Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2024

Intelligent driving regulations and vehicles going overseas: research on regional markets around the world and access strategies.??

?

"Going out”: discussion about regional markets around the world and access

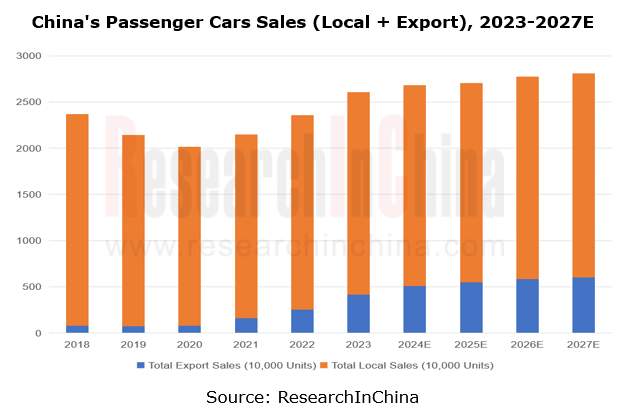

In 2023, China exported up to 4.14 million passenger cars. Wherein, 640,000 battery electric vehicles (BEV) were exported to Europe, accounting for 41.27% of the total battery electric passenger car exports, and the export value was RMB132.5 billion, or 55.13% of the total; 310,000 BEVs were exported to Southeast Asia, making up 20.09%, and the export value was RMB22.3 billion, or 9.28% of the total. USA has imposed high punitive tariffs on Chinese electric vehicles, and Europe also has such a plan. In spite of many challenges, Chinese passenger cars are still expected to make breakthroughs in major regional markets such as Russia, Southeast Asia, the Middle East, and South America.???????

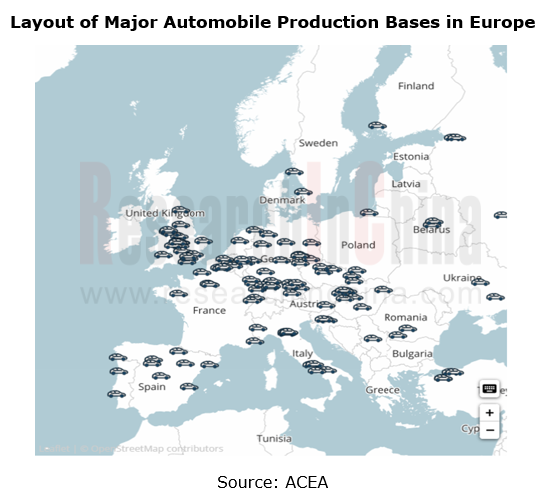

European automotive market and autonomous driving regulations

According to the data from European Automobile Manufacturers' Association (ACEA), there have been 322 automobile assembly, engine and battery manufacturing plants in Europe, 213 of which are located in the European Union (EU) countries. A total of 127 plants produce cars, 71 make buses, 56 manufacture trucks (heavy-duty vehicles), 46 make vans (light commercial vehicles), 71 build engines, and 42 are battery manufacturing bases.??

?

?

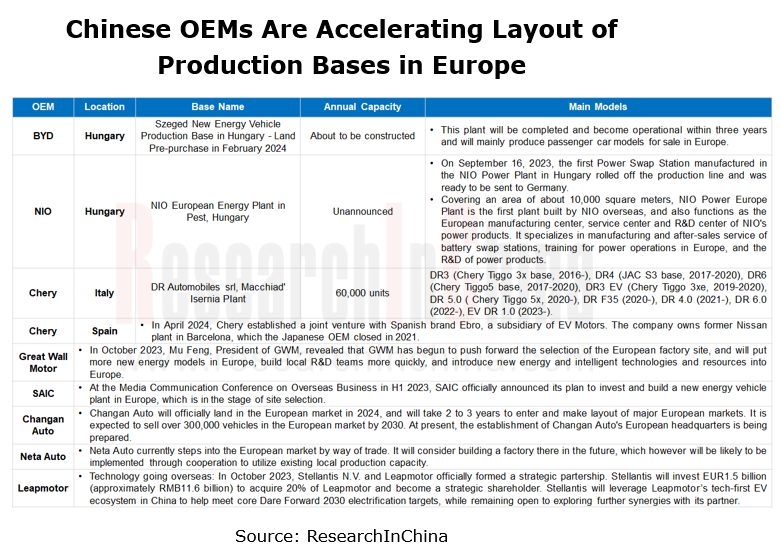

In October 2023, the EU launched an anti-subsidy investigation into Chinese electric vehicles. It currently conducts a sample investigation into Chinese companies. As this investigation comes to an end, the investigation report is very likely to affirm that Chinese electric vehicles are subsidized, and 15% to 30% punitive tariffs will be imposed on Chinese electric vehicles exported to the EU. European professional institutions predict the tariff rate may be 19%. Against this background, Chinese OEMs are quickening their pace of deploying production bases in Europe.??

As a joint economy, the EU is highly interconnected in terms of autonomous driving regulations. The autonomous driving regulations in EU members are mainly based on EU regulations, with only tweaks in some details. Therefore, meeting EU autonomous driving regulations is a must for Chinese companies to go overseas.?

The EU has the strictest and newest environmental protection policies and the latest battery traceability policies globally. It is another policy barrier for Chinese OEMs’ technology, and the trade protection implemented by EU;

EU’s autonomous driving regulations are safety-oriented and the strictest in the world;?

Although the UK has left the EU, its autonomous driving regulations overall remain consistent with the EU.??

Due to varying attitudes towards China, European countries also have different requirements for Chinese companies’ autonomous driving overseas:

Germany: German OEMs Volkswagen and Mercedes Benz have an open attitude towards Chinese companies in intelligent driving, and remain the closest contact with them. The overseas expansion of Chinese companies in intelligent driving can further increase the shares of Volkswagen and Mercedes Benz in the EU market; Momenta, Deeproute. ai, and NIO among others have established intelligent driving development centers in Germany. The country will become a bridgehead for China's autonomous driving technology to go global;????

Germany: German OEMs Volkswagen and Mercedes Benz have an open attitude towards Chinese companies in intelligent driving, and remain the closest contact with them. The overseas expansion of Chinese companies in intelligent driving can further increase the shares of Volkswagen and Mercedes Benz in the EU market; Momenta, Deeproute. ai, and NIO among others have established intelligent driving development centers in Germany. The country will become a bridgehead for China's autonomous driving technology to go global;????

Hungary: it is politically friendly to China, located at the center of the EU, and positioned as a production and R&D center, with production bases of multiple OEMs. Hungary vigorously participates in R&D and testing of autonomous driving technology, and is expected to become the country of? the greatest strategic importance for China in the EU market in the future, becoming a "springboard" for Chinese companies to enter EU.??

Hungary: it is politically friendly to China, located at the center of the EU, and positioned as a production and R&D center, with production bases of multiple OEMs. Hungary vigorously participates in R&D and testing of autonomous driving technology, and is expected to become the country of? the greatest strategic importance for China in the EU market in the future, becoming a "springboard" for Chinese companies to enter EU.??

France: Autonomous driving testing started early.? In 2014, it invested 40 million euros to carry out a number of autonomous vehicle test projects. In 2019, it took the lead in passing laws & regulations and related framework that allow autonomous driving vehicles on the road. However, in recent years, the development of autonomous driving of new energy vehicles lags behind that of Germany;

France: Autonomous driving testing started early.? In 2014, it invested 40 million euros to carry out a number of autonomous vehicle test projects. In 2019, it took the lead in passing laws & regulations and related framework that allow autonomous driving vehicles on the road. However, in recent years, the development of autonomous driving of new energy vehicles lags behind that of Germany;

UK: it built an automated vehicle center in 2015 and then proposed commercialization of autonomous vehicles in the UK by 2025. The new Automated Vehicles Act released in 2023 aims to clarify that the responsibility for autonomous vehicle accidents should be taken by OEMs. This Act is only applicable to L3+ automated vehicles.???

UK: it built an automated vehicle center in 2015 and then proposed commercialization of autonomous vehicles in the UK by 2025. The new Automated Vehicles Act released in 2023 aims to clarify that the responsibility for autonomous vehicle accidents should be taken by OEMs. This Act is only applicable to L3+ automated vehicles.???

Southeast Asia automotive market and autonomous driving regulations

ASEAN countries and China signed the Regional Comprehensive Economic Partnership (RCEP), the world's largest free trade agreement which involves trade facilitation and technological cooperation on electric vehicles. This agreement will help facilitate interconnection and mutual benefit between China and ASEAN countries in the field of electric vehicles.?

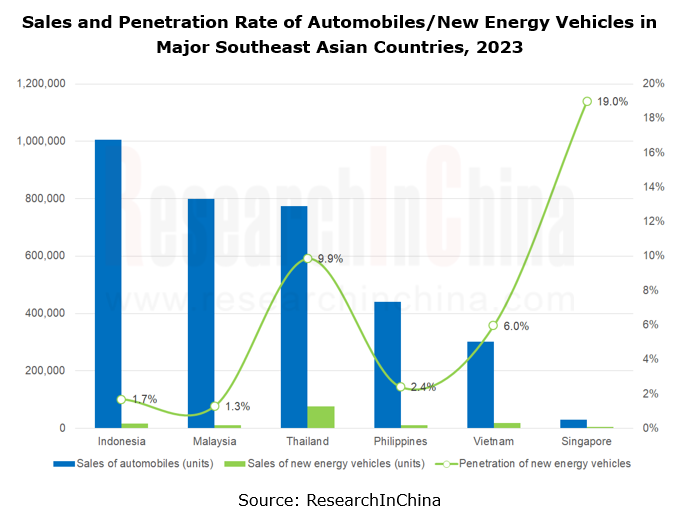

According to the road driving status of vehicles, in the ASEAN region, exactly half of countries are left-hand drive vehicle markets (Philippines, Vietnam, Laos, Cambodia and Myanmar), and the other half are right-hand drive vehicle markets (Malaysia, Brunei, Indonesia, Thailand and Singapore). According to automobile sales data released by automobile associations of Southeast Asian countries, it can be seen that automobile sales in Southeast Asian countries sustained high growth in 2023. Wherein, Indonesia saw the highest sales, up to 1 million units, and Malaysia followed.?

Thailand: With its geographical advantage, it has become an ideal destination for Chinese auto brands to go overseas. Located in the center of Southeast Asia, Thailand not only connects Cambodia, Laos, Myanmar, and Vietnam, but also radiates to China and India, making it a key gate for investors to enter the ASEAN market. As a major agricultural country, Thailand actively build agricultural cooperation with countries such as China and Singapore to introduce advanced technologies and agricultural machineries such as unmanned intelligent rice transplanters and plant protection drones, and jointly carry out R&D projects to support local agricultural development.??

In the Southeast Asian market, Thailand leads in vehicle manufacturing. It has introduced a range of loose policies in electric vehicle production and investment. It is one of the main destinations for Chinese OEMs to build factories overseas. OEMs like GAC, Chery, SAIC, Great Wall, BYD and Neta Auto, and even battery giant CATL, have announced the building of factories in Southeast Asia, with a total investment of over RMB10 billion.???

?

Singapore: it adopts the Regulatory Sandbox system to supervise the autonomous vehicle industry. On the one hand, it can test the safety capabilities of vehicles; on the other hand, it also grants the Land Transport Authority (LTA) of Singapore extensive discretion, gathering legislation experience for the LTA to formulate rules for licensing conditions, operations or test routes.????

Singapore has made multiple deployments in autonomous driving, having tested projects in Singapore Changi Airport, logistics parks, and university communities. There is currently no automobile manufacturing base in Singapore, but only an autonomous driving R&D and test center. This is related to Singapore's development layout. Enterprise Singapore encourages and supports Singaporean enterprises to work on innovation-driven development, and promotes their integration and cooperation with global high-quality resources, so as to gain greater international competitive edges.????

Singapore positions itself as a regional autonomous driving R&D center. The sales of new energy vehicles will not surge due to Singapore's private car policy. Yet among Southeast Asian countries, Singapore has great potential in developing autonomous driving. NIO has been officially listed on the main board of Singapore Exchange, with stock code being “NIO", and has also established an AI and autonomous driving R&D center in Singapore. Li Auto will set up an office in Singapore to recruit R&D teams related to AI inference chips and SiC power chips.

“Bringing in”: China’s regulatory frameworks for autonomous driving, data and AI

China’s regulatory framework for autonomous driving road test

The National Comprehensive Three-dimensional Transportation Network Planning Outline clarifies that by 2035, China's autonomous driving technology will lead in the world. The Outline for Building China's Strength in Transportation suggests taking "strengthening R&D of autonomous driving technology and building an independent, controllable and complete industry chain" as an important part of building a country with strength in transportation.?

China’s regulations on application of AI in vehicles?

China is striking agreements on AI governance with countries around the world, including Russia and France, aiming to establish a global rule system and ecosystem. In terms of top-level design, China has issued policy documents, for example, Global AI Governance Initiative, Next Generation Artificial Intelligence Development Plan, Measures for Scientific and Technological Ethics Review (Trial), and Opinions on Strengthening Ethical Governance of Science and Technology.???

Application of AI in vehicles needs to meet national regulatory requirements such as Interim Measures for the Administration of Generative Artificial Intelligence Services and Provisions on the Administration of Deep Synthesis of Internet-based Information Services. OEMs’ foundation models need to enter the Chinese Deep Synthesis Service Algorithm Filing List, specifically involving algorithm filing, security assessment, and filing of foundation models for use. Domestic deep synthesis technology services (text, pictures, audio, video, virtual reality, etc.) require algorithm filing, which often takes 2-4 months.

In May 2024, the EU Artificial Intelligence Act (AI Act) took effect. EU pays particular attention to AI foundation models and data protection. EU General Data Protection Regulation (GDPR) poses very strict requirements for the use and processing of personal data.

China's regulations on data security and data asset circulation

China has speeded up the construction of its data asset system and established the National Data Administration. In the field of intelligent driving, regarding issues such as Tesla FSD entering into China and data export, the Data Department of Lin-gang Special Area Management Committee, as the direct supervisor, will further formulate regulations on local data collection, local training, and data export of Tesla and other foreign OEMs. In February 2024, "Measures for the Classified and Graded Management of Cross-border Data Flow in the Lin-gang Special Area" was released, defining three levels of cross-border data, i.e., core data, important data and general data and making it clear that core data is prohibited from crossing borders.

According to the policies Measures for the Security Assessment of Outbound Data Transfer and Provisions on Promoting and Regulating Cross-border Data Flow, for Tesla FSD's entry into China, Tesla is likely to need to build local data cloud training and storage centers to meet data compliance requirements.??

In addition, the Notice on Carrying out Pilot Work on Expanding the Opening-up of Value-added Telecommunications Services" issued by the Ministry of Industry and Information Technology has loosened the restrictions on the proportion of foreign investment in data centers, which will help foreign-funded OEMs build local training centers in China.

In general, China has formulated a range of policies and regulations on L3/L4 autonomous driving on-road use, cybersecurity, data security, vehicle-road-cloud integration, smart roads, and mapping, providing compliance guidance for OEMs.

(1) Regulations on L3/L4 autonomous driving on-road use in China:

Highway-based L2/L2+ technology has been marketed, and highway-based L3 technology has entered the test stage;?

Highway-based L2/L2+ technology has been marketed, and highway-based L3 technology has entered the test stage;?

At present, many provinces and municipalities have issued L3/L4 autonomous driving road test regulations, involving specific requirements for vehicle insurance, safety officers, and application conditions for demonstration use and operation. The Ministry of Transport has released the second batch of pilot applications of autonomous driving, covering highway passenger and freight transportation, urban mobility and logistics, intra-park transportation and operation in specific scenarios;

At present, many provinces and municipalities have issued L3/L4 autonomous driving road test regulations, involving specific requirements for vehicle insurance, safety officers, and application conditions for demonstration use and operation. The Ministry of Transport has released the second batch of pilot applications of autonomous driving, covering highway passenger and freight transportation, urban mobility and logistics, intra-park transportation and operation in specific scenarios;

In terms of low-speed autonomous driving, some cities have issued detailed regulations, targeting low-speed autonomous vehicles with speeds not exceeding 15km/h.?

In terms of low-speed autonomous driving, some cities have issued detailed regulations, targeting low-speed autonomous vehicles with speeds not exceeding 15km/h.?

?(2) China’s regulations on autonomous driving cybersecurity and data security:

Cybersecurity: clarify that pilot cities should have provincial or municipal intelligent connected vehicle safety monitoring capabilities, vehicle cybersecurity and data security management capabilities, etc.;

Cybersecurity: clarify that pilot cities should have provincial or municipal intelligent connected vehicle safety monitoring capabilities, vehicle cybersecurity and data security management capabilities, etc.;

Data security: ensure that vehicle information and personal information of owners, as well as vehicle data, are protected from unauthorized access, tampering or leakage. Follow the principles: 1) In-vehicle processing, not provided outside the vehicle unless absolutely necessary; 2) No collection by default; 3) Accuracy range application; 4) Desensitization.??

Data security: ensure that vehicle information and personal information of owners, as well as vehicle data, are protected from unauthorized access, tampering or leakage. Follow the principles: 1) In-vehicle processing, not provided outside the vehicle unless absolutely necessary; 2) No collection by default; 3) Accuracy range application; 4) Desensitization.??

?(3) China's regulations on autonomous driving roads, maps, and traffic

Vehicle-road-cloud integration: the purpose is to build a unified V2X technology standard and test evaluation system. In 2024, C-NCAP introduced C-V2X technology into the active safety evaluation for the first time;

Vehicle-road-cloud integration: the purpose is to build a unified V2X technology standard and test evaluation system. In 2024, C-NCAP introduced C-V2X technology into the active safety evaluation for the first time;

Smart roads for autonomous driving: adopt an "end-edge-cloud" integrated technical architecture and establish a technical system of road engineering facilities supporting autonomous driving.

Smart roads for autonomous driving: adopt an "end-edge-cloud" integrated technical architecture and establish a technical system of road engineering facilities supporting autonomous driving.

Mapping for autonomous driving: build a relatively perfect autonomous driving map system according to regulatory requirements for different types of autonomous driving maps, intelligent vehicle base maps, and geographical mapping information collection and management.

Mapping for autonomous driving: build a relatively perfect autonomous driving map system according to regulatory requirements for different types of autonomous driving maps, intelligent vehicle base maps, and geographical mapping information collection and management.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...