Research on Automotive Cloud Services: As Dedicated Automotive Cloud Platforms Are Launched, the Market Enters A Phase of Differentiated Competition

1. The exponentially increasing amount of vehicle data makes cloud migration an inevitable choice.

From the perspective of companies, the goals of digital transformation are to digitize all elements of the whole process throughout the full life cycle of vehicles, including R&D, production, sale, operation, and after-sales service; upload the data in the local servers and computer rooms of automakers to the cloud; connect the data channels of each link to gradually realize the integrated management of data in the whole industry chain, and the cloud-pipe-terminal integrated real-time interconnection; and build service operation models that span the full life cycle of users to enhance the connections between upstream and downstream partners in the industry and create greater value.

In terms of products, vehicle intelligence and connectivity are booming. For example, starting from L2, every time the autonomous driving functions evolve to a higher level, the consumption of cloud infrastructure platforms, applications, and services will rise by an order of magnitude. As high-level autonomous driving comes into mass production, the number of vehicle sensors and the amount of data multiply, making it difficult for local processing to meet the requirements. Cloud migration thus will be the best choice.

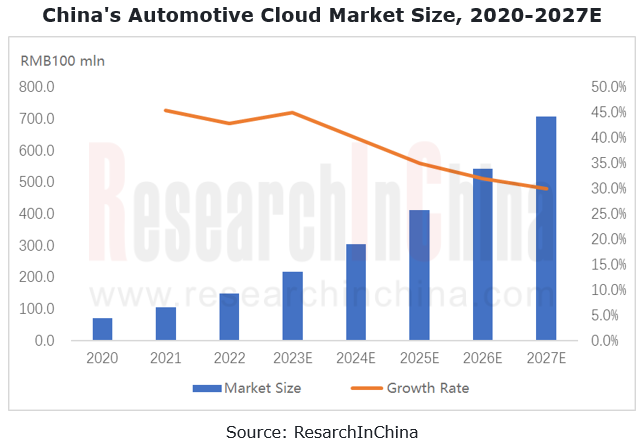

Automakers spend tens of millions of yuan every year building cloud services, which gives a big boost to the market. In 2022, China's automotive cloud service market was valued at over RMB15 billion, and it is expected to sustain the growth rate of 30-40% in the next five years.

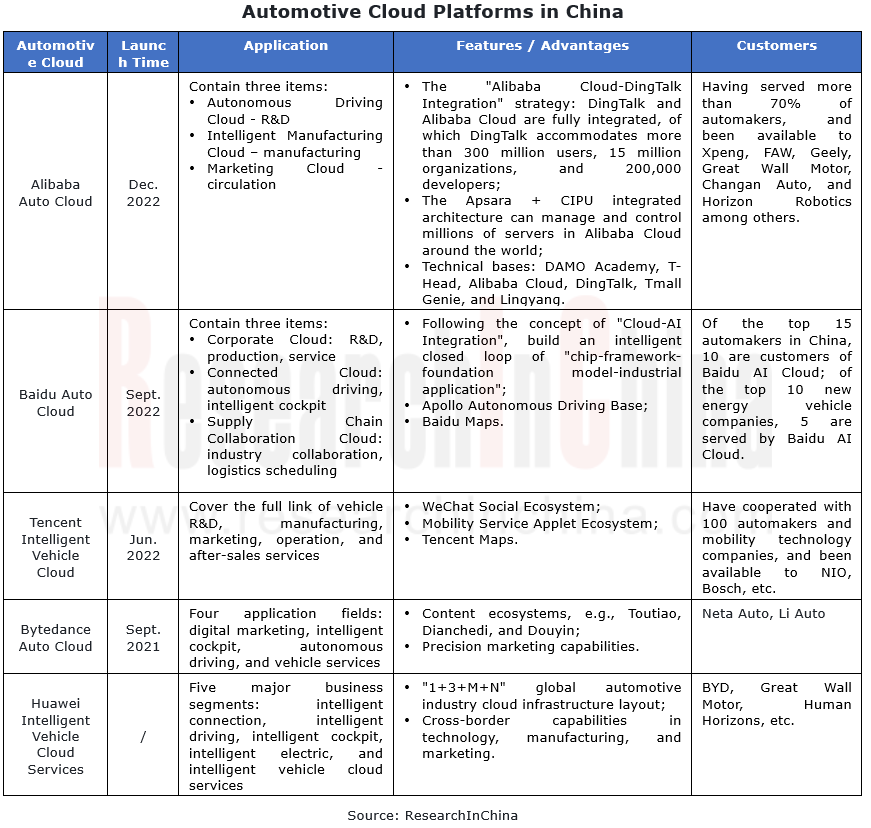

2. As dedicated automotive cloud platforms are launched, differentiated competition becomes crucial.

In 2021, ByteDance announced the "ByteDance Auto Cloud", which will provide cloud services in four segments: Digital Marketing, Intelligent Cockpit, Autonomous Driving, and Vehicle Services. In 2022, Tencent Intelligent Cloud Cloud, Baidu Auto Cloud, and Alibaba Auto Cloud became available. All the five giants (BATHD), i.e., Baidu, Alibaba, Tencent, Huawei and Douyin have stepped in the market, and the competition in automotive cloud services built on exclusive automotive cloud has become fiercer.

The service scope of each automotive cloud is much of a muchness, generally covering R&D, manufacture, marketing, and supply chain. The support for R&D is concentrated in the fields of autonomous driving, intelligent cockpit, telematics, and “three electrics” (battery, motor and ECU). How to gain differentiated competitive edges in the competition therefore has become the key to success for companies.

3. The differentiated competitive edges in cloud services are mainly built from two aspects: basic resource layer services and upper-layer R&D tool chains.

In terms of basic resource layer, supercomputing centers are an important indicator for assessing service capabilities, and Alibaba and Baidu are the first to deploy.

In August 2022, Alibaba Cloud launched the two intelligent supercomputing centers located in Zhangbei County and Ulanqab, with total compute of 15 EFLOPS (15 exascale floating-point operations per second). At the same time, Alibaba Cloud also introduced the "Apsara Intelligent Computing Platform", an intelligent computing solution which opens up intelligent computing capabilities by way of "platform + intelligent computing center".

Following the five intelligent computing centers in Yangquan, Jinan, Fuzhou, Yancheng, and Tianjin, Baidu Cloud started construction of the Baidu AI Cloud-Shenyang Intelligent Computing Center in May 2023, a project with a land area of about 2.4 hectares, floor areas of 42,000 square meters, and the total planned computing power of 500P, 200P for Phase I. In the future, Baidu Shenyang Intelligent Computing Center will not only involve physical data center construction capabilities and intelligent computing infrastructure capabilities, but also comprehensive solutions for AI software and hardware ecosystem capabilities such as foundation models, supporting the computing tasks of companies in different business scenarios and meeting the industrial application requirements of foundation models in the era of intelligent computing.

With regard to R&D tool chains, cloud service providers are committed to creating "fully furnished" service experiences for users by offering "full-process" and "fully closed-loop" services.

In Tencent's autonomous driving cloud platform, virtual simulation has become a key link.

In Tencent's autonomous driving cloud platform, virtual simulation has become a key link.

Huawei's autonomous driving cloud platform "Octopus" has built in a dataset with 20 million frame annotations, a library with 200,000 simulation scenes, a complete tool chain, and annotation algorithms, covering the full life cycle businesses such as autonomous driving data, models, training, simulation, and annotation, and helping automakers to build autonomous driving development capabilities on a "zero" basis.

Huawei's autonomous driving cloud platform "Octopus" has built in a dataset with 20 million frame annotations, a library with 200,000 simulation scenes, a complete tool chain, and annotation algorithms, covering the full life cycle businesses such as autonomous driving data, models, training, simulation, and annotation, and helping automakers to build autonomous driving development capabilities on a "zero" basis.

Baidu makes a full-stack layout and enables a data closed loop by virtue of from chip (Kunlunxin), deep learning (PaddlePaddle) and training foundation model (ERNIE) to search (Baidu Search), cloud platform (Baidu AI Cloud), autonomous driving (Apollo) and intelligent connection (Xiaodu).

Baidu makes a full-stack layout and enables a data closed loop by virtue of from chip (Kunlunxin), deep learning (PaddlePaddle) and training foundation model (ERNIE) to search (Baidu Search), cloud platform (Baidu AI Cloud), autonomous driving (Apollo) and intelligent connection (Xiaodu).

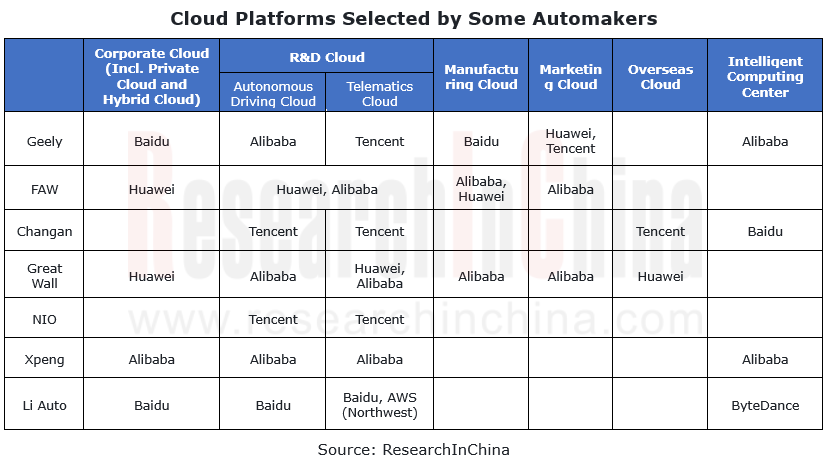

4. Under the multi-cloud strategy, the need of OEMs has changed from the pursuit of resources to efficiency.

With the in-depth migration to the cloud, the resource needs of OEMs for cloud migration have been overall met, and thus the underlying logic of the cloud strategy of companies has changed from the pursuit of resources to efficiency to finally improve their overall digitization capabilities in production and operation. In this process, OEMs are no longer tightly bound with some cloud platform, but implement a multi-cloud strategy where different business types are put on different cloud platforms.

Examples include:

Based on the "1+6+N" Geely Hybrid Cloud Platform co-built with Baidu, Geely works with Alibaba to build the Xingrui Intelligent Computing Center, and teams up with Tencent on telematics and security solutions.

Based on the "1+6+N" Geely Hybrid Cloud Platform co-built with Baidu, Geely works with Alibaba to build the Xingrui Intelligent Computing Center, and teams up with Tencent on telematics and security solutions.

FAW Group uses Huawei Cloud Stack to build hybrid cloud architecture, and also cooperates with Alibaba Cloud on intelligent manufacturing, digital marketing and other businesses.

FAW Group uses Huawei Cloud Stack to build hybrid cloud architecture, and also cooperates with Alibaba Cloud on intelligent manufacturing, digital marketing and other businesses.

Without a doubt, the multi-cloud strategy offers benefits. It can integrate the advantages of various cloud platforms, enable refined business deployment, and reduce costs for companies, and also helps automakers to gain the core initiative in building cloud platforms and avoid being puzzled by the “soul” dispute. Yet the challenges of the multi-cloud strategy are also unavoidable. How to allocate storage/computing power among multiple clouds, cross-cloud data synchronization’s dependency on bandwidth, and whether costs and network delays will have an impact are all urgent problems to be solved. Hence how to formulate a multi-cloud strategy is a problem for OEMs.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...