New Energy Vehicle Electric Drive and Power Domain industry Report, 2024

OEMs lead the integrated development of "3 + 3 + X platform", and the self-production rate continues to increase

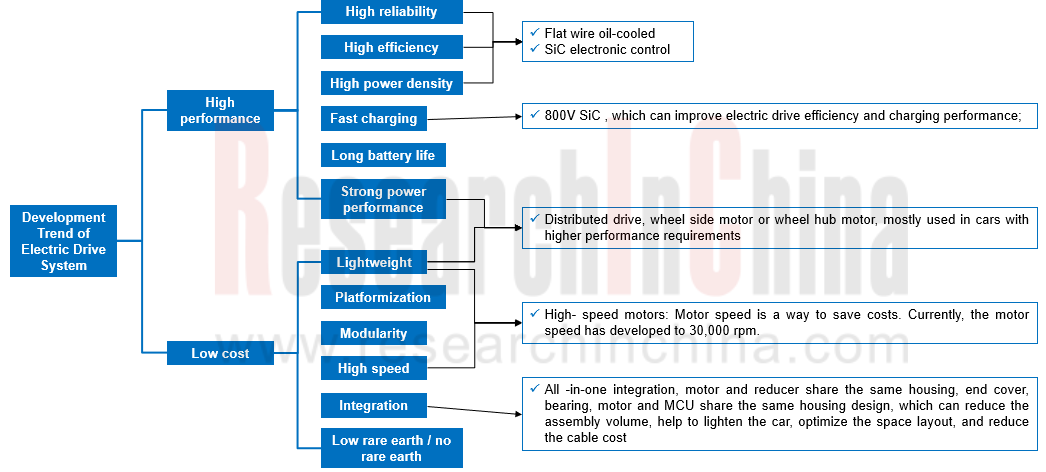

The electric drive system is developing around technical directions of high integration, high efficiency, high power density, high cost performance, high reliability, low noise, etc. High performance and low cost are the eternal themes, and technologies such as high speed/torque, oil cooling, flat wire motor, 800V high voltage, SiC power module, and all-in-one physical/system integration are developing rapidly.

The research framework of this report includes:

Source: ResearchInChina

Electric drive assembly: Development towards all-in-one integration and dual-motor distributed drive

Electric drive assembly application trend: OEMs lead the integrated development of the "3+3+X platform", and the self-production rate continues to increase

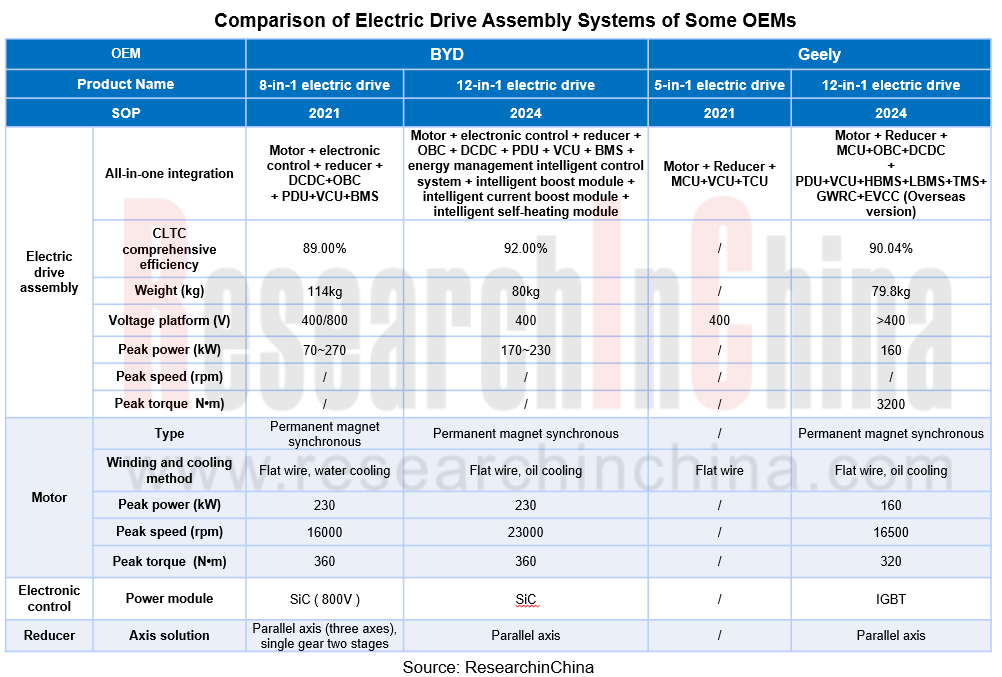

Based on requirements of the vehicle, OEMs are pursuing the volume, cost and weight of electric drive assembly more and more, which coincides with advantages of the all-in-one integrated solution. At present, OEMs are constantly increasing their efforts to develop their own all-in-one electric drive systems, and are no longer satisfied with "six-in-one" or "eight-in-one" products, but are constantly improving the level of integration. Currently, the most integrated electric drive in the industry is "twelve-in-one" electric drive, with BYD and Geely as typical representatives.

In May 2024, BYD released the e-platform 3.0 Evo, which pioneered the twelve-in-one intelligent electric drive system. This electric drive consists of previous eight-in-one plus four functional modules, namely, it integrates the motor, electronic control, reducer, OBC, DCDC, PDU, VCU, BMS, energy management intelligent control system, intelligent boost module, intelligent current boost module, and intelligent self-heating module. It was first launched on Sea Lion 07EV.

The integration concept of BYD's twelve-in-one electric drive system is to improve system efficiency and reliability. By optimizing energy management strategies, reducing losses during energy conversion, and strengthening thermal management effects, vehicle performance and range can be improved.

In April 2024, Geely Galaxy released an eleven-in-one intelligent electric drive at the Beijing Auto Show, which integrates 11 components including motor, electric control, reducer, VCU, HBMS, LBMS, OBC, DCDC, PDU, TMS, GWRC (intelligent anti-skid control), etc. the overseas version is a twelve-in-one electric drive, which integrates EVCC (global charging protocol conversion) on the basis of eleven-in-one electric drive.

The integration concept of Geely's twelve-in-one electric drive is cross-domain integration, which deeply integrates functions of power domain and chassis domain to achieve more precise vehicle control. on the basis of conventional electric drive and charging & distribution systems, special components such as thermal management integration module, low-voltage BMS and GWRC are added. Among them, the thermal management integration module unifies heat pump and PTC control, which is actually a large integration of powertrain on the small integration of thermal management control; low-voltage BMS conforms to the trend of low-voltage lithium electrification, shares chip resources with high-voltage BMS, and realizes the intelligent charging of vehicle battery; and the integration of GWRC technology allows Geely to complete the partial integration of power domain and chassis domain. in the cross-domain stage, power domain and chassis domain are integrated to jointly undertake the control related to vehicle movement, such as torque output of the power system and braking control of the chassis system. More precise vehicle control can be achieved.

From the perspective of all-electric drive assembly, all-in-one has become the future development trend. the development route of all-in-one electric drive is a process from independent distribution to high integration, and the powertrain will evolve towards the "3+3+X platform".

"3+3+X" is a structural framework for the integration of electric drive systems for new energy vehicles:

The first "3" represents the integration of motor, motor controller and reducer, that is, the electric drive three-in-one;

The second "3" represents the integration of OBC, PDU, and DCDC, that is, power integration; the integration of electric drive three-in-one and charging & distribution three-in-one lays the foundation for integration of electric drive three-in-one;

"X" refers to the integration of specific product components such as vehicle control unit (VCU), BMS, 48V DCDC, thermal management controller, or the integration of functions such as boost and pulse heating. This part has not yet been clearly defined. X also provides greater expansion space for further integration of later electric drives.

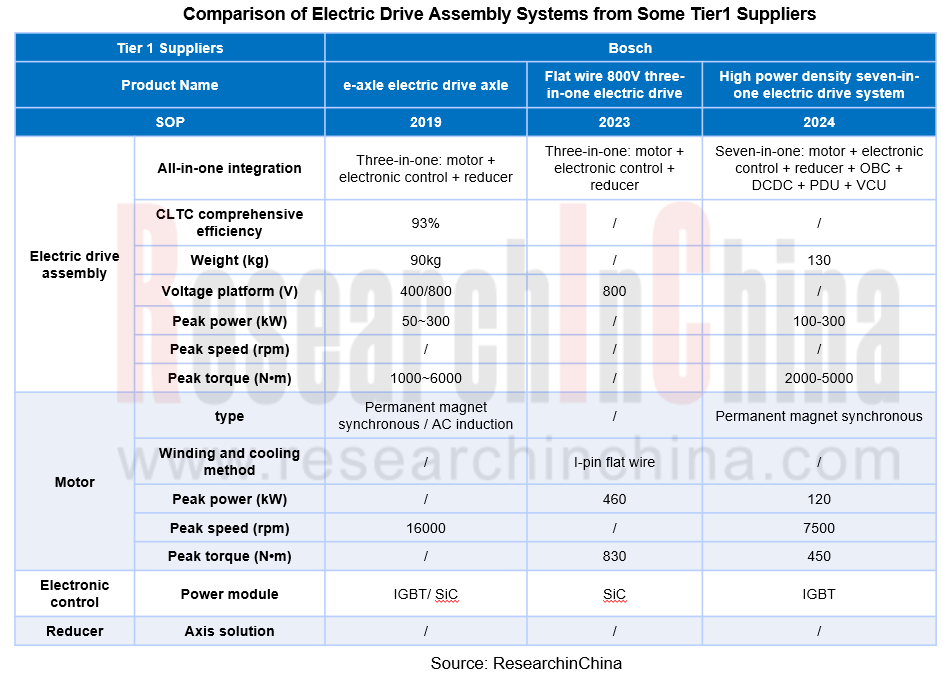

Compared with the highly integrated solutions led by OEMs, it is difficult for independent third-party Tier 1 suppliers to simultaneously develop product lines such as electric drive, on-board power supply, thermal management, and vehicle control. therefore, they tend to launch "six-in-one" and "seven-in-one" products and strengthen the expansion and R&D of related product lines.

Electric drive assembly application trends: OEMs accelerate the development of multi-motor distributed wheel-side drive systems

Distributed drive has characteristics of high efficiency, low energy consumption and low using cost, which can further reduce the weight of powertrain system and meet the lightweight requirements. in addition, this drive mode also has advantages of short transmission chain, compact structure, improved tire adhesion distribution and driving efficiency, which can make the driving/braking torque of each wheel independently controllable and provide flexible power distribution for the vehicle.

The two important technical routes of distributed drive are wheel-side motor and hub motor. Dongfeng is the representative of passenger car hub motor, and BYD is the representative of wheel-side motor. At present, passenger cars driven by wheel-side motors have been launched, but the large-scale mass production application of hub motors in passenger cars is not yet mature. in order to better match the application, most new energy passenger cars on the market use a centrally integrated dual-motor drive system, but due to the impact of cost, dual motors are currently mainly installed on high-end off-road and luxury brand models.

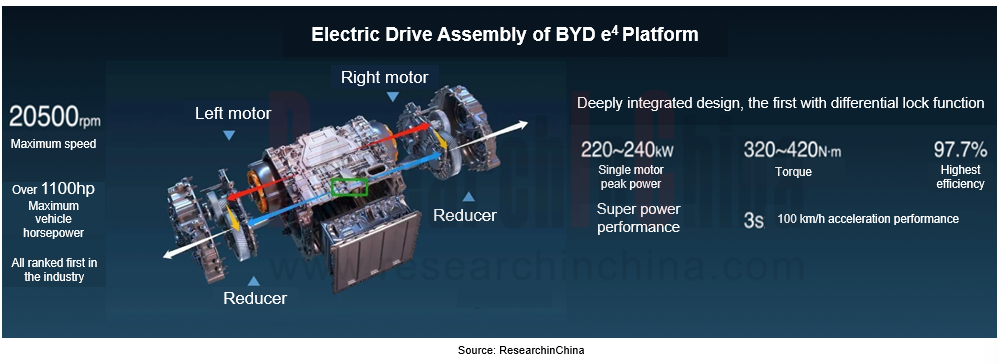

Take BYD's e4 platform as an example. the platform is independently developed based on BYD's mature wheel-side motor technology, which can realize four-motor independent drive, deep vehicle fusion perception, and body stability vector control. the electric drive assembly system equipped with e4 platform integrates two sets of motors, motor controllers, and reducers, respectively. Motors and reducers are arranged in parallel, and a half shaft extends from each of the two sets of reducers to connect and control the left and right wheels. the maximum horsepower can exceed 1,100 horsepower and the maximum speed can reach 20,500 rpm. Meanwhile, all models of the e4 technology platform are equipped with an 800V high-voltage SiC electronic control system as standard, with a maximum efficiency of 99.5%.

The core steering system + braking system of e4 Platform are integrated into the powertrain, using four wheel-side motors to control the speed and torque of each wheel respectively, thus realizing the functions of "brake system" and "steering system".

Drive motor: Developing towards high speed, flat wire oil cooling, less rare earth/no rare earth

Main development lines of new energy vehicle drive motors are also lightweight, low cost, and high efficiency. Focusing on these three development lines, drive motors are developing towards high speed, flat wire oil-cooled motors, and rare earth-free motors.

Drive motor application trend: high speed

The development of high speed can make the motor smaller and lighter, and can also make the vehicle consume less energy, have a longer range, accelerate faster, and have a higher speed. These are all important dimensions for improving the experience of new energy vehicles, and are also important reasons why major OEMs are scrambling to develop higher speed motors.

Meanwhile, high speed has put forward higher requirements on the design of motors. Bearing selection, motor heat dissipation, shaft material, stator and rotor silicon steel sheet material, electromagnetic simulation, mechanical strength simulation, thermal simulation, tolerance calculation and matching, etc. have become more challenging.

At present, most high-speed motors have a speed range of 18,000-22,000 rpm and a power range of 200-300 kW. Starting in 2023, Chinese OEMs will begin to launch a number of cars equipped with motors with speeds above 20,000rpm. OEMs represented by Huawei, Xiaomi, and GAC are seeking to break through the new physical limits of high-speed motors. Xiaomi's latest V8s motor has a maximum speed of 27,200 rpm and is expected to be installed in vehicles in 2025.

Take the Xiaomi V8s motor as an example: Xiaomi has created a super motor V8s based on a breakthrough in rotor materials, with a maximum speed of 27,200 rpm. Achieving a high speed is only the first step. to make the motor work stably at a high speed, more technical difficulties need to be overcome, such as heat dissipation and efficiency.

In terms of heat dissipation: Xiaomi V8s motor adopts two-way full oil cooling and S-shaped three-dimensional oil circuit design. the stator part uses a double-circulation three-dimensional oil circuit to increase the heat dissipation area by 100%. Meanwhile, stator silicon steel sheets are stacked in an offset manner to increase the contact area with the oil and make the heat conduction more sufficient; the rotor part uses an S-shaped oil circuit, and the shaft and iron core are cooled synchronously, which increases the heat dissipation area by 50%, and the maximum temperature of rotor is reduced by 30°C.

In terms of reducing losses, the stator uses 0.2mm silicon steel sheets. Iron loss of the stator accounts for more than 70% of total iron loss of the motor. the stator uses thin silicon steel sheets to reduce motor losses and improve efficiency.

In terms of improving strength, motor rotor uses high-strength special silicon steel sheets with a tensile strength of 960MPa and a thickness of 0.35mm to prevent the rotor magnetic bridge from breaking under high speed conditions.

The rotor magnetic bridge of Xiaomi V8s motor has also been optimized. the width of magnetic bridge between the large V magnets has reached 3mm, and the thickness of magnetic bridge at outer circle has reached 1.5mm. as the width of magnetic bridge increases, the leakage magnetic flux also becomes larger, so thicker magnets are needed to increase the magnetic potential.

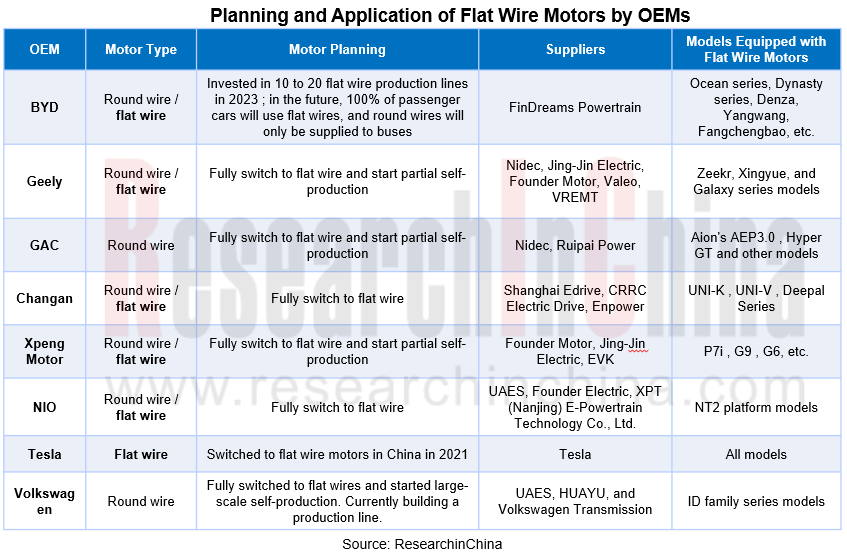

Drive motor application trend: flat wire oil-cooled motor

Flat wire motors have advantages of small size, light weight, high efficiency, and good heat dissipation performance. they are an important technical route for achieving lightweight and miniaturization of electric drive systems for new energy vehicles. today, the cost of power batteries for new energy vehicles remains high. Flat wire motors are gradually entering the industry's vision as a new direction for cost reduction. the gaps between flat wires are much tighter than those between round wires, and they have a higher slot fill rate and power density, which can improve motor efficiency. in addition, motor technology innovation is closely related to the development of process materials, and new windings can rapidly improve motor performance.

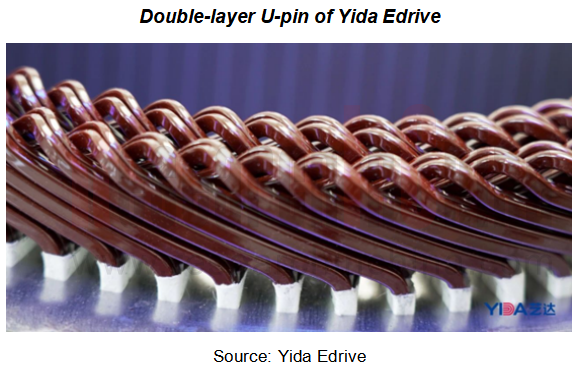

In order to further improve the efficiency or performance of the motor, a number of innovative winding processes have emerged in the industry based on flat wire windings, such as the X-pin of UAES/BorgWarner/GAC Aion, the braided wave winding of ZF, the N-Pin of Shanghai Edrive, the double-layer U-pin of Yida Edrive, and the Umini-pin of Huayu Automotive Electric Drive.

In terms of production technology, Yida Electric Drive's 8-layer winding motor adopts U-Pin double-layer technology. the winding end structure is compact, and there is a very small air gap between conductors to facilitate heat dissipation. Compared with common flat wire U-Pin process, the height of winding end and the size of motor are further reduced. However, the U-Pin double-layer technology has high process requirements and is difficult to manufacture, requiring strong production equipment and R&D technical support.

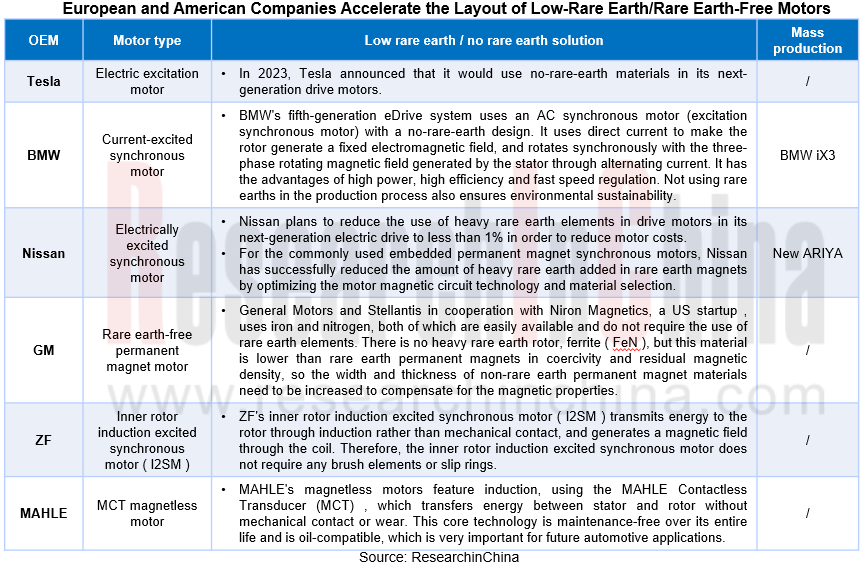

Drive motor application trends: European and American companies accelerate the layout of low-rare earth/rare earth-free motors

Current major application types of new energy vehicle drive motors are permanent magnet synchronous motors and asynchronous AC motors. Among them, permanent magnet synchronous motors occupy more than 95% of entire new energy market due to their advantages such as high efficiency, small size, and high power-density. the core material of permanent magnet synchronous motors is rare earth, and due to the limited rare earth resources and other reasons, the cost of rare earth permanent magnet synchronous motors is high, so reducing the use of rare earth or completely replacing it with other lower-priced materials has become one of the ideas for the industry to reduce costs and increase efficiency.

OEMs are interested in rare earth-free motors not only to reduce costs and improve efficiency, but also to avoid the risk of rare earth material monopoly, especially European and American companies. China is a country with abundant rare earth resources, which is exactly what foreign OEMs are worried about. the US Department of Energy began to organize the development of light rare earth or rare earth-free motors a few years ago. Currently, rare earth-free motors have become a hot spot for overseas car competition.

At present, application of electric excitation motors is mainly concentrated in overseas companies, such as Renault, BMW, Tesla, Nissan and other OEMs. in 2023, Tesla announced that its next-generation permanent magnet motors will no longer use rare earth materials. In addition to Tesla, many global car brands are also developing motors that do not contain rare earths. For example, General Motors and Stellantis are also planning to develop a new generation of rare earth-free permanent magnet motors. the goal of Mercedes' next-generation MMA EV platform is to completely abandon heavy rare earths.

Under the influence of OEMs, companies in the industry chain are also actively planning product routes. Suppliers such as Valeo, BorgWarner, Mach, and Vitesco have also launched electric excitation motors. Japanese company Proterial (formerly Hitachi Metals) has trial-produced permanent magnet motors that do not contain the rare earth element neodymium, and plans to commercialize them by 2035; ZF has also developed a zero-rare-earth magnet-free motor "2SM". Although China has an advantage in rare earth resources, there are still many Chinese companies including BYD, Huawei, Quanten Technologies, InfiMotion Technology, and Santroll Electric that are also making relevant layouts for EESM.

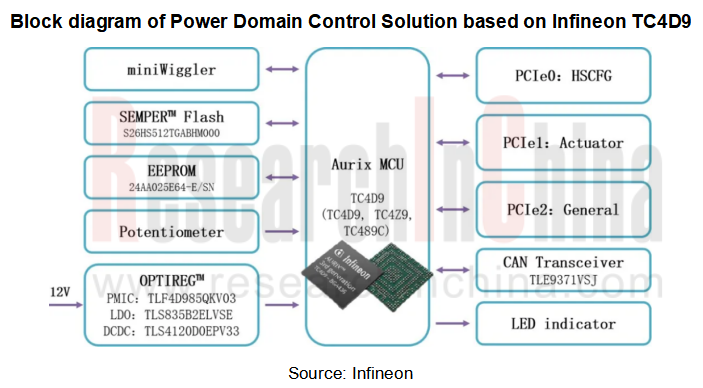

Power domain: Use multi-core high-performance MCU chips to meet cross-domain integration needs

The powertrain control system of new energy vehicles is evolving from vehicle controller VCU to power domain controller PDCU, power chassis cross-domain fusion controller, and central computer. Its main control chip will also move from 32-bit MCU to a heterogeneous SoC integrating "CPU+XPU" to support hardware acceleration requirements in various scenarios.

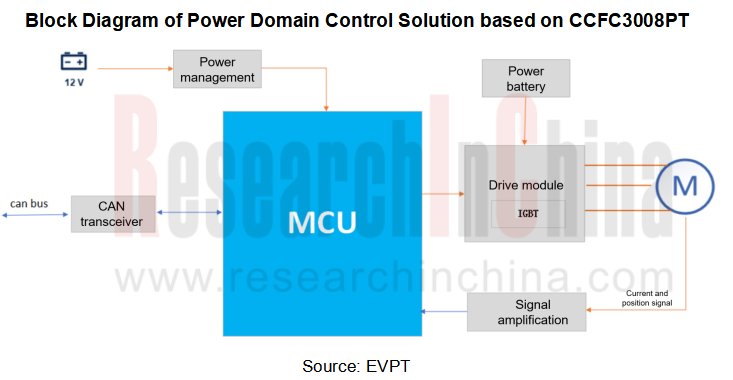

Early all-in-one controllers were physically integrated (single board, multiple chips). By simplifying connections and sharing shells to reduce costs and weight, control modules such as VCU, BMS, and motor controllers were integrated on one PCB board, which still had multiple controllers, and multiple MCUs each controlled some components, and were physically connected by multiple wiring harnesses and interfaces. in the power domain control stage, control modules such as VCU, BMS, and motor controllers will realize chip integration (single board, single chip). All control modules share a master MCU. A controller, a single-chip MCU, and a set of algorithms are used on one PCB board to directly control electric motor/control/battery components.

The power domain has lower requirements for AI computing power but higher requirements for safety, so it needs an MCU chip with more powerful performance and resources as its master chip. the master chip of power domain control generally adopts an ASIL-D level 32-bit MCU chip, equipped with a power supply that meets functional safety, and a simple safety monitoring MCU. the power domain MCU mainly emphasizes low-power design, real-time control, and ASIL-D level functional safety.

At present, the core automotive-grade MCU related to control in the power domain market is still dominated by overseas chip giants such as STMicroelectronics, NXP, and Infineon. the application of Chinese chip vendors in power domain market is concentrated on basic applications in the power domain such as motor control, engine control, and BMS.

NXP's S32E processor is suitable for electric vehicle control and intelligent actuation systems. the S32E series provides real-time processing capabilities, mainly for low-latency, high-real-time applications, including braking, hybrid control, functional safety, chassis, power domain controllers, etc. This series of chips uses a 16nm process to meet L3~L4 functions, while the next generation of planned products will use a 5nm process, targeting more advanced L4~L5 autonomous driving function system requirements. in addition, the S32E series processors also provide additional functions (5V analog and I/O with complex timers) to support drive applications.

Infineon's AURIX? TC4xx series MCUs can solve range anxiety, charging speed and x-in-1 system cost issues in new energy vehicles, and promote the development of cutting-edge applications such as e-Mobility, ADAS, EEA and AI.

In terms of domestically produced chips, EVPT VCU5000 series controller selected CCore Technology MCU—CCFC3008PT.