Research on DJI Automotive: lead the NOA market by virtue of unique technology route.

In 2016, DJI Automotive’s internal technicians installed a set of stereo sensors + vision fusion positioning system into a car and made it run successfully. DJI Automotive's technologies such as perception, positioning, decision and planning accumulated in the drone field have been successfully transferred to intelligent driving field.?

Almost all founding and management team members of DJI Automotive came from DJI’s drone projects. DJI Automotive had only about 10 members at the beginning, mainly composed of representatives temporarily transferred from the Flight Control Department and Vision Department of DJI at that time.?

?

DJI claims that it is a company specializing in the research of intelligent robots, and drones and autonomous vehicles are different forms of intelligent robots. Relying on its unique technology route, DJI holds lead in the mass production and application of NOA. By DJI Automotive’s estimates, around 2 million passenger cars taking to road will be equipped with DJI Automotive’s intelligent driving systems in 2025.?

Continuously optimize stereo vision sensors

One of the core technologies of DJI Automotive is stereo vision. Even when other sensors like GPS fail, based on visual perception of the stereo camera, drones can still enable hovering, obstacle avoidance, and speed measurement among others.?

After applying stereo vision technology to autonomous vehicles, DJI Automotive continues to optimize stereo vision sensors according to requirements of different autonomous driving levels.

In 2023, to meet the needs of NOA, DJI Automotive launched the second-generation inertial navigation stereo vision system, which eliminates the overall lens hood by adding a customized optical polarizer and cancels the rigid connecting rod using a better self-calibration algorithm. This makes it easier to install the sensor, and the distance between two cameras can be flexibly configured from 180 mm to 400 mm. Elimination of the rigid connecting rod is a huge progress in stereo vision sensors, allowing stereo cameras to be applied in much more scenarios.

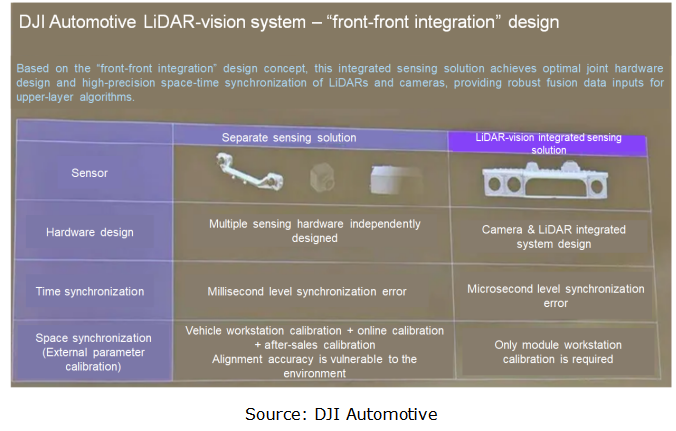

Based on the needs of L3 autonomous driving, in 2024 DJI Automotive introduced a LiDAR-vision system, which combines LiDAR, stereo sensor, long-focus mono camera and inertial navigation. Compared with the currently common "LiDAR + front camera" solution on the market, the system can reduce the costs by 30% to 40%, while enabling 100% performance and replacing all the functions. Thanks to the integrated design, the "LiDAR-vision" solution can also be built into the cabin as a whole, reducing the overall installation costs.????

???

???

The "LiDAR-vision" solution can further enhance safety in vehicle longitudinal control. Thanks to LiDAR's precise ranging capabilities and robustness to illumination, the "LiDAR-vision" solution can further improve safety and comfort of intelligent driving system in such scenarios as cut-in at close range, complex traffic flow in urban areas, response to vulnerable road users (VRU), arbitrary obstacle avoidance, detour, and VRU at night.

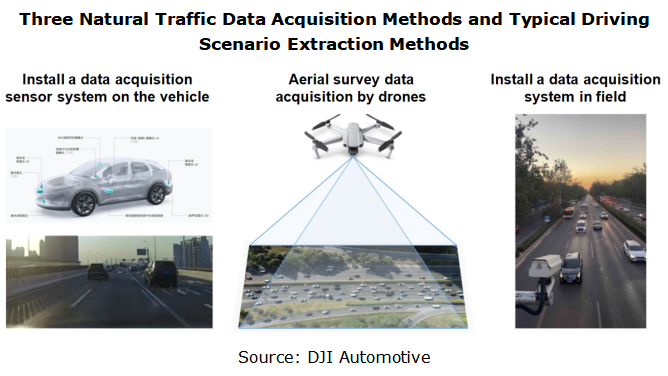

Use drone technologies for data acquisition and simulation

Among the three autonomous driving data acquisition methods, acquisition by vehicles is the most common, but the proportion of effective data is low, and it is easy to interfere with real behaviors of surrounding vehicles, and it is unable to record data in blind spots of sensors. Another method is acquisition in field, with low flexibility and insufficient reliability, a result of angle skew and low image accuracy.????

?

?

According to the in-depth research by fka, the automotive technology research institute of RWTH Aachen University, and DJI Automotive's own practices in the past two years, aerial survey data acquisition by drones has obvious advantages. Drones can collect richer and more complete scenario data, and can directly collect aerial objective shots of all vehicles in blind spots of the target vehicle without obstruction, reflecting more realistic and interference-free human driving behaviors, and more efficiently collecting data in specific road sections and special driving scenarios, for example, on/off-ramps and frequent cut-ins.???

Why does the implementation of vision-only autonomous driving suddenly accelerate?

Why has the pace of implementing vision-only technology solutions suddenly quicken since 2024? The answer is foundation models. The research shows that a truly autonomous driving system needs at least about 17 billion kilometers of road verification before being production-ready. The reason is that even if the existing technology can handle more than 95% of common driving scenarios, problems may still occur in the remaining 5% corner cases.??

Generally, learning a new corner case requires collecting more than 10,000 samples, and the entire cycle is more than 2 weeks. Even if a team has 100 autonomous vehicles conducting road tests 24 hours a day, the time required to accumulate data is measured in "hundred years" - which is obviously unrealistic.

Foundation models are used to quickly restore real scenarios and generate corner cases in various complex scenarios for model training. Foundation models (such as Pangu model) can shorten the closed-loop cycle of autonomous driving corner cases from more than two weeks to two days.

Currently, DJI Automotive, Baidu, PhiGent Robotics, GAC, Tesla and Megvii among others have launched their vision-only autonomous driving solutions. This weekly report summarizes and analyzes vision-only autonomous driving routes.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...