ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2023 – Chinese Companies

Research on China’s local Tier 1 suppliers: build up software and hardware strength, and “besiege” driving-parking integration by three routes.

01 Build up their own software and hardware capabilities

In 2021, SAIC announced its determination to self-develop core technologies and products, which made a splash in the industry. Many OEMs hold high the banner of "full-stack independent development" to hold in hands core technologies and products. Emerging carmakers like NIO, XPeng Motor and Li Auto have taken the lead in deploying full-stack technologies from hardware and middleware to application algorithms, while high-end brands of conventional automakers, such as IM Motor and Aion, have also stepped up their R&D efforts.

In this context, China’s local Tier 1 suppliers are the first to adjust their strategic direction, and strengthen their software and hardware capabilities by way of cooperation and self-development. Some of them have transformed from hardware suppliers to full-stack intelligent driving system solution providers, and have secured several mass production projects from OEMs, for example, Lynk Co-Pilot Navi, the intelligent driving system Freetech developed for Lynk & Co 09EM-P Voyage Edition, and the Supervision system co-developed by iMotion and Mobileye for ZEEKR 001.

According to ResearchInChina, in 2023Q1 Freetech joined the camp of the top five L2+ ADAS suppliers in China. Based on the ODIN digital intelligence base solution (self-developed sensor/domain controller/intelligent driving algorithm, and data closed-loop system), Freetech can provide complete software and hardware integrated solutions.

In 2022, Freetech mass-produced ADC15 and ADC20 domain controllers, of which ADC20, with J3+TDA4 VM+TC397 and 13TOPS computing power, supports 6V5R/5V5R NOA and has been spawned and installed in quite a few models such as Geely Boyue L and Lynk 09 EM-P Voyage Edition. The ADC30 domain controller under development, with 448TOPS computing power and 3*J5+2*TDA4VH+2*TC397, supports 11V5R3L, and enables L3 autonomous driving. ADC30 is scheduled to be produced in quantities in 2024, and will be applied to the project cooperated with FAW Hongqi.

ADC-X, Freetech’s next-generation domain controller with DNN compute up to 1000TOPS or higher, packs two SoCs and two MCUs, enabling such functions as point-to-point autonomous driving and AVP in urban areas.

In addition, Neusoft Reach, iMotion and SenseTime among others are creating full-stack autonomous driving solutions that integrate hardware, software, data, systems and grouped services.

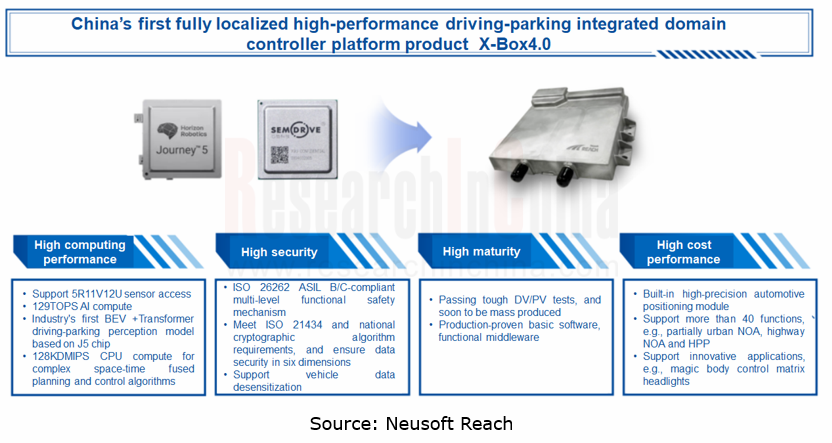

Making full use of its software technical strength and based on the new SDV development mode, Neusoft Reach announced X-Box 4.0, a high-performance driving-parking integrated domain controller for L2++, in April 2023. This controller carries Horizon Journey 5 chip with computing power up to 129 TOPS, and supports access to 11 HD cameras, 4D radar, ultrasonic radar and 8MP camera, enabling driving assistance in complex road conditions such as some city scenarios, highways and expressways.

X-Box 4.0 can be delivered as a packaged solution or some modules of layers, and the fully open system architecture allows partners to port and deploy products rapidly. The product has been designated and is scheduled to be mass-produced in H2 2023.

Dong Xiaohang, chief consultant of Neusoft Reach’s autonomous driving business, said that full-stack Tier 1 suppliers provide some standard hardware, middleware, architecture and application algorithms in layers and modules, support the open business and R&D models of automakers, and help them build up their own core competence, and this concomitant ecosystem cooperation model is a way of survival for players to go further.

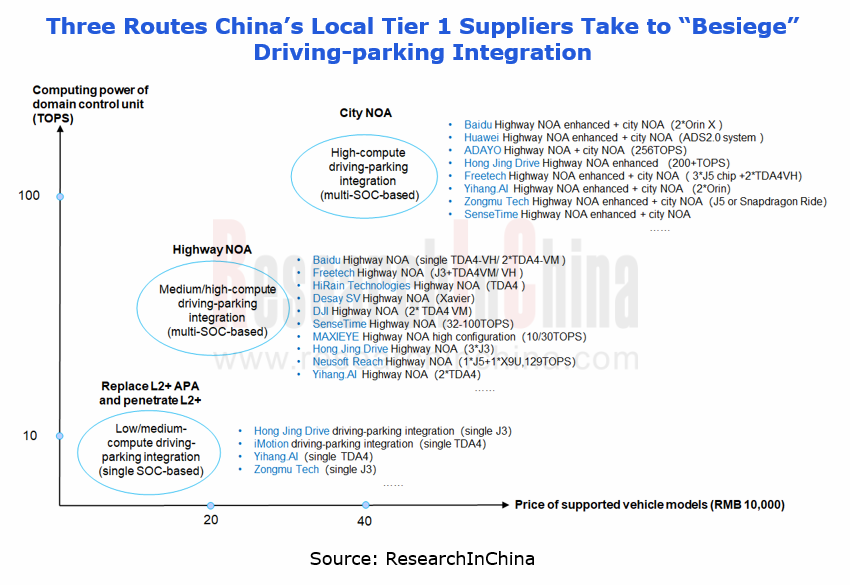

02 Local Tier 1 suppliers“besiege” driving-parking integration by three routes.

Supported by "software-hardware integration", China’s local Tier 1 suppliers keep improving their L1 to L4 intelligent driving solutions, meeting the needs of multiple scenarios such as parking, highway and city. Wherein, driving-parking integration has become a "high ground" to be contended for.

Since 2022, besides some OEMs that develop independently, emerging Tier 1 suppliers including iMotion, Freetech, Hong Jing Drive and Huawei have become the mainstream driving-parking integrated solution providers.

Hong Jing Drive boasts full stack technologies covering hardware, algorithm, software and data, providing L2-L4 driving-parking integrated solutions. In 2022, Hong Jing Drive's driving-parking integrated domain controller solution based on three Horizon J3 chips was installed on the third-generation Roewe RX5. It enables enhanced highway NOP and home-zone parking pilot (HPP) functions.

Hong Jing Drive is developing Hyper Piot 3.0, an advanced intelligent driving solution that uses a high-performance single-SoC domain controller with computing power up to 500TOPS and supports 4D radars, enabling such functions as NOP-C (navigate-on-pilot city) and AVP (automated valet parking).

In April 2023, Hong Jing Drive launched another single-SoC lightweight driving-parking integrated solution which supports vehicle models valued at less than RMB150,000. The solution adopts single Journey 3 chip and two MCUs from Infineon and SemiDrive and supports 5V5R, enabling highway NOA, APA/RPA and other functions. The volume production of this solution is expected to start in 2023.

In addition to Hong Jing Drive, iMotion, MAXIEYE, Yihang.AI and the like have also introduced lightweight driving-parking integration solutions that also enable basic highway NOA through optimized algorithms and time-division multiplexing. In Yihang.AI’s case, based on single TDA4, its driving-parking integrated solution Lite can make the NOA function available using technologies like algorithmic pruning, knowledge distillation and shared Backbone.

In general, Tier 1 suppliers in China have started "layered" layout of driving-parking integrated solutions. Thereof, the emergence of low-compute lower-cost solutions indicates that the market tends to be rational and pragmatic. But which route more caters to consumers still needs to be verified by the market.

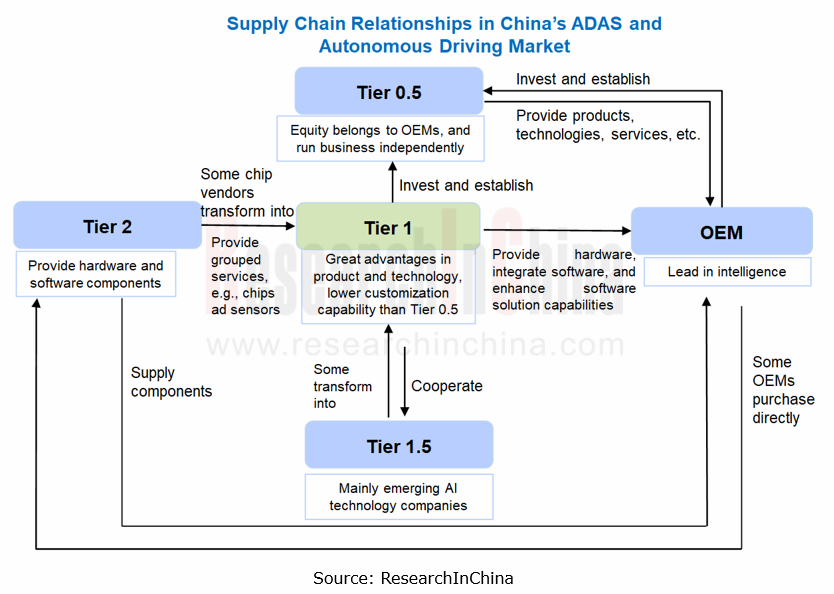

03 The supply chain relationships are being reshaped, and “openness + cooperation” helps local Tier 1 suppliers go further.

In recent years, the pace of reshaping intelligent vehicle supply chain relationships has quickened. As Tier 0.5, Tier 1.5 and new Tier 1 suppliers spring up, the supply relationships of conventional Tier 1 suppliers have been changing from a vertical structure to a network structure.

In the meantime, suppliers keep changing their roles to adapt to the needs of OEMs, and tend to partner with them in diversified models. The previous "black box" model can no longer meet the needs, and Tier 1 suppliers begin to serve OEMs in a more open way. The "gray box" and "white box" models thus come out.

Black box: conventional cooperation model where Tier 1 suppliers provide hardware and software.

Grey box: a model between white box and black box, in which Tier 1 suppliers can provide hardware (e.g., domain controllers) and custom software development to OEMs, and OEMs can designate all logo markings.

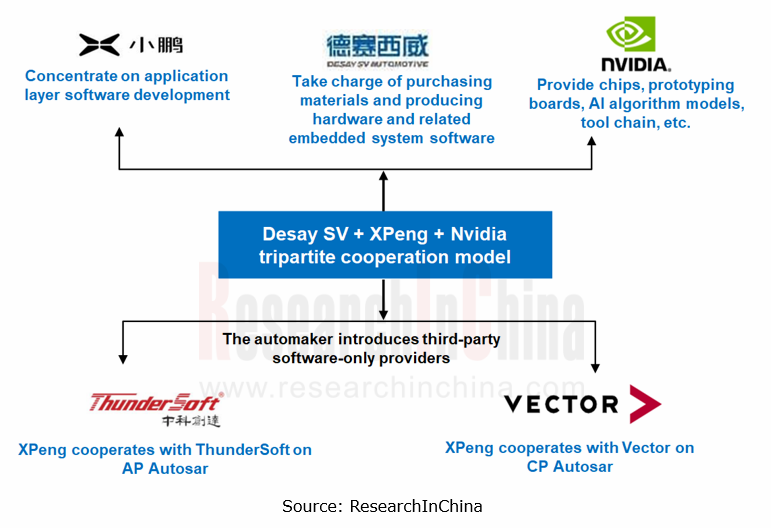

White box: OEMs self-develop application algorithms, software, etc., and Tier 1 suppliers provide hardware and related services. For example, the cooperation between Desay SV, XPeng Motor and Nvidia is a typical case of the white box model. Wherein, XPeng Motor independently develops a range of algorithms (e.g., perception and decision) and upper layer application software; Desay SV takes on hardware (intelligent driving domain controller), and some embedded software; Nvidia offers chips.

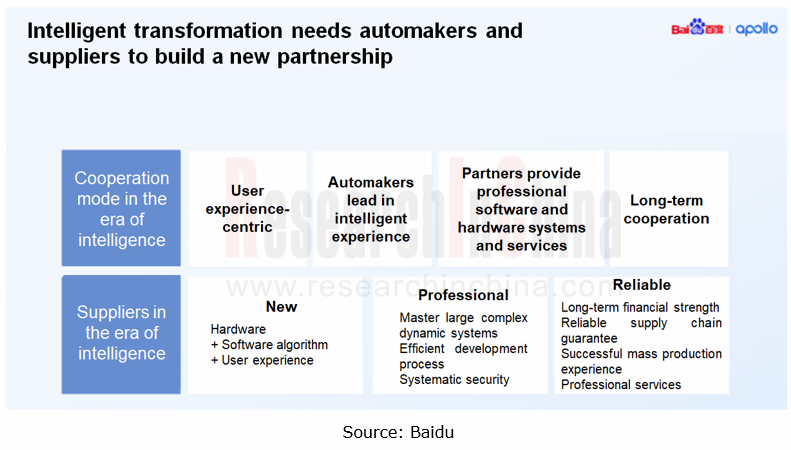

In the run-up to the Auto Shanghai 2023, Baidu announced that it wants to be a new, specialist Tier 1 supplier. Li Zhenyu, president of Baidu Intelligent Driving Group, said that automakers are the leader in the value chain of the automotive industry, and Baidu respects their position. He also indicated that Baidu explores a new customer experience-centric cooperation model between the "white box" and "black box".

In the new relationship designed by Baidu, automakers and Tier 1 suppliers are cooperating in a clear division of labor, openness and equality. Baidu will open up four key capabilities to automakers, namely, experience definition, independent experience evolution, full-cycle OTA service, and co-creation for growth.

Specifically, before SOP, Baidu Apollo can open up the human-machine interface, core capability SDK and underlying software interface in the form of API and SOA services, so that automakers can define and enable the matching human-machine interface and intelligent driving style according to their own brand positioning and target customers, and even participate in the technical process of intelligent vehicle control to improve end user experience.

Following successful SOP and delivery, Baidu Apollo can open up the intelligent driving data closed-loop cloud and grouped toolchain to automakers, helping them build a data closed-loop after a new model is launched, allowing them to independently improve data-driven intelligent driving experience, and giving them higher independence to win the intelligence race.

In a longer period (e.g. 3 years) after SOP, if automakers want to still equip their models with the features and experience provided by Baidu Apollo's main intelligent driving products, Baidu Apollo will also be willing to provide corresponding solutions for them, for example, via quarterly OTA updates, ensuring that models will always have the latest intelligent driving capabilities.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...