In-vehicle Communication and Network Interface Chip Industry Report, 2023

In-vehicle communication chip research: automotive Ethernet is evolving towards high bandwidth and multiple ports, and the related chip market is growing rapidly.

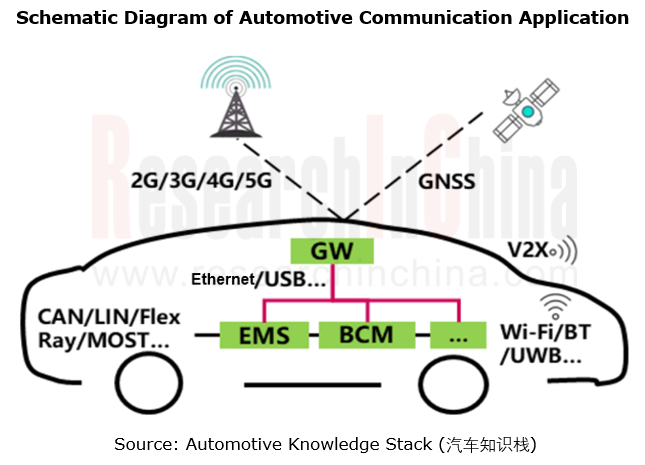

By communication connection form, automotive communication falls into wireless communication and wired communication.

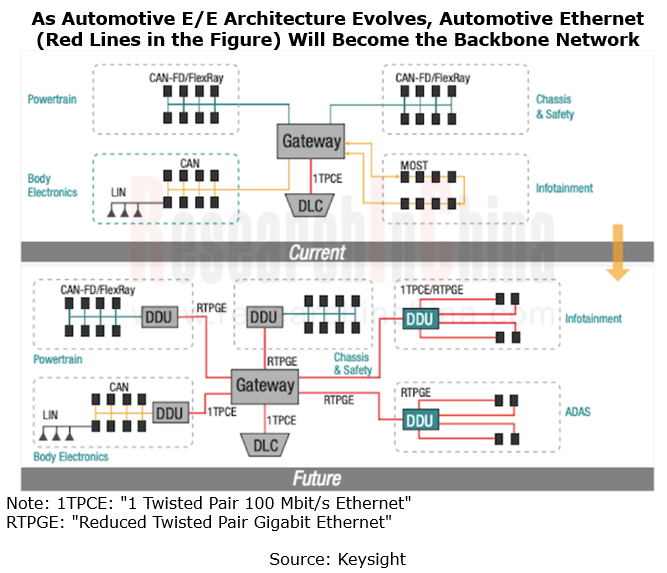

An automotive electronic and electrical system uses a communication network as the carrier to connect electronic devices in a vehicle through wiring harnesses. As automotive E/E architecture evolves and in-vehicle functions become more complex, the increasing number of sensors in a vehicle leads to a surge in vehicle data. This requires very high vehicle real-time communication and data processing capabilities. The automotive Ethernet with high bandwidth, low delay and high reliability therefore will be more suitable for the long-term evolution of future E/E architecture and the high-speed in-vehicle communication.

In the zonal architecture, the centralization of functions allows vehicles to pack far fewer ECUs. At this time, the central computing platform requires extremely high computing power of controllers, but relatively low computing power of zone controllers. To meet vehicle functional safety requirements, automotive Ethernet will become the data backbone link in the zonal architecture for the massive data transmission and migration between central and zone controllers, and the interaction between software and algorithms.

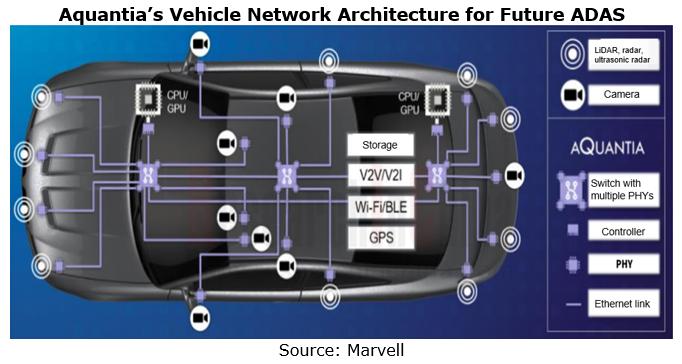

When Ethernet is used as the backbone network for future vehicles, the information interaction between zone controllers is enabled via Ethernet switches. At present, vehicle network communication chip vendors like Marvell, Broadcom and NXP have proposed the next-generation network architecture.

For example, Aquantia (acquired by Marvell) predicts that the vehicle network architecture for future ADAS will have two central computing units (GPU/CPU), and connect all cameras and sensors via three switches, and Ethernet will be adopted for the entire vehicle connection. Each sensor needs to carry a PHY chip, and each switch node also needs to be configured with several PHY chips to input the data transmitted from sensors. Automotive Ethernet involves redundant backup design where hardware functions have a backup or are processed in parallel. Data from cameras and sensors are sent to a central computing unit, while the other central computing unit functions as a backup and take control of the vehicle in case that the former one fails.

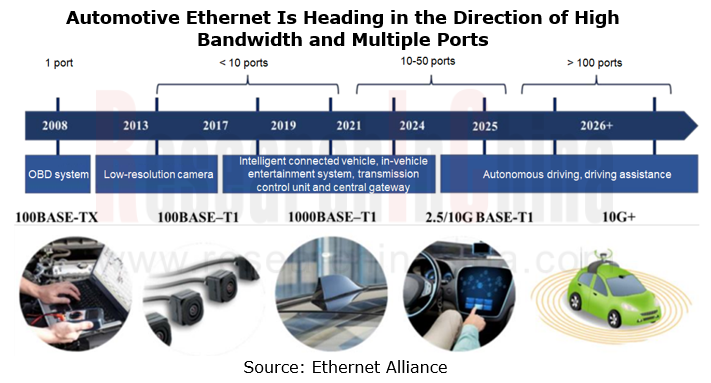

Automotive Ethernet is evolving towards high bandwidth and multiple ports.

Automotive Ethernet chips are led by physical layer (PHY) interface chip and Ethernet switch chip. PHY chips convert digital/analog signals based on the physical layer, and do not process data. Based on the data link layer, switch chips process transmitted data, covering fast forwarding and switching, filtering and classification of data packets.

With the evolution of automotive E/E architecture, automotive Ethernet chips boast an increasing penetration. China’s automotive Ethernet chip market booms. For instance, automotive Ethernet PHY chips are largely used in central computing systems, ADAS and IVI systems. According to the average number of PHY chips per vehicle and the average price of PHY chips, China’s passenger car Ethernet PHY chip market is estimated to be worth RMB5.8 billion in 2022. In the future, as automotive Ethernet penetrates into other vehicle fields, a single vehicle will use more chips, and high-speed PHY chips take a rising share, which will offset the decline in the price of a single chip model. It is conceivable that China’s passenger car Ethernet PHY chip market will be valued at RMB21.87 billion in 2025.

The evolution direction and speed of automotive E/E architecture have an impact on the development direction and speed of future automotive Ethernet. To meet the data transmission requirements (e.g., multi-functional interaction) in intelligent cockpits, automotive Ethernet will head in the direction of high bandwidth and multi-port configurations in the future.

Autonomous driving promotes the development of 10G+ automotive Ethernet.

As autonomous driving technology matures, vehicles have ever higher requirements for real-time performance and sensibility of massive data transmission. In addition, the use of autonomous driving on roads will trigger demand for massive data storage, and the real-time storage of high-definition data from sensors such as cameras and LiDAR requires higher in-vehicle network bandwidth.

The higher the level of autonomous driving, the greater the demand for high-speed vehicle communication network. To meet the requirements of L3 and higher-level autonomous driving, 2.5/5/10G automotive Ethernet will be largely introduced into in-vehicle networks. L4/L5 autonomous vehicles will depend more heavily on automotive Ethernet, and many of them will introduce the 10G+ standard. Therefore, high-speed automotive Ethernet is essential for L3+ autonomous driving.

Most mainstream or emerging automakers have laid out "centralized" E/E architecture in advance, and will apply it in production models during 2023-2025. 10G bandwidth is a must in realization of zonal architecture in 2025. In the 10G automotive Ethernet chip market, only Marvell and Broadcom can provide 10G+ Ethernet switches.

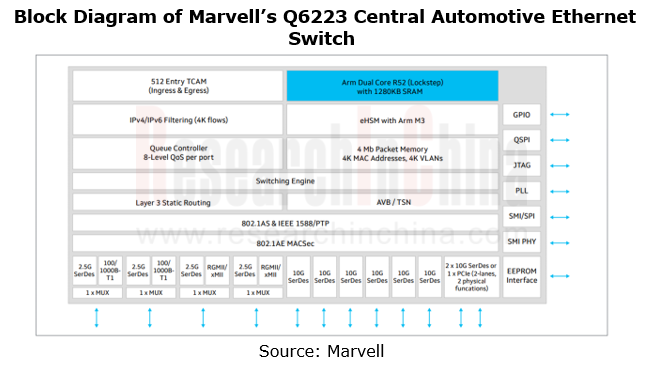

In June 2023, Marvell announced the Brightlane Q622x family of central Automotive Ethernet switches to support the zonal networking architectures of next-generation vehicles. Zonal switches aggregate traffic from devices located within a physical zone of a car like processors, sensors, actuators and storage systems, and is connected to the central computing switch via high-speed Ethernet for information exchange.

Brightlane Q622x switches are single-chip devices, including Q6222 and Q6223:

Brightlane Q6223 delivers 90 Gbps of bandwidth, nearly 2x the capacity of currently available automotive switches. The non-blocking 12-port design can be configured from among the eight integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available.

Brightlane Q6222 contains nine ports for 60 Gbps, with five integrated 10G SerDes ports, four integrated 2.5G SerDes ports, and two integrated 1000Base-T1 PHYs available for selection.

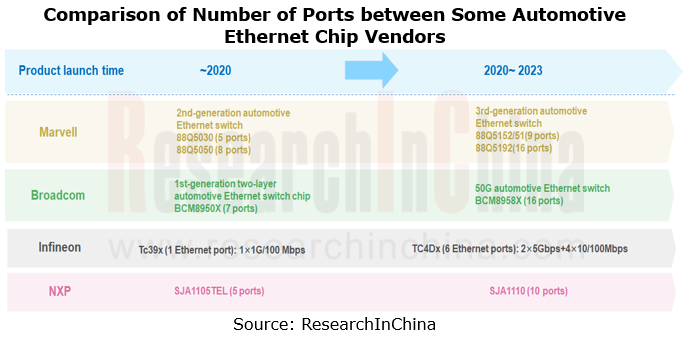

The number of automotive Ethernet ports increases with the evolution of automotive E/E architecture

As automotive E/E architecture evolves, the penetration of automotive Ethernet is on the rise, and the demand for Ethernet node chips will also jump in the future, with over 100 Ethernet ports per intelligent vehicle.

So far, production vehicle do not have many Ethernet ports, which are often used in subsystems such as IVI, in-vehicle communication, gateway, and domain controller. A vehicle network architecture with Ethernet as the backbone has yet to be built. In the future, with the production of models based on zonal architecture, automotive Ethernet will be used much more widely in vehicle network communication architecture, and by then the number of automotive Ethernet communication ports will swell accordingly.

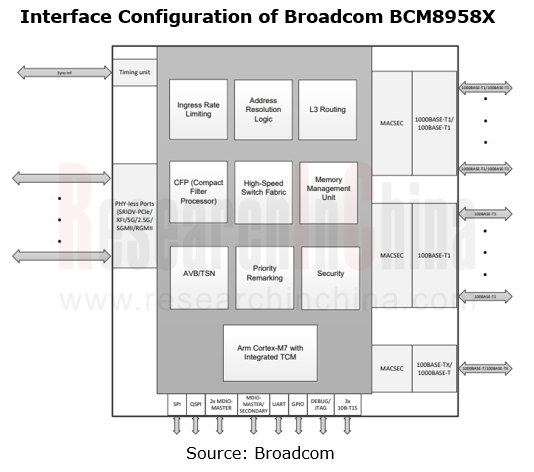

The new products or updated/iterative products released by chip vendors such as Broadcom and NXP tend to have increasing communication ports.

In May 2022, Broadcom announced BCM8958X, a high bandwidth monolithic automotive Ethernet switch device that features 16 Ethernet ports of which up to six are 10 Gbps capable (XFI or PCIe x1 4.0 with SRIOV), as well as integrated 1000BASE-T1 and 100BASE-T1 PHYs.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...