Intelligent Vehicle Cockpit-Driving Integration Research Report, 2023

Cockpit-Driving Integration Research: many companies are making layout and may implement it during 2024-2025.

1. What is the real cockpit-driving integration?

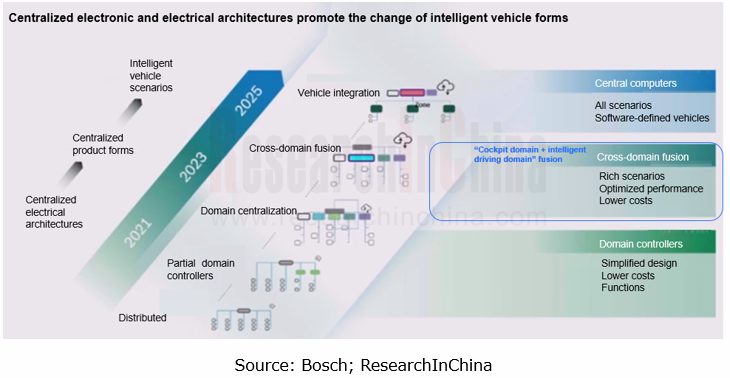

At present, automotive electronic and electrical architectures are evolving towards domain integration and central computing. Some functional domains (intelligent driving domain, cockpit domain, chassis domain, body domain, power domain, etc.) are being integrated, for example, body and chassis domain integration, and cockpit and intelligent driving domain integration.

Cockpit-driving integration refers to the integration of cockpit and intelligent driving domains into a high-performance computing unit that supports both intelligent driving and intelligent cockpit functions. It is an effective solution to reducing development cycle and vehicle cost.

Cockpit-driving integration falls into two types: multi-SoC integration, that is, cockpit and intelligent driving functions are deployed on different boards; single SoC integration, that is, the software and algorithms of cockpit and intelligent driving are all deployed on one board.

Based on a single SoC and with a hypervisor running on the chip, the real cockpit-driving integration divides different functional modules through the hypervisor to enable different security levels of secure cockpit and driving functions. Yet limited by architecture solutions, software and hardware technologies, supply chain and other factors, the cockpit-driving integration based on a single SoC is hard to come true in a short time.

2. How to facilitate cockpit-driving integration?

Given varying maturity and requirements of cockpit and intelligent driving technologies, cockpit-driving integration is iterating and being promoted in a gradual manner.

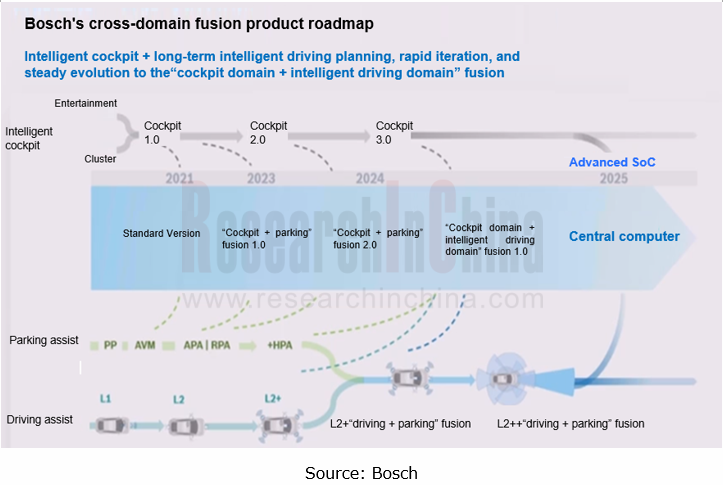

Zhao Jianhong, the vice president of product at EnjoyMove Technology, said that the company will prioritize cockpit-driving integrated solutions because of the demand from OEMs. At present, for parking solutions are relatively mature, and cockpit domain controllers offer sufficient computing power, integrating parking into cockpit domain controllers brings a cost advantage. Cockpit-parking integration signifies the first step of cockpit-driving integration, that is, cockpit-driving integration will be considered after the cockpit-parking integration technology matures.

Bosch Group also plans to achieve cockpit-driving integration around 2024 after the implementation of the Cockpit-Parking Integration 1.0 (based on Qualcomm 8155) and Cockpit-Parking Integration 2.0 (based on Qualcomm 8295).

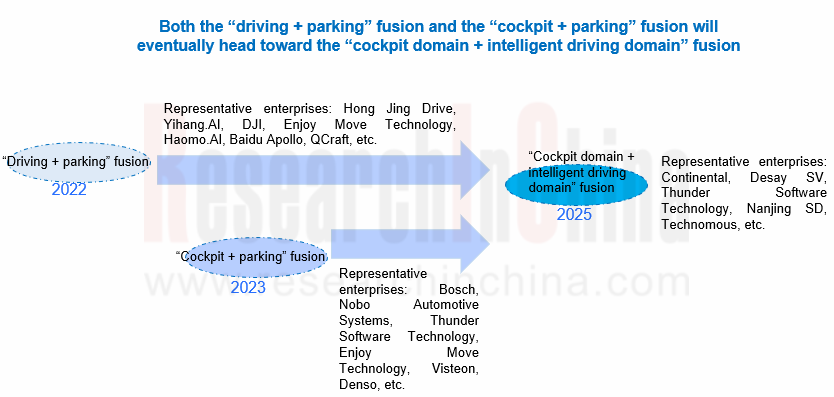

In the future, both the driving-parking integration (launched in 2022 on large scale) around intelligent driving, and the cockpit-parking integration (expected to be mass-produced in 2023) centering on the cockpit will eventually head towards the cockpit-driving integration expected to be spawned around 2025.

3. How companies deploy cockpit-driving integration?

Since 2022, cockpit-driving integration has become the focus of the industry, attracting entrants like Z-ONE, Neta Auto, Tesla, Desay SV, ThunderSoft and Continental.

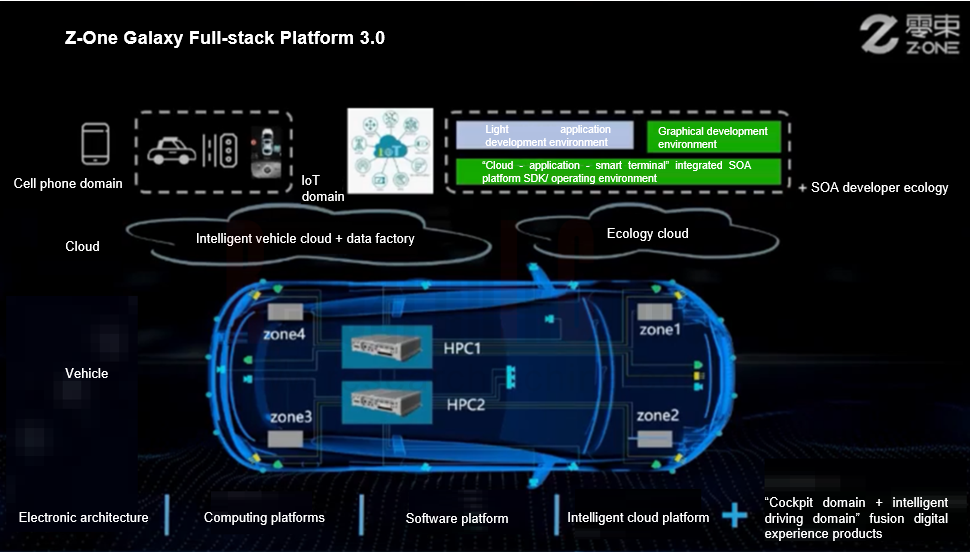

Z-ONE: the Galaxy Full-stack Solution 3.0 for smart cars was released in November 2022. It adopts central computing and zonal control, and is equipped with ZXD, a cockpit-driving integrated computing platform. It is scheduled to be mass-produced in 2025.

Features of ZXD:

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

The conventional domain framework is broke up for the layered design of "cloud platform + central brain + zone + intelligent sensing and execution" so as to realize software and hardware decoupling, and cross-domain integration.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

Based on Chinese homemade chips, the AI compute up to 1,000 TOPS supports continuously simultaneous operation of multi-domain functions (e.g., autonomous driving and in-vehicle infotainment), independent calculation of cockpit and intelligent driving domains, and hard-core information encryption, as well as L4 and above autonomous driving, and high-resolution multi-screen display of intelligent cockpit.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

The pre-installed intelligent vehicle operating system ZOS can realize "software and hardware synergy" with China’s local chips, offer standard uniform interfaces for software and hardware decoupling, and provide a unified development platform for cross-domain integration.

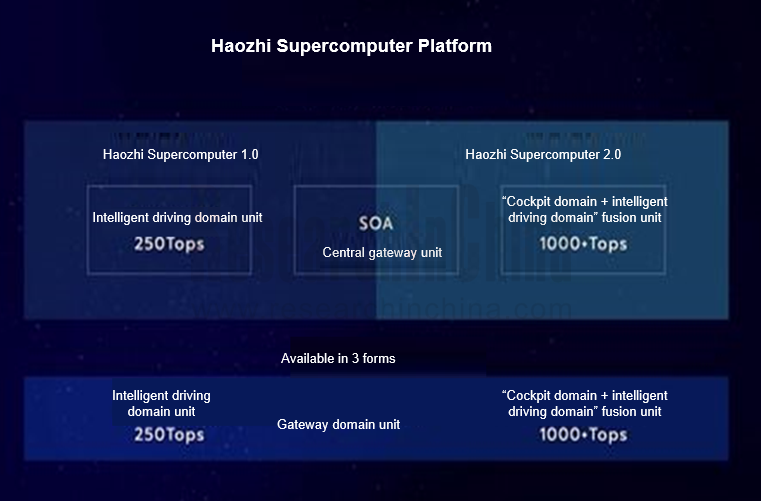

Neta Auto: the latest electronic and electrical architecture is a central computing architecture whose core is a supercomputing platform (including Haozhi Supercomputer 1.0 and Haozhi Supercomputer 2.0). With computing power up to 1,000 TOPS, it supports L4 autonomous driving integrated with intelligent driving and cockpit functions.

Haozhi Supercomputer 2.0 uses a "central + zonal" architecture composed of two boards: a cockpit-driving integration domain unit and an intelligent control unit. It will be applied to Neta S+/Shanhai Platform.

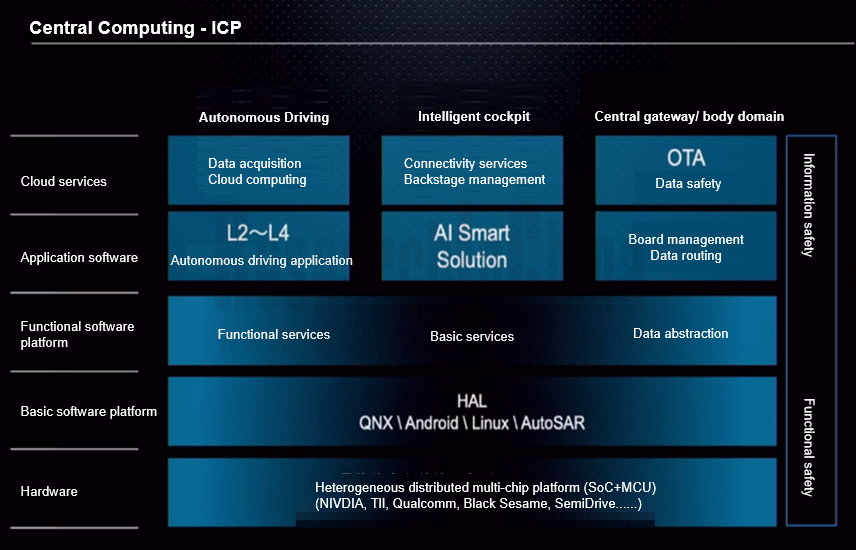

Desay SV: in April 2022, Desay SV unveiled "Aurora", an automotive intelligent computing platform. As a multi-SoC based cockpit-driving integrated solution, it realizes a leap from domain controllers to central computing platform, with the following features:

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Hardware: supports mainstream heterogeneous SoCs with high computing power, such as NVIDIA Orin, Qualcomm SA8295, and Black Sesame Huashan A1000, and deliver total computing power of over 2,000 TOPS.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Function: integrate core functional domains such as intelligent cockpit domain, intelligent driving domain and connectivity services, to achieve cross-domain integration.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Structure: adopt a plug-in structure, and offer flexibly configured computing power to meet the requirements of models at varying prices.

Most of the cockpit-driving integrated solutions of OEMs and Tier1 suppliers in China are based on multiple SoCs from Qualcomm, Nvidia and SemiDrive. The single SoC based solutions are still under development.

It is worth noting that NVIDIA and Qualcomm have successively released high-compute cockpit-driving integrated chips since 2022, providing strong support for application of single SoC solutions.

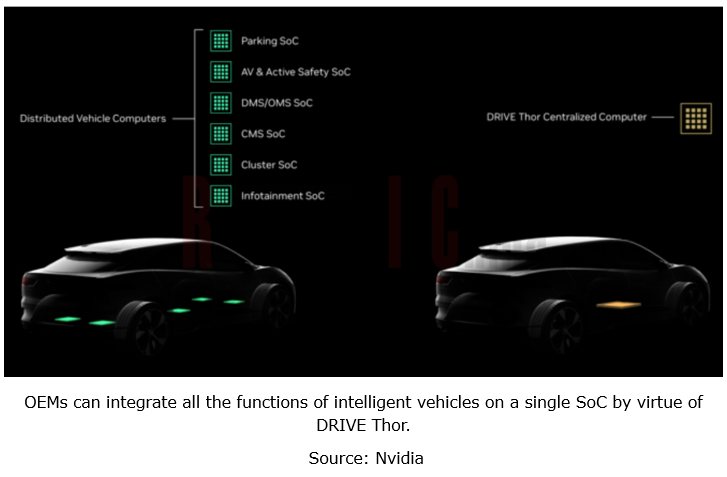

Nvidia: Nvidia announced DRIVE Thor, a superchip of epic proportions, in September 2022. With computing power of 2,000 TOPS, it is compatible with Linux, QNX and Android-based IVI systems, and supports cockpit-driving integration. Nvidia plans to put DRIVE Thor into production in 2024.

Nvidia DRIVE Thor will be installed in ZEEKR’s next-generation smart cars to be produced in early 2025. The latest news in March showed that Lenovo will also adopt Nvidia DRIVE Thor. According to Lenovo's plan, its cockpit-driving integrated controller will be launched during 2024-2025, with computing power of 1,000/2,000 TOPS.

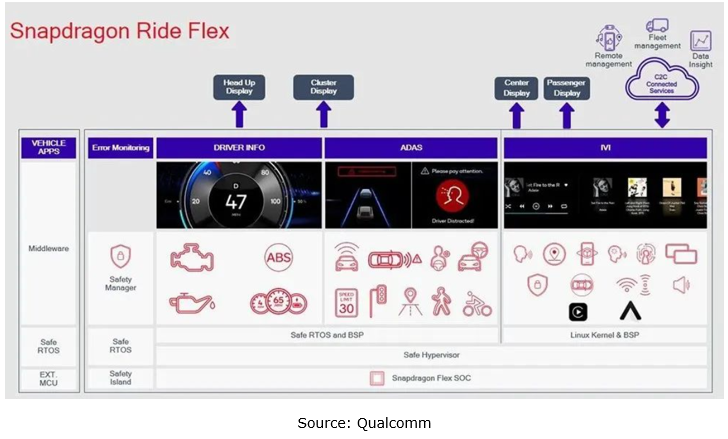

Qualcomm: in January 2023, Qualcomm launched the Snapdragon Ride Flex, the automotive industry’s first scalable family of SoCs to simultaneously support digital cockpits and ADAS. The expected start of production will begin in 2024.

The Snapdragon Ride Flex has three levels: Mid, High, and Premium. The AI compute of the single Premium SoC is above 600 TOPS. Combined with AI accelerators (probably NPUs or MAC arrays), it can support performance of up to 2,000 TOPS.

It is known that Volkswagen will adopt the Snapdragon Ride Flex to support single-chip multi-domain computing (covering driving assistance and intelligent cockpit). The Snapdragon Ride Flex will first land on the new-generation PPE-based Porsche Macan that will be launched in 2024.

Generally speaking, cockpit-driving integration is still in the exploration stage, facing quite a few problems and challenges in organizational structure, technology development and industrial chain coordination, for example: integration of high-compute chips; SOA-based software layered design, and cross-domain integration of operating systems and middleware; application of high-bandwidth, low-latency automotive Ethernet communication technology.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...