With policy support, the localization rate of automotive MCU will surge.

Chinese electric vehicle companies are quickening their pace of purchasing domestic chips to reduce their dependence on imported ones and expedite the development of China's semiconductor industry system. According to unofficial goals, the overall penetration rate of homegrown automotive chips will be increased to over 20% in 2025, and state-owned and private automakers are encouraged to buy homemade chips as priority. Amid the long mass production cycle of automotive MCUs and the extremely low localization rate for a long time, the policy support will help local automotive MCUs boom.??

In January 2024, the Ministry of Industry and Information Technology released the Guidelines for the Construction of the National Automotive Chip Standard System, suggesting that: in 2025, more than 30 key automotive chip standards should be formulated to clarify the basic requirements concerning environment and reliability, electromagnetic compatibility, functional safety, information security and more, and the technical specifications for key products and applications including control, computing, storage, power and communication chips should be formulated to meet the basic needs for safe and reliable application and pilot demonstration of automotive chip products; in 2030, more than 70 automotive chip standards should be formulated. Favorable policies facilitate the development of Chinese automotive MCU vendors.?

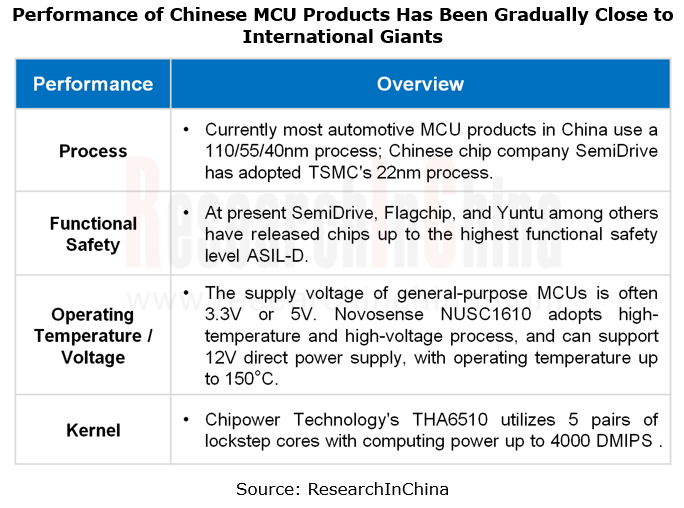

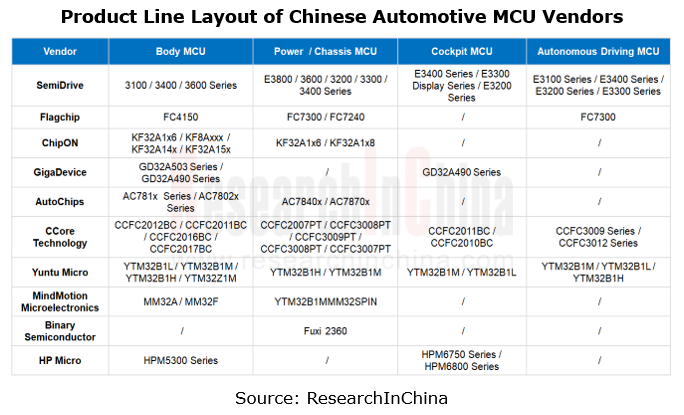

International giants gain first-mover advantages in automotive MCUs. Chinese vendors started with body control with relatively low safety requirements, and some leading companies also work to make layout in power/chassis, cockpit, and autonomous driving fields. Chinese vendors gradually improve their automotive MCU product line layout and narrow the gap with international tycoons in product performance.?

1. Chinese automotive MCU vendors have made an all-round layout of low-, mid- and high-end products.

High-end automotive MCUs have always been monopolized by international giants. For example, Infineon has a monopoly in the autonomous driving field; NXP and Renesas prevail in the gateway and power/chassis fields.???

In recent years, Chinese vendors have been vigorously laying out high-end automotive MCU products, and some of them such as SemiDrive, AutoChips have already made a foray into the high-end market.

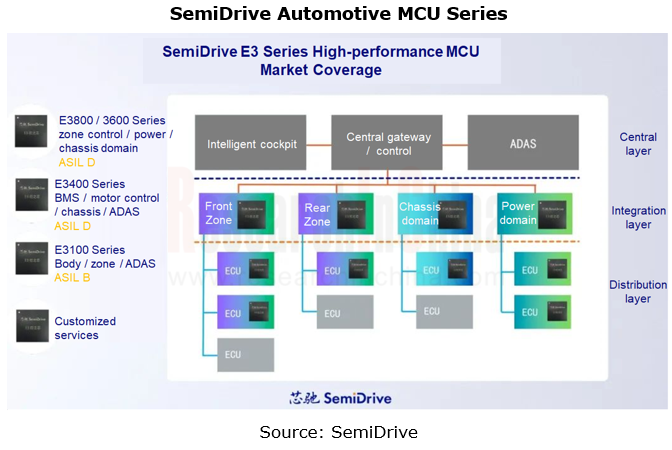

SemiDrive: it launched the E3 series of automotive MCUs for domain control, body, chassis, power, ADAS, battery management system (BMS) and other applications in 2022, and has shipped more than a million pieces. Suspension controllers (CDC) mounted on models like Chery Tiggo 9 and EXEED Stellar are powered by SemiDrive E3 series products.????

In March 2024, SemiDrive further improved the E3 series and released E3119F8/E3118F4, targeting such application fields as body domain control, zone controllers, front-view all-in-one, and LiDAR. The new product uses ARM Cortex R5F CPU, and packs at most two independent 400MHz high-performance application kernels, with the main frequency of the information security kernel up to 200MHz. In terms of tool chain, SemiDrive supports IAR and Greenhills, adapts to the mainstream ARM debugger, and provides SDK/MCAL basic software support. Currently, SemiDrive is partnering with multiple Chinese and foreign AutoSAR vendors and working on BSW adaptation.?????

In current stage, SemiDrive's products have covered high-end fields of zone control, chassis and intelligent driving.??

AutoChips: In October 2023, it introduced AC7870x, its first multi-kernel high-frequency MCU that meets the ASIL-D functional safety level and is based on Arm Cortex R52 kernel. AC7870x is primarily applied in the fields of power chassis, “three electrics” for new energy vehicles, and zone controllers under new EEA. The company thus officially entered the high-end automotive MCU field.???????

2. Build an independent domestic chip supply chain.

From 2021 to 2022, automotive MCUs were difficult to buy, with soaring prices, which made Chinese automakers realize the importance of an independent supply chain system and also gave scope to China’s local automotive MCUs.???

Chinese MCU vendors are trying hard to build a local supply chain:

Yuntu Micro: More than half of upstream partners are domestic. The company has achieved full localization in multiple links from upstream wafer fabs to packaging and testing. The localized supply chain makes products more cost-effective.??

OmniVision: OMX14xN in the OMX14x series is an automotive MCU with a fully localized supply chain from fab to packaging and testing.

AutoChips: AC7802x, an automotive MCU mass-produced in August 2023, is a fully localized chip.?

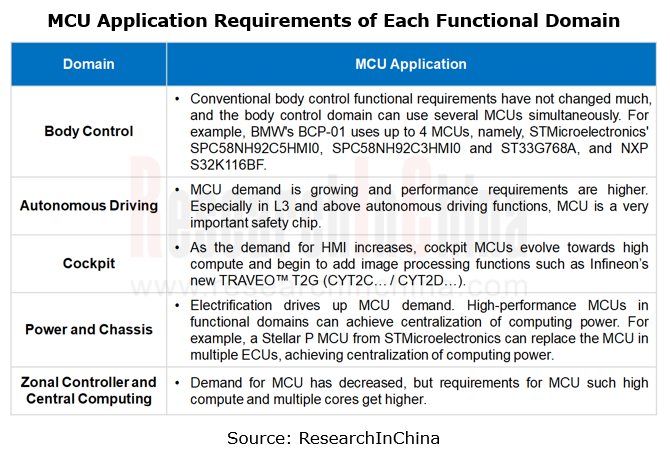

Application of automotive MCU in functional domains

Conventional automobiles need about 40-50 MCUs. As EEA gets upgraded, the MCU requirements of autonomous driving, cockpit, body & zone control, power, chassis, central computing and so on have also changed. MCU products head in the direction of high performance.??

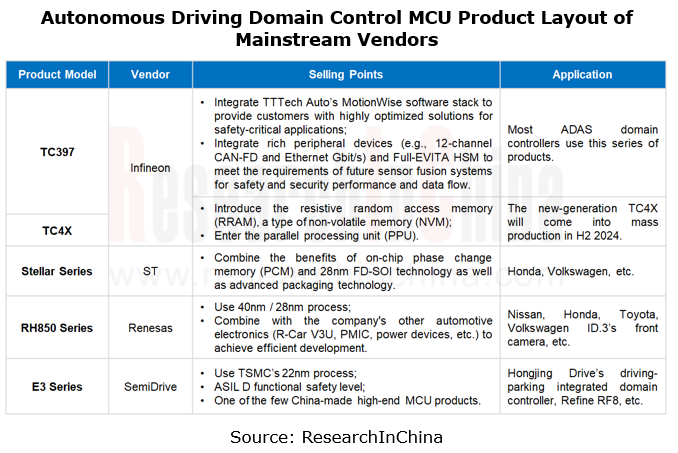

For autonomous driving domain control, mainstream MCU products include Infineon TC297X/397X Series and the latest TC4X Series, ST Stellar Series, Renesas RH850 Series, TI Hercules, and SemiDrive E3 Series.??

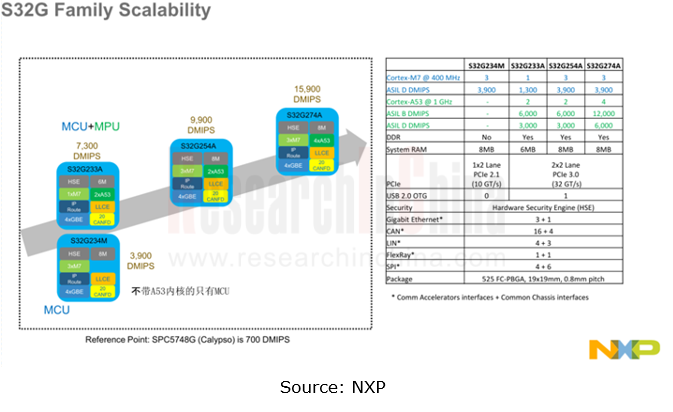

Central supercomputing platforms have higher requirements on chips' functional safety. For example, Leapmotor's Four Leaf Clover central supercomputing platform adopts NXP S32G. Wherein, the Standard Configuration version adopts Qualcomm 8155 (3rd Generation Snapdragon Cockpit Platform) + NXP S32G (3 cores); the Medium Configuration version adopts Qualcomm 8295 (4th Generation Snapdragon Cockpit Platform) + NXP S32G (7 cores).???

NXP S32G Family utilizes three 400MHz Arm Cortex-M7 cores, and provides support for different products according to cost requirements and application scenarios.??

?

?

MCU core design trends include GPU, new storages, built-in HSM security components, etc.

Conventional MCU products mainly integrate eight components such as CPU, memory, I/O port, serial port, timer, interrupt system and special function register. The development of domain control architecture brings new demand for high-performance and high-security MCUs.

Furthermore with the increasingly high MCU performance, the difference between MCU and MPU becomes ever smaller. From some moves of international giants in current stage, it can be seen that crossover MCU or crossover MPU is a layout direction they head in. Putting some hardware only available in MPU into MCU not only realizes low power consumption, low cost and simplicity of MCU, but also enables applications that were enabled only by MPU in the past.?????

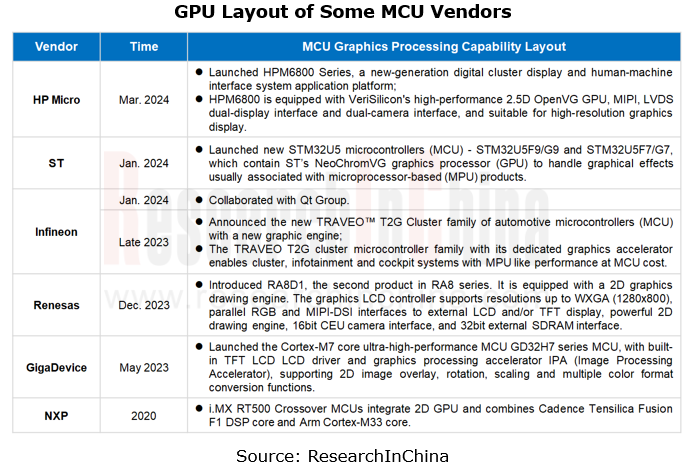

MCU’s graphics processing capabilities are being enhanced.

As vehicles pose ever higher requirements for image definition, zoomable maps, video play, etc., MCU vendors have begun to compete in graphics processing in recent year. International tycoons like ST, Infineon, Renesas and NXP have launched MCU products with GPU integrated. Chinese vendors such as GigaDevice and HPMicro have also been working to make layout.???

?

?

For example, the new TRAVEO? T2G Cluster family of automotive microcontrollers (MCU) with a new graphics engine enables cluster, infotainment and cockpit systems with MPU like performance at MCU cost.??

In terms of memory, the graphics engine within the MCUs minimizes the memory required for graphics processing by a factor of 3 to 5, resulting in lower power consumption and lower costs.

The requirements for MCU security are higher.

MCU is an important node in vehicle networks and interacts with other ECUs (electronic control unit) via communication protocols such as CAN (controller area network) bus or Ethernet. These communication protocols, if not encrypted or authenticated, will easily intercepted and tampered by attackers, leading to malicious vehicle control or other safety incidents.

MCU thus plays a critical role in automotive cybersecurity. To cope with increasingly severe cybersecurity threats, effective measures need to be taken to strengthen automotive cybersecurity. Major automotive MCU vendors are also vigorously deploying high-security MCU products.?

SemiDrive: SemiDrive E3 series meets the AEC-Q100 Grade 1 reliability certification. It is China’s first MCU to pass German TUV ASIL D/SIL 3 functional safety level certification and China’s national cryptographic product Level 2 certification, and has passed the TUV ASPICE CL2 evaluation. It is known that the new automotive MCU products E3119F8 and E3118F4 unveiled in March 2024 integrate hardware security modules (HSM), comply with the Full EVITA information security level, and cooperate with the industry's leading information security solution providers, and support ISO 21434-compliant information security firmware. This sub-series can support ISO 26262 ASIL-B functional safety level. SemiDrive will provide functional safety software library, FMEDA and various functional safety documents, and complete the ASIL-B level product functional safety certification.????

Renesas: The RH850 series MCUs have a built-in intelligent cryptography unit (ICU), which stores the secret key in a separate storage area that cannot be directly accessed by the CPU. A dedicated mechanism is required to enhance the actual anti-tampering function and support high-end encryption operations such as RSA and ECC. They can provide security services such as software operation prevention, hardware and software connection, secure boot, and verification of ECUs in network nodes.

Automotive Microcontroller Unit (MCU) Industry Report, 2024 released by ResearchInChina highlights the following:

Automotive MCU market (status quo, size, pattern, supply and demand, etc.;)

Automotive MCU market (status quo, size, pattern, supply and demand, etc.;)

Application, localization and main product cases of automotive MCU in different application fields (body control, autonomous driving, intelligent cockpit, power chassis, central computing domain control, etc.);

Application, localization and main product cases of automotive MCU in different application fields (body control, autonomous driving, intelligent cockpit, power chassis, central computing domain control, etc.);

Key points in automotive MCU industry development (process, core technology, storage technology, image processing function, functional safety, etc.);

Key points in automotive MCU industry development (process, core technology, storage technology, image processing function, functional safety, etc.);

Chinese and foreign automotive MCU vendors (product layout, new product R&D dynamics, product applications, etc.).?

Chinese and foreign automotive MCU vendors (product layout, new product R&D dynamics, product applications, etc.).?

?

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...