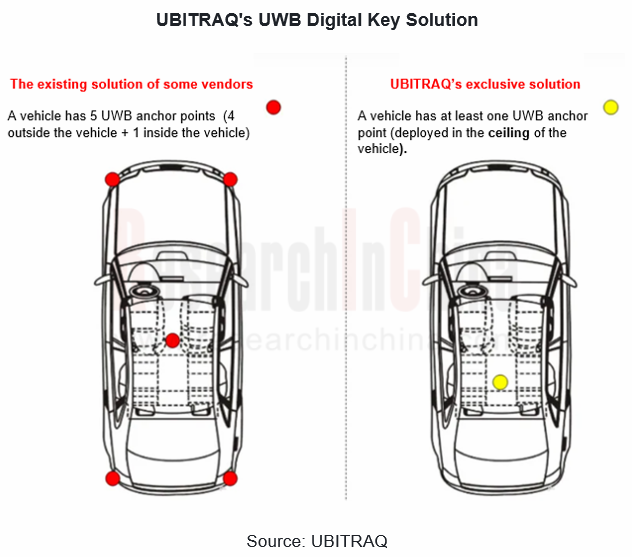

At present, the 4+1 or 0+4 UWB solution finds broad application in the industry. 4+1 stands for four exterior anchor points (on both sides of the front and rear bumpers) and one interior anchor point (center console), providing a wider coverage and the overall performance of keys.

UBITRAQ has introduced its pioneering, patented UWB-AOA single base station positioning system to UWB digital key application scenarios. This product can reduce the number of anchor points in a single vehicle with a UWB digital key from five to at least one (one UWB-AOA is deployed inside). It is currently in closed beta.

Main advantages of UBITRAQ's UWB solution:

1. Reduce the number of UWB anchor points from 5 to 1, slashing the hardware cost;

2. Use fewer devices and wire harnesses, lowering installation difficulty and cost;

3. Lower complexity and higher reliability;

4. Lower maintenance cost.

YF Tech provides different solutions (high, medium and low configurations) to customers. Wherein, the medium and high configuration solutions based on BLE, UWB and NFC modules enable centimeter-level positioning, obtain user trajectories, predict user behaviors, and allow for customization of gesture extension functions.

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...