Research on automotive smart glass: How does glass intelligence evolve

ResearchInChina has released the Automotive Smart Glass Research Report 2024. The report details the latest advances in dimming glass and glass antenna technologies in automotive smart glass, analyzes typical vehicle models, summarizes the layout and market share of suppliers, and predicts future development trends.

As an important part of automotive intelligent technology, automotive smart glass (including dimming glass, glass antennas, window intelligent information displays and touch-responsive glass) is gradually changing people's riding experience. As per the installation of automotive smart glass, the Automotive Smart Glass Research Report 2024 focuses on "smart dimming glass” and "glass antennas".

1.The increase in panoramic canopy installations drives higher demand for smart dimming glass

Driven by the demand for vertical space utilization of new energy vehicles and consumer demand for better cockpit experience, the panoramic canopy market is growing rapidly In the first half of 2024, 1.16 million passenger cars in China were equipped with panoramic canopies, representing a 6.5% increase compared to the same period last year and accounting for 12.0%.

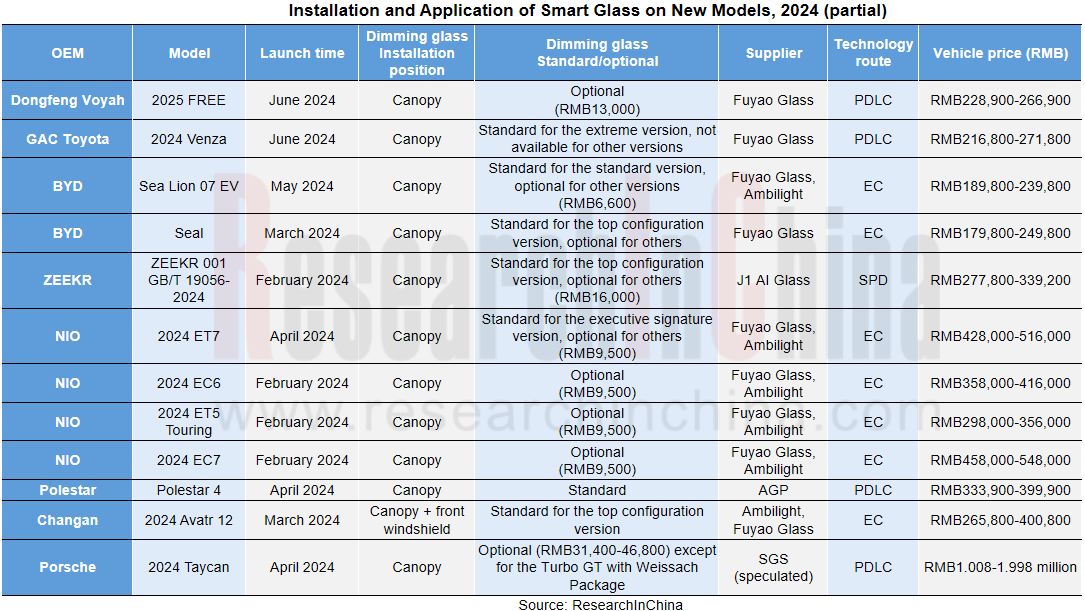

Against this background, the widespread application of panoramic canopies has encountered a severe challenge - dimming and heat insulation. With its unique advantages, smart dimming glass can meet the rigid market demand. More and more OEMs are offering smart dimming glass as a high-end or optional feature when launching models equipped with panoramic canopies, aiming to provide consumers with a more flexible, comfortable and energy-saving riding environment.

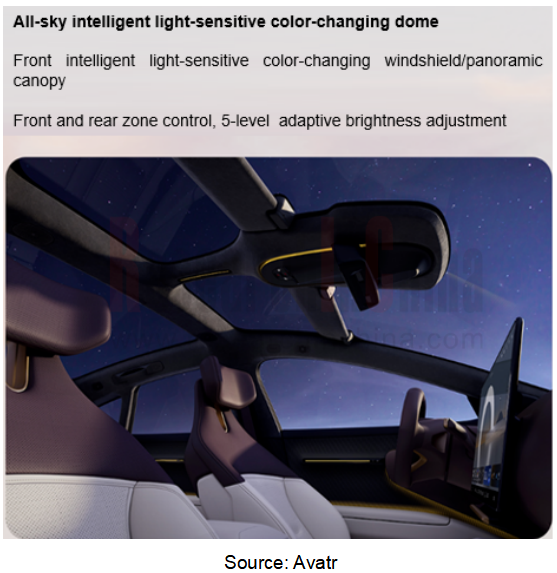

Case 1: Avatr 12 is equipped with a front intelligent light-sensitive color-changing windshield and an intelligent light-sensitive panoramic canopy

The top configuration version of Avatr 12 is equipped with an intelligent light-sensitive front windshield and an intelligent light-sensitive panoramic canopy, which can effectively block the sun, insulate heat and protect privacy while ensuring an ultra-wide field of view. Among them, the intelligent light-sensitive color-changing front windshield uses 5-layer laminated glass with adaptive light-sensitive function, with a lighting area of up to 2.57 square meters, low energy transmittance and strong ultraviolet defense; the intelligent light-sensitive panoramic canopy uses 7-layer laminated canopy, which supports Zone control enables full color change within 90 seconds. The 7-layer laminated intelligent light-sensitive panoramic canopy supports zonal control, and changes color within 90 seconds.

Case 2: NIO ET7 is equipped with a zoned smart dimming panoramic canopy

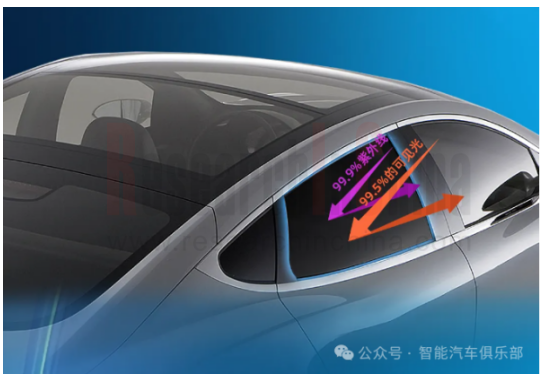

The 2024 ET7 executive signature version is equipped with a zoned smart dimming panoramic canopy, which uses EC light sensing technology to intelligently perceive ambient light, actively adjust shading, provide sun protection and heat insulation, and protect privacy. It can adjust the front and rear of the canopy separately. It supports four levels of independent adjustment for the front and rear zones, and can block 99.9% of ultraviolet rays and 86.3% of heat.

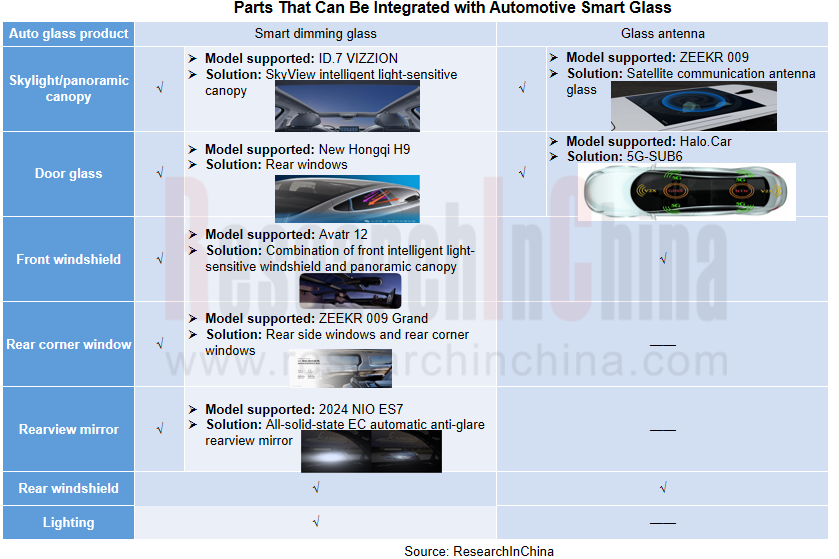

2. The application of automotive smart glass is accelerating and expanding from sunroofs to all auto parts.

At present, smart dimming glass is mainly used in automotive sunroofs/canopies. As the technology matures, dimming glass has gradually been integrated into core parts such as door glass, rear corner windows, front/rear windshields, etc.; and glass antenna technology has also been applied to sunroofs, front windshields, door glass, etc., demonstrating its versatility and high integration.

Case 1: The rear windows of the new Hongqi H9 feature stepless dimming

The new Hongqi H9 equipped with stepless LC dimming glass supports wide temperature intelligent dimming from -20℃ to 85℃ and can block 99.9% of ultraviolet rays and 99.5% of visible light. After the dimming function is turned on, the brightness of the left/right windows can be manually adjusted and the brightness can be stored. In addition, LC dimming glass offers ultimate privacy, ensuring that no one outside the car can peek into the car, while the view inside the car is unobstructed. It surpasses traditional gray glass to perfectly protect privacy even when the screen is always on at night.

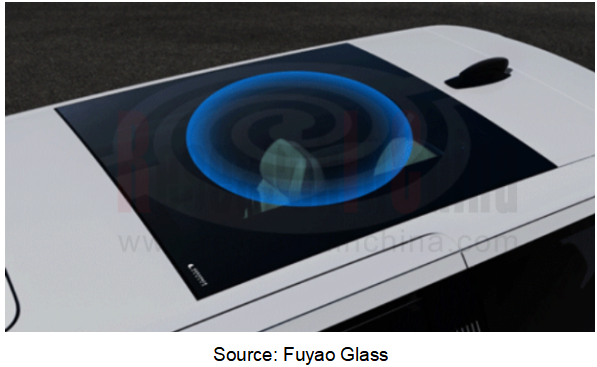

Case 2: ZEEKR 009 installs satellite communication antenna glass on the sunroof

The antenna is integrated into the sunroof of ZEEKR 009 through metal coating technology, which not only achieves heat insulation and sun protection, but also enables high-precision automotive satellite communication. In emergency situations, such as when the ground network is damaged, the vehicle can autonomously alarm through the satellite antenna.

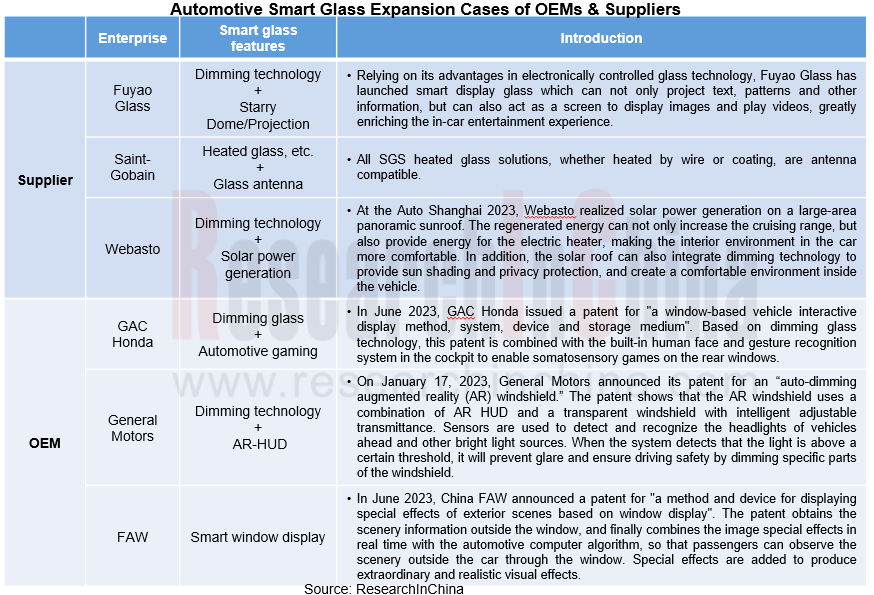

3. How do OEMs and suppliers expand intelligent glass?

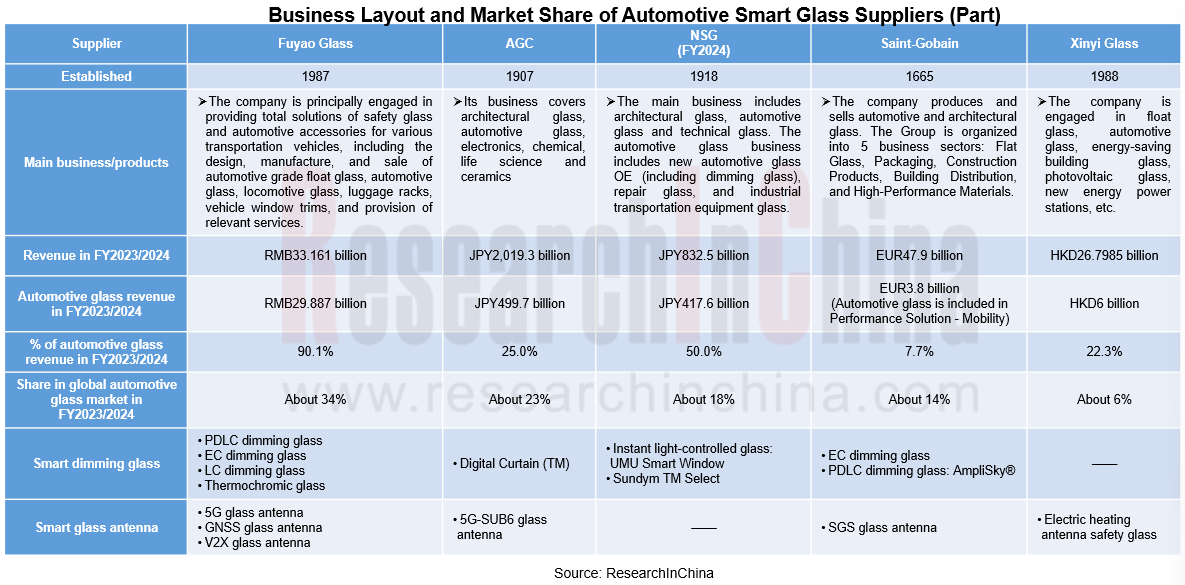

The global automotive glass market is highly concentrated, with four leading companies accounting for approximately 90% of the market. According to public information, China-based Fuyao Glass ranked first with about 34% market share in 2023, followed by AGC with 23%, NSG with 18% (in FY2024) and Saint-Gobain with 14%.

With the accelerated development of automotive intelligence and connectivity, the manufacturing and research and development of automotive smart glass which is a core component of the vehicle is no longer limited to glass suppliers. OEMs are also actively involved, forming an ecosystem in which suppliers and OEMs participate. In this ecosystem, suppliers leverage their excellent manufacturing capabilities and professional technologies to produce high-performance smart glass products; OEMs vigorously join in the research and development process, gain insights into changes in market demand, and meet users' growing demand for personalization and customization, further broadening the application scope of automotive smart glass.

Case 1: Fuyao’s panoramic canopies feature starry domes and projection functions

The starry dome can be customized with patterns and create a romantic atmosphere with gorgeous lights. The projection canopy can display high-definition images in full color, forging an exclusive "private cinema" in the cockpit.

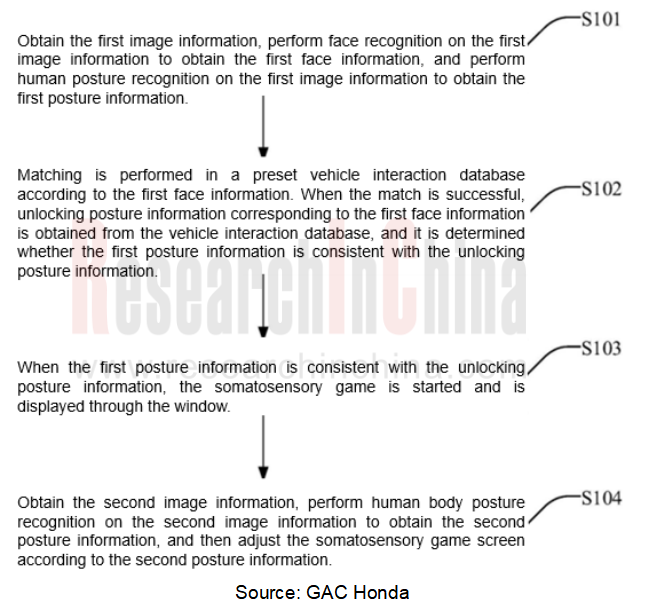

Case 2: GAC Honda enables immersive somatosensory games on rear windows based on dimming glass technology

The window interactive display patent disclosed by GAC Honda in June 2023 uses double-layer dimming glass and double-sided OLED screen technology. Combined with the in-cockpit human recognition system, it brings an unprecedented immersive somatosensory gaming experience to rear passengers, significantly improving the interactivity and entertainment in the car.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...