Roadside perception research: evolution to integration, high performance and cost control.

In June 2023, at a regular policy briefing of the State Council the Ministry of Industry and Information Technology of China (MIIT) pointed out that the state will still adhere to the "vehicle-energy-road-cloud" integrated development, further improve connectivity infrastructures, and accelerate the construction of infrastructures for C-V2X, roadside perception and edge computing.

In addition, the gradual implementation of the standards concerning roadside perception facilitates the steady and orderly development of the whole industry:

In May 2023, the "Roadside Sensing System for Vehicle Infrastructure Cooperative System—Part 1: Technical Requirements" and the "Roadside Sensing System for Vehicle Infrastructure Cooperative System—Part 2: Test Methods", two standards Beijing Baidu Zhixing Technology Co., Ltd. took the lead in formulating, was drafted for comments.

In May 2023, the "Roadside Sensing System for Vehicle Infrastructure Cooperative System—Part 1: Technical Requirements" and the "Roadside Sensing System for Vehicle Infrastructure Cooperative System—Part 2: Test Methods", two standards Beijing Baidu Zhixing Technology Co., Ltd. took the lead in formulating, was drafted for comments.

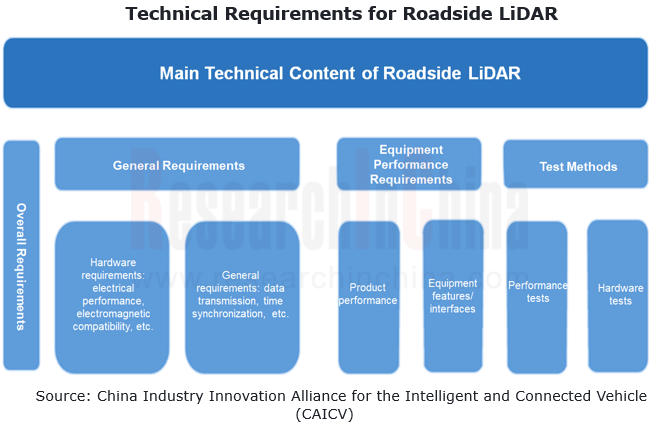

In June 2023, the CVIS Roadside Infrastructure—Technical Requirements and Test Methods for LiDAR was filed and reviewed, and officially fit into in the standard development plan of the China Society of Automotive Engineers, with the drafting task being No.2023-029. The standard was jointly initiated by Beijing Baidu Zhixing Technology Co., Ltd., Beijing Chewang Technology Development Co., Ltd. (BJCW) and Hesai Technology Co., Ltd.

In June 2023, the CVIS Roadside Infrastructure—Technical Requirements and Test Methods for LiDAR was filed and reviewed, and officially fit into in the standard development plan of the China Society of Automotive Engineers, with the drafting task being No.2023-029. The standard was jointly initiated by Beijing Baidu Zhixing Technology Co., Ltd., Beijing Chewang Technology Development Co., Ltd. (BJCW) and Hesai Technology Co., Ltd.

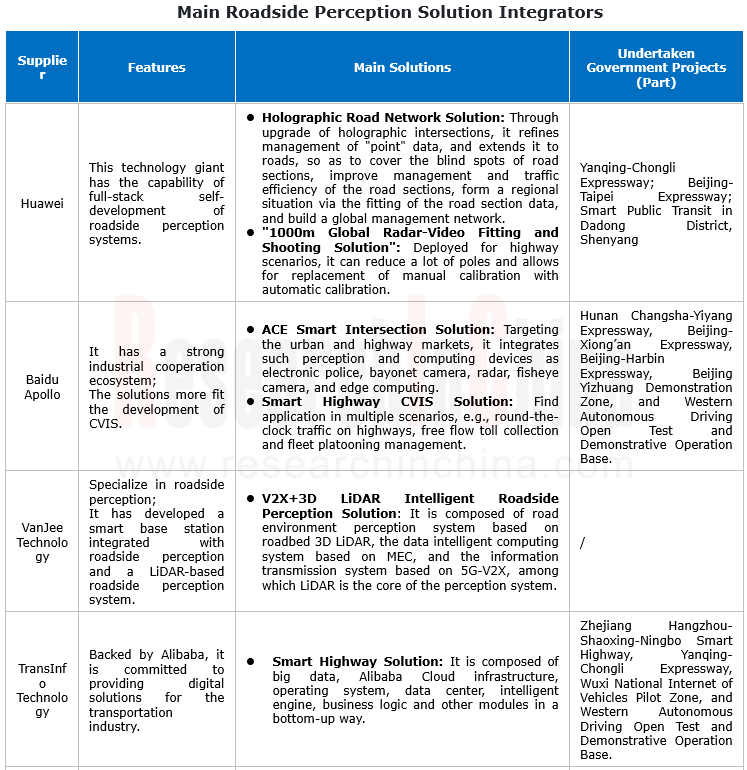

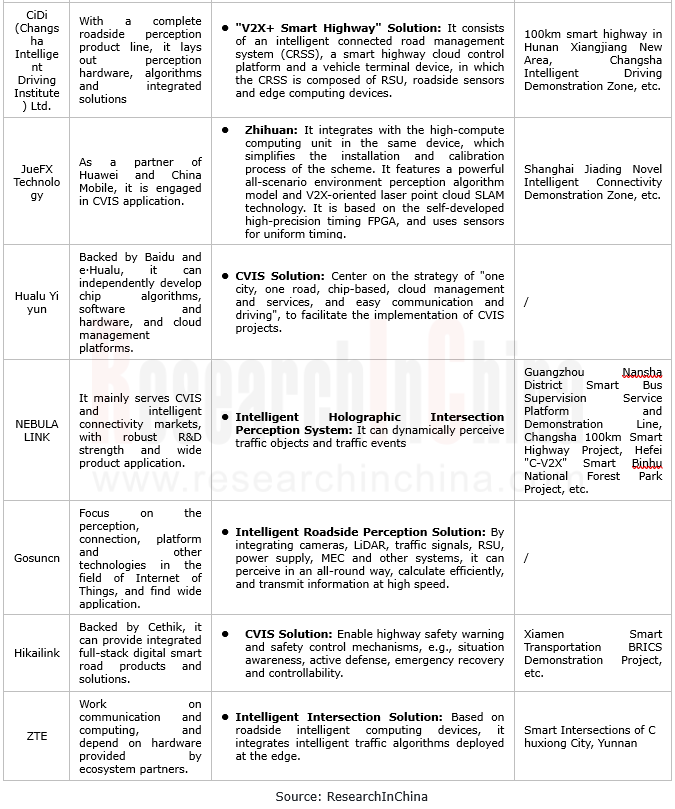

Based on roadside perception, roadside perception solution providers extend upward to the intelligent transportation industry.

The ultimate goal of roadside perception of smart roads is to serve people and enhance experience. For cost reasons, the current deployment of roadside perception hardware does not need to cover all roads, but starts from key sections and key scenarios, and then gradually expands to a larger number of smart road sections.

By business layout, roadside perception solution integrators can be roughly divided into two types:

Deploy some roadside perception hardware devices by themselves to open up the roadside perception industry chain. Most of the roadside perception solution integrators in the industry adopt this model, and Huawei is the most typical one. Huawei has completed the comprehensive layout of roadside perception hardware, computing units, communication units and integrated solutions;

Deploy some roadside perception hardware devices by themselves to open up the roadside perception industry chain. Most of the roadside perception solution integrators in the industry adopt this model, and Huawei is the most typical one. Huawei has completed the comprehensive layout of roadside perception hardware, computing units, communication units and integrated solutions;

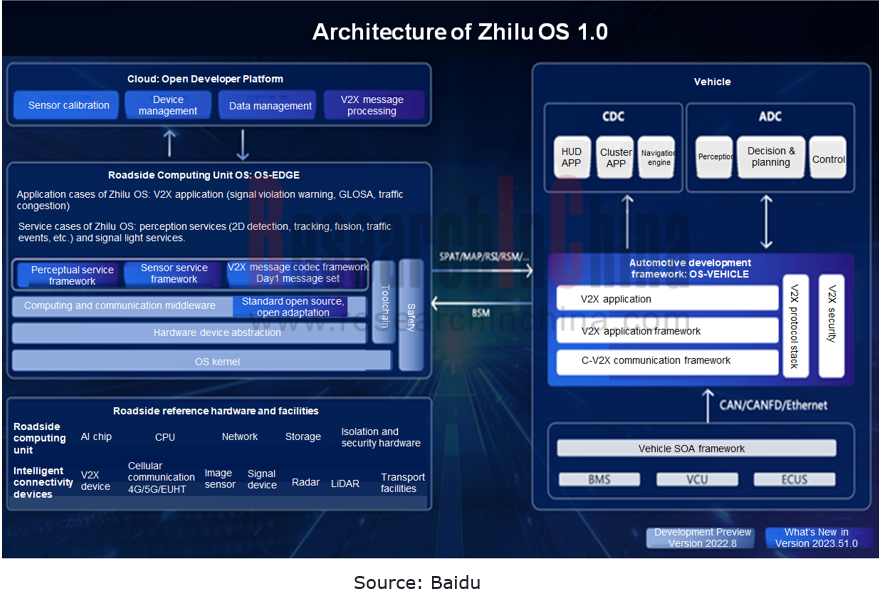

Rely on roadside perception hardware from ecosystem partners. Those that underline ecosystem cooperation and remain weak in hardware deployment adopt this model, and Baidu is the most typical one. Baidu concentrates on developing integrated solutions and system architectures, while its roadside hardware is largely supplied by its partners.

Rely on roadside perception hardware from ecosystem partners. Those that underline ecosystem cooperation and remain weak in hardware deployment adopt this model, and Baidu is the most typical one. Baidu concentrates on developing integrated solutions and system architectures, while its roadside hardware is largely supplied by its partners.

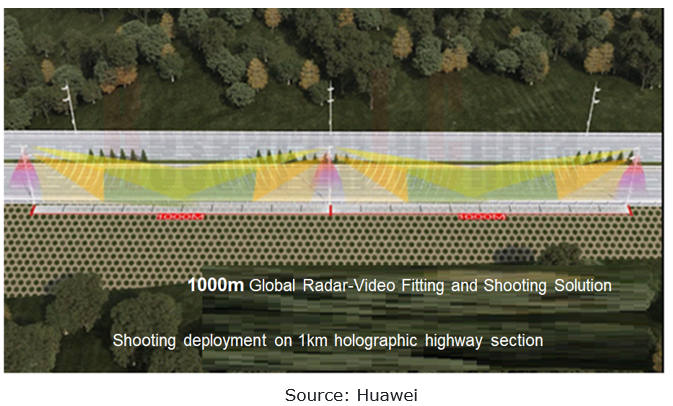

Huawei

In 2023, Huawei introduced the "1000m Global Radar-Video Fitting and Shooting Solution" suitable for highway scenarios. With the multi-dimensional perceptual fusion technology based on video and radar, the solution enables accurate collection of the road network traffic information, and real-time acquisition of dynamic and static traffic data. It allows for structured analysis and fitting of the collected data via ITS800, the intelligent transportation edge hardware. Combined with HD maps, it can also realize round-the-clock perception, high-precision detection and low-cost deployment (reducing a large number of poles).

Baidu

In May 2023, Baidu announced the "Zhilu OS 1.0". Driven by high-level autonomous driving technology and application, it is a basic software platform for intelligent connected roadside computing units under the overall architecture of China's vehicle-road-cloud integrated solutions. It can provide complete vehicle-road-cloud integrated development environments, frameworks and application examples, helping intelligent transportation system integrators, automakers and autonomous driving technical solution providers among others to easily build CVIS-based autonomous driving systems and intelligent transportation applications from 0 to 1.

Roadside perception hardware evolves to high performance and cost control.

As an underlying basic technology, intelligent roadside perception plays a crucial part in the development of intelligent transportation/smart roads. Roadside perception hardware mainly includes camera, radar, LiDAR, and radar-video all-in-one. At present, single roadside perception hardware fails to meet the requirements of smart roads, while multi-sensor fusion is a development trend of roadside perception. The whole roadside perception hardware market is heading in the direction of high performance and cost reduction.

Integration

From the roadside perception market in 2023, it can be seen that both roadside video-only devices and radar-video all-in-ones tend to be integrated in appearance, becoming diversified, not limited to conventional forms like gun, cuboid and sphere.

Huawei

In March 2023, Huawei launched a stereo event radar-video all-in-one, a device equipped with two 8-megapixel cameras and radar. With the built-in 4T computing power supporting radar-video fitting algorithms, it integrates video and radar perception through the long- and short-focus relay lenses to perceive the entire tunnel, hereby effectively solving the problem of multiple sensors and difficult connection in the tunnel.

Sinoits

In April 2023, Sinoits unveiled Atongmu, its self-developed dual-spectrum radar-video all-in-one that uses infrared thermal imaging and visible light to collect videos. Integrating radar traffic analysis technology, it can accurately detect the position, speed and other information of objects, without being intervened by weather. This new cost-effective product works around the clock and features wide coverage and high accuracy. It is free of light, day and night, fog or rain. It requires lower additional deployment cost and low maintenance cost, and offers high reliability.

SMiTSense

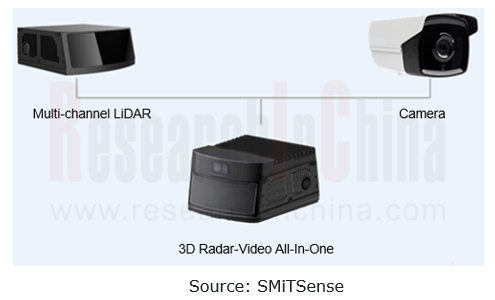

In June 2023, SMiTSense introduced a 3D radar-video all-in-one, a device which combines the radar-video fusion algorithm with the radar-video fusion sensor for software-hardware co-optimization. It performs spatial matching and time synchronization of the 3D point cloud of the LiDAR and the 2D color image of the camera. With high object recognition accuracy, it can be used widely in intelligent transportation, for example, holographic tunnel, blind spot warning, overspeed warning, signal violation detection, and illegal road occupation.

4D radar

Radar is conventional hardware for roadside perception. In recent years, roadside vendors have started exploring the application of 4D radar to roadside. Among the mainstream roadside perception hardware suppliers, Raysun, DeGuRoon and HURYS have launched their 4D radar products.

DeGuRoon

“CitRadar-4DIR600”, a 4D imaging radar revealed in March 2023, adopts a multi-beam time-sharing mode and intelligent MIMO virtual aperture synthesis technology, with the overall performance 64 times higher than conventional radars. The powerful data processing capability enables the radar to track up to 1,000 structured objects and support the data output in a 600m range.

HURYS

In July 2022, HURYS launched RTE V29 microwave detector, a brand-new roadside 4D radar. Leveraging the self-developed 4D radar front-end and industry’s leading algorithm, it perceives all participants in various traffic environments and accurately scans the profile height of objects, and empowers the high-precision holographic perception of intersections and road sections with high detection accuracy.

Multi-channel solid-state LiDAR

LiDAR has obvious advantages at the roadside. The high cost however makes it hard to be used at the roadside on large scale. Thus the top priority for LiDAR suppliers is to cut down the application cost of roadside LiDARs.

High-resolution LiDAR performs much better in detection range and number of detected objects. For example, a 300-channel LiDAR offers a 150-meter detection range, while a 32-channel LiDAR can only perceive about 50 meters.

In addition, solid-state LiDAR is more applicable to the roadside that requires devices to work for a long time even without interruption. It remains superior in reliability and cost and is thus aligned more closely with the requirements for construction of 5G CVIS.

Innovusion

The Falcon AI was released at the end of 2022 as highly integrated ultra-long range AI LiDAR designed for CVIS and smart high-speed scenarios, with the longest detection distance of 500m and high-computing GPU module supporting various deep learning algorithms. It can greatly reduce the configuration requirements of edge computing and the complexity of system deployment.

Falcon AI, an integrated ultra-long-range AI LiDAR released in late 2022, targets vehicle-infrastructure cooperation and smart highway scenarios, with the longest detection range up to 500 meter. It integrates a high-compute GPU module to support various deep learning algorithms, which can greatly reduce the configuration requirements of edge computing and the complexity of system deployment.

The Smart Road - Roadside Perception Industry Report, 2023 highlights the following:

Roadside perception industry (policies, standard formulation, market size, market structure, business model, etc.);

Roadside perception industry (policies, standard formulation, market size, market structure, business model, etc.);

Key roadside perception technologies (LiDAR, radar, cameras, etc.) (status quo, trends, main suppliers and products), development trends of multi-sensor fusion for roadside perception, etc.;

Key roadside perception technologies (LiDAR, radar, cameras, etc.) (status quo, trends, main suppliers and products), development trends of multi-sensor fusion for roadside perception, etc.;

Deployment cases of roadside perception hardware in main scenarios (smart highway, smart intersection, smart bus line, etc.);

Deployment cases of roadside perception hardware in main scenarios (smart highway, smart intersection, smart bus line, etc.);

Major roadside perception system integrators (summary on business lines, roadside perception integrated solutions, deployment of roadside perception hardware, etc.);

Major roadside perception system integrators (summary on business lines, roadside perception integrated solutions, deployment of roadside perception hardware, etc.);

Major roadside perception hardware suppliers (product line layout, new product launch, etc.).

Major roadside perception hardware suppliers (product line layout, new product launch, etc.).

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...