OEMs’ overseas layout research: automobile exports are expected to hit 7.18 million units in 2025.

1. China’s automobile export market bucked the trend.

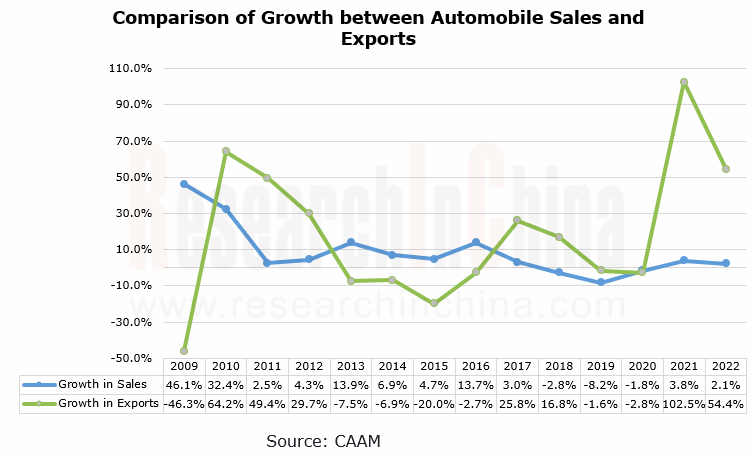

During 2021-2022, the global economy suffered an overall slump amid the severe outbreak inside and outside China, tense international geopolitical situation, a big rise in prices of bulk commodities, and imbalance between supply and demand. In this context, China’s automobile exports bucked the trend, and hit 3.111 million units in 2022, a year-on-year upsurge of 54.4%, of which 679,000 new energy vehicles were exported, soaring by 120%, a growth far higher than in the domestic market.

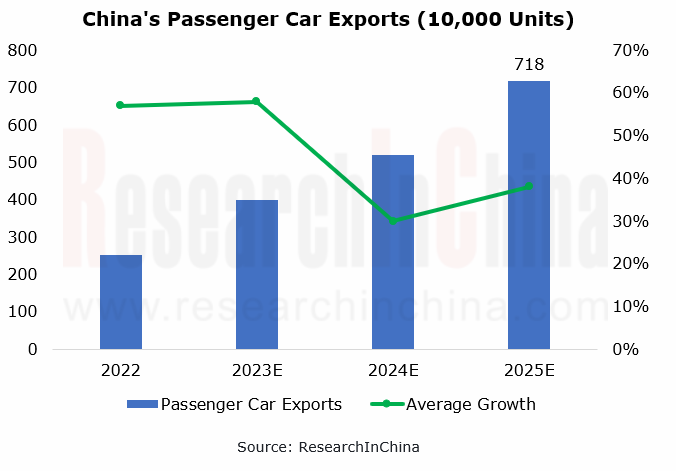

By ResearchInChina’s estimate, China's passenger car exports will still gain momentum in the next three years, and are expected to reach 7.18 million units in 2025.

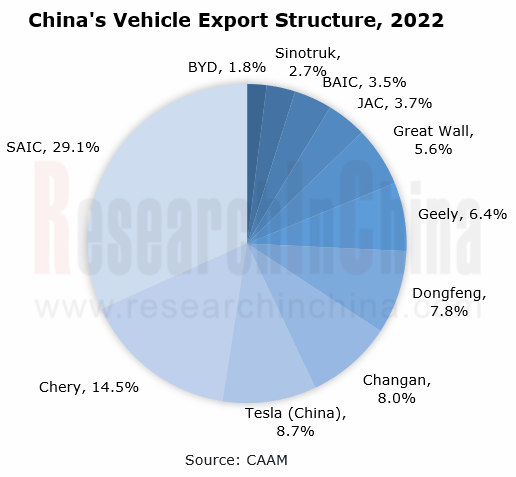

2. SAIC, Chery and Changan took a combined over 50% share of the export market.

As the Chinese market becomes a competitive stock market, Chinese automakers go overseas to seek larger development space. In 2022, SAIC commanded 29.1% of China's vehicle export market, ranking first; Chery was positioned second with a 14.5% share; Changan was the second runner-up among Chinese auto brands, with an 8.0% share. The three automakers together made up 51.6% of China's vehicle export market.

SAIC's overseas layout: since its export of CKD components for mini commercial vehicles to Indonesia in 2005, SAIC-GM-Wuling has started its overseas journey. Adhering to the “systematic, planned and organized” overseas layout strategy, SAIC overall deploys the whole industry chain from products to services at abroad. It adopts differentiated marketing models according to market environments, industrial policies and mobility needs of consumers. For example, for Europe, MG targets the new energy market, and also follows the upward branding strategy to create a "star car" brand; for the Southeast Asian market, SAIC stands out by virtue of differentiated product features and perfect local aftersales services.

Chery’s overseas layout: Chery is China’s first automaker to export complete vehicles, CKD components, engines, and complete vehicle manufacturing technology and equipment to foreign countries. After launching the “three-step” international strategy, Chery has carried out the "go-up" overseas branding model since 2020, and has worked to expand its layout in mainstream international markets such as Europe and the US. Chery plans to achieve the strategic goal of exporting 500,000 vehicles valued at USD5 billion in 2025.

Changan's overseas layout: Changan Automobile built China's first overseas vehicle design center in Turin, Italy in 2003. With years of overseas layout, Changan has established a global collaborative R&D pattern in ten places of six countries, each with its own focus. In terms of strategic planning for overseas layout, Changan strategically puts forward five major deployments and four development goals in its “Vast Ocean Plan”: Changan plans an overseas market investment of USD10 billion, annual sales of over 1.2 million vehicles, and more than 10,000 overseas staffs, and to build itself into a world-class auto brand in 2030.

3. NIO, Xpeng and Neta Auto adopt new business models overseas.

At present, Chinese automakers sell vehicles overseas still through conventional channels such as general agency and distribution. In some key overseas markets, NIO, Xpeng, and Neta Auto among others have begun to test the direct sale model. Under this model, automakers directly control service quality, provide ultimate user experience, and gain user data in time to create a fan user ecosystem. In addition, bypassing dealers helps automakers lower purchase costs, make more sales profits, and accumulate experience for long-term branding and getting a solid foothold.

NIO adopts the "direct sale + battery swap + subscription" model in overseas markets. In Norway, it builds direct-sale stores, allowing consumers to book cars online and experience offline; it also establishes a complete service system, and introduces the Baas program (a “rechargeable, swappable and upgradeable" battery service model that features "car and battery separation, battery rental” and acts as a solution to the problems faced by electric vehicles, such as battery attenuation, rapid battery technology update, and low residual value indicator of used cars), realizing that services come before sale. In Germany, the Netherlands, Denmark, and Sweden, it at first adopted the "rent only, not sell" subscription strategy (the car subscription period ranges from 1 month to 60 months), and then added the sales option.

In overseas markets, Xpeng mainly adopts the "direct sale + authorization" model to open markets as soon as possible. Xpeng deploys direct-sale stores to better display its brand image to the markets and consumers. It also cooperates with distributors to increase shipments, having formed strategic partnerships with leading distributors in Europe, including EmilFrey NV Group in the Netherlands and Bilia Group in Sweden.

Neta Auto still adopts its domestic "direct sale + distribution" sales model in overseas markets, having built cooperation with Thailand's PTT on energy replenishment. In September 2022, Neta Auto’s first 3.0 Image Direct Sale Experience Space in Thailand started operation. Users can experience the intelligent electric car lifestyle in this exhibition hall and participate in interaction activities.

4. European and American markets are expected to become strategic high grounds for Chinese OEMs that are going overseas.

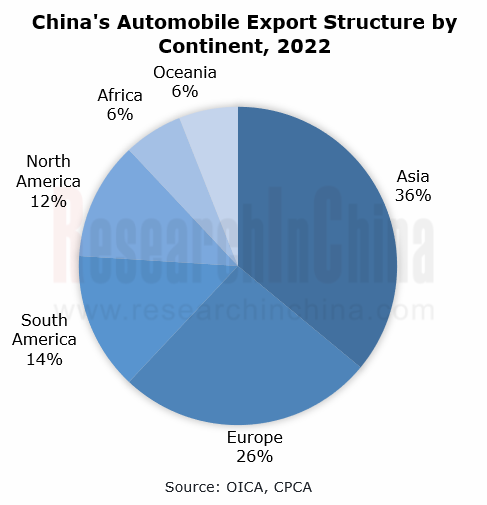

At present, Asia is the largest market for China’s automobile exports, sharing 36% of its total exports. Europe, the second largest export market, has taken a rising share of China’s automobile exports since 2018, up from 6% to 26% in 2022.

In recent years, ever more Chinese automakers have aimed their overseas strategy at the large, mature developed markets such as Europe and the US. Successfully gaining a foothold in the fiercely competitive European and American markets can not only provide a strong endorsement for the automakers, but also help them integrate global R&D strength to polish their own products, services and other capabilities. For example, SAIC did its utmost to open the European new energy market via its brand MG in 2022, and also adheres to the upward branding strategy to create a "star car" brand; Geely has also stepped into the high-end markets in Europe and Americas through the brand Volvo, having built a climbing or market expansion strategy.

5. The overseas layout path of Chinese automakers: localize globally and enhance differentiation.

Energy transition is an established fact, and electric vehicles are undoubtedly the top priority in Chinese automakers’ overseas layout plans in the years to come. In the face of the electric vehicle red sea market competition that already starts, increasing automakers are carrying out the concept of "thinking globalization, implementing localization".

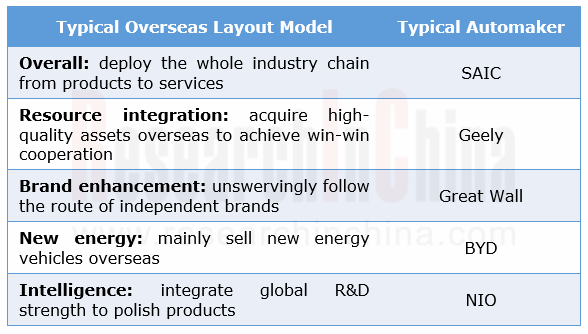

From the overseas strategy of automakers, it can be seen that ever more of them make a transformation from simple product exports to industrial exports, work hard on an expansion in overseas markets, and establish R&D/design centers, overseas regional headquarters, and automobile factories, so as to achieve localized production, localized supply chain, localized management, and localized sales and services. Furthermore, in their efforts to gain a foothold in market segments, they adopt strategies tailored to local conditions and strengthen differentiated competitive edges, for example, they create hot products, global flagship models, and a unique global brand image; they develop targeted products according to regional characteristics and needs to meet customer demand quickly and accurately.

Yet as the competition in the automotive industry intensifies, automakers going overseas will face more uncertainties and more complicated situations. Facing the stringent data security review overseas, Chinese automakers that take intelligence and connectivity as the selling points of their intelligent products need to systematize compliance management as soon as possible, build a compliance review platform, and provide professional compliance support. Additionally, political, social, cultural and technological risks cannot be ignored as well. Establishing a sound risk control and right protection mechanism can best serve the automakers that are going overseas.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...