Automotive cloud services: AI foundation model and NOA expand cloud demand, deep integration of cloud platform tool chain

In 2024, as the penetration rate of intelligent connected vehicles continues to increase, the development of automotive cloud services will show the following trends:

AI foundation model and NOA installed in vehicles expand the demand for automotive cloud services

AI foundation model and NOA installed in vehicles expand the demand for automotive cloud services

Deep integration of cloud platform tool chain

Deep integration of cloud platform tool chain

Cloud native further changes the way automotive software is developed

Cloud native further changes the way automotive software is developed

Terminal-cloud integration

Terminal-cloud integration

Cloud infrastructure resources are further in short supply, and cloud vendors are increasing their investment costs

Cloud infrastructure resources are further in short supply, and cloud vendors are increasing their investment costs

......

......

1. AI foundation model and NOA installed in vehicles expand the demand for automotive cloud services

In 2024, after experiencing a price war, OEMs’ cost reduction has become a focus, the pace of business cloudification has slowed down, and the demand for cloud has declined; but with the mass production of NOA and the installation of cloud-based AI foundation models in vehicles, the demand for automotive cloud services has increased instead of decreased.

AI foundation model and NOA installed in vehicles have the following requirements for cloud services:

1.Hardware infrastructure: The operation of AI foundation model/NOA requires a lot of computing power. In addition to placing higher demands on the performance and number of cloud servers, it also tests the network performance of server facilities.

2.Software solution:

AI foundation model: As of September 2024, the foundation model installed in domestic mass-produced models mainly adopts cloud-based deployment. Some emerging OEMs (such as NIO/ Xpeng Motors/Li Auto) adopt terminal-cloud integration deployment, in which complex functional modes still need to call cloud-based models to complete.

AI foundation model: As of September 2024, the foundation model installed in domestic mass-produced models mainly adopts cloud-based deployment. Some emerging OEMs (such as NIO/ Xpeng Motors/Li Auto) adopt terminal-cloud integration deployment, in which complex functional modes still need to call cloud-based models to complete.

After the foundation model was installed in vehicles, the frequency of user interactions increased, from a few interaction requests per day to dozens or even hundreds of interaction requests per day, which led to an increase in demand for cloud services.

After the foundation model was installed in vehicles, the frequency of user interactions increased, from a few interaction requests per day to dozens or even hundreds of interaction requests per day, which led to an increase in demand for cloud services.

NOA: NOA’s installation volume has surged significantly, and the frequency of use has also increased, which has led to an increase in the amount of data processed and stored, an increase in the demand for cloud services, and an increase in the supporting tool chain.

NOA: NOA’s installation volume has surged significantly, and the frequency of use has also increased, which has led to an increase in the amount of data processed and stored, an increase in the demand for cloud services, and an increase in the supporting tool chain.

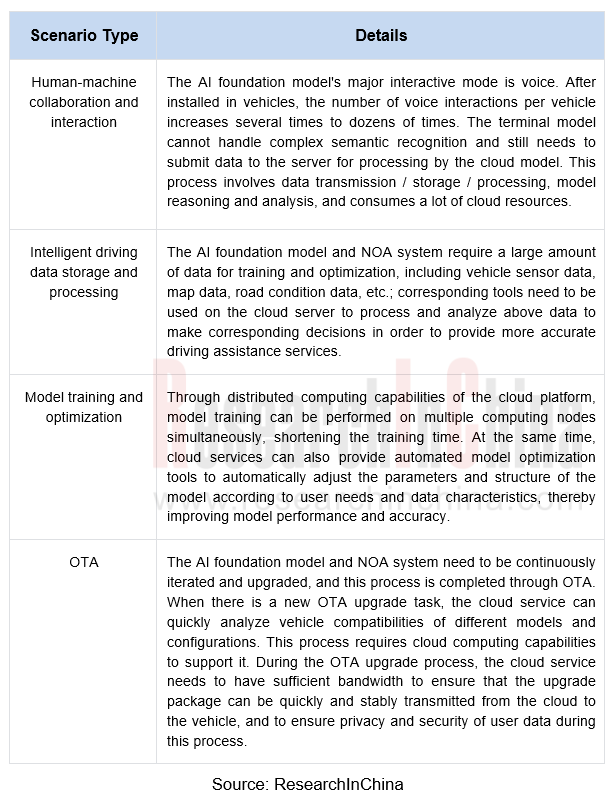

After the AI foundation model and NOA are installed in vehicles, the demand for cloud services in some key scenarios is as follows:

In 2024, Alibaba Cloud provides Momenta with stable and flexible cloud-native computing resources to build automated closed-loop data. The solution supports an end-to-end technical framework, covers visual perception AI capabilities, and can promote large-scale deployment and application of intelligent driving solutions. Momenta uses Spot cases to achieve high cost- effectiveness based on the elasticity of Alibaba Cloud ESS&HPA mechanisms.

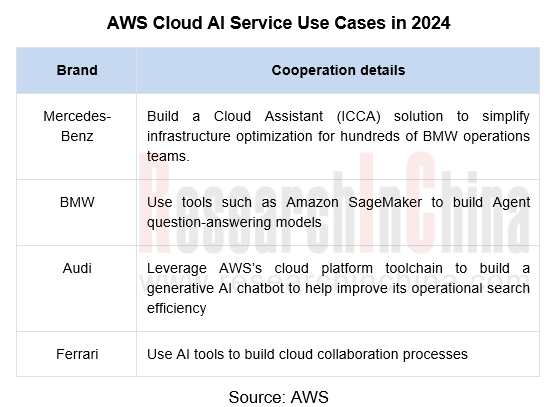

In the same year, AWS cooperates with international brands such as Mercedes-Benz and BMW to build AI assistants through cloud platform tool chain to improve operational efficiency.

2. Deep Integration of cloud platform tool chain

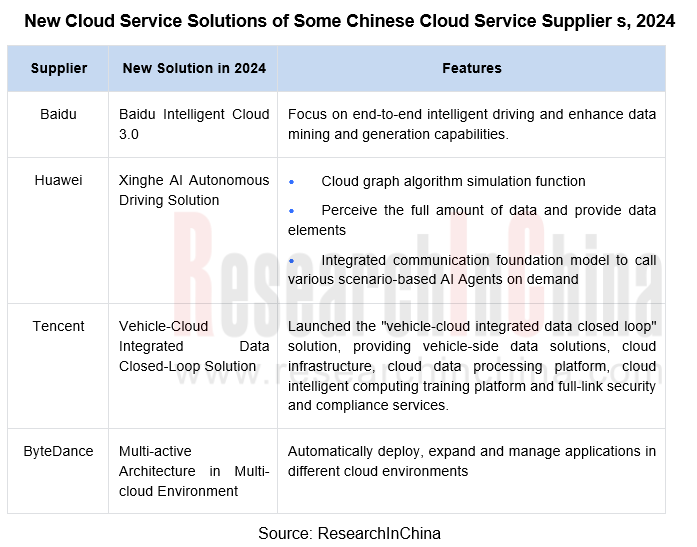

In 2024, automotive cloud service solutions will further develop in the direction of deep integration, realizing data integration and intelligent decision support for the entire chain from design and development to production management, supply chain optimization, marketing promotion and even after-sales service. New solutions of cloud vendors reflect characteristics of deep functional integration and perfect tool chain:

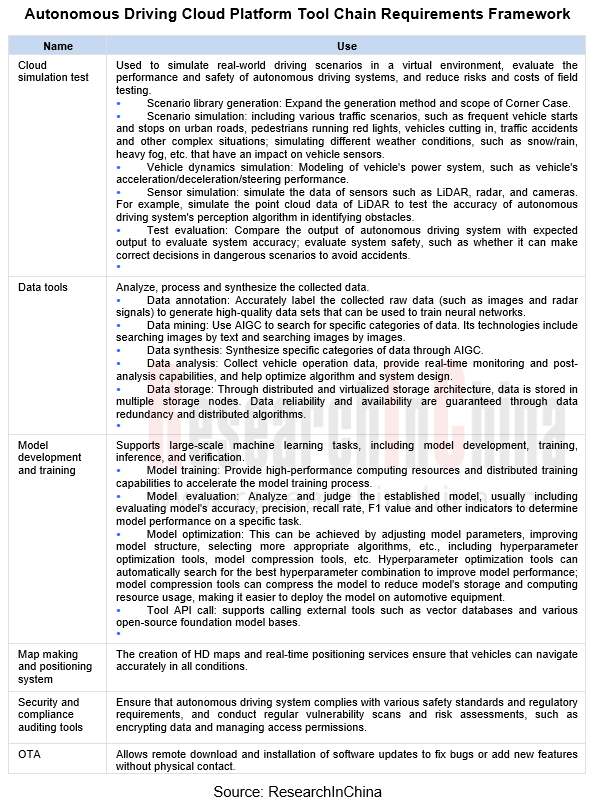

In 2024, taking the autonomous driving cloud platform as an example, most cloud service solutions include the following tool chains:

In September 2024, Baidu launched Intelligent Cloud 3.0, focusing on end-to-end intelligent driving development. Features include:

It can be used for full-process intelligent driving training from vehicle to cloud, including building virtual simulation data;

It can be used for full-process intelligent driving training from vehicle to cloud, including building virtual simulation data;

By improving training efficiency in the cloud and breaking down data barriers between the vehicle and the road, a real-time vehicle-road cloud platform is built; the platform provides services including early avoidance of congested sections, beyond-visual-range risk warnings, traffic light reminders, and remote live bird's-eye view.

By improving training efficiency in the cloud and breaking down data barriers between the vehicle and the road, a real-time vehicle-road cloud platform is built; the platform provides services including early avoidance of congested sections, beyond-visual-range risk warnings, traffic light reminders, and remote live bird's-eye view.

Provides a cloud-based cockpit foundation model for R&D scenarios such as semantic understanding scheduling, content generation, vector search, and cross-modality.

Provides a cloud-based cockpit foundation model for R&D scenarios such as semantic understanding scheduling, content generation, vector search, and cross-modality.

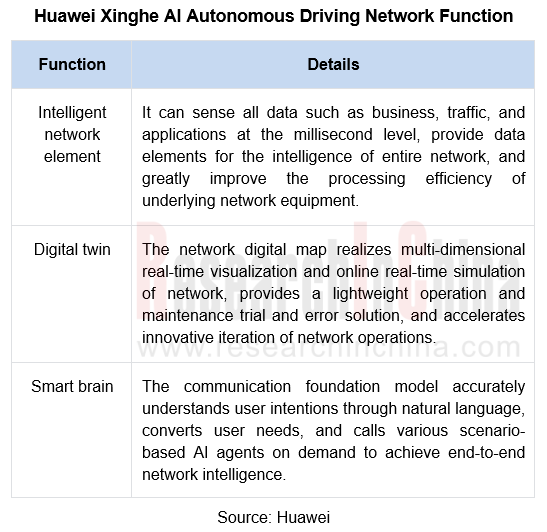

In September 2024, Huawei launched the L4 autonomous driving network solution - Xinghe AI autonomous driving network, which implements network data analysis, multi - scenario simulation and Agent calling in the cloud:

3. Cloud native further changes the way automotive software is developed

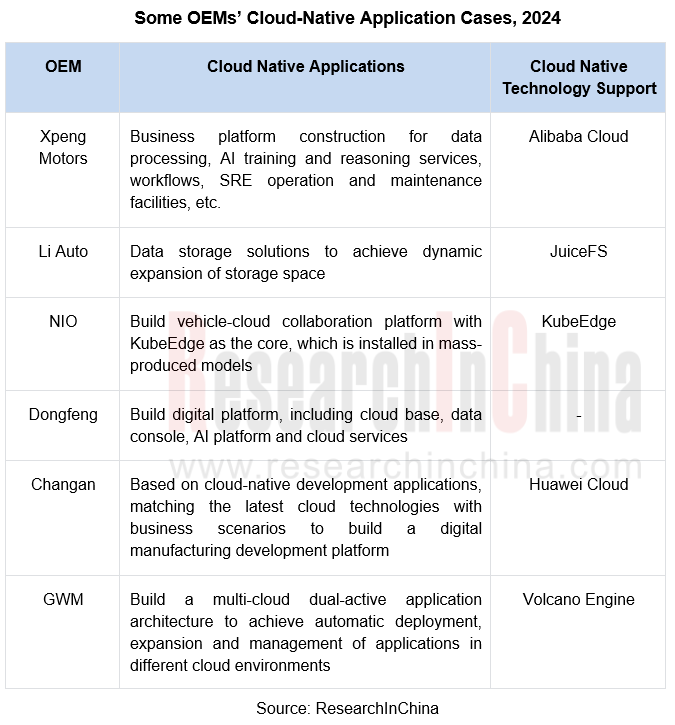

As some OEMs/Tier1s begin to build a vehicle-cloud collaborative infrastructure and try to upload vehicle-side data to the cloud for analysis and processing, and send cloud-side commands to the vehicle to achieve simple vehicle-cloud interaction. Cloud native technology has begun to be applied to the cloud-vehicle collaborative development process in automotive industry.

Cloud native is a software approach to building and running scalable applications in new dynamic environments such as public clouds, private clouds, and hybrid clouds. The concept of "cloud native" was proposed before 2020, but its application in automobiles has been in the exploratory stage and has not been widely used. It is mainly concentrated in telematics and some intelligent cockpit functions. In 2024, with the application of multi-cloud environments and AI technologies, the application scenarios of cloud native will increase greatly, and begin to affect construction logic of PaaS/SaaS cloud service solutions in the automotive industry from underlying layer:

On the vehicle side, in addition to in-vehicle infotainment system, cloud native has been used for the development and optimization of related technologies for autonomous driving and intelligent cockpit. For example, through large-scale computing and training functions of cloud-based autonomous driving platform, more accurate models and more comprehensive algorithms are provided for autonomous driving system, improving the safety and reliability of autonomous driving.

In the cloud, OEMs use a more complete cloud platform to store, mine, analyze and process vehicle data, provide support for intelligent vehicle operations, and gradually apply cloud-native software development models to OEM supply chain management, production and manufacturing and other fields, achieving collaborative optimization of entire industry chain. For example, container orchestration technology (Kubernetes, etc.) has gradually become the core technology for OEMs to build cloud-vehicle software collaborative development platforms.

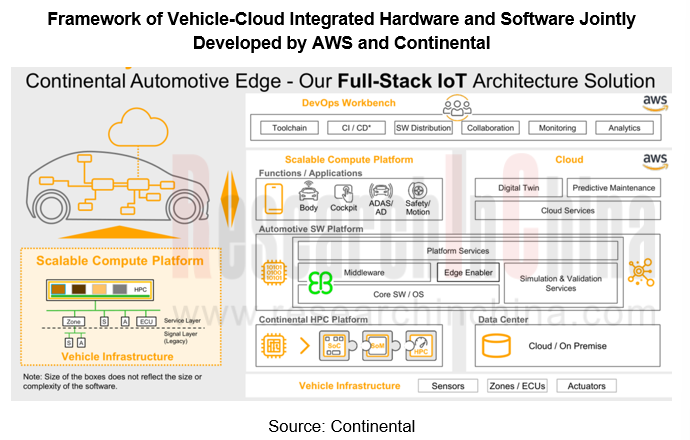

Taking the cooperation between AWS and Continental to develop cloud-based ECU as an example, Continental used AWS Graviton to simulate the hardware environment, then selected operating system and middleware to run on AWS EC2, and completed the creation of virtualized development environment through AWS EC2.

In 2024, cloud native applications will focus on:

1.Computing power management: The cloud-native platform can provide efficient computing power management technologies, including GPU computing power scheduling and distributed training, to meet the needs of AI algorithm training and real-time reasoning.

2.Optimization of service mesh and API gateway: Besides 5G communication, performance optimization of service mesh, collaboration with Kubernetes scheduler, flexible configuration and security protection of API gateway also have a great impact on cloud communication.

3.Data management and governance: Data management capabilities of Automotive Cloud Native Platform include data storage, backup, cleaning, labeling, and data security & compliance management. As OEMs increasingly value the circulation of data assets, efficient data circulation and sharing have become one of factors affecting the cloud native platform.

4.Cloud resource utilization: Some OEMs are beginning to pay attention to factors such as energy efficiency and resource utilization of cloud native technologies. Some energy-saving technologies and strategies reduce the energy consumption of cloud native platforms, while improving resource utilization efficiency and reducing operating costs.

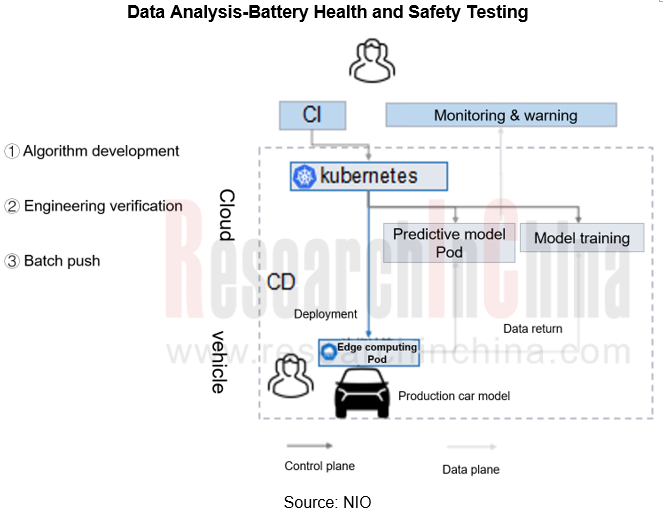

NIO uses cloud-native technology to build a vehicle-cloud collaborative development platform

In order to solve problems such as scarce computing power, chaotic edge node management, and unstable cloud communications, NIO uses KubeEdge as the core of platform and builds a complete vehicle-cloud collaborative development platform with Kubernetes + KubeEdge as the technical base.

NIO's vehicle-cloud collaboration platform uses KubeEdge's cloud-edge communication mechanism to solve the tidal effect problem of node connections.

Typical application scenarios of this technology include:

1. New energy vehicle battery health and safety data analysis: In the algorithm development stage, use containerization to develop edge algorithms; in the engineering vehicle verification stage, deploy edge computing container applications in small batches; after verification, replace the corresponding mass production base image.

2. Build a vehicle-side software test management platform: After introducing cloud native capabilities, Virtual car, test benches, and real vehicles can be connected to K8s for unified monitoring and management, which can arrange test tasks more reasonably and improve the utilization of test resources.

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...