48V Low-voltage Power Distribution Network (PDN) Architecture Industry Report, 2024

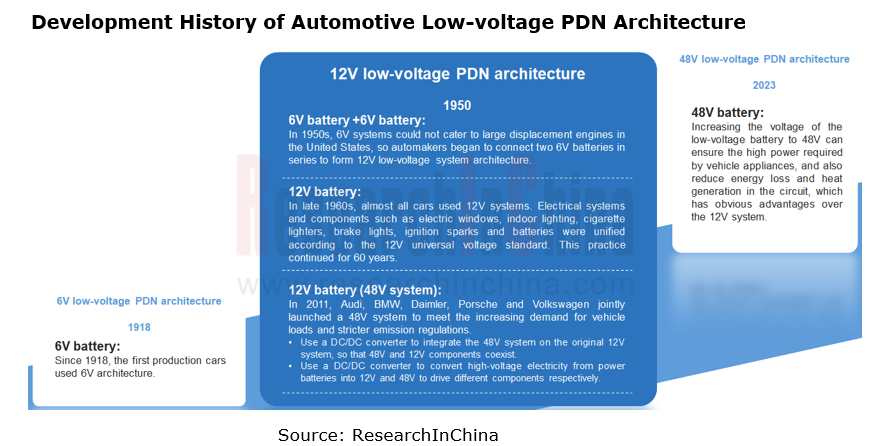

Automotive low-voltage PDN architecture evolves from 12V to 48V system.

Since 1950, the automotive industry has introduced the 12V system to power lighting, entertainment, electronic control units and other low-power electronic devices in automobiles. In 2011, Audi, BMW, Daimler, Porsche and Volkswagen jointly launched a 48V system, and formulated the standard LV148 to meet the increasing demand for vehicle loads and stricter emission regulations.

Use a DC/DC converter to integrate the 48V system on the original 12V system, so that 48V and 12V components coexist.

Use a DC/DC converter to integrate the 48V system on the original 12V system, so that 48V and 12V components coexist.

Use a DC/DC converter to convert high-voltage electricity from power batteries into 12V and 48V to drive different components respectively.

Use a DC/DC converter to convert high-voltage electricity from power batteries into 12V and 48V to drive different components respectively.

In November 2023, Tesla officially delivered Cybertruck. Increasing the voltage of the low-voltage battery to 48V can ensure the high power required by vehicle appliances, and also reduce energy loss and heat generation in the circuit, which has obvious advantages over the 12V system.

Cybertruck is of great significance. Tesla also plans to incorporate the 48V system into Model Y in late 2024. Tesla's strong lead may trigger a revolution of automotive low-voltage PDN architecture.

There are mainly two 48V low-voltage PDN technology development routes:

(1) 12V+48V redundant system

Currently, conventional 48V mild hybrid systems use an electrical topology in which 48V and 12V components coexist. In the future, 48V may act as the third voltage rail of the distribution system of more battery electric vehicles in addition to mild hybrid vehicles. Three rails (HV, 48V and 12V) will coexist on the same vehicle, and some medium-power (1kW-10kW) loads can run in the 48V power supply system.

Also automotive 12V lead-acid batteries are about to withdraw from the market. Europe has issued a decree indicating that all new cars should no longer use lead-acid batteries beyond 2030, which poses a very big challenge to OEMs seeking alternative solutions. At present, 12V lithium batteries have been fully adopted by BYD and Tesla in cars.

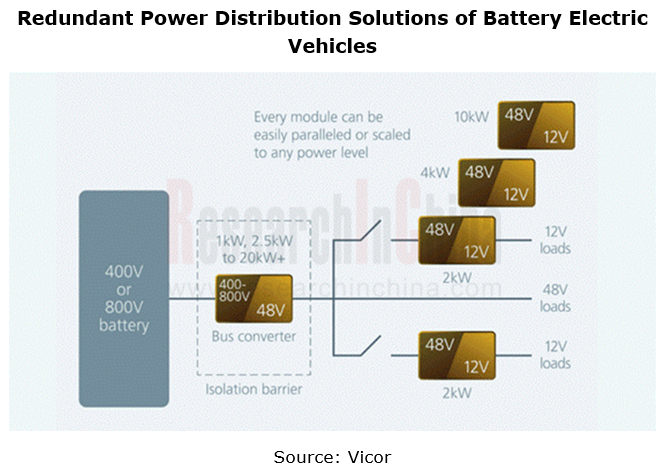

Furthermore, the virtual E/E architecture proposed by Vicor directly eliminates 12V/48V physical batteries, thus reducing the weight and cost of the xEV. The E/E architecture features 12V and 48V battery virtualization based on BCM6135 and NBM2317 modules. The 48V bus also serves as a more efficient source for powering higher loads in a vehicle such as the A/C condenser, water pump and active chassis stabilization systems.

(2) 48V system

In Cybertruck design, Tesla plans to completely discard the 12V power supply and bring all the electrical equipment on the vehicle into the 48V working scope. Tesla will use a zone controller as a 48V hub to then power other controllers. Without the supply chain support, Tesla has redesigned a large number of ECUs by adding power protection device, 48V E-Fuse, high-side switch and so on.

48V systems still face a long-term supply chain deployment cycle, which will bring huge potential demand.

The power that a 12V system can provide is up to 3kW-4kW, so automakers can only integrate a certain number of new electrical devices by constantly reducing the power of electrical equipment.

The wiring harness of 48V PDN architecture can support higher-power electrical appliances. For auto parts have long been developed and designed on the 12V, suppliers have to redesign components, including circuits, chip protection voltages and diagnostics, for the sake of 48V. They also need to set standards for 48V and redo reliability experiments, EMC, etc.

The impacts of 48V on the components supply chain include:

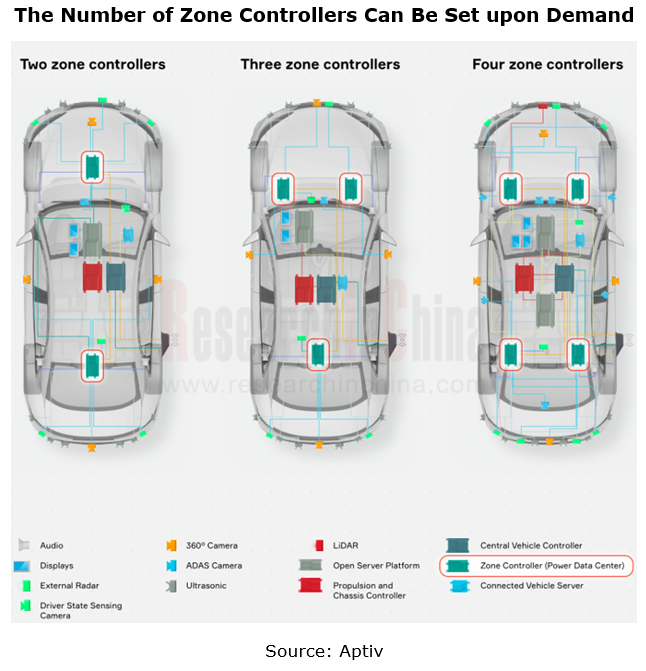

1. Zone controllers coupled with 48V eFuse serve as the vehicle power distribution hub.

Zone controllers simplify the migration to 48V architecture. According to Tesla's design, the vehicle with zone controller architecture only needs a battery as the power supply, which can provide 48V voltage and distribute the power to zone controllers. In the configuration, the zone controllers can provide 48V voltage to the adaptive components, and also reduce the voltage to 12V for other unsuitable components.

In current stage, there are two semiconductor-based eFuse power distribution solutions by application scenarios:

Driver IC-based MOSFET discrete solution: it is suitable for constant current circuits. This solution combines a range of built-in protection functions such as overvoltage, overcurrent, short circuit and thermal protection. The current limit of the overcurrent protection can be set directly via software, which facilitates platform-based hardware application and is applicable to high current situations. The standard threshold of a single smart MOSFET in the automotive industry is 30A. In actual design, >30A high current applications are still mainly fuses + relays.

Intelligent high-side driver (HSD) switch integration solution: it integrates driver + MOSFET + current detection + thermal protection + voltage protection + EMC + diagnostics on a single chip, and is suitable for non-constant current circuits. This solution is still limited to low current load applications (<25A), with low cost and high reliability.

2. Steer-by-wire (SBW), electric power steering (EPS) and rear wheel steering motors are connected to 48V.

Vehicle electrification has increased the number and power of electrical components in vehicles, making the voltage of the automotive power supply prone to fluctuation, thus affecting the control accuracy of steer-by-wire. The design and control of brake-by-wire systems therefore need to be matched with higher-voltage automotive power supplies (e.g., 48V). For autonomous driving at L3 and above, the redundant EPS system has new requirements for 48V steering motors which can provide a quicker response to 48V systems.

According to the Steer-by-wire Technology Roadmap Exposure Draft released in April 2022, the overall goal is to realize the world’s leading steer-by-wire for L3+ and L4+ autonomous driving in 2025 and 2030, with the penetration of steer-by-wire up to 5% and 30%, respectively.

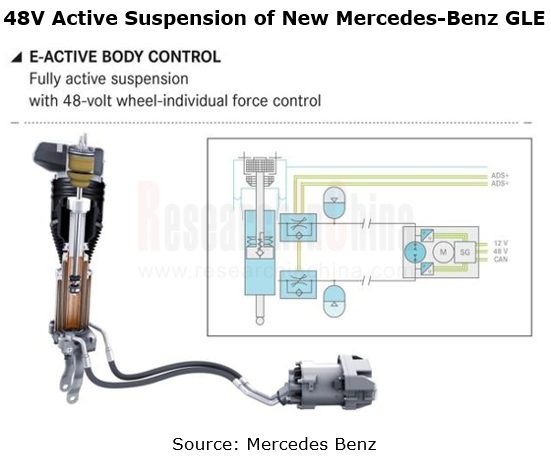

3. Fully active suspension has been mass-produced for 48V hybrid electric vehicles, and will be introduced into battery electric vehicles.

The air suspension often seen in high-performance new energy vehicles is semi-active. The fully active suspension with better performance includes the 48V E-ABC system on Mercedes-Benz GLE, the 48V electromechanical coupling active suspension system on Audi A8, and the "Skyride" fully active suspension on NIO ET9, all of which adopt 48V loads supporting high power.

Mercedes-Benz GLE and Audi A8 boast 48V mild hybrid power systems, which independently control the four-wheel suspension via 48V pressure pumps and ADS+ pressure regulating valves.

ET9, the first model based on NIO’s all-electric platform NT3.0, integrates three core hardware systems (steer-by-wire, rear wheel steering and fully active suspension) for the first time. NIO ET9 supports both 12V and 48V systems, that is, two 12V systems plus a 48V system in the vehicle system. The 48V system is specially designed to support high-power loads, such as fully active suspension (FAS).

4. Redundant topology of 12V/48V power supply

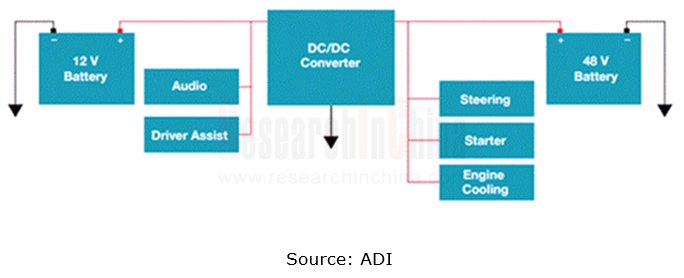

Tesla expects to completely eliminate the 12V power supply and realize intelligent power distribution through zone controllers, which is too radical for most OEMs. The coexistence of 12V and 48V power supply networks and the DC/DC conversion may still be preferred by most OEMs.

12V buses continuously supply power to ignition, lighting, infotainment and audio systems, while 48V buses powers active chassis system, air conditioning compressor, adjustable suspension, electric supercharger, turbocharger and even regenerative brake.

From the perspective of high-level autonomous driving redundancy systems, most conventional vehicles only have a single-circuit main power supply system. When the single-circuit power supply system can’t provide power due to failure, the electrical loads of the vehicles, including autonomous driving systems, can't work normally. For the vehicles that are in the autonomous driving mode, there is a risk of losing control. In this case, 12V and 48V redundant power supply networks come into being.

In addition, the potential impacts of 48V on the components supply chain are reflected in super-high-compute central computing units, low-voltage intelligent power distribution units, low-voltage wiring harness units, 12V/48V lithium batteries and BMS, 48V DC/DC converters, 48V micromotors, 48V braking systems, 48V cooling fans, 48V electronic water/oil pumps and more. In a word, 48V low-voltage PDN architecture will have a fairly profound impact on the automotive industry.

1 Overview of 48V Low-voltage Power Distribution Network (PDN) Architecture

1.1 Advantages and Disadvantages of 48V Low-voltage PDN Architecture

1.1.1 Development History of Automotive Low-voltage PDN Architecture

1.1.2 48V Low-voltage PDN Architecture VS 12V Low-voltage PDN Architecture

1.1.3 Development Necessity of 48V Low-voltage PDN Architecture

1.1.4 What Are the Advantages of 48V System for Electric Vehicles over Conventional 12V System? (1)

1.1.5 What Are the Advantages of 48V System for Electric Vehicles over Conventional 12V System? (2)

1.1.6 What Are the Advantages of 48V System for Electric Vehicles over Conventional 12V System? (3)

1.1.7 48V Low-voltage PDN Architecture Can Reduce Copper Usage and Costs

1.1.8 48V Low-voltage PDN Architecture Can Support Higher-power Appliances

1.1.9 48V Low-voltage PDN Architecture Can Reduce Wiring Harnesses

1.1.10 48V Low-voltage PDN Architecture Can Make xEV Lighter, Which Is of Great Significance to xEV (1)

1.1.11 48V Low-voltage PDN Architecture Can Make xEV Lighter, Which Is of Great Significance to xEV (2)

1.1.12 48V Low-voltage PDN Architecture Can Make xEV Lighter, Which Is of Great Significance to xEV (3)

1.1.13 Difficulties and Obstacles in Popularizing 48V Low-voltage PDN Architecture (1)

1.1.14 Difficulties and Obstacles in Popularizing 48V Low-voltage PDN Architecture (2)

1.2 48V System Design Challenges

1.2.1 48V System Design: Voltage Control

1.2.2 48V System Design: Energy Management Challenges

1.2.3 48V System Design: Arc Discharge & Ground Failure

1.2.4 48V System Design: Dual Voltage System CAN Bus Communication & Electromagnetic Compatibility (EMC)

1.3 Standards and Policies for 48V Low-voltage PDN Architecture

1.3.1 ISO 16750-2: 2023 Road Vehicles - Environmental Conditions and Testing for Electrical and Electronic Equipment - Part 2: Electrical Loads

1.3.2 ISO 21780:2020 Road Vehicles - Supply Voltage of 48V - Electrical Requirements and Tests

1.3.3 GB/T 28046 Road Vehicles - Environmental Conditions and Testing for Electrical and Electronic Equipment

1.3.4 GB 18384-2020 Electric Vehicles Safety Requirements

1.3.5 LV 124 Quality and Reliability Test Standard Established by German Automotive Manufacturers

1.3.6 LV 148 Standards

1.3.7 48V Low-voltage PDN Architecture - Policy Summary

1.4 48V EEA Design of Cybertruck

1.4.1 EEA of Cybertruck

1.4.2 400V/800V High-voltage Battery System of Cybertruck (1)

1.4.3 400V/800V High-voltage Battery System of Cybertruck (2)

1.4.4 Modular Harness Design of Cybertruck

1.4.5 High-voltage Wiring Harness Layout of Cybertruck

1.4.6 Charging Socket Assembly Arrangement of Cybertruck (1)

1.4.7 Charging Socket Assembly Arrangement of Cybertruck (2)

1.4.8 48V Low-voltage Architecture Diagram of Cybertruck

1.4.9 48V Low-voltage Battery System of Cybertruck (1)

1.4.10 48V Low-voltage Battery System of Cybertruck (2)

1.4.11 48V Low-voltage Distribution Unit of Cybertruck (1)

1.4.12 48V Low-voltage Distribution Unit of Cybertruck (2)

1.4.13 48V Low-voltage Distribution Unit of Cybertruck (3)

1.4.14 48V Low-voltage Distribution Unit of Cybertruck (4)

1.4.15 48V Control System of Cybertruck

1.4.16 E-fuse Power Supply Architecture Design of Cybertruck

1.5 Traditional 48V Mild Hybrid Architecture

1.5.1 Classification of Hybrid Power Systems

1.5.2 48V Mild Hybrid System Architecture (1)

1.5.3 48V Mild Hybrid System Architecture (2)

1.5.4 Models (including Imports) Equipped with 48V Mild Hybrid Systems, 2023

1.5.5 Obstacles to the Development of 48V Mild Hybrid System

1.5.6 Valeo - 48V Mild Hybrid System (1)

1.5.7 Valeo - 48V Mild Hybrid System (2)

1.5.8 Bosch - 48V Mild Hybrid System (1)

1.5.9 Bosch - 48V Mild Hybrid System (2)

1.5.10 Continental/Vitesco Technologies - 48V Mild Hybrid System (1)

1.5.11 Continental/Vitesco Technologies - 48V Mild Hybrid System (2)

2 Main Updated Components of 48V Low-voltage PDN Architecture

2.1 Influence of 48V Low-voltage PDN Architecture on Components

2.1.1 It Takes a Long Time for a Car to Evolve from 12V to 48V

2.1.2 48V Low-voltage PDN Architecture Brings New Parts Opportunities

2.1.3 Parts Upgrades of 48V Low-voltage PDN Architecture

2.1.4 Power Equipment Supported by 48V System

2.1.5 High Power Load of 48V System

2.2 Power Architecture: Redesigned ECU

2.2.1 Tesla Designs the Transformer Module in ECU to Adapt to 48V Low-voltage Architecture

2.2.2 Tesla Plans to Redesign All ECUs and Completely Cancel 12V Power Supply

2.2.3 Zone Controller with 48V E-fuse (1)

2.2.4 Zone Controller with 48V E-fuse (2)

2.2.5 Zone Controller with 48V E-fuse (3)

2.2.6 Zone Controller Is the Key to Import 48V Architecture

2.2.7 Power Supply System of Main Automotive Controller Hardware (1)

2.2.8 Power Supply System of Main Automotive Controller Hardware (2)

2.2.9 Power Supply System of Main Automotive Controller Hardware (3)

2.2.10 Power Supply System of Main Automotive Controller Hardware (4)

2.2.11 Power Supply System of Main Automotive Controller Hardware (5)

2.2.12 Power Supply System of Main Automotive Controller Hardware (6)

2.3 Power Architecture: Brand-new Low-voltage PDN, Intelligent Distribution Box

2.3.1 Power Architecture Upgrade: Intelligent Power Distribution by Vehicle Partition

2.3.2 Power Architecture Upgrade: Reducing Wiring Harnesses Is One of the Main Purposes

2.3.3 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (1)

2.3.4 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (2)

2.3.5 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (3)

2.3.6 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (4)

2.3.7 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (5)

2.3.8 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (6)

2.3.9 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (7)

2.3.10 Trend from Fuse Boxes to Intelligent Power Distribution Boxes (8)

2.3.11 Typical Tier 1 Suppliers of Intelligent Power Distribution Boxes (Passenger Cars)

2.3.12 Domestic Passenger Car Intelligent Distribution Box OEM Market Size, 2025E-2030E.

2.3.13 Typical Tier 1 Suppliers of Intelligent Power Distribution Boxes (Commercial Vehicles)

2.3.14 Power Distribution Boxes for Commercial Vehicles (1)

2.3.15 Power Distribution Boxes for Commercial Vehicles (2)

2.3.16 Power Distribution Boxes for Commercial Vehicles (3)

2.3.17 Power Distribution Boxes for Commercial Vehicles (4)

2.3.18 Power Distribution Boxes for Commercial Vehicles (5)

2.4 Power Architecture: High-Level Power Distribution Hub, Zone Controller

2.4.1 Power Supply Topology Becomes More and More Complex amid the Trend of EEA Upgrading

2.4.2 Zone Controller: Key Hub for Migration to 48V Electrical Architecture (1)

2.4.3 Zone Controller: Key Hub for Migration to 48V Electrical Architecture (2)

2.4.4 Zone Controllers Simplify the Transition to 48V Electrical System Architectures

2.4.5 The Next-generation EEA: Centralized Computing + Zone Controllers

2.4.6 Zonal EEA Framework

2.4.7 Zone Controllers Are the Integration Point of Multiple ECUs

2.4.8 Design Solution of ZCU

2.4.9 Case: Intelligent Power Distribution Application of UAES’ Zone Controllers

2.5 Power Architecture: Intelligent Fuse (eFuse)

2.5.1 Zone Controller Equipped with eFuse

2.5.2 eFuse Provides a Semiconductor Solution for Circuit Protection as an Integrated Circuit

2.5.3 eFuse Has Built-in Protection Function to Handle Circuit Faults

2.5.4 Advantages of eFuse over Traditional Fuse

2.5.5 PDN for Centralized EEA (1)

2.5.6 PDN for Centralized EEA (2)

2.5.7 48V Upgrading Accelerates the Application of eFuse

2.5.8 Tesla Has Replaced Low-voltage Relay+Fuse with eFuse

2.5.9 eFuse Usage Per Electric Vehicle

2.5.10 Two Power Distribution Solutions Based on eFuse Semiconductor Devices

2.5.11 HSD Chips for Low Current Load Control

2.5.12 Power Distribution Chip Solution of Model 3

2.5.13 Intelligent Power Distribution Design of ZEEKR (1)

2.5.14 Intelligent Power Distribution Design of ZEEKR (2)

2.6 Power Architecture: 48V/12V Redundant Power Supply Network and DC/DC

2.6.1 48V/12V Redundant Power Supply Network

2.6.2 Bidirectional DC/DC Solution for 48V/12V Battery System

2.6.3 Infineon: 48V Can Be Used as the Third Voltage Rail of the Vehicle

2.6.4 Vicor’s 48V Distributed Architecture Design (1)

2.6.5 Vicor’s 48V Distributed Architecture Design (2)

2.6.6 Vicor’s 48V Distributed Architecture Design (3)

2.6.7 Vicor’s 48V Distributed Architecture Design (4)

2.6.8 Dual Power Supply System for High-level Autonomous Driving (1)

2.6.9 Dual Power Supply System for High-level Autonomous Driving (2)

2.6.10 Dual Power Supply System for High-level Autonomous Driving (3)

2.6.11 Dual Power Supply System for High-level Autonomous Driving (4)

2.6.12 48V Automotive-grade DC/DC Converter Chip

2.6.13 48V Automotive-grade DC/DC Converter: Overall Power Requirements

2.6.14 48V Automotive-grade DC/DC Converter: Typical Products

2.6.15 48V Automotive-grade DC/DC Converter: Installation Methods

2.6.16 Bosch's 48V DC/DC Converter

2.7 Energy Storage System: 48V/12V Lithium Battery and BMS

2.7.1 Low-voltage Lithium Battery for New Energy Vehicle

2.7.2 Low-voltage Lithium Battery: Tesla’s 12V Lithium Battery

2.7.3 Low-voltage Lithium Battery: 12V Lithium Battery for BYD’s Hybrid Vehicle

2.7.4 Application of 48V Lithium Battery in Mild Hybrid System

2.7.5 Cybertruck Introduces 48V Lithium Battery

2.7.6 Bosch's Second-generation 48V Battery

277 EVE's Third-generation 48V Lithium Battery

2.7.8 12V/24V/48V Lithium Battery of Camel Group

2.7.9 Low-voltage Lithium Battery: Business and Product Progress of Core Suppliers

2.7.10 48V BMS (1)

2.7.11 48V BMS (2)

2.7.12 48V BMS (3)

2.7.13 48V Lithium Battery Management System of Jingwei Hirain

2.7.14 12V Lithium Battery Management System of Jingwei Hirain

2.7.15 Innoscience - GaN BMS Controller

2.7.16 48V BMS Suppliers

2.7.17 Content-per-car Value of 48V BMS

2.7.18 New EEA of Virtual 48/12V Lithium Battery: Disadvantages of Traditional Physical Battery

2.7.19 New EEA of Virtual 48/12V Lithium Battery: Virtual Battery Replaces 12V Battery

2.7.20 New EEA of Virtual 48/12V Lithium Battery: Virtual Battery Replaces 48V Battery

2.8 Electric Motor Control System: 48V Micromotor

2.8.1 Which Motors Will Switch to 48V?

2.8.2 Automotive Micromotor: Classification

2.8.3 Automotive Micromotor: Composition of Industry Chain

2.8.4 Automotive Micromotor: Market Size

2.8.5 Automotive Micromotor: Electrification and Intelligence Promote the Increase of Micromotor Scenarios

2.8.6 Automotive Micromotor: Application

2.8.7 Automotive Micromotor: Competitive Landscape

2.8.8 Automotive Micromotor: Seat Motor

2.8.9 Automotive Micromotor: Market Size and Development Trend of Seat Motor

2.8.10 Automotive Micromotor: Seat Motor Competitive Landscape

2.8.11 Automotive Micromotor: Development Advantages of 48V Seat Motor

2.9 Steering System: 48V Steering Motor

2.9.1 High-power Steering System Needs 48V System

2.9.2 Automotive Steering System - Introduction and Classification

2.9.3 EPS

2.9.4 Components of EPS

2.9.5 EPS - Industry Chain

2.9.6 Redundant EPS Technical Solution (1)

2.9.7 Redundant EPS Technical Solution (2)

2.9.8 Actuator Redundancy - Steering

2.9.9 EPS Develops toward Steer-by-wire

2.9.10 SBW Redundant Design

2.9.11 SBW

2.9.12 SBW - Major Suppliers and Status Quo of Products

2.9.13 Development Trends of Passenger Car Intelligent Steering

2.9.14 Roadmap of Passenger Car Intelligent Steering System

2.9. 15 Requirements of SBW for L2~L4+ Autonomous Driving System

2.9.16 48V Steering System - Steering Motor Case

2.9.17 48V Steering Motor Suppliers

2.10 Brake-by-wire System: 48V EMB

2.10.1 Brake-by-wire System Has Strong Demand for 48V.

2.10.2 Classification of Brake-by-wire System

2.10.3 Electro-Hydraulic Brake (EHB)

2.10.4 Electro-Mechanical Brake (EMB)

2.10.5 Components of Brembo EMB System

2.10.6 Brake-by-wire Redundant Design for L3 and Higher-level Autonomous Driving

2.10.7 Braking System of Autonomous Driving = IBC + ESC + EPB

2.11 Suspension System: 48V Fully Active Suspension

2.11.1 Classification of Suspension System

2.11.2 Mercedes-Benz’s 48V E-Active Body Control (E-ABC) (1)

2.11.3 Mercedes-Benz’s 48V E-Active Body Control (E-ABC) (2)

2.11.4 Audi’s 48V Electromechanical Coupled Active Suspension System

2.11.5 NIO’s Intelligent Chassis-by-wire - Skyride

2.11.6 NIO ET9’s Skyride Fully Active Suspension

2.11.7 Lamborghini’s 48V Active Wheel Frame System

2.12 Thermal Management System: 48V Cooling Fan

2.12.1 New Energy Vehicle Cooling Fan - Classification

2.12.2 New Energy Vehicle Cooling Fan - Structure and Parameters

2.12.3 New Energy Vehicle 48V Cooling Fan - Business and Product Progress of Suppliers (1)

2.12.4 New Energy Vehicle 48V Cooling Fan - Business and Product Progress of Suppliers (2)

2.13 Thermal Management System: 48V Electronic Water Pump/Oil Pump

2.13.1 New Energy Vehicle Electronic Pump

2.13.2 New Energy Vehicle Electronic Water Pump - Classification

2.13.3 New Energy Vehicle Electronic Water Pump - Structural Design

2.13.4 New Energy Vehicle Electronic Water Pump - Technical Parameters

2.13.5 48V Electronic Water Pump/Oil Pump: Business and Product Progress of Core Suppliers (1)

2.13.6 48V Electronic Water Pump/Oil Pump: Business and Product Progress of Core Suppliers (2)

3 48V Passenger Car Market

3.1 Status Quo of Domestic Passenger Car Market

3.1.1 Changes in Market Share of Domestic Passenger Cars by Country

3.1.2 Domestic Passenger Car Sales and Forecast (By Fuel and Voltage)

3.1.3 Domestic Passenger Car Sales and Forecast (By Fuel and Voltage) (Attachment)

3.2 Market Prospect of 48V Low-voltage PDN Architecture

3.2.1 Forecast for Sales of Passenger Cars with 48V Low-voltage PDN Architecture

4 48V Low-voltage PDN Architecture Planning of OEMs

4.1 Tesla

4.1.1 Comprehensive Shift to 48V Low-voltage PDN Architecture

4.1.2 48V Low-voltage PDN Architecture Development Planning

4.1.3 48V Low-voltage PDN Architecture: Technical Analysis (1)

4.1.4 48V Low-voltage PDN Architecture: Technical Analysis (2)

4.1.5 48V PDN Architecture

4.1.6 48V Low-voltage PDN Architecture: Sharing Strategy

4.2 NIO

4.2.1 Evolution of EEA (1)

4.2.2 Evolution of EEA (2)

4.2.3 NT2.0 Platform

4.2.4 NT3.0 Platform: Next-generation Vehicle Digital Architecture Planning

4.2.5 NT3.0 Platform: ET9 48V Low-voltage PDN Architecture

4.2.6 NT3.0 Platform: ET9 48V Fully Active Suspension

4.3 Li Auto

4.3.1 CCU of LEEA 3.0

4.3.2 ZCU Power Distribution Design of LEEA 3.0

4.4 BYD

4.4.1 Development Trends of Modular Platform

4.4.2 Seal's Low-voltage PDN

4.4.3 DENZA’s D9 48V Low-voltage Motor

4.4.4 48V Battery

4.4.5 12V Lithium Battery

4.5 ZEEKR

4.5.1 Intelligent Power Distribution Design of ZEEA 3.0 (1)

4.5.2 Intelligent Power Distribution Design of ZEEA 3.0 (2)

4.6 Mercedes-Benz

4.6.1 EEA of STAR 3

4.6.2 Dual Power Supply System Design of STAR 3

4.7 GM

4.7.1 48V Mild Hybrid System

4.8 BMW

4.8.1 48V Mild Hybrid System

4.9 Volvo

4.9.1 EEA of SPA 2

4.9.2 Network Architecture of SPA 2

4.9.3 48V Mild Hybrid System (Battery)

4.9.4 48V Mild Hybrid System

4.10 48V Low-voltage PDN Architecture Summary of Major Automakers

4.10.1 Brand-new EEA and 48V PDN Deployment of OEMs (1)

4.10.1 Brand-new EEA and 48V PDN Deployment of OEMs (2)

4.10.1 Brand-new EEA and 48V PDN Deployment of OEMs (3)

5 Potential Parts Suppliers of 48V Low-voltage PDN Architecture

5.1 Bosch

5.1.1 48V Steering Motor (1)

5.1.2 48V Steering Motor (2)

5.1.3 48V Battery

5.1.4 48V DC/DC Converter

5.1.5 48V DC/DC Converter: Technical Features

5.2 Onsemi

5.2.1 48V System

5.2.2 48V APM Solution

5.2.3 48V Low DC/DC Converter

5.2.4 48V Starter/Generator All-in-one

5.2.5 Electric Vehicle Assistance System

5.2.6 High-side SmartFET Drivers

5.2.7 NCV78343 Series LED String Pixel Controller for Automotive (Front) Lighting

5.2.8 48V Low-voltage PDN Architecture Application Solution in Engineering Vehicle Market

5.2.9 Efforts Are Being Made to Increase the Voltage of Power Electronic Devices

5.3 AVL

5.3.1 48V Mild Hybrid System

5.3.2 48V P4 E-motor

5.3.3 BMS

5.3.4 Electric Drivetrain

5.4 Vicor

5.4.1 Power Supply Network for Charging, Conversion and Distribution

5.4.2 Brand-new 48V Power Supply Network (Virtual 48V Power Supply)

5.4.3 Virtual 48V Power Supply by BCM6135 Module

5.4.4 Technical Logic of BCM Bus Converter (1)

5.4.5 Technical Logic of BCM Bus Converter (2)

5.5 HMC

5.5.1 Profile

5.5.2 Micromotor Business

5.5.3 Micromotor

5.5.4 Micromotor-related

5.5.5 Standard Platform-based Development of Micromotor

5.6 Wanxiang A123 Systems

5.6.1 Super Nano LiFePO4

5.6.2 48V Battery

5.6.3 48V Battery Products

5.6.4 48V Battery Parameters

5.6.5 48V Battery Development

5.7 Camel Group

5.7.1 Low-voltage Lithium Battery Solution

5.7.2 Application Scenarios of Low-voltage Lithium Battery

5.7.3 Low-voltage Lithium Battery Products

5.7.4 48V Lithium Battery Supply

5.8 Hunan Oil Pump

5.8.1 Profile

5.8. 2 Dongxingchang Technology - 48V Steering Motor

5.8.3 Dongxingchang Technology - 48V Servo Hub Motor

5.8.4 Hunan Oil Pump - Development Trend of 48V Low-voltage Motor

5.9 Kunshan Huguang Auto Electric

5.9.1 Profile

5.9.2 Main Products

5.9.3 Low-voltage Wiring Harness Supply

5.9.4 Aluminum Conductor

5.10 Johnson Electric

5.10.1 Automotive Micromotor Business

5.10.2 Automotive Micromotor Business

5.10.3 Electric Closing Drive System

5.10.4 Drivetrain System

5.10.5 Electric Closing Drive System

5.10.6 Tactile feedback

5.10.7 HMI

5.10.8 Intelligent Cockpit

5.10.9 Steering and Chassis

5.10.10 Steering Motor Platform

5.10.11 High-power EPS Motor

5.10.12 Automotive Electronic Stability Control (Esc) Motor

5.10.13 Thermal Management System

5.10.14 Lighting System

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...