The market tends to be more concentrated in leading companies in terms of hardware.

The commercial vehicle telematics industry chain covers several key links such as OEMs, operators, terminal device manufacturers, communication service providers, and content service providers, and the market value is mainly distributed among hardware manufacturers and service operators. Wherein, hardware, the basis for realizing telematics, mainly includes T-Box, driving recorder, human-computer interaction terminal, and smart gateway.

T-Box: It is a telematics information exchange center, which can communicate directly with vehicle CAN, collect, transmit and analyze data such as vehicle status and condition, and then upload the data and analysis results to the backend via the mobile communication network. It can also receive the commands issued by the backend and send back execution results, achieving the purpose of reducing vehicle loss, fuel consumption and carbon emission and improving operation efficiency. In the field of commercial vehicles, telematics services with T-Box as the data center are oriented to business, consumer and government users, and empower them in multiple dimensions, helping automakers to supervise and manage vehicles in full life cycle, fleets to cut down cost and improve efficiency, dealers to reduce financial risks, and drivers to enhance vehicle use experience.

Driving recorder: it is a special digital recording device installed on large passenger and goods vehicles to record such data as vehicle speed, time and location, according to "Regulations on Implementation of Road Traffic Safety Law" and "Technical Specifications for Safety of Power-driven Vehicles Operating on Roads" (GB 7258).

IVI: As a vehicle intelligent terminal, center console screen is the core outlet of information and functions related to in-vehicle human-computer interaction, telematics, ADAS, infotainment system, fleet management system, and repair & maintenance. It not only enhances driver's experience, but also is of great significance to reducing fuel consumption and cost and improving vehicle efficiency. From early 7 inches to current mainstream 8 inches and 10 inches, and then gradually to 12 inches, large touch screens have become a design trend of truck center console screen in recent years.

Smart gateway: It is an entry point that allows vehicles to communicate with the outside world. For example, SAIC Maxus’ Smart Gateway 2.0 integrates 5G communication terminals, wireless communication WIFI module, high-precision positioning module, electronic exterior rearview mirror module and V2X module, and can flexibly adapt to various platform projects of commercial vehicles and passenger cars to enable more optimized comprehensive costs of related products and meet more intelligent needs at the same cost.

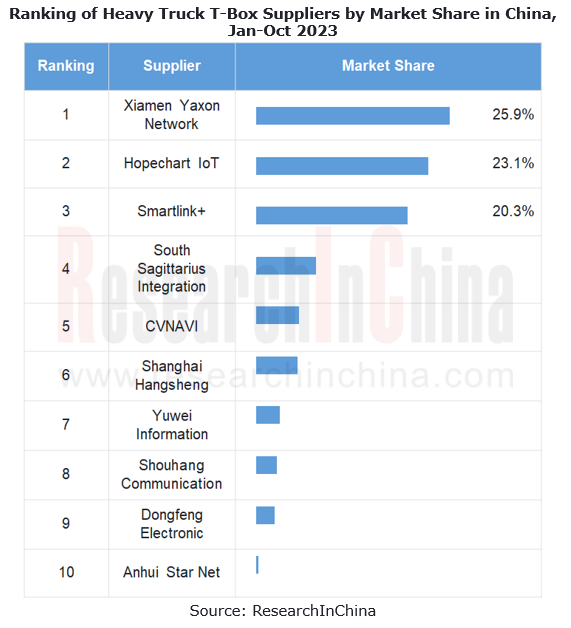

As leading players gain greater technical strength and their supply relationships become stable, the commercial vehicle hardware device market tends to be more concentrated in leading companies. In H1 2023, TOP3 suppliers (Xiamen Yaxon Network, Hopechart IoT and Smartlink+) took a combined 71.4% share in the heavy truck T-Box market. With regard to supply relationships, Xiamen Yaxon Network mainly supported Sinotruk, Foton and JAC.; Hopechart IoT was a supplier of Shaanxi Automobile, Beiben and Foton; Smartlink+, a joint-venture subsidiary of FAW Jiefang, had its T-Box products downwards adapting to T-Box hardware of multiple manufacturers in software and hardware separation mode, and upwards was tightly bond with FAW, with a surging market share.

The market more needs a hardware + algorithm + platform + service integrated business model.

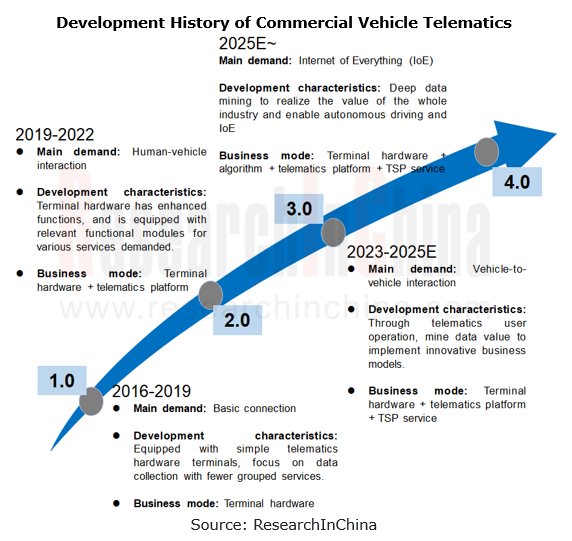

Commercial vehicle telematics has passed through Phase 1.0 (basic connection) and Phase 2.0 (human-vehicle interaction), and is now entering Phase 3.0 (V2V interaction/Internet of everything). As edge computing, cloud storage and other infrastructures develop and the demand for connected services for different scenarios increases, the hardware + algorithm + platform + service integrated business model makes it easier to enable multi-dimensional vehicle data interaction and provides differentiated scenario services for users. It will become a mainstream business model of commercial vehicle telematics in the future.

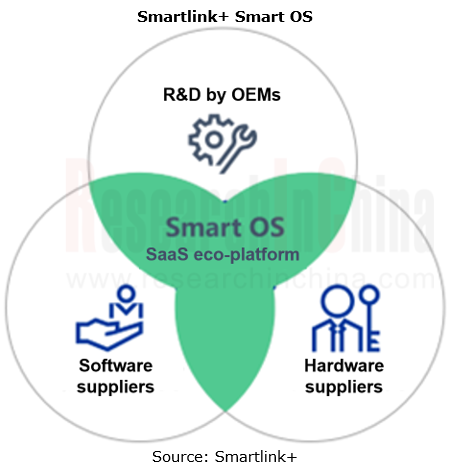

In the process of promoting connected and intelligent upgrade, how to break down the barriers between hardware, data, and service for integration of ecological resources is a big enduring problem faced by OEMs. Wherein, openness of OEM data and responsiveness of supplier services is the key to vehicle intelligence. On this basis, some OEMs try to break down this barrier by way of setting up subsidiaries specializing in telematics. Examples include Smartlink+ set up by FAW Jiefang and iTink set up by Foton Motor.

Smartlink+ is a joint venture subsidiary established by FAW Jiefang in 2020. It provides complete T-Box-centered solutions of hardware, algorithm, platform and service in the field of commercial vehicle telematics, which can help drivers and other consumer users expand value-added services and also assist business users such as OEMs and fleets reducing cost and improving efficiency.

Based on multi-dimensional big data (200+ kinds of vehicle raw data, 500+ kinds of label data pre-processed by intelligent devices, and 300+ kinds of scenario-based model calculation data), Smartlink+ can monitor and analyze different scenario applications of different vehicles. Coupled with financial platform, operation & management platform and fleet management platform, it can provide vehicle full lifecycle management services, digital fleet management services, intelligent vehicle eco-services, and intelligent vehicle control services for automakers, meeting the needs of automakers, dealers, fleets, as well as retail drivers.

iTink Telematics, a wholly-owned subsidiary of Foton, specializes in commercial vehicle telematics business, and has the ability to provide customers with hardware + platform + application + data + operation integrated solutions. Based on product data, telematics data and customer data and combing product characteristics data, it builds big data analysis models. Based on 436 data algorithms, it builds 158 data models and outputs 214 types of intelligent prediction results, which are intelligently pushed to prompt users through mobile phone + Foton e-Home + vehicle screen, and intelligently match tools, accessories and maintenance schemes to enhance service accuracy and efficiency.

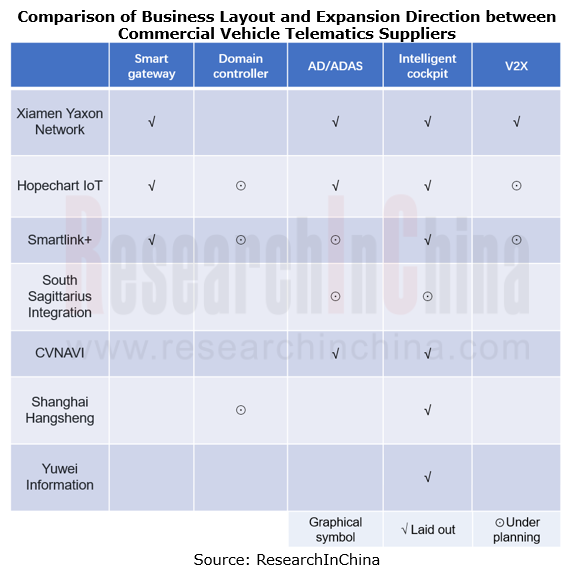

Commercial vehicle telematics suppliers expand business towards AD/ADAS and intelligent cockpit.

In terms of intelligence and connectivity, commercial vehicles are developing along the path of passenger cars. For intelligence, dual warning functions have come into mass production, and L2 functions such as LKA and ACC will be largely seen in vehicles in the next 2-3 years. As for connectivity, as more sensors are used in vehicles, commercial vehicles will generate far more data, and need more vehicle connectivity and analysis technologies for predictive analysis. In addition, as new-generation drivers come into service, cockpit entertainment and interaction intelligence will become new development directions of telematics applications.

Commercial vehicle telematics suppliers head in the following detections in business expansion:

1. Smart gateway and domain controller: Leading OEMs such as FAW Jiefang, Sinotruk, and BAIC Foton are developing domain controller architectures, and connected terminals like T-Box will develop in the direction of domain control and gateway. The body domain controller developed by Xiamen Yaxon Network takes Ethernet as the core and integrates such functions as BCM, PEPS, TPMS and Gateway. It allows for addition of seat adjustment, rearview mirror control, air conditioning control and other functions, and finds application in all kinds of commercial vehicles and passenger cars for intelligent control.

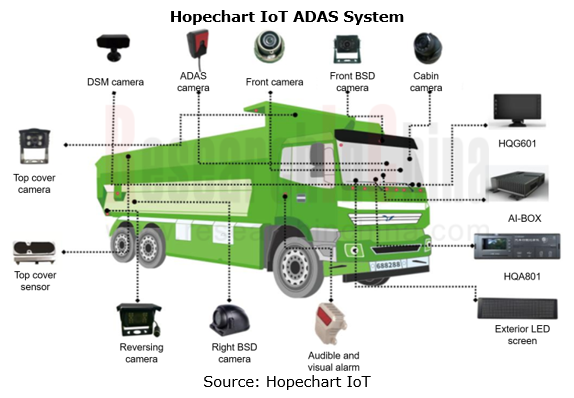

2. AD/ADAS: According to Intelligent Connected Vehicle Technology Roadmap 2.0, intelligent connected freight vehicles will realize conditional driving automation and platooning on highways by 2025, and high driving automation on highways by 2030. AD/ADAS is one of the expansion focuses of suppliers at this stage. Xiamen Yaxon Network, Hopechart IoT, and Smartlink+ among others combine ADAS map data and vehicle sensor data to develop PCC (Predictive Cruise Control), which saves energy through power optimization. According to test and verification by Jiefang Yingtu, the rate of fuel saving per 100km by PCC in commercial vehicles can reach 4%-8%. Moreover, Xiamen Yaxon Network, Hopechart IoT, and CVNAVI are developing BSD, DMS, and dual warning (FCW+LDW) systems to improve driving safety as the top priority. In the next step, suppliers will utilize data analysis and algorithms to improve system accuracy.

3. Intelligent cockpit: In the future, while developing towards intelligent cockpits for passenger cars, commercial vehicle cockpits will add more services for specific scenarios such as logistics and transportation, and cockpit OS developed specifically for commercial vehicle scenarios will become software foundation for cockpit intelligence. The most typical example is Smartlink+, which can link more ecosystems in line with commercial vehicle scenarios and provide users with richer intelligent vehicle ecosystem services, using Smart OS, a cockpit operating system with software-hardware separation architecture.

4. V2X: 5G network offers benefits of high bandwidth, low latency, high reliability, etc. In the field of commercial vehicle telematics, 5G plays a role in the following: ①Connection efficiency improvement; ②V2X application acceleration. For example, Xiamen Yaxon Network's V2X solution covers such scenarios as urban roads, highways, smart buses, autonomous ports, smart mines, and AVP-enabled parking lots.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...