Baidu works on three autonomous driving development routes: Apollo Platform, Apollo Go (autonomous driving mobility service platform) and intelligent driving solutions.

Apollo Platform

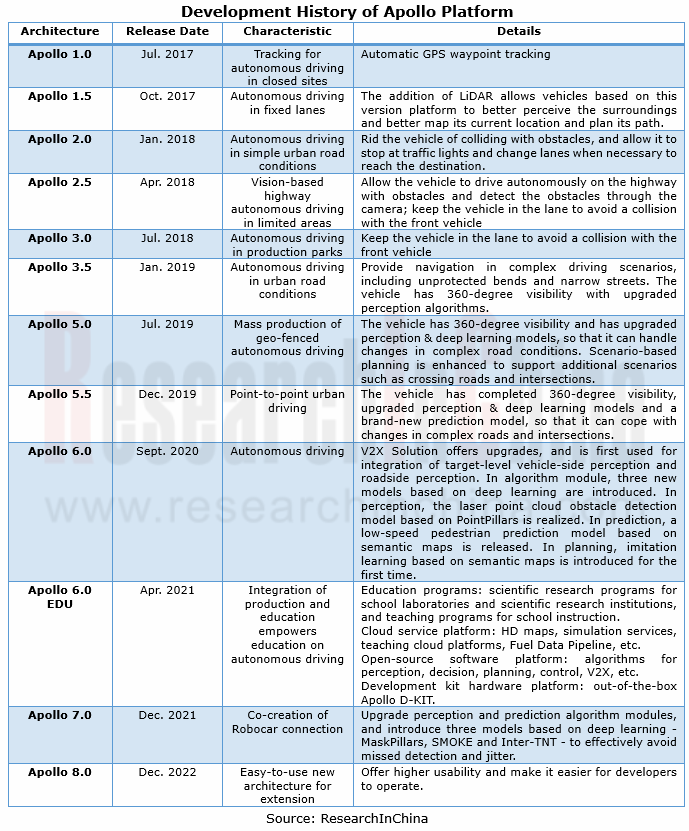

In July 2017, Baidu announced the Apollo program, and released an open-source autonomous driving platform. In late 2018, Baidu officially opened up its Apollo V2X Solution. At present, Baidu Apollo boasts industry-leading solutions in three major fields: autonomous driving, intelligent vehicle and intelligent transportation. Baidu Apollo's vehicle intelligence solutions have been mass-produced for 134 models under 31 auto brands and mounted on a total of over 7 million vehicles.

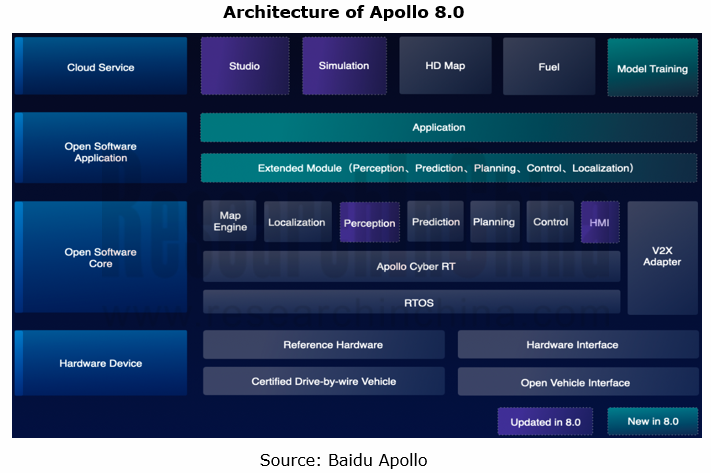

On December 28, 2022, Baidu officially launched Apollo 8.0 for all developers, which provides higher usability and makes it easier for developers to operate.

Robotaxi

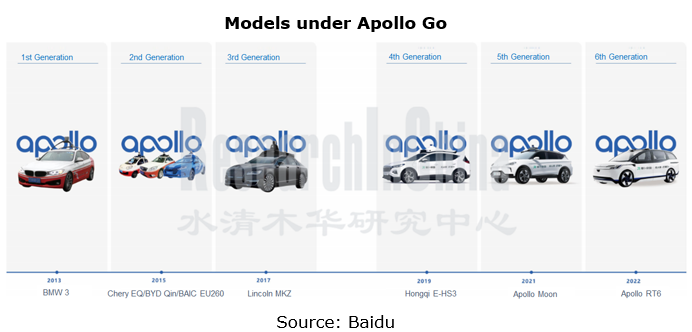

By April 2023, Baidu Apollo had tested a total mileage of more than 50 million kilometers, and its mobility brand "Apollo Go" had gone into normal operation in Beijing, Shanghai, Guangzhou, Shenzhen, Chongqing and Wuhan. Apollo Go is expected to cover up to 65 cities by 2025.

As of July 2022, Baidu had released six generations of production autonomous vehicle products, among which Apollo RT6, the sixth-generation product, is scheduled to be first available to Apollo Go in 2023.

Intelligent Driving Solutions

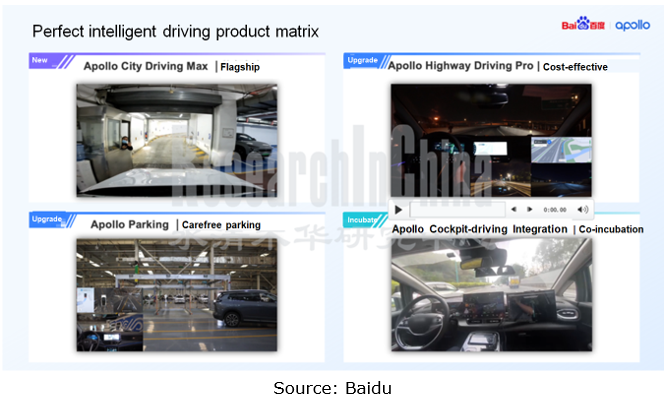

Baidu’s intelligent driving product matrix covers: Apollo City Driving Max, Apollo Highway Driving Pro, Apollo Parking, and Apollo Cockpit-driving Integration.

In April 2023, Apollo introduced its flagship product - Apollo City Driving Max. The "lightweight HD map" used in this system is nearly 80% “lighter” than conventional HD maps in the industry. Apollo City Driving Max packs 2 NVIDIA Orin X SoCs with the computing power of 508 TOPS, 2 high-beam LiDARs with a detection range of 180 meters, 7 8MP cameras, 4 3MP surround view cameras, 5 radars and 12 ultrasonic sensors.

Apollo City Driving Max uses only vision to enable urban navigate on autopilot (NOA). In the production stage, LiDAR will be added as a perceptual redundancy.

The new Voyah FREE, which debuted at the Auto Shanghai 2023, carries Apollo Highway Driving Pro, which offers such driving assistance functions as highway pilot, urban driving assist, and all-scenario efficient parking. The solution can provide accurate environmental perception and decision to enable multiple functions such as automated parking, automatic follow and automatic lane change.

In 2023, Apollo Highway Driving Pro was upgraded, with the computing platform upgraded to a single TDA4-VH platform. Moreover, Baidu teamed up with Black Sesame Technologies to deploy Apollo Highway Driving Pro in the HuaShan-2 A1000 chip platform.

Baidu's first-generation Apollo Cockpit-driving Integration uses Qualcomm 8295 (with the AI compute of 30 TOPS equivalent to NVIDIA Xavier) to enable intelligent cockpit and driving assistance functions.

Domain integration represents an important development trend of the intelligent driving industry in 2023. As a part of domain integration, cockpit-driving integration has begun to be laid out by many ADAS companies. Tier1 suppliers such as Baidu, Huawei and Desay SV have deployed their own product lines in the fields of intelligent driving and intelligent cockpit, making it easy for them to develop cockpit-driving integrated solutions.

For most players that only lay out intelligent driving or intelligent cockpits, it is necessary for them to cooperate with others on cockpit-driving integration. At the Auto Shanghai 2023, Banma Zhixing and HoloMatic Technology forged a strategic partnership to co-develop a cockpit-driving integrated solution. This is a typical cooperation case.

Related Reports:

Ambarella’s Intelligent Driving Business Analysis Report, 2022-2023

NXP’s Intelligence Business Analysis Report, 2022-2023

Jingwei Hirain’s Automotive and Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Cockpit Business Analysis Report, 2022-2023

Bosch’s Intelligent Cockpit Business Analysis Report, 2022-2023

Baidu’s Intelligent Driving Business Analysis Report, 2022-2023

Aptiv’s Intelligent Driving Business Analysis Report, 2022-2023

ZF’s Intelligent Driving Business Analysis Report, 2022-2023

Continental’s Intelligent Driving Business Analysis Report, 2022-2023

Bosch’s Intelligent Driving Business Analysis Report, 2022-2023

Horizon Robotics’ Business and Products Analysis Report, 2022-2023

Desay SV’s Intelligent Driving Business Analysis Report, 2022-2023

Renesas Electronics’ Automotive Business Analysis Report, 2023

Infineon’s Intelligent Vehicle Business Analysis Report

Haomo.AI’s Intelligent Driving Business Analysis Report

SenseTime’s Intelligent Vehicle Business Analysis Report

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...