Market status: vehicle models with smart surfaces boom in 2023

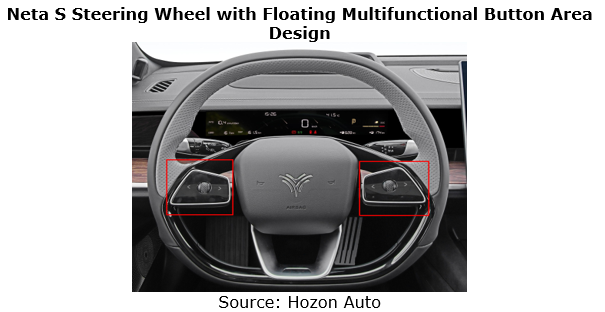

From 2018 to 2023, there were an increasing number of models equipped with smart surfaces, up to 52,000 units in 2022 and 256,000 units from January to September 2023, and main models were Haval H6, Deepal SL03, and Neta S. Among them, Deepal SL03 uses smart surfaces in ambient lighting with translucent leather; Neta S packs multifunctional steering wheel where "scroll wheel + virtual buttons" is used to complete relevant operations.

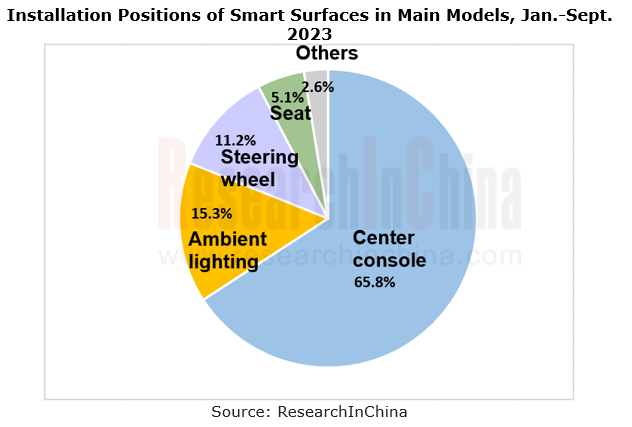

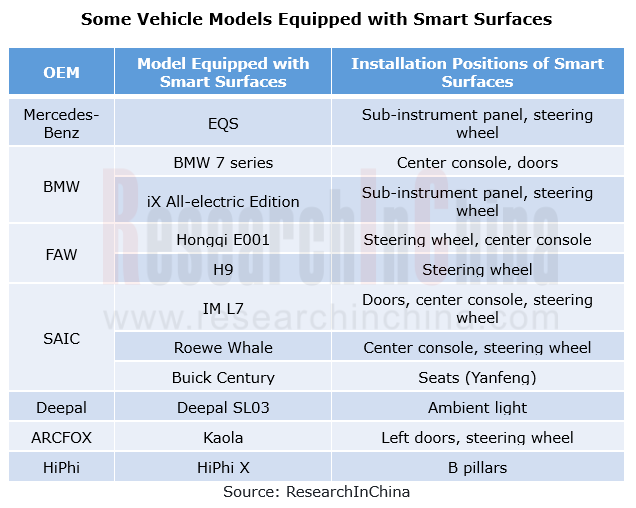

Smart surfaces can be installed on center console, ambient lighting, steering wheel, doors, seats and other parts of a vehicle. From January to September 2023, body parts equipped with smart surfaces were mainly center console, steering wheel and ambient lighting.

Suppliers: Chinese suppliers start late, but have market and cost advantages

On the whole, there is a large technical gap between Chinese smart surface suppliers and their foreign peers. Yet the Chinese market has a low-cost ecological industry chain, helping domestic suppliers to adopt more flexible market schemes.

Foreign suppliers (leading Tier1s, e.g., Continental and Antolin) can directly meet the requirements of OEMs (e.g., BMW), and use their R&D strength to help OEMs with requirement verification.

Foreign suppliers (leading Tier1s, e.g., Continental and Antolin) can directly meet the requirements of OEMs (e.g., BMW), and use their R&D strength to help OEMs with requirement verification.

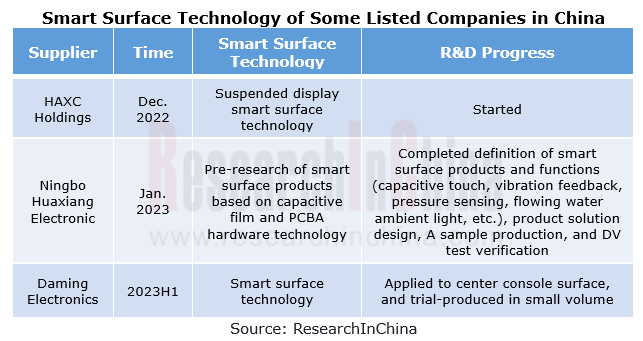

Chinese smart surface suppliers develop slowly. From 2022 to 2023, more listed companies joined the smart surface industry chain.

Chinese smart surface suppliers develop slowly. From 2022 to 2023, more listed companies joined the smart surface industry chain.

As smart surface technology advances in China, Chinese suppliers need to combine software and systems to overall deploy smart surfaces, and rid themselves of a business service model of simply processing or providing hardware.

In July 2023, Marelli introduced the new Miragic, a display for cars that disappears when not in use. Featuring Marelli's innovative Shy-Tech solution, this disappearing display seamlessly integrates in OEMs' cockpit style, blending discreetly with various materials and surfaces. It provides equal or better visibility than conventional displays, enhancing safety by limiting distractions for the driver.

Moreover, Marelli Miragic simplifies parts integration and assembly operations, greatly reducing weight of related body components.

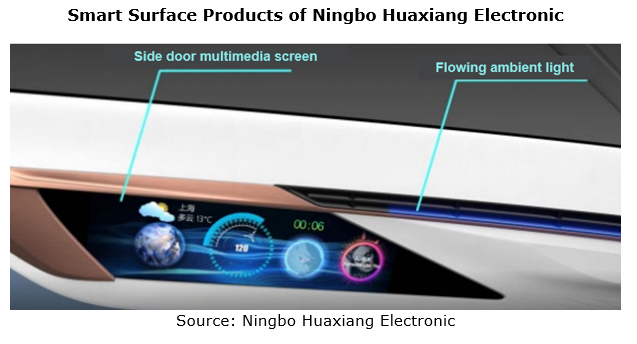

Ningbo Huaxiang Electronic develops new smart surface materials and technologies using multimodal interaction technology, fusing perception data in "vision", "voice" and other modes, and combining them with automotive electronics and optoelectronics technologies. Huaxiang Electronic plans iteration of next-generation smart surface technology based on multimodal interaction, with the ultimate goal of evolving it into an intelligent vehicle assistant.

As of June 2023, Ningbo Huaxiang Electronic's smart surface products are still under development and have yet to be designated. In the first phase of R&D, its smart surface integrates such functions as smart touch, vibration feedback, and pressure sensing for preventing touch by mistake. Ningbo Huaxiang Electronic can design and customize surface materials as required, and enables personalized HMI hardware and software functions by integrating logo and ambient lights among others, and combining hidden touch buttons and translucent surfaces on trim strips, door panels and instrument panel.

OEM: conventional OEMs are more willing to use smart surfaces.

From 2020 to 2023, conventional OEMs showed higher willingness to develop and accept smart surfaces and launched more vehicle models.

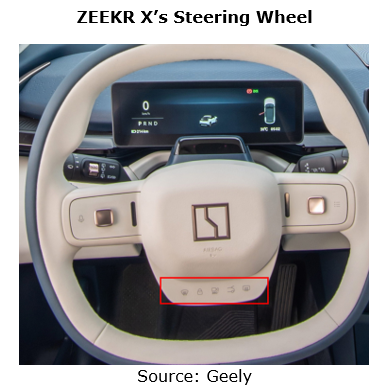

Geely ZEEKR X's steering wheel adopts a "touch buttons + physical buttons" joint operation mode where a touch panel installed under the steering wheel is used to control trunk, front glass heating and other functions.

Launched in April 2023 and scheduled to go on sale in November, Hongqi E001 is equipped with smart surface functions:

Each touch function icon can be illuminated by touch to adjust functions of music, fragrance and air conditioning;

Each touch function icon can be illuminated by touch to adjust functions of music, fragrance and air conditioning;

Smart surface operation buttons work on the capacitance principle. Inductive touch switch can penetrate insulating material shells to detect effective touch of fingers, with high sensitivity;

Smart surface operation buttons work on the capacitance principle. Inductive touch switch can penetrate insulating material shells to detect effective touch of fingers, with high sensitivity;

The pressure sensing and vibration feedback functions allow users to sense without observing, which improves driving safety.

The pressure sensing and vibration feedback functions allow users to sense without observing, which improves driving safety.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...