China Passenger Car Mobile Phone Wireless Charging Research Report, 2023

Automotive Wireless Charging Research: high-power charging solutions will lead the trend, with the installations to hit more than 10 million units in 2026.

Technology Trend: Qi2 Standard

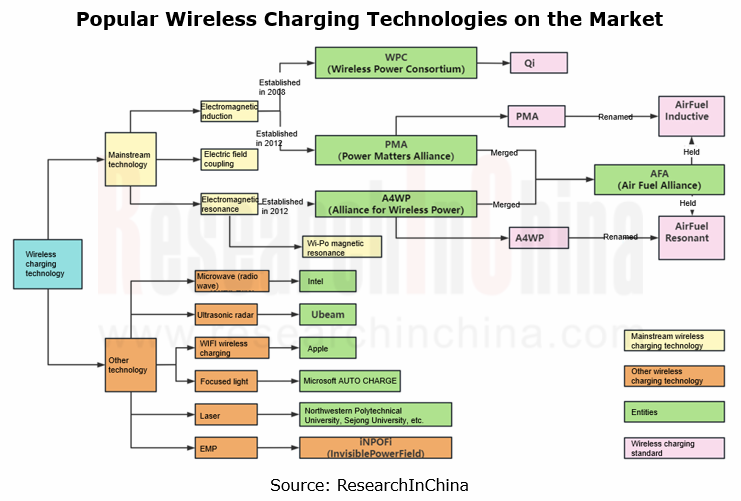

The automotive mobile phone wireless charging module is an integrated device that uses wireless charging technology to charge a mobile phone in the vehicle. The mainstream wireless charging technologies include electromagnetic induction, electromagnetic resonance and electric field coupling. At present, mainstream mobile phone wireless charging solutions use electromagnetic induction technology to charge a mobile phone as per the Qi Standard created by the Wireless Power Consortium (WPC). Since 2017, electromagnetic resonance-based mobile phone wireless charging solutions have appeared on the market, but their application scope is far narrower than electromagnetic induction-based ones.

The automotive mobile phone wireless charging modules has been a standard configuration for most mid-to-high-end models. It is often installed near the center console in line with the Qi Standard, with the general charging power range of 5W-15W. To improve the charging efficiency, some models cooperate with mobile phone vendors (Xiaomi, Huawei, OPPO, Apple, etc.) and adopt private protocols with the charging power ranging at 40W-50W. In the future, more models will be equipped with high-power wireless charging modules, and wireless charging solutions for continuous and stable charging during driving.

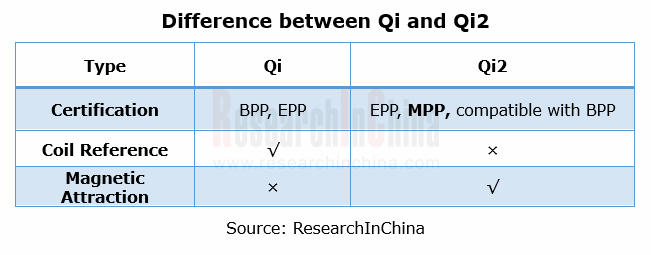

Following the launch of the logo of the Qi2 in January 2023, the WPC released the Qi2 Standard in April, with corresponding adjustments to the certification for mainstream automotive mobile phone wireless charging modules. The WPC developed Magnetic Power Profile (MPP), a magnetic attraction feature added to wireless charging modules.

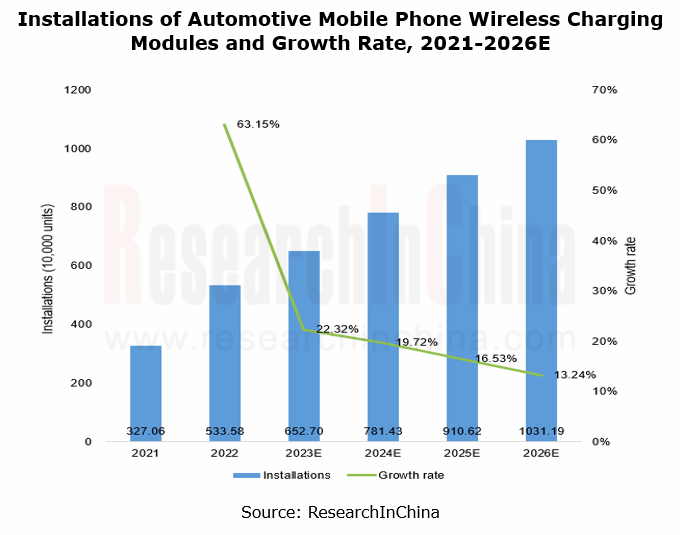

Market Size: the installations of automotive wireless charging modules are expected to hit more than 10 million units in 2026.

From 2021 to 2026, the installations of automotive mobile phone wireless charging modules will sustain steady growth, expected to exceed 10 million units in 2026.

Competitive landscape: there is still scope for localization.

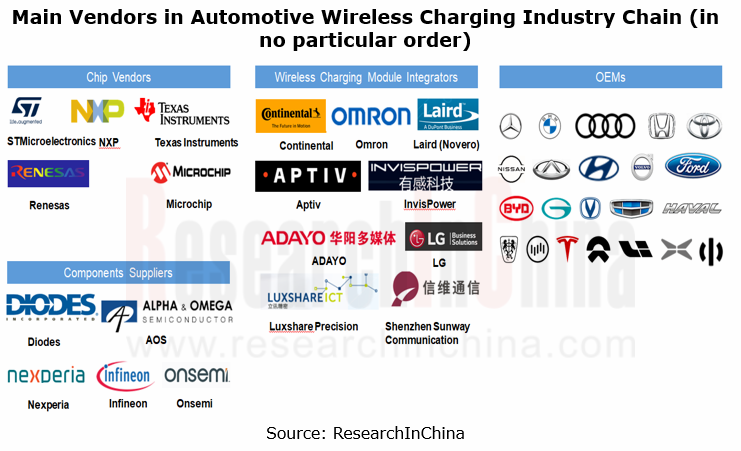

The main vendors in the automotive wireless charging industry chain are as follows:

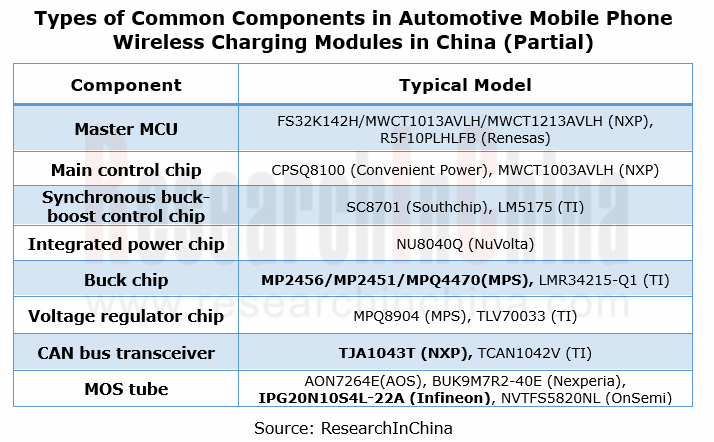

Foreign vendors like NXP and Renesas Electronics can design automotive mobile phone wireless charging solutions and provide chip products. Chinese vendors such as InvisPower, ADAYO and Sunway Communication can manufacture modules and provide automotive wireless charging solutions leveraging the key components from foreign vendors, such as NXP’s main control chip, TI’s voltage regulator chip, and AOS’ MOS tube. The widely used wireless charging chip solutions in China are those from ConvenientPower and Southchip.

NXP

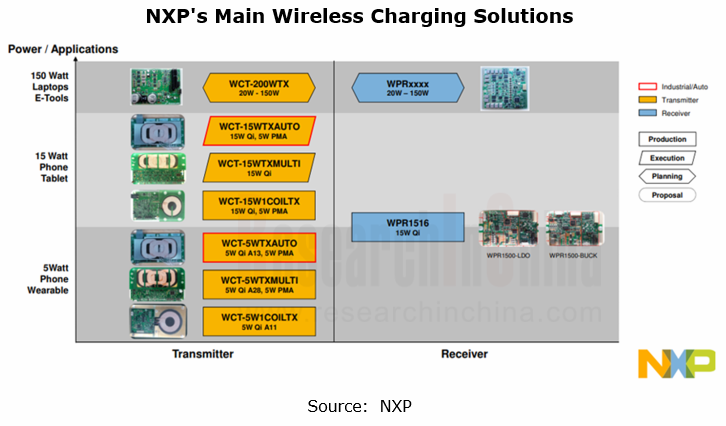

Among NXP's main wireless charging solutions, WCT-15WTXAUTO and WCT-5WTXAUTO are the most widely used, with respective power of 15W and 5W. The platforms are specially designed for AUTOSAR-compliant automotive wireless charging application. They use automotive-grade components, and AUTOSAR software and drivers, and conform to the latest Qi Standard.

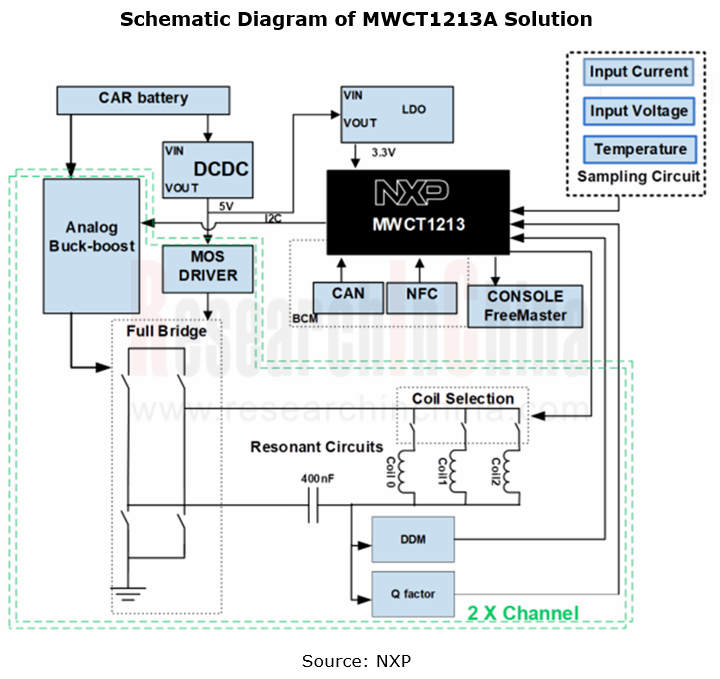

Among multiple MCUs, the MWCT1x1xA family is the most popular, for example, in the MWCT1213A solution, the system supports dual-channel transmitter control and manages overall system state, with the power of 15W.

Strategy of automakers: pursue high-power solutions and independently develop heat dissipation technology

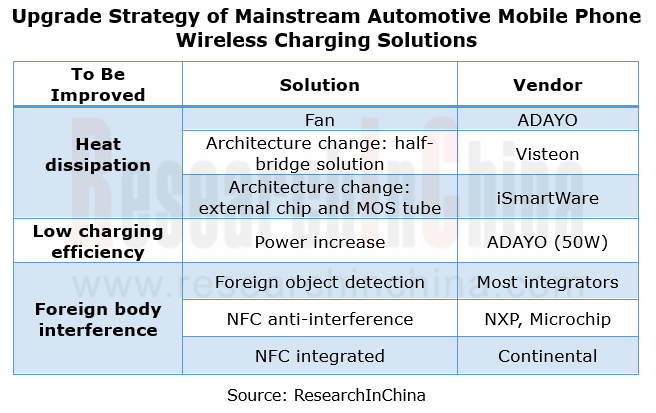

At present, the Qi Standard-certified electromagnetic induction charging solutions are the mainstream automotive mobile phone wireless charging solutions. In terms of structure, SOC solutions with built-in full-bridge MCUs and built-in power tubes have a serious problem of heating.

The mainstream automotive mobile phone wireless charging solutions have the following three shortcomings: 1. Severe heating problem; 2. Slow charging and low module transmitting power; 3. Vulnerable to interference, e.g., metal and NFC key.

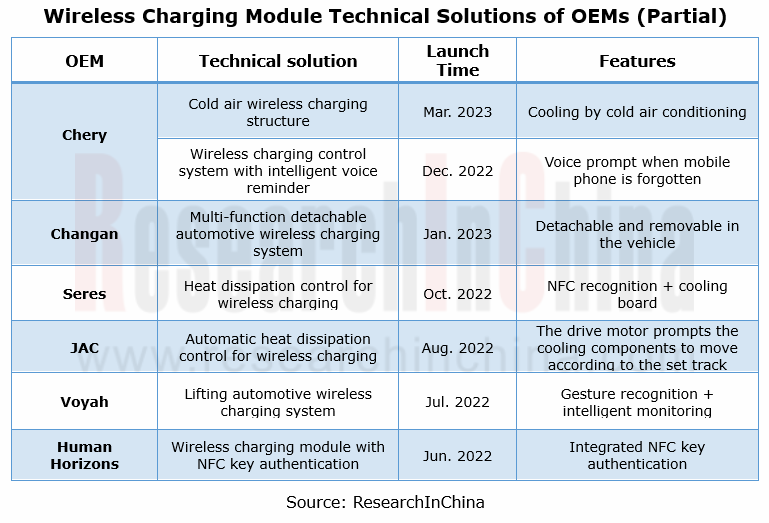

To solve the above problems, OEMs have begun to independently develop corresponding technical solutions. They have developed such technologies as air cooling, intelligent voice prompt, NFC integration, and detachable wireless charging modules.

The wireless charging board of Li L series models (L7-L9) lies in the center console, and is supplied by Luxshare Precision. It features slow charging, adopts the Qi Standard and supports both Android and Apple phones. The charging power of Android phones is 50W. In 2022, Li L series introduced the MFM-certified MagSafe wireless charging board, raising the charging power of Apple phones to 15W.

In the IM L7, the intelligent lifting wireless charging panel uses the gravity sensing function to detect the mobile phone completely placed on the module, then automatically tilts and sinks before the system starts charging; when a non-metallic device is placed on it, the panel will remain still.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...