China Charging/Swapping (Liquid Cooling Overcharging System, Small Power, Swapping, V2G, etc) Research Report, 2024

Research on charging and swapping: OEMs quicken their pace of entering liquid cooling overcharging, V2G, and virtual power plants.

China leads the world in technological innovation breakthroughs in electric vehicles. New technologies such as high-power liquid cooling overcharging, intelligent swapping, vehicle-to-grid (V2G), PV-storage-charging integration, and virtual power plants have become the new development trends of charging infrastructure in the next stage.??

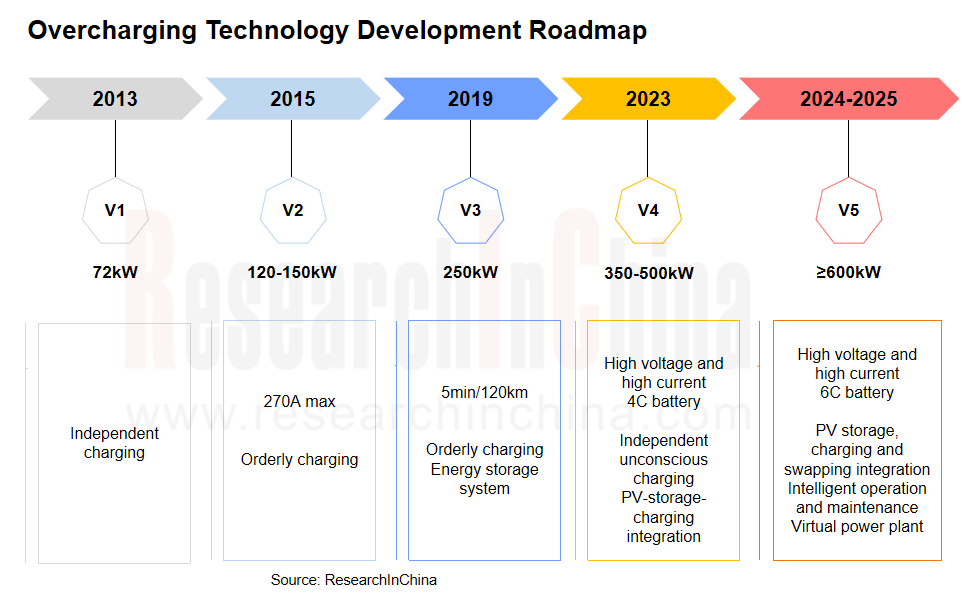

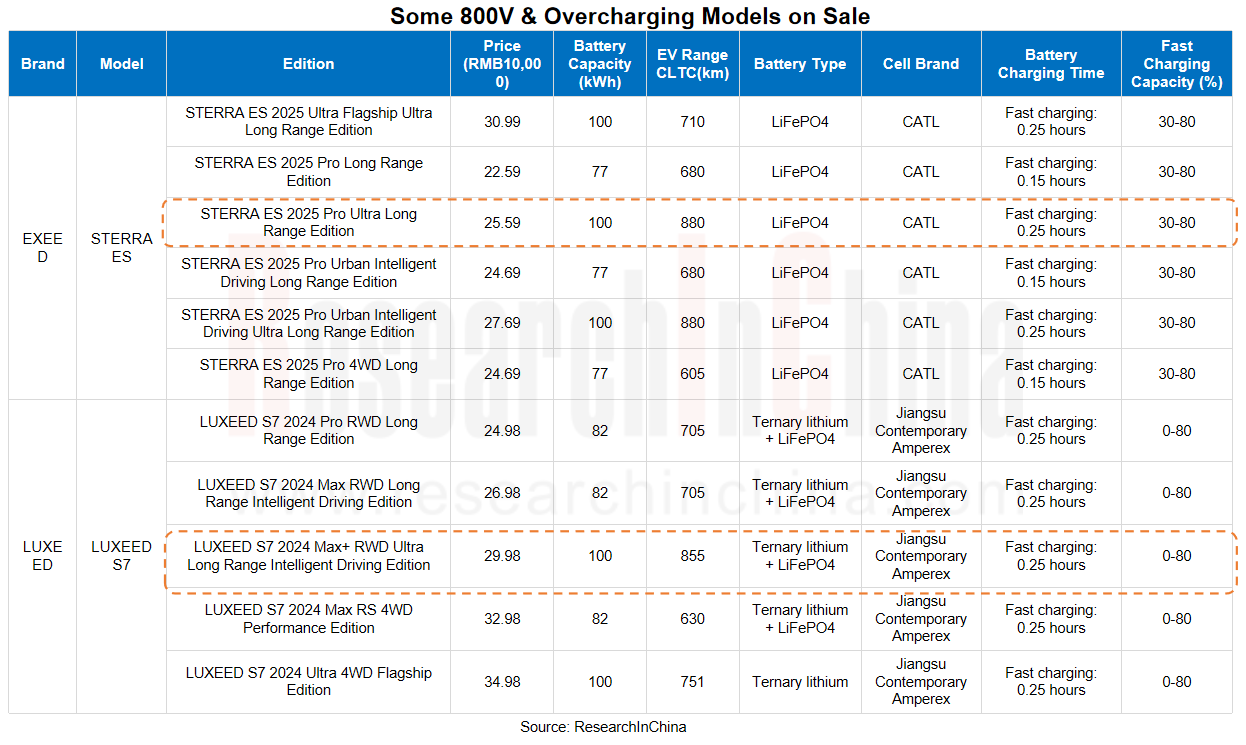

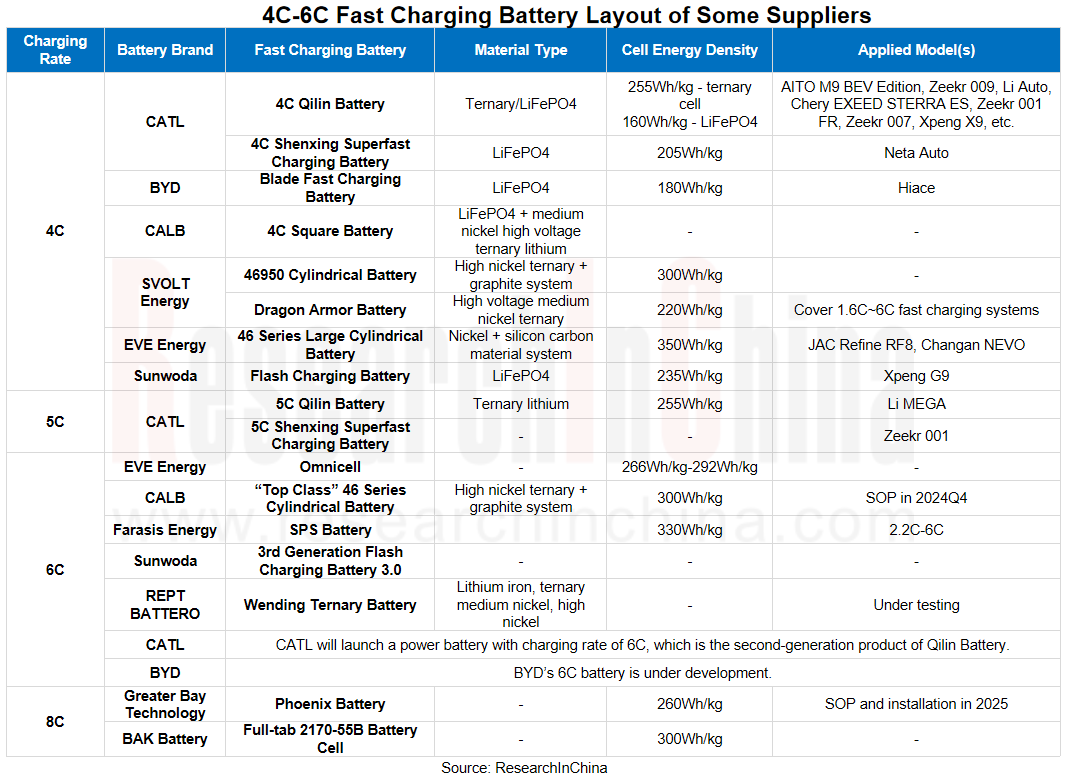

A single liquid cooling overcharging gun features power of >480kW, and 4C-6C fast charging batteries will become standard configuration of flagship models.?

"Overcharging", namely, ultra-fast charging, uses high-power DC charging mode, reducing a lot of charging time, and can charge from 0% to 80% in 10-20 minutes or less. There are two main ultra-fast charging technology routes: high current and high voltage. The former requires thermal management technology and is difficult to implement, while the latter can reduce energy consumption and weight, increase cruising range, and save space.??

Liquid cooling technology can effectively dissipate the heat generated during charging, increase the cable transmission power, and ultimately achieve high-power charging. The application of liquid cooling charging technology has significantly improved the charging efficiency of vehicles, featuring high charging efficiency, low heat generation, high safety, and low noise.?

As of now, there have been more than 2,400 >360kW stations with liquid cooling overcharging in China, but with less than 1% market share. Multiple OEMs, operators and solution providers have announced a plan to build a large-scale overcharging network:?

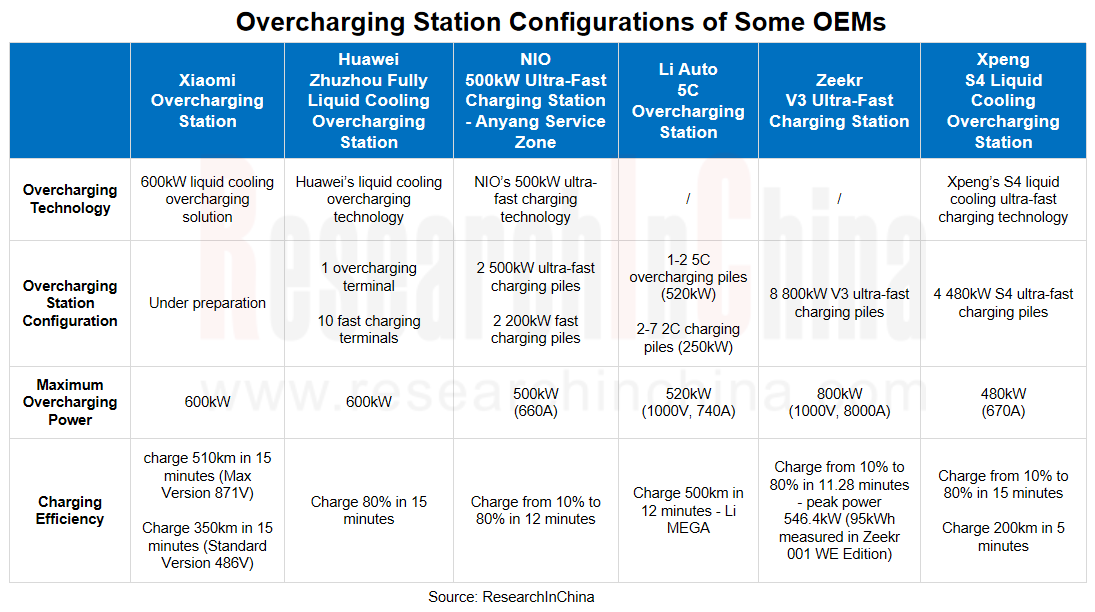

OEMs: NIO has deployed over 20,000 liquid cooling overcharging guns; Li Auto has put into use 600 overcharging stations; Xpeng’s S4 overcharging stations have covered 100 cities;

OEMs: NIO has deployed over 20,000 liquid cooling overcharging guns; Li Auto has put into use 600 overcharging stations; Xpeng’s S4 overcharging stations have covered 100 cities;

Operators: leading charging operators like TELD and StarCharge have released overcharging products;

Operators: leading charging operators like TELD and StarCharge have released overcharging products;

Solution providers: Huawei plans to implement more than 100,000 overcharging stations in 2024.

Solution providers: Huawei plans to implement more than 100,000 overcharging stations in 2024.

Comparing the configuration, charging efficiency and other parameters of overcharging stations of major OEMs, currently their overcharging stations still use the overcharging pile + fast charging pile combination. The charging power of a single overcharging gun has been higher than 480kW, even up to 800kW.???

Seen from the policy orientation of local governments, a single >480kW gun is defined as an overcharging pile; in March 2024, the Development and Reform Commission of Shenzhen City and the Shenzhen Administration for Market Regulation formulated standards for the grading evaluation of overcharging equipment and the design of overcharging stations, clarifying that the rated power of a single overcharging gun should not be lower than 480kW.?????

In terms of battery, the decline in cost of lithium battery raw materials has brought about the shift from cost orientation to performance orientation. OEMs such as NIO, Zeekr and Aion have launched models with a range of 800km on market. EV range of over 800km will become the standard for flagship models.?????

OEMs’ deployment of self-operated overcharging stations has a significant impact on the pricing strategy, sales and user experience of flagship models.

Battery structure innovation and process optimization continue to improve system specific energy:

There is still potential for diversity in cell structure designs, for example: (1) CALB’s "top-class" cylindrical cell; (2) CALB’s One-Stop square cell; (3) EVE Energy's cylindrical π battery system; (4) ZENERGY’s Qiankun battery system.

There is still potential for diversity in cell structure designs, for example: (1) CALB’s "top-class" cylindrical cell; (2) CALB’s One-Stop square cell; (3) EVE Energy's cylindrical π battery system; (4) ZENERGY’s Qiankun battery system.

Large modules and CTP continue to iterate, over 10,000-ton integrated die-casting is introduced into battery trays, CTB technology optimizes battery volume utilization, and mass production of large cylindrical batteries speeds up.

Large modules and CTP continue to iterate, over 10,000-ton integrated die-casting is introduced into battery trays, CTB technology optimizes battery volume utilization, and mass production of large cylindrical batteries speeds up.

At present, the fully liquid cooling charging piles put into operation on the market deliver the maximum single-gun power of 600-800kW, still far from the limit of ultra-fast charging. According to GB/T20234.1-2023 Connection Set of Conductive Charging for Electric Vehicles - Part 1: General Requirements, a new national standard for new energy vehicle charging guns, which was issued and took effect in September 2023, this document applies to DC charging connection sets with rated voltage not higher than DC1500V and rated current (continuous maximum operating current) not higher than 1000A. This means that when the technology is mature, overcharging piles can achieve the maximum charging power of 1500kW.??

From another perspective, OEMs still need to face the status quo that at present the existing charging piles with <250A charging current sweep as high as 98% and the >400A overcharging piles account for less than 1%. To solve the problem of limited charging speed caused by the current limit of public DC charging piles, BYD has explored another more cost-effective overcharging technology route.??

New BYD Hiace 07 EV is equipped with an 800V vehicle voltage platform and the e-platform 3.0Evo, the world's first intelligent current-boosting fast charging technology. Hiace 07 EV packs voltage-boosting (pile-to-vehicle) and current-boosting (vehicle-to-blade battery) technologies. Based on voltage-boosting charging, the current-boosting charging technology gets upgraded, breaking the 250A current limit at the pile end and achieving maximum current of 400A at the vehicle end. Under any voltage platform, the maximum capacity of GB15 standard-compliant public DC charging piles in the existing charging networks will be brought into full play.????

1. Voltage boosting: As the basic technical point of BYD's traditional high-voltage platform solutions, the rated voltage of 550V is boosted to over 700V, meeting the charging requirements of 180-240KW;

2. Current boosting: The new technology uses a high-voltage electronic control system to boost the pile-to-vehicle charging current from 250A to 400A at the blade battery end, meeting the charging requirements of 180-240KW.??

For vehicle-to-grid (V2G), OEMs set foot in the electricity sales side reform and virtual power plants, and explore business models.

On January 4, 2024, the National Energy Administration issued a programmatic document on vehicle-to-grid (V2G), the "Implementation Opinions of the National Development and Reform Commission and Other Ministries and Commissions on Strengthening the Integration and Interaction between New Energy Vehicles and Power Grids". This document is a programmatic document for launching V2G at the national level, suggesting that V2G is officially launched as a national project, and the corresponding implementation rules and pilot plan documents will be issued subsequently.?????

The document is aimed at governments at all levels and power grid systems, and indicates China’s intention of promoting V2G through power grids first. The document proposes a technology roadmap for implementation of V2G.

According to the document, V2G can be divided into two stages: orderly charging, and bidirectional charging and discharging.

Orderly charging is to reduce the load pressure on power grids caused by large-scale fast charging of vehicles, by way of dynamically adjusting the charging time and power according to the actual power demand of users, and shaving peaks and filling valleys.

Bidirectional charging and discharging is to give full play to the energy storage capacity of electric vehicle batteries, provide flexible adjustment capabilities for power grids through reverse power transmission to the power grids, and ensure the balance between social power supply and demand.

According to the policy document, before 2025, large-scale orderly charging should be achieved, and bidirectional charging and discharging should be initially verified through pilot projects; by 2030, large-scale application of bidirectional charging and discharging should be achieved and the adjustment capabilities of V2G should be fully utilized.???

OEMs are also stepping up deployment of V2G technology and exploration of business models.

NIO: Virtual peak-shaving unit + virtual frequency regulation unit provides flexible adjustment capabilities.

As energy storage equipment, a battery swap station can naturally become a "virtual power plant". Since the construction of the second-generation station in 2022, NIO has been working to achieve the energy storage attribute of battery swap stations.

In February 2024, NIO Power and China Southern Power Grid Energy Storage signed a framework cooperation agreement. Their cooperation involves virtual power plants, battery swapping services, and battery cascade utilization and recycling, providing peak shaving, frequency regulation and demand-side response services to the society and making them distributed energy equipment.??

On January 9, 2024, NIO rolled out the first 10 V2G pilot charging piles in total, with 36 piles distributed in Shanghai. Users can use these V2G pilot charging piles for reverse discharge to power grids.?

Volkswagen: with CAMS, piloted a sequential charging (V1G) project in the Beijing-Tianjin-Hebei region.

Volkswagen Group China and CAMS jointly initiated a sequential charging (V1G) project in the Beijing-Tianjin-Hebei region. The self-built sequential charging control and management platform is used to connect to State Grid's electric vehicle supervision platform; CAMS charging equipment with V1G sequential charging technology is used to respond to and manage the sequential charging of electric vehicle owners recruited in the pilot project, in accordance with the grid control instructions.???

1 Classification/Policy/Ownership of Charging and Swapping Infrastructure

1.1 Overview of Charging and Swapping Service Network System

1.1.1 Classification

1.1.2 Charging Interface Standards and Classification

1.1.3 Charging Rate

1.1.4 Intelligent Orderly Charging/Flexible Charging/Virtual Power Plant

1.1.5 Research Framework

1.1.6 Industrial Chain

1.1.7 Major Participating Companies

1.2 Charging Service Network System - Policies and Regulations

1.2.1 Charging Infrastructure Construction Becomes a National Strategy

1.2.2 Overall Roadmap of China's Charging and Swapping Infrastructure for 2025-2035

1.2.3 China Charging Service Network System - Current Policies

1.2.4 Overall Planning - "Guiding Opinions on Further Building a High-Quality Charging Infrastructure System"

1.2.5 Highway Scenario-Opinions on Accelerating Construction of the Main Skeleton of National Comprehensive Three-dimensional Transportation Network

1.2.6 City Public - "Notice on Organizing the Pilot Work of Comprehensive Electrification of Vehicles in Public Areas"

1.2.7 Rural Scenario - "Implementation Opinions on Accelerating Charging Infrastructure Building to Better Support New Energy Vehicles to the Countryside and Rural Revitalization"

1.2.8 New Technology Model - "Implementation Opinions of NDRC and Other Departments on Strengthening Integration and Interaction of New Energy Vehicles and Power Grid"

1.2.9 Financial Subsidies - Notice on Launching the Pilot Work of Supplementing Shortboards for Charging and Swapping Infrastructure in the County (Cai Jian [2024] No. 57)

1.3 Charging Service Network System - Standard Documents

1.3.1 Charging and Swapping Infrastructure - Standard Framework

1.3.2 Charging and Swapping Infrastructure - Standard Classification

1.3.3 Charging and Swapping Infrastructure - List of Standards (1)

1.3.4 Charging and Swapping Infrastructure - List of Standards (2)

1.3.5 Charging and Swapping Infrastructure - National Standard System

1.3.6 Charging and Swapping Infrastructure-Strong National Standard "Safety Requirements for Electric Vehicle Conductive Charging Systems"

1.4 China Energy Storage System - Standard System

1.4.1 China will write the "Development of New Energy Storage" into Government Work Report for the first time in 2024

1.4.2 Energy Storage System Standard System - National Standard/Industry Standard (1)

1.4.3 Energy Storage System Standard System - National Standard/Industry Standard (2)

1.4.4 Energy Storage System Standard System - National Standard/Industry Standard (3)

1.5 Charging Service Network System - Development trend

1.5.1 Future Development Direction of China's Charging Industry

1.6 China New Energy Vehicle Market Data

1.6.1 China New Energy Vehicle Ownership

1.6.2 China New Energy Vehicle Sales

1.6.3 China New Energy Passenger Car Sales

1.6.4 China New Energy Passenger Car Sales by Brand

1.6.5 China New Energy Passenger Car Sales by Model

1.6.6 China New Energy Commercial Vehicle Sales

1.7 Ownership of China Charging and Swapping Infrastructure

1.7.1 Ownership of China Charging and Swapping Infrastructure

1.7.2 Ownership of China Public Charging Stations/Piles in China

1.7.3 China Public Charging Piles - DC/AC Proportion

1.7.4 Distribution of Public Charging Stations/Piles in China -TOP10 Provinces and Cities

1.7.5 Distribution of Public Charging Stations/Piles in China - by Province and City

1.7.6 Ownership of Charging Piles (Private Charging Piles) built with Piles in China

1.7.7 China Charging Pile Ownership and Vehicle Pile Ratio

2 Ultra-high Power DC Charging Technology and Market

2.1 High-power DC Charging - Policy Standards

2.1.1 High Power DC Charging - Policies and Regulations

2.1.2 High Power DC Charging - Standard Specification

2.1.3 High Power DC Charging - ChaoJi Charging System

2.1.4 Construction Plan of Multiple "Overcharging Cities" in China - Regional Policy Guidance

2.1.5 Shenzhen Overcharging City Construction Planning - Policies, Standards, Construction Process

2.1.6 Vehicle Charging Safety Certification - New Energy Vehicle Electrical Safety Technology Verification System

2.2 Overcharging system - Overcharging Station/Pile

2.2.1 Overcharging System - Overcharging Definition

2.2.2 Overcharging Station/Pile - Overcharging Configuration

2.2.3 Overcharging Station/Pile - Market Layout (1)

2.2.4 Overcharging Station/Pile - Market Layout (2)

2.2.5 Li Auto-5C Overcharging Station

2.2.6 Geely Zeekr-800kW Charging V3 Overcharging Station

2.2.7 Sungrow Power Supply - 640kW Air Cooling Overcharging Pile IDC480/640 series

2.2.8 Huawei Full Liquid Cooling Overcharging Station

2.2.9 Overcharging System Requires Adjustment of High-voltage Fast Charging Battery, Vehicle, Charging Pile Industry Chain

2.3 Overcharging System - Liquid Cooling Overcharging

2.3.1 Definition and Classification

2.3.2 Ownership of Liquid Cooling Overcharging Station

2.3.3 Working Principle of Liquid Cooling Charging Pile

2.3.4 Cost Calculation of-Vehicle High Voltage and Liquid Cooling Charging Pile

2.3.5 Full Liquid Cooling Split DC Bus Architecture Overcharging System

2.3.6 Competition Landscape of Liquid Cooling Overcharging Station

2.3.7 Huawei Liquid Cooling Overcharging System Solution

2.3.8 Shenzhen Infypower/TELD New Energy

2.3.9 Liquid Cooling Overcharging-Charging Module

2.3.10 Liquid Cooling Charging Module (1)

2.3.11 Liquid Cooling Charging Module (2)

2.3.12 Liquid Cooling Overcharging - Liquid Cooled Charging Gun Lighter, Fast Charging

2.3.13 Liquid Cooling Overcharging Gun Line Products

2.3.14 Liquid Cooling Overcharging - Volvo Liquid Cooling Charging Gun

2.4 Overcharging System - Flexible Charging Stack

2.4.1 Overcharging System - Charging Stack Becomes Mainstream Solution

2.4.2 Overcharging System - Mainstream Flexible Charging Stack

2.4.3 Overcharging System - Full Liquid Cooling DC Charging Stack

2.4.4 Overcharging System-1200kW Flexible DC Charging Stack

2.4.5 Overcharging System - Electric Vehicle Flexible Charging Stack Product Parameters

2.5 Overcharging System - Overcharging Battery

2.5.1 Overcharging Battery - Systematic Group Standard (Latest)

2.5.2 Overcharging Battery - (1)

2.5.3 Overcharging Battery - (2)

2.5.4 Overcharging Battery - 4C Battery Application

2.5.5 4C Fast Charging Battery Summary

2.5.6 Main 4C Fast Charging Battery Products

2.5.7 SPS Soft Pack Power Battery System of Farasis Energy

2.5.8 4C Battery Shenxing Fast Charging Battery of CATL

2.5.9 Lithium Iron Phosphate Battery: BRIC Battery of Zeekr

2.5.10 5C-8C Fast Charging Battery List

2.6 Overcharging Battery - Large Cylindrical Battery

2.6.1 Square Battery VS Cylindrical Battery

2.6.2 Overcharging Battery Trends (1)

2.6.3 Overcharging Battery Trends (2)

2.6.4 Large Cylindrical Battery Mass Production Planning (1)

2.6.5 Large Cylindrical Battery Mass Production Planning (2)

2.6.6 Large Cylindrical Battery Loading Process

2.6.7 Tesla Large Cylindrical Battery

2.6.8 Omnicell Battery of EVE Battery: 6C Fast Charging Large Cylindrical Lithium Battery (1)

2.6.9 Omnicell Battery of EVE Battery: 6C Fast Charging Large Cylindrical Lithium Battery (2)

2.6.10 BAK Cylindrical Battery

2.7 Overcharging Battery Material - Anode Materials

2.7.1 Anode Material is the Decisive Factor for Improving Fast Charging Performance of Battery

2.7.2 Main Types of Anode Materials

2.7.3 Fast Charging Material and Process Upgrade of Overcharging Battery Anode Materials

2.7.4 Three Routes to Improve the Rate Performance of Overcharging Battery Anode Materials (1)

2.7.5 Three Routes to Improve the Rate Performance of Overcharging Battery Anode Materials (2)

2.7.6 Three Routes to Improve the Rate Performance of Overcharging Battery Anode Materials (3)

2.7.7 Structural Classification of Silicon-carbon Composites

2.7.8 Preparation Solution of Silicon-carbon Composites

2.7.9 China Lithium Battery Anode Materials - Market Share

2.7.10 Silicon-based Anode Material Layout (1)

2.7.11 Silicon-based Anode Material Layout (2)

2.7.12 Silicon-based Anode Material Layout (3)

2.7.13 Technology Innovation of Anode Materials

2.7.14 Silicon-based Anode Material of Shanghai Putailai New Energy

2.7.15 Case of Solid-state Battery Anode Material

2.8 Overcharging Battery Material - Other Materials

2.8.1 Conductive Agent

2.8.2 Electrolyte

2.8.3 Cathode Material

2.9 Overcharging System - 800V High Voltage Vehicle Architecture

2.9.1 800V High Voltage Vehicle Architecture has Become Mainstream Vehicle Solution for High-power Charging Technology

2.9.2 800V High Voltage Vehicle Architecture - Main Architecture Solution

2.9.3 800V High Voltage Vehicle Architecture - Vehicle Parts Upgrade

2.9.4 800V High Voltage Vehicle Architecture - Vehicle Parts Upgrade Selection

2.9.5 800V High Voltage Vehicle Architecture - Component Cost Analysis

2.9.6 Sales of 800V High Voltage Vehicle Models in China, 2023-2024

2.9.7 800V Platform Vehicle Application Market Size

2.9.8 Parameter List of 800V Models Sold in China, 2024 (1)

2.9.9 Parameter List of 800V Models Sold in China, 2024 (2)

2.9.10 800V Vehicle Architecture - Electric Drive Products/Technologies (1)

2.9.11 800V Vehicle Architecture - Electric Drive Products/Technologies (2)

2.9.12 800V Vehicle Architecture - Electric Drive Products/Technologies (3)

2.10 MCS MW Charging System for Medium and Heavy Commercial Vehicles

2.10.1 MCS MW Charging System

2.10.2 MCS MW Charging System-V2.4~ V3.2

2.10.3 MCS MW Charging - Industry Standard

2.10.4 MCS MW Charging - Hardware and Software Development, Verification Test

2.10.5 MCS MW Charging - On Board Example (1)

2.10.6 MCS MW Charging - On Board Example (2)

3 Low Power DC Technology and Market

3.1 Low Power DC Charging Technology

3.1.1 Low Power DC Charging - Technology Introduction

3.1.2 Low Power DC Charging - Alternative Scenarios

3.1.3 Low Power DC Charging - Key Components

3.2 Low Power DC Charging - Pile Terminal

3.2.1 Low Power DC Charging-Product Category

3.2.2 Low Power DC Charging Alternatives (1)

3.2.3 Low Power DC Charging Alternatives (2)

3.2.4 Low Power DC Charging - OEM Solution

3.2.5 Low Power DC Charging - Charging Operation

3.2.6 Low Power DC Charging-22KW V2G Solution

3.3 Low Power DC Charging - Vehicle Terminal

3.3.1 Low Power DC Charging - On-Board Charger (OBC) Introduction

3.3.2 Low Power DC Charging - Alternatives

3.3.3 Low Power DC Charging - OBC Disassembly Diagram (1)

3.3.4 Low Power DC Charging - OBC Disassembly Diagram (2)

3.3.5 Low Power DC Charging - De-OBC Process

3.3.6 Low Power DC Charging - Vehicle De-OBC Cost Analysis

3.3.7 Low Power DC Charging (1)

3.3.8 Low Power DC Charging (2)

3.3.9 Low Power DC Charging (3)

4 V2G/Vehicle Grid Interaction/Virtual Power Plant Technology and Market

4.1 Energy Structure Transformation Boosts Charging Infrastructure

4.1.1 impact of Charging and Swapping Infrastructure on Power Grid

4.1.2 Charging and Swapping Infrastructure Power Side- Overall Thinking of Carbon Asset Development Research

4.1.3 Charging and Swapping Infrastructure Power Side-Cost-Benefit Analysis of Vehicle Grid Integration

4.1.5 Charging and Swapping Infrastructure Power Side - Development Trend

4.2 G2V/V2G/V2H

4.2.1 G2V/V2G/V2H - Technical Principle

4.2.2 Research on Charging and Discharging Technology of V2X Electric Vehicle

4.2.3 V2G Technology Introduction

4.2.4 V2G Related Promotion Policies

4.2.5 Popularity of Charging Network Promotes Development of V2G Industry

4.2.6 V2G Technical Framework

4.2.7 Vehicle-Grid Coordination can Change Energy Loss and Peak Load of Disordered Charging

4.2.8 Large-scale Commercialization of V2G still Takes Time

4.2.9 V2G Pilot in China

4.2.10 Typical V2G Charging Station Application Project in China (1)

4.2.11 Typical V2G Charging Station Application Project in China (2)

4.2.12 V2G - Jiangsu Wuxi Vehicle Grid Interaction Demonstration Area

4.2.13 V2G Project Case - Shanghai Automotive Innovation Port V2G Pilot Project

4.2.14 V2G is still in Pilot Stage

4.3 Virtual Power Plant

4.3.1 Development Advantages

4.3.2 Positioning in the Energy Internet

4.3.3 Policy Promotion

4.3.4 Local Policy Implementation Plan

4.3.5 Market Potential

4.3.6 Development Planning

4.3.7 Key Participants and Benefit Analysis

4.3.8 Business Model Analysis

4.3.9 Domestic Main Management Platform Solution

4.3.10 Practice of Foreign Virtual Power Plant Projects

4.3.11 Layout of Major Participating Enterprises in China (1)

4.3.12 Layout of Major Participating Enterprises in China (2)

4.3.13 Case - Energy Storage + Virtual Power Plant Project

4.3.14 Operation Case of Virtual Power Plant + Power Station of Huaneng Zhejiang

4.3.15 Case -State Grid Shanghai Dispatching Virtual Power Plant

4.4 PV-Storage-Charging Integrated Station

4.4.1 PV-Storage-Charging Integrated Station Solution

4.4.2 Solution Advantages

4.4.3 Technical Standards

4.4.4 System Structure

4.4.5 Cost Analysis

4.4.6 Case Study

4.4.7 Shenzhen Overcharging-Public Institution: "PV- Storage-Overcharging V2G" Integrated Demonstration Station

5 Swapping Technology and Market

5.1 Swapping Mode - Policy Guidance

5.1.1 Swapping Mode - List of Policies and Standards

5.1.2 Ministry of Transport: Agree in principle that the State Power Investment Corporation will build a network and operate a demonstration pilot in Heavy Truck Swapping Stations

5.1.3 Swapping Mode - Application Pilot Promotion Goal

5.1.4 Swapping Mode - Standard Document

5.1.5 Swapping Mode - Shanghai Heavy Truck Swapping Group Standard Officially Released

5.2 Swapping Mode - Development Status and Trends

5.2.1 Swapping Mode Introduction and Classification

5.2.2 Comparison of Swapping Mode and Charging Mode and Development Trend Prospect

5.2.3 Development Environment of "Vehicle-Power Separation +Swapping Network" Model

5.2.4 Swapping Mode - Promotion Value Analysis

5.2.5 Swapping Mode - Energy Value Analysis

5.2.6 Swapping Model - Business Model Value Chain Splitting

5.2.7 Swapping Market Industry Chain

5.2.8 Swapping Mode - Business Model Analysis

5.2.9 Swapping Mode - Swapping Station Construction

5.2.10 Swapping Mode-Analysis of Enterprise Types in China Swapping Industry

5.2.11 Swapping Mode - Swapping Operators

5.3 Passenger Car Swapping

5.3.1 Main Swapping Technologies and Development Trends of Passenger Cars

5.3.2 Main Participants of Passenger Car Swapping

5.3.3 Number and Distribution of Swapping Stations in China

5.3.4 Passenger Car Swapping Business and Planning List (1)

5.3.5 Passenger Car Swapping Business and Planning List (2)

5.3.6 NIO fourth Generation Swapping Station Case

5.3.7 NIO & State Grid Bidirectional Swapping Station

5.4 Heavy Truck Swapping

5.4.1 Heavy Truck Model Classification

5.4.2 New Energy Penetration Rate of Heavy Truck industry is Low

5.4.3 Heavy Truck Swapping is the Best Way to Promote Electrification of Heavy Trucks

5.4.4 Heavy Truck Swapping Business Model

5.4.5 Heavy Truck Swapping Supply Chain/Value Chain

5.4.6 Heavy Truck Battery Concentration is High

5.4.7 Business Planning of Major Heavy Truck Swapping Operators (1)

5.4.8 Business Planning of Major Heavy Truck Swapping Operators (2)

5.4.9 Heavy Truck Swapping Station Case

5.4.10 Main Parts Matching for Major Heavy Truck Models

5.4.11 Charging and Swapping Business Case of Suzhou Harmontronics Automation

5.4.12 Swapping Ecological Business Case of Eurocrane

5.4.13 Swapping Station Case of Xuji Electric

5.4.14 Development Advantages of Swapping Heavy Truck

5.4.15 Large-scale Promotion of Swapping still has Great Challenges

6 Charging Infrastructure Operation Market

6.1 Market Analysis

6.1.1 Industry Status

6.1.2 Participant Classification

6.1.3 China Public Charging Stations - Sub-Operators

6.1.4 China Public Charging Pile - Number of Major Operators

6.2 Construction of Charging Stations

6.2.1 Related Construction Standards

6.2.2 Construction Process

6.2.3 Cost Analysis

6.2.4 Investment Cost Estimation and Income Forecast of Photovoltaic + Charging Pile Project

6.2.5 Pain Points and Solutions

6.3 Operation of Charging Stations

6.3.1 Profit Model

6.3.2 Third Party Companies Operate Charging Piles

6.3.3 Charging Station Construction and Operation Plan of Xiaofeng Charging

6.3.4 Overcharging Station Solution of Star Charge

6.3.5 Overcharging Station Energy Operation of Star Charge

6.4 Aggregate Charging Operation

6.4.1Charging Mode

6.4.2 Aggregate Charging Operators

6.4.3 First-tier Aggregate Charging Company VS Heavy Asset Operators

6.4.4 Profit Model of Aggregate Charging Operators

6.5 Operation of Highway Charging Stations

6.5.1 Development Status of Highway Charging Infrastructure in China

6.5.2 China Highway Charging Infrastructure by Region

6.5.3 China Highway Charging Infrastructure - Share of 750V/120kW and above DC Pile

6.5.4 China Highway Charging Infrastructure - National Policy

6.5.5 Highway Charging Stations Charging Charges

6.5.6 Highway Charging and Swapping Infrastructure - Operation Model

6.5.7 China Expressway Charging Pile - Solution (1)

6.5.8 China Expressway Charging Pile - Solution (2)

7 Charging Facilities Layout of Major OEMs

7.1 NIO

7.1.1 Charging and Swapping Infrastructure Layout

7.1.2 NIO Power (1)

7.1.3 NIO Power (2)

7.1.4 BaaS Model

7.1.5 1st/2nd/3rd/4th generation Swapping Stations

7.1.6 RGV Patented Swapping Platform

7.1.7 Charging and Swapping Network Layout

7.1.8 Ultra Fast Charging

7.1.9 V2G

7.1.10 Virtual Power Plant (1)

7.1.11 Virtual Power Plant (2)

7.1.12 V2G

7.1.13 Battery Operation System

7.1.14 Home Charging Piles

7.1.15 Charging Interoperability

7.2 XPeng Motors

7.2.1 Charging and Swapping Infrastructure Layout

7.2.2 Charging Network Operation

7.2.3 800kW Liquid Cooling S5 Overcharging Pile

7.2.4 S4 Overcharging Station

7.2.5 Self-operated Charging Station

7.2.6 Charging Facility Usage Process

7.2.7 Home Charging Service Solution

7.3 Li Auto

7.3.1 Charging Facilities Development

7.3.2 Overcharging Station

7.3.3 Charging Network

7.3.4 20kW DC Home Pile

7.3.5 Home Charging Pile

7.4 Tesla

7.4.1 Charging Facility Development

7.4.2 Overcharging Station Construction

7.4.3 Supercharger Stations Category

7.4.4 V4 Supercharger

7.4.5 PV-Storage-Charging integrated Overcharging Station

7.4.6 Mobile Charging and Automatic Charging Services

7.4.7 Home Charging Pile Service Solution

7.5 BYD/Denza

7.5.1 Charging Facilities Development

7.5.2 Global Intelligent Fast Charging Technology Cluster (1)

7.5.3 Global Intelligent Fast Charging Technology Cluster (2)

7.5.4 Denza-D9 Dual Charging Technology

7.5.5 Home Charging Pile

7.5.6 BYD Sea Lion 07 EV-800V + e Platform 3.0 EvO

7.6 SAIC Feifan

7.6.1 Vehicle Swapping Ecology

7.7 Avatr

7.7.1 High Voltage Fast Charging Station

7.8 BAIC/ArcFox

7.8.1 BAIC New Energy Swapping Station Layout

7.8.2 BAIC ArcFox Charging Network Construction

7.8.3 BAIC ArcFox Overcharging Station

7.8.4 BAIC New Energy Private Charging Service

7.9 GAC Aion

7.9.1 Charging Facilities Development

7.9.2 Power Supply Network

7.9.3 Overcharging Station (1)

7.9.4 Overcharging Station (2)

7.10 Geely/Zeekr

7.10.1 Charging Facilities Development

7.10.2 Charging Network Layout

7.10.3 Zeekr V3 Overcharging Station

7.10.4 Swapping Service

7.10.5Wireless Charging Service

7.10.6 Home Charging Pile

7.11 IM

7.11.1 Charging Facilities Development

7.11.2 Public Charging Network

7.11.3 Fast Charging Station

7.11.4 Wireless Charging

7.11.5 Home Charging Pile (1)

7.11.6 Home Charging Pile (2)

7.12 Voyah

7.12.1 VOYAH POWER Six-in-One Charging Service

7.12.2 Charging Network

7.12.3 Overcharging Technology

7.12.4 800V Platform

7.12.5 Home Charging Pile

7.13 Leapmotor

7.13.1 800V Fast Charging

7.14 Neta

7.14.1 Public Charging Network

7.14.2 V2G Vehicle Grid Smart Energy Demonstration Project

7.14.3 7kW/20kW Home Charging Pile

7.15 Xiaomi Auto

7.15.1 Liquid Cooling Overcharging

7.15.2 Home Charging Pile

7.16 Lotus

7.16.1 Overcharging Network

7.16.2 Flash Charging Robot

7.16.3 PV-Storage-Charging Integrated Station

7.16.4 Home Charging Pile

7.17 Volvo

7.17.1 Two-way Charging

7.17.2 Wireless Charging

7.17.3 Mobile Charging Unit

7.18 Volkswagen

7.18.1 Charging Facilities Development

7.18.2 Charging Facilities Layout in China

7.18.3 High Power Charging System

7.18.4 V1G orderly Charging

7.18.5 Robot Automatic Charging

7.18.6 Home Charging Pile

7.18.7 Charging Service Layout in Overseas Countries

7.19 BMW

7.19.1 Charging Network Layout

7.19.2 600kW High Power Charging Pile Layout

7.19.3 Private Charging Pile

7.20 Summary of Charging Pile Construction of Major OEMs

7.20.1 Layout of Charging Piles of Major OEMs

7.20.2 Construction of Overcharging Piles of Major OEMs

7.20.3 Comparison of Home Charging Infrastructure Installation of Major OEMs

7.20.4 Installation Process of Home Charging Pile for Vehicle Accessories of Major OEMs

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...