Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024

In-cabin Monitoring study: installation rate increases by 81.3% in first ten months of 2023, what are the driving factors?

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report, 2023-2024 ", mainly combing DMS, OMS-based in-cabin monitoring system market status, in-cabin monitoring solutions of main models, domestic and foreign monitoring system suppliers, industry chain suppliers, etc., and development trend of in-cabin monitoring.

The primary driver of in-cabin monitoring systems is regulations, and major automotive countries such as China, the United States, European Union, South Korea, and India have introduced relevant regulations or technical standards.

One of the most leading one is Driver Drowsiness and Attention Warning systems (DDAWS) issued by the EU, which requires the mandatory implementation of DDAWS requirements for newly certified models in categories M and N with speeds exceeding 70 km/h from July 6, 2022, and the mandatory installation of DDAWS systems on all newly registered models from July 7, 2024.

In China, the 2024 exposure draft of "C-NCAP Management Rules" includes DMS in the project score for the first time, setting three scenario weights for DMS (including fatigue monitoring and attention monitoring), and the project score is 2 points, second only to AEB in the ADAS experimental score.

Overall, from the perspective of policy and regulatory environment, in-cabin monitoring is becoming one of the smart vehicle functional evaluation projects, and the market demand is expected to continue to grow.

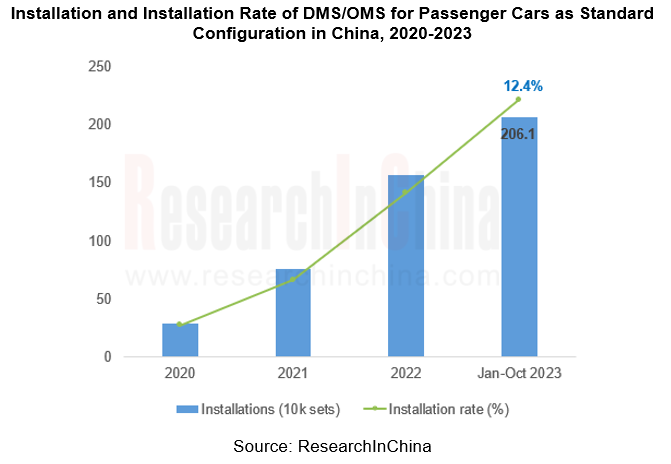

1. From January to October 2023, the installation of passenger car in-cabin monitoring systems in China increased by 81.3% year-on-year.

In recent years, the in-cabin monitoring market has entered the fast lane. From January to October 2023, the installation of China's passenger car cabin monitoring system reached 2.061 million sets, an increase of 81.3% year-on-year; the installation rate reached 12.4%, an increase of 4.5 percentage points over the same period last year.

From the perspective of brand distribution, the brands with a large installation from January to October 2023 include Tesla, Li Auto, Changan, NIO, BYD, etc. The total installation of the TOP10 brands accounts for 72%.

2. ADAS will drive the growth in demand for DMS systems

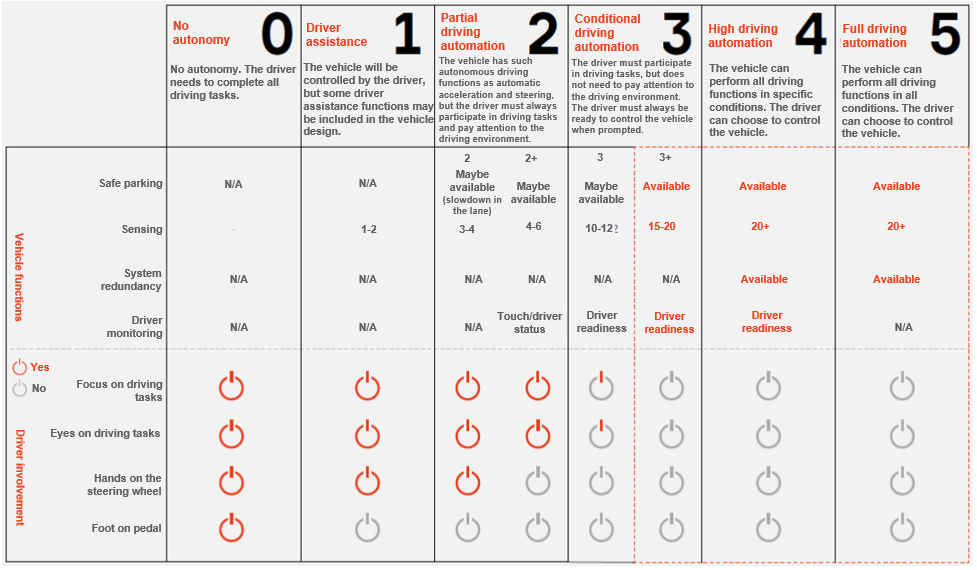

In addition to regulations, the expansion of functions such as intelligent cockpit and high-level driver assistance on board also promotes in-cabin monitoring systems such as DMS and OMS. For example, in autonomous driving systems above L2, human-machine co-driving has become a difficult problem that needs to be solved, and DMS has become an indispensable redundancy solution. In addition, in different scenarios of high-level autonomous driving, the functional requirements and system strategies of in-cabin monitoring are different, and the functions and scenarios need to be defined according to the system requirements of autonomous driving.

Source: Aptiv

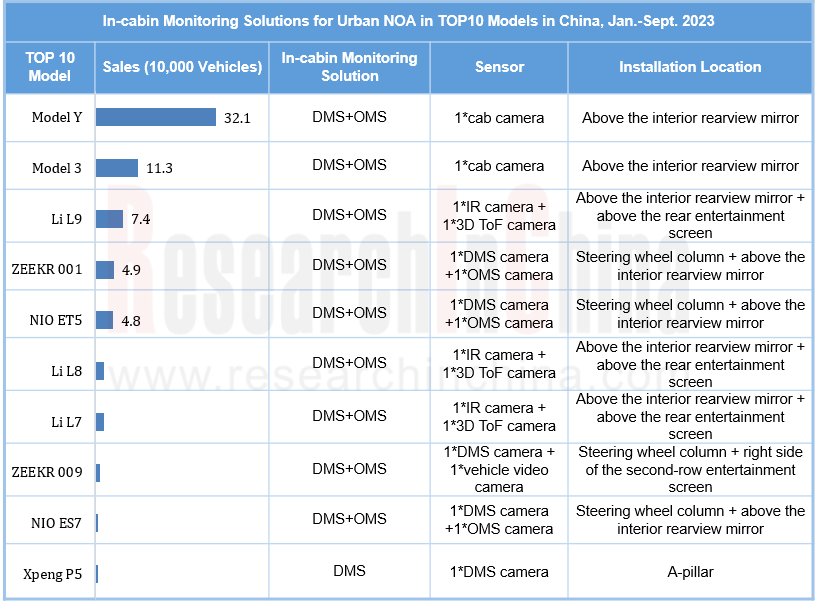

From the perspective of the top 10 models of urban NOA assembly, DMS + OMS has become the mainstream solution for in-cabin monitoring, mostly through 1-2 cameras to achieve all-round monitoring of drivers and occupants, meeting the high-level autonomous driving redundancy while also meeting intelligent requirements of cockpit.

Source: ResearchInChina

Tesla Model Y has a camera in the cab of the car. In October 2023, the version was upgraded to add a "Driver Sleepy Warning" function. This function uses camera to determine whether the driver is paying attention and sounds an alarm. It also allows users to remotely view the in-car camera when the vehicle's Sentinel mode or Pet mode functions are activated.

3. Radar sensors are widely used in OMS

In some scenarios (such as legacy child monitoring), the monitoring range of camera is easily affected by conditions such as installation location and line of sight, making it difficult to achieve accurate monitoring and alerting. And radar sensors (including radar, ultrasonic radar, UWB radar) have ability to penetrate solid matter, which can more accurately detect unattended children, monitor the status of occupants, and estimate the vital signs of drivers. The application in cabin monitoring is expected to expand.

As a new system radar, UWB works in the frequency band of 6-8GHz. The UWB radar has robust and high-precision characteristics, which can penetrate solid materials inside the car, such as metal barriers, car seats and baby blankets. It can also accurately detect very small movements, such as the detection of small fluctuations in the chest when a baby breathes.

Among in-cabin monitoring suppliers, HARMAN upgraded the Ready Care product function in January 2023. After upgrade, the vital signs sensing and legacy child detection functions can be realized through 24 GHz living body radar sensor and 60 GHz occupancy radar sensor.

Among OEMs, GAC Trumpchi E9, which was launched in May 2023, has an OMS equipped with two OMS cameras, a vital signs monitoring radar (located above the inner rearview mirror) and an infrared monitor. Through this radar, the vital signs of drivers and passengers in the car can be detected.

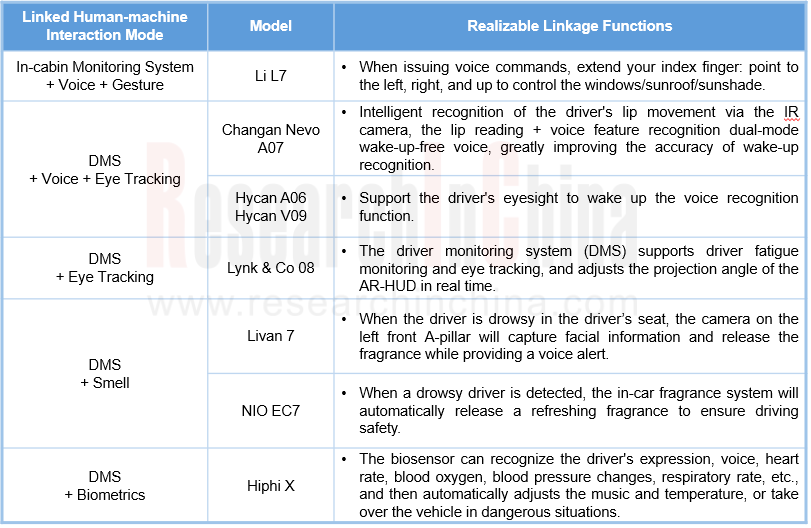

4. Further integration of in-cabin monitoring system and multi-modal interaction

The in-cabin monitoring system, as the key ring of human-vehicle interaction, is being integrated with other multi-modal interactions such as voice/gesture/biometrics/smell in the cockpit.

Jingwei Hirain intelligent cockpit full cabin perception system SCSS has perception, presentation and processing capabilities, including camera modules, microphones, ambient lights, streaming media rearview mirrors, AR-HUD, smart seats, domain controllers and other components, which can deeply integrate ADAS, TBOX, body, HD maps and other information.

In mass-produced models, for example, the in-cabin monitoring system of Li Auto L7 supports interactive linkage with voice + gesture recognition; the DMS system of Changan Qiyuan A07, Lynk & Co 08, Rui Lan 7 and other models supports linkage with voice, eye tracking, and smell.

Application Case of DMS/OMS and Multi-modal Interaction Integration

Source: ResearchInChina

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...