Passenger Car Radar Industry Research in 2023:

?In 2023, over 20 million radars were installed, a year-on-year jump of 35%;

?Driven by multiple factors such as driving-parking integration, NOA and L3, 5R solutions will become the mainstream configuration in the market in 2026.

?Influenced by the rising sales of China’s local suppliers, intelligent involution and other factors, localization is a megatrend.

?4D radars have landed on vehicles on a small scale and are expected to be mass-produced and installed on a large scale during 2025-2026.

?At present, 4D radars mainly involve cascade solutions; single-chip solutions will become the focus of the future layout and be implemented in 5-8 years.

?Analysis on BOM of Jingwei Hirain’s MRR510 front radar.

1. In 2023, over 20 million radars were installed, a year-on-year jump of 35%; it is estimated that more than 5 million 4D radars will be installed in 2026

According to ResearchInChina, 20.021 million radars will be installed in new passenger cars in China in 2023, up 21.6% year on year; in 2026, the number will hit 39.618 million.

From January to June 2023, the overall installations of 4D radars in new passenger cars in China exceeded 114,000 units, accounting for 1.3% of the total radar installations. In terms of the replacement order, 4D radars will first replace front radars, that is, priority will be given to meeting the driving needs in intelligent driving, and second replace corner radars to better meet high-level safety function requirements. It is expected that the installations of 4D radars will reach 5.594 million units in 2026, making up 14.1% of the total radar installations.

The main factors driving up radar installations include:

Consumer side: OEMs focus on deploying NOA functions, of which 5R becomes standard

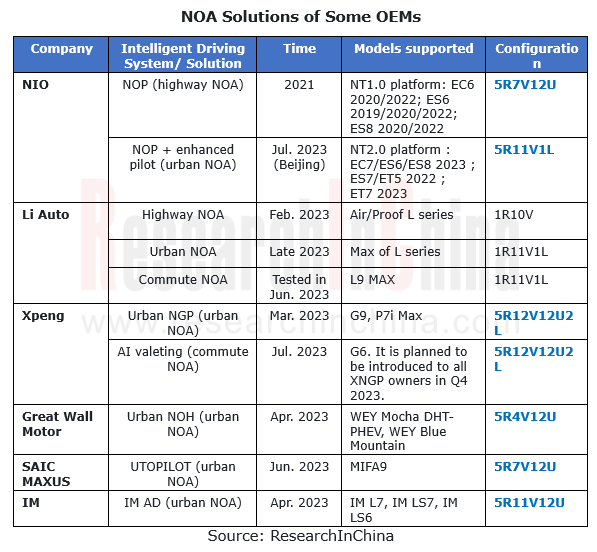

NOA, a hotspot in the layout of major OEMs, includes highway NOA, urban NOA and commute NOA, among which 5R NOA solutions prevail in the market.

Highway NOA (L2.5): At the end of 2020, some Chinese automakers began to apply NOA to highway scenarios, and highway NOA thus became a layout highlight. In 2022, highway NOA intensively boarded vehicles.

Urban NOA (L2.9): In the second half of 2022, Xpeng, AITO and other OEMs took a lead on planning urban scenarios, extending NOA from highways to urban areas. In 2023, most leaders engaged in intelligent driving released their urban NOA plans, so 2023 marked the first year of urban NOA.

Commute NOA: it is the combination of urban NOA + route memory, and the selling point is to make it convenient to commute. It is likely to become another new arena following urban NOA. At present, companies that have launched such a solution include Li Auto and Xpeng.

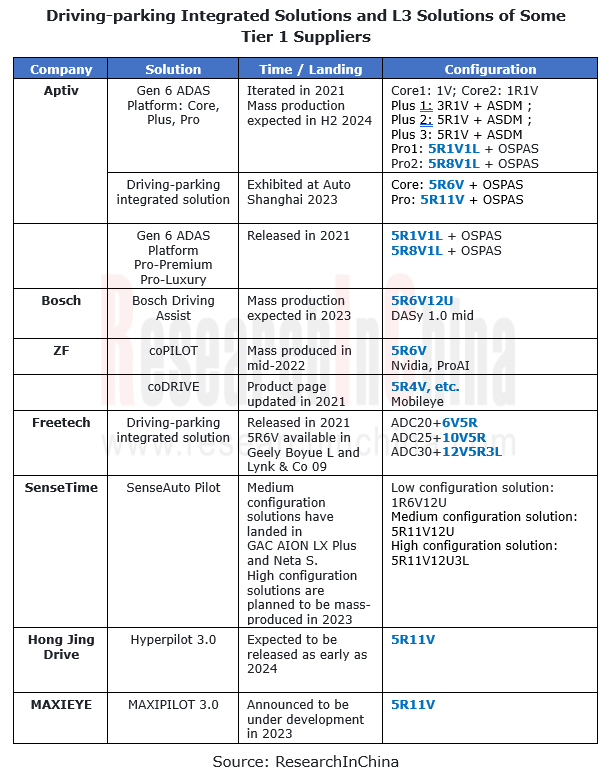

Supply side: Tier1 suppliers at home and abroad have introduced a large number of driving-parking integrated solutions and a variety of L3 solutions, which take 5R as the mainstream configuration.

For the driving-parking integrated solutions launched by many international and Chinese Tier 1 suppliers such as Aptiv, ZF, Freetech and iMotion, 5R has become the standard configuration of most mid-to-high-end solutions. According to the statistics of ResearchInChina, from January to May 2023, 490,000 sets of driving-parking integrated solutions were installed in production models, a like-on-like spurt of 138%; the installation rate hit 6.7%, up about 3.8 percentage points from the prior-year period. By 2025, the installations will reach 6.19 million sets, and the installation rate will climb to 30%.

As L3-related laws and regulations mature, the implementation of L3 has been put on the agenda, and will become another driving force for 5R solutions. For L3 solutions launched by Tier 1 suppliers, such as Bosch, Aptiv, Hong Jing Drive and MAXIEYE, 5R has also been a standard configuration.

The implementation of NOA and driving-parking integration as well as future L3 solutions will directly boost the installations of 5R solutions. According to the data from ResearchInChina, it is estimated that the proportion of 5R solutions will be 8.15% in 2023, 5.49 percentage points higher than that in 2021; the proportion of 5R solutions will reach up to 39.6% in 2026.

2. 4D radars are mainly cascade solutions, and single-chip solutions are expected to be implemented within 5-8 years.

Radar chips have passed through four development phases: radio frequency front end + processor; single SOC + digital analog; small-scale separation of SoC to the large-scale; a single chip can meet the needs of OEMs for high-level intelligent driving, a phase when the functional applications and scenarios of intelligent driving have basically been solidified, and the demand from OEMs has also stabilized.

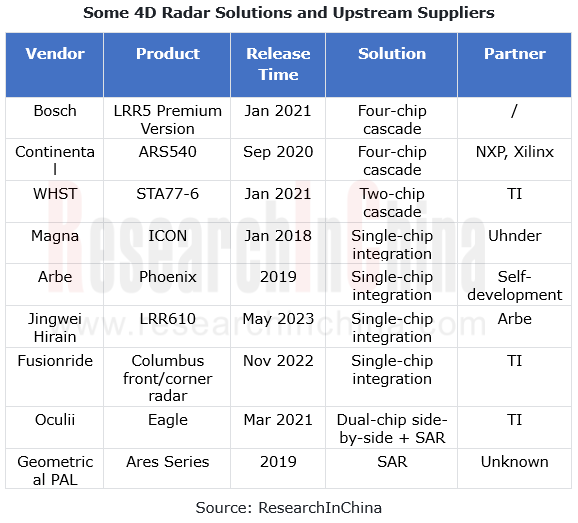

4D radar technology routes can be roughly divided into multi-chip cascade, single-chip integration, virtual aperture imaging, and metamaterials. Currently, the 4D radars that have been or will be installed in passenger cars are mainly multi-chip cascade, especially two-chip and four-chip cascade. Mature single-chip solutions will have cost performance/cost advantages, and are expected to become the focus of the future layout and be implemented in 5-8 years.

Models such as BMW IX, Li L7, and Rising Auto R7 have been confirmed to be equipped with 4D radars. Among them, Rising Auto R7 adopts ZF's FRGen21 front radar, 4-chip cascade 12T16R from TI and Xilinx, and Hella’s 4D corner radar; Li L7 Pro uses WHST's STA77-6 front radar, and 2-chip cascade 6T8R from TI.

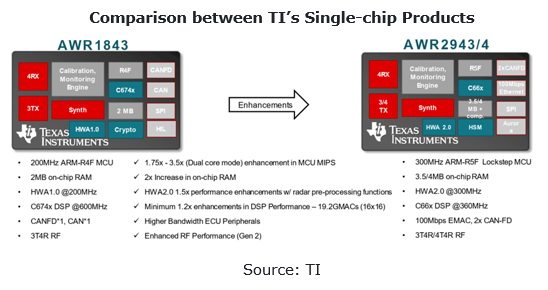

At present, the main suppliers of single-chip solutions are TI, Arbe, and Uhnder.

TI released AWR2944, its second-generation radar single chip, in January 2022. Compared with the previous AWR1843, AWR2944 adopts a 4T4R solution, which has one more transmitting channel than AWR1843 and can improve angle estimation. The MCU is upgraded from R4F to R5F with dual-core lock step, and the DSP is upgraded from C67x to C66x. HWA (radar algorithm accelerator) iterates from version 1.0 to 2.0, supporting radix-2 and radix-3 FFT, CFAR-OS and data compression. At present, the 4D radars based on this chip include WHST’s STA77-5S forward radar and Fusionride’s Columbus forward radar series.

3.Influenced by the rising sales of China’s local suppliers, intelligent involution and other factors, localization is a megatrend.

In the infancy of intelligent driving, conventional OEMs give priority to safety, quality and intelligent driving system integration when selecting suppliers, so they will prefer mature brands represented by foreign Tier 1 suppliers like Continental and Bosch which are versed in the automotive field to ensure that their software and hardware meet automotive standards. Foreign suppliers enjoy first-mover advantages and industry influence, so they sweep 90% of the Chinese radar market.

In 2022 and H1 2023, in the Chinese radar market, foreign suppliers took a more than 95% share, among which Bosch, the largest front radar supplier, made up 50.6% of the market in H1 2023, and Hella, the largest corner radar supplier, occupied 49.8% in H1 2023.

For Chinese radar suppliers, the key to catching up with and overtaking foreign counterparts lies in technical expertise, qualifications, and mass production experience, so radar suppliers with great technical strength and certain mass production experience gain greater first-mover advantages.

For example, Nova Electronics began to develop radars in 2014 and launched its first corner radar in 2018. So far, its products have covered front radars (including 4D radars), corner radars and cockpit radars. At present, the main products include NOVA 77GF-B Plus front radar (mass-produced in Q1 2022), NOVA 77GB-C corner radar (mass-produced in Q2 2021), NOVA 77GB-C Pro corner radar (mass-produced in February 2022), NOVA 77GB-T corner radar (mass-produced in 2022) and 4D imaging radar (launched in 2023 and designated by three OEMs).

WHST, established in 2015, supplied corner radars in small quantities in 2016. In 2018, the STA24-1 corner radar landed in two models, including Leopaard Mattu. Now, its products embrace front radars (including 4D radars), corner radars, cockpit radars, side radars and tailgate radars. The main products include STA 77-5 forward radar (mass-produced in 2021), STA 77-6 4D front radar (mounted on Li L7 Pro and Deepal SL03 in 2023), and STA 77-8 4D front radar (the company built cooperation with first-tier OEMs in China on custom development based on this product in 2022).

Chuhang Tech, founded in 2018, launched its first corner radar - ARC1 in December 2019. At present, its products cover front radars (including 4D radars), corner radars, cockpit radars, and stealth radars (innovative products). The main products include ARF front radar (installed by Neta, Leapmotor and JAC in 2022), ARC corner radar (available in Haima and Leapmotor in 2022), 4D front radar with 6 transmitters and 8 receivers (used by Windrose Technology and an independent new energy vehicle company in 2023), and 4D front radar with 12 transmitters and 16 receivers.

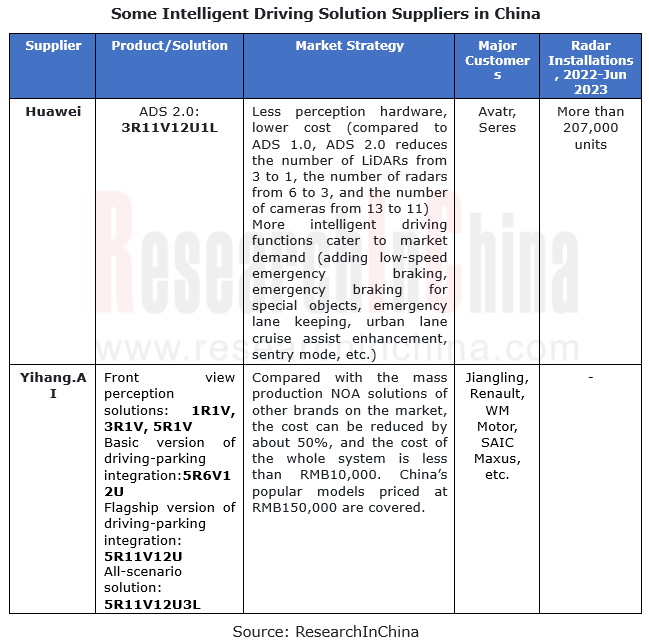

In the future, as technology matures, intelligent driving solutions will head in the direction of lower cost, higher efficiency, supporting services, application and localized delivery. By then, the advantages of domestic radar suppliers will be highlighted. For example, local suppliers such as Huawei and Baidu carry out more flexible market strategies than foreign Tier 1 suppliers. For example, compared with ADS 1.0, Huawei's ADS 2.0 cuts down hardware while improving intelligent driving functions, achieving cost reduction and efficiency improvement. ADS 2.0 has been installed in Avatr 11, AITO M5 and other models, among which the sales of AITO M5 totaled 69,000 units from 2022 to June 2023, with 207,000 radars installed. Yihang.AI's driving-parking integrated and all-scenario solutions also have a big cost reduction, with cost slashed by about 50% compared with other NOA solutions on the market.

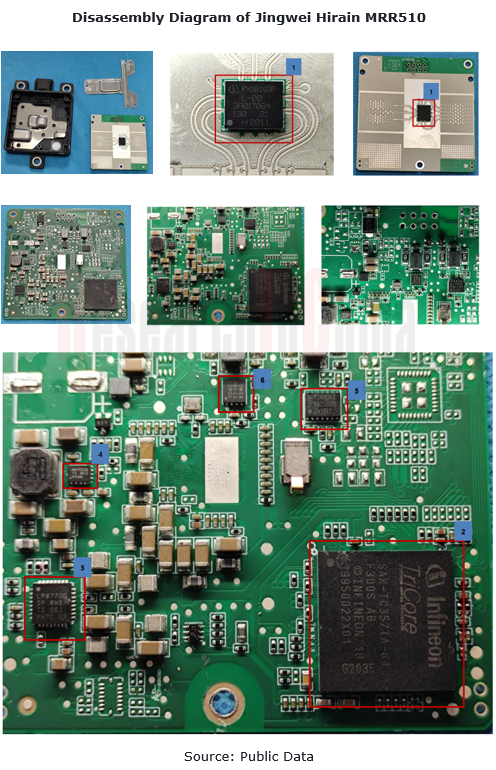

4. Analysis on BOM of Jingwei Hirain’s MRR510 front radar

MRR510 is a 77GHz front radar released by Jingwei Hirain in 2022, with the ranging of 0.5-190m, the ranging accuracy of ±0.1m, the HFOV of 90°, the VFOV of 18°, and the side angle accuracy of ±0.5°, and the speed measuring accuracy of ±0.05 m/s. It has been available to SAIC, JAC, Jiangling Ford and other brands. The chip solution has 3 transmitters and 4 receivers, and the upstream suppliers include Infineon, TI and NXP. Referring to the market price, the BOM cost of the known parts of MRR510 is approximately USD35.827.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...