China Passenger Car Cockpit Multi/Dual Display Research Report, 2023-2024

In intelligent cockpit era, cockpit displays head in the direction of more screens, larger size, better looking, more convenient interaction and better experience. Simultaneously, the conventional “one-chip, one-display” solution has been gradually replaced by “one-chip, multi-display” and “multi-chip, multi-display” solutions. The trend towards multi and dual display solutions accelerates, with a share hitting a new high.?

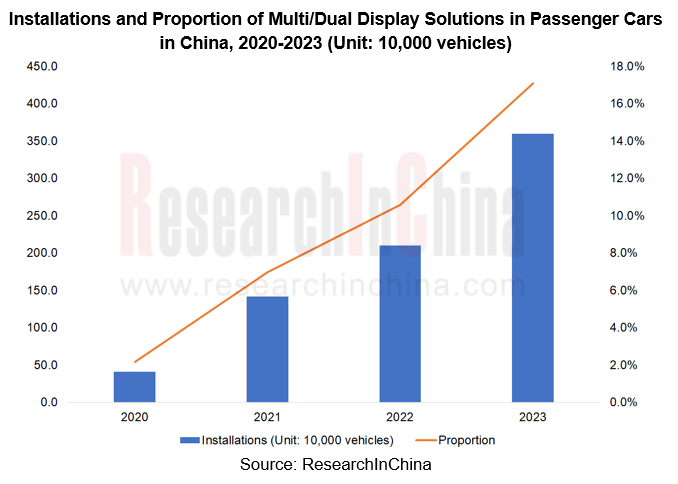

In 2023, China's passenger car multi and dual display solutions were installed on nearly 3.6 million vehicles, making up more than 17% of the total, up 6.5 percentage points on the previous year. In 2023, among brands with models on sale in China's passenger car market (excluding imported models), a total of 43 brands deployed multi-display models, and 52 brands deployed dual-display models. Much more brands chose multi and dual display solutions. (Comparably, the statistics in China Passenger Car Cockpit Multi/Dual Display Research Report, 2022 show there were 21 brands deploying multi-display models and 44 brands deploying dual-display models).??

???

???

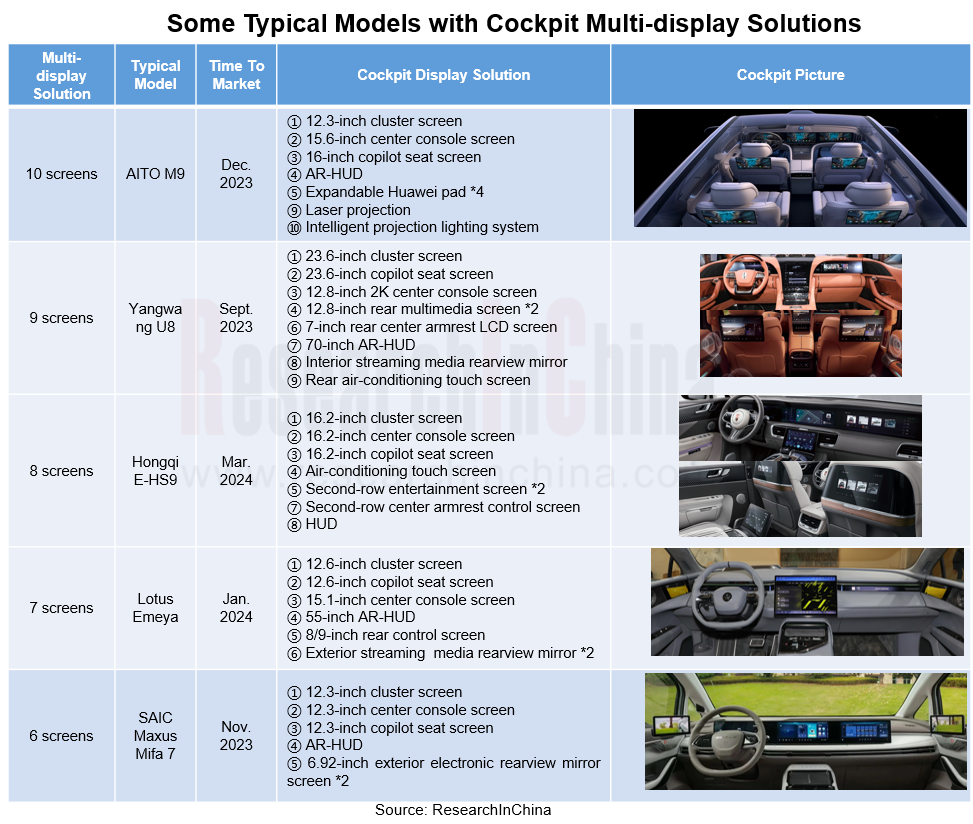

1. More displays: intelligent cockpit has entered the 10-screen era, and 12-screen solutions are expected to be installed in cars in 2024.

In terms of multi and dual display solutions, auto companies and suppliers are innovating to provide consumers with diverse choices. Regarding multi-screen solutions, intelligent cockpit has stepped into the 10-screen era, and 12-screen solutions are expected to be installed in cars in 2024.

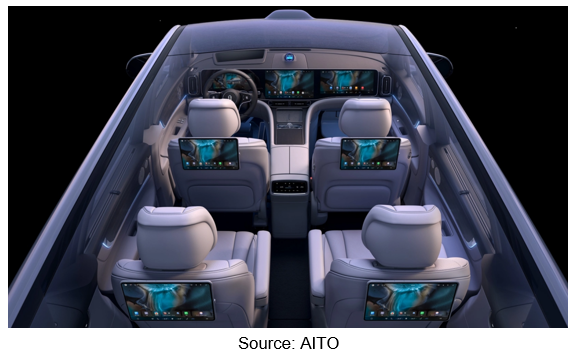

Typical model with 10-screen solution: AITO M9

The top configuration of AITO M9 is 10 screens, including front triple-display, one? AR-HUD, one? giant-scale laser projection screen, one? megapixel-level intelligent projection lighting system and four Huawei pads that can be connected to the IVI system to realize car control. AITO M9 uses distributed soft buses to enable cross-screen integration. Both driver and copilot seat passenger can control the content on rear screens, including laser projection, for example, choose what to see at will and all the people in car can see the same content across screens.?

On M9, AITO first adopted front triple-display, including 12.3-inch LTPS LCD dashboard screen at the driver's seat, 15.6-inch 2K LTPS LCD center console screen, and 16-inch 3K LTPS LCD entertainment screen at the copilot seat. The driver’s and copilot seat screens support three-finger slide to circulate the content?

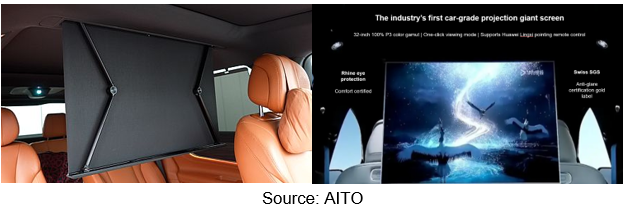

Meanwhile, AITO M9 is equipped with the automotive-grade projection system for the first time. The projection screen is hidden in the roof B-pillar beam, and features an X-type connecting structure on the back and motor locking mode, providing strong shock resistance.??

?

?

The 32-inch laser projection screen in AITO M9 supports 100% P3 color gamut display. Coupled with the second-row zero-gravity seats, it creates a one-click viewing mode. As for interaction, the projection screen supports voice, Huawei smartphone and Huawei Lingxi pointing remote control (similar to a remote control). As concerns displayed content, the projection product can display the content on the IVI or projected from a smartphone (via AITO APP).?????

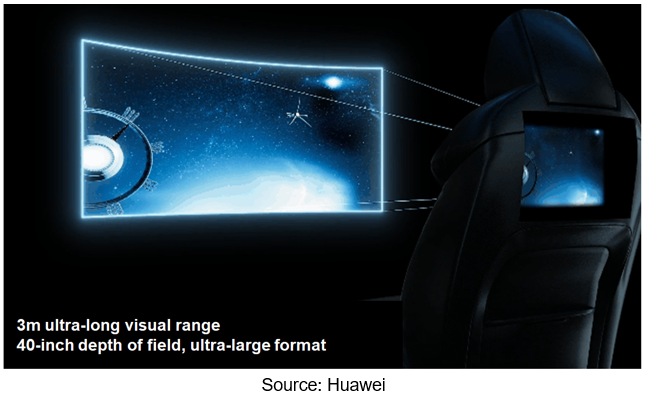

In addition, when M9 was just rolled out, AITO had a pre-launch marketing of the first automotive light field screen (actually not mounted on the car), which may be optional in the future. HUAWEI xScene light field screen enables long-range imaging in 3 meters and 40 inches, and adopts multiple Huawei optical technologies such as 3D spatial optical system design, 20-level polarization medium design without phase errors, and collimated backlight design (see the report for details). According to Huawei, the next-generation facelifted AITO M7 will also support optional light field screens. Moreover, based on Avatr’s brand positioning and Huawei's technical concentration, it is expected that Avatr will be very likely to pack the light field screen in the future.????

?

?

Typical model with 9-screen solution: Yangwang U8

As the first model of Yangwang brand, Yangwang U8 is quite different from BYD and Denza models in cockpit display solution. It adopts a combination of 9 screens, including cluster, center console, copilot seat screen, AR-HUD, interior streaming media rearview mirror, two second-row entertainment screens, second-row air-conditioning control screen and second-row center armrest control screen.??

Yangwang U8 is equipped with a curved screen for the first time - 12.8-inch R800 curved center console screen, which is made of OLED, 2K resolution, and 50 times higher color contrast ratio than conventional LCD screens. Five-screen linkage can be achieved between center console screen, copilot screen, rear multimedia screen and AR-HUD.

In 2024, it is expected that electronic exterior rearview mirrors will be installed in cars on a small scale. By then, intelligent cockpits will have two more displays, and may enter the 12-screen era. As of the publication of this article, the statistics show that models equipped with electronic exterior rearview mirrors in China's passenger car market have included Lotus Eletre, Lotus Emeya, SAIC Maxus Mifa 7, and Avatr 12, of which the last three models were launched on market within the past six months.??

?

?

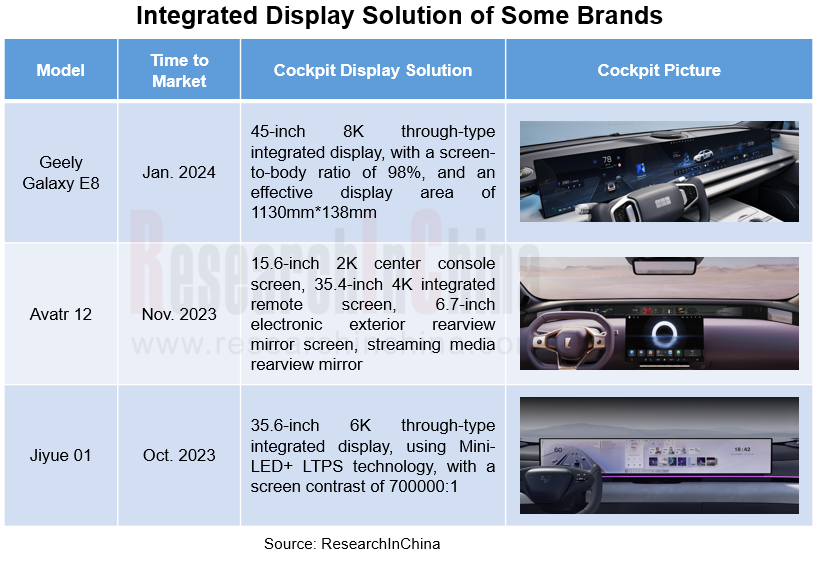

2. Larger display: 1.3m 45-inch ultra-wide integrated display is available in cars.

When it comes to screen size expansion, integrated display is the first choice. Integrated display tends to be designed with larger size, higher resolution, more convenient interaction, touch and voice fusion control, and personalized settings. As of the publication of this article, three Chinese independent brands have used integrated triple-displays in their cars, namely, Geely Galaxy E8, Jiyue 01 and Avatr 12. Geely E8 has the widest through-type integrated display among current production models.?

?

?

Geely Galaxy E8

As a mid-to-high-end new energy brand under Geely brand, Geely Galaxy differs greatly from GEOME and ZEEKR (Geely's other two new energy vehicle brands) in terms of cockpit display solution. Galaxy L7, its first model, uses a display combination of 10.25-inch digital cluster + 13.2-inch vertical center console screen + 16.2-inch copilot seat screen. It is the first time that Geely brand adopts a >12.3-inch copilot seat screen solution.???????

As the second model of Geely Galaxy, Galaxy E8 carries a more radical display solution. It is equipped with a 45-inch through-type integrated display that spans 1.3 meters and features 8K resolution, 1500-nit display effect, 89% ultra-high color gamut, and 98% ultra-high screen-to-body ratio. It is known that the display was created by Geely together with BOE and Skyworth. In terms of IVI system, Galaxy E8 is equipped with Neusoft’s cockpit domain controller based on Qualcomm 8295, which cooperates with Geely’s IVI system Galaxy N OS.???????

?

?

Avatr 12

Avatr 12, available on market in November 2023, pioneers the use of a 35.4-inch integrated remote display that supports 4K resolution and can display information such as boot animation, basic cluster, ADAS scene reconstruction area, and map information. Users can self-define cards according to usage habits, integrated rest modes, charging scenarios, etc. In the IVI system, Avatr 12 uses the Kirin 9610A + Harmony OS 4 combination.???

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...