China Car Electric Window Regulator Industry Report, 2014-2017

-

July 2014

- Hard Copy

- USD

$2,500

-

- Pages:112

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ075

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

With the maturity and development of technologies as well as users’ higher requirements on comfort, the installation rate of Chinese car electric window regulators has been gradually rising. In 2013, the installation rate exceeded 88% and the demand outnumbered 75 million pieces, up 19% year on year. In the next few years, Chinese car electric window regulator market will present a CAGR of over 10%; in 2017, the market size is expected to exceed 110 million pieces, with the installation rate up to 95%.

Globally, car electric window regulators include three types: cable, flexible axle and cross-arm. Cable and cross-arm ones dominate the Chinese market, with the combined market share of over 95% in 2013. In China, cable ones are mainly used in sedans, while cross-arm ones are suitable for sedans and commercial vehicles. Flexible axle ones can be applied to various models of vehicle, but they only find application in a tiny minority of cars since China's flexible axle and flexible axle motor technologies still desire to be much improved; nevertheless, the flexible axle window regulator is expected to be the future development direction.

As China's largest local car electric window regulator manufacturer, Shanghai SIIC Transportation Electric Co., Ltd. seized 10% market share in 2013, slightly lower than 2012. Founded by HUAYU Automotive Systems Co., Ltd. (70% stake) and SIIC (30% stake) jointly, the company mainly produces cable and cross-arm car electric window regulators and serves Shanghai Volkswagen, Shanghai GM, etc..

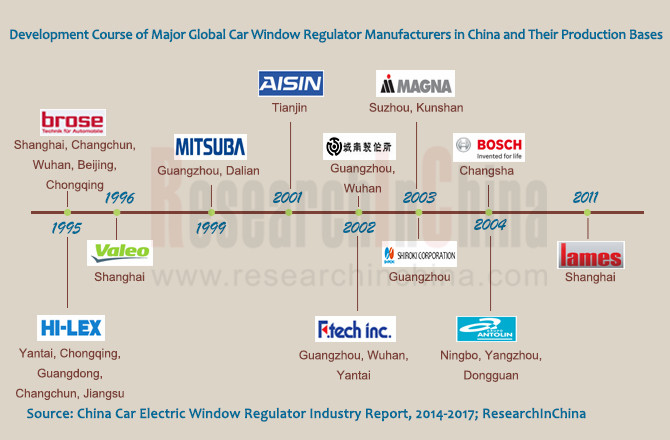

Foreign manufacturers Brose, Hi-Lex, Mitsuba, F. Tech and Magna Closures have established production bases in China, in which Brose is the first one that entered the Chinese market in 1995 to produce cable and cross-arm car electric window regulators, power window motors and anti-pinch electronic modules. As of June 2014, Brose had established a headquarters, three R & D / sales centers, five wholly owned factories and four joint-stock plants, with a total headcount of 3,300 in China.

The report mainly includes:

Installation rate and development trend of car electric window regulators in China;

Installation rate and development trend of car electric window regulators in China;

Demand and development trend of car electric window regulators in China;?

Demand and development trend of car electric window regulators in China;?

Import and export of car electric window regulators in China;

Import and export of car electric window regulators in China;

Supporting and Market Size of cable, flexible axle and cross-arm? car electric window regulators in China;

Supporting and Market Size of cable, flexible axle and cross-arm? car electric window regulators in China;

Sales channels and gross margin by channel of car electric window regulators in China;?

Sales channels and gross margin by channel of car electric window regulators in China;?

Operation, window regulator output and sales volume, market share and supply of domestic and foreign car electric window regulator manufacturers in China.

Operation, window regulator output and sales volume, market share and supply of domestic and foreign car electric window regulator manufacturers in China.

1. Definition and Classification

1.1 Definition

1.2 Classification

2. Car Electric Window Regulator Market in China

2.1 Evolution

2.2 Market Size

2.2.1 Installation Ratio

2.2.2 Market Demand

2.2.3 OEM & AM Markets

2.2.4 Market Structure

2.2.5 Window with Anti-trap Function

2.3 Competition Pattern

2.3.1 Market Shares

2.3.2 Supply Relation

2.4 Distribution Channel

2.5 Profit Level

2.6 Development Trend

3. Import and Export

3.1 Import

3.2 Export

4. Industry Chain

4.1 Overview of Industry Chain

4.2 Raw Materials Market

4.2.1 Motor

4.2.2 Reducer

4.2.3 Wiring Harness

4.2.4 Plastic

4.3 Downstream Development

4.3.1 Global Demand

4.3.2 China’s Demand

5. Key Foreign Companies

5.1 Brose

5.1.1 Profile

5.1.2 Operation

5.1.3 Car Window Regulator

5.1.4 Status in China

5.2 Magna Closures

5.2.1 Profile

5.2.2 Car Window Regulator

5.2.3 Status in China

5.3 Bosch

5.3.1 Profile

5.3.2 Operation

5.3.3 Car Window Regulator

5.3.4 Status in China

5.4 Aisin

5.4.1 Profile

5.4.2 Operation

5.4.3 Car Window Regulator

5.4.4 Status in China

5.5 Valeo

5.5.1 Profile

5.5.2 Operation

5.5.3 Status in China

5.6 Mitsuba

5.6.1 Profile

5.6.2 Operation

5.6.3 Car Window Regulator

5.6.4 Status in China

5.7 Shiroki

5.7.1 Profile

5.7.2 Operation

5.7.3 Car Window Regulator

5.7.4 Status in China

5.8 Hi-Lex

5.8.1 Profile

5.8.2 Operation

5.8.3 Car Window Regulator

5.8.4 Status in China

5.9 Grupo Antolin

5.9.1 Profile

5.9.2 Operation

5.9.3 Car Window Regulator

5.9.4 Status in China

5.10 Johnan Manufacturing

5.10.1 Profile

5.10.2 Car Window Regulator

5.10.3 Status in China

5.11 F. Tech

5.11.1 Profile

5.11.2 Operation

5.11.3 Status in China

5.12 Lames

5.12.1 Profile

5.12.2 Car Window Regulator

5.12.3 Status in China

6. Key Local Manufacturers

6.1 Shanghai Hongbao Auto Parts Co., Ltd.

6.1.1 Profile

6.1.2 Output & Sales Volume & Supporting Coustomer

6.1.3 Subsidiary

6.2 Shanghai SIIC Transportation Electric Co.,Ltd.

6.2.1 Profile

6.2.2 Output & Sales Volume & Supporting Coustomer

6.3 Shenyang Jinbei Kwan Jin Auto Parts Co., Ltd.

6.3.1 Profile

6.3.2 Output & Sales Volume & Supporting Coustomer

6.4 Guizhou Guihang Automotive Components Co.,Ltd

6.4.1 Profile

6.4.2 Revenue and Gross Margin

6.4.3 Output & Sales Volume & Supporting Coustomer

6.4.4 Subsidiary

6.5 Tri-Ring Group

6.5.1 Profile

6.5.2 Output & Sales Volume & Supporting Coustomer

6.6 Shanghai Inteva Automotive Door Systems Co., Ltd.

6.6.1 Profile

6.6.2 Output & Sales Volume & Supporting Coustomer

6.7 Guangzhou Mitsuba Electric Co.,Ltd.

6.7.1 Profile

6.7.2 Output & Sales Volume & Supporting Coustomer

6.8 Aisin Tianjin Body Parts Co.,Ltd.

6.8.1 Profile

6.8.2 Output & Sales Volume & Supporting Coustomer

6.9 Shanghai Brose Automotive Components Co., Ltd.

6.9.1 Profile

6.9.2 Output & Sales Volume & Supporting Coustomer

7. Summary and Prediction

7.1 Market Summary and Prediction

7.1.1 Equipment Ratio

7.1.2 Market Demand

7.2 Manufacturers Summary and Prediction

7.2.1 Market Share

7.2.2 Supporting Relationship

Main Types of Electric Window Regulators

Feature Comparison between Cable, Flexible Axle and Cross-arm Window Regulators

Performance Comparison between Cable, Flexible Axle and Cross-arm Window Regulators

Development History of Electric Window Regulators in China

Installation Rate of Car Electric Window Regulators in China, 2011-2017E

Installation Rate of Passenger Car Electric Windows in China, 2012-2017E

China’s Demand for Car Electric Window Regulators, 2011-2017E

Failure Rate of Car Door and Window in China

Methods of Fixing Window Regulators

Demand for Car Electric Window Regulators in Chinese OEM Market, 2011-2017E

Demand for Car Electric Window Regulators in Chinese AM, 2011-2017E

Installation Rate of Cable, Flexible Axle and Cross-arm Electric Window Regulators in China, 2013

Installation Rate of Passenger Car Window Anti-pinch Function in China, 2012-2017E

Market Share of Major Car Electric Window Regulator Enterprises in China, 2012-2014

Supply of Window Regulators in the World

Supply of Window Regulators in China

Sales Channels of Car Window Regulators in China

Gross Margin of Car Window Regulators in China by Sales Channel

Import Volume and Value of Car Window Regulators in China, 2009-2014

Average Import Price of Car Window Regulators in China, 2009-2014

Top 10 Import Sources of Car Window Regulators in China, 2013

Top 10 Import Sources of Car Window Regulators in China, Jan-Apr 2014

Export Volume and Value of Car Window Regulators in China, 2009-2014

Average Export Price of Car Window Regulators in China, 2009-2014

Top 10 Export Destinations of Car Window Regulators in China, 2013

Top 10 Export Destinations of Car Window Regulators in China, Jan-Apr 2014

Car Electric Window Regulator Industry Chain

Output and Sales Volume of Major Automotive Micromotor Enterprises in China, 2012

Output and Sales Volume of Major Automotive Reducer Enterprises in China, 2012

Enterprises Whose Automotive Wiring Harness Sales Volume Exceeded 1 Million Sets in China, 2012

Plastic Price Indices in China, 2011-2014

Global Automobile Output, 2009-2017E

China's Automobile Output, 2009-2017E

Brose’s Sales, Number of Employees and Investment, 2004-2014

Main Vehicle Models Supported by Brose’s Car Window Regulators

Brose’s Plants in China

Main Vehicle Models Supported by Car Window Regulators of Magna Closures

Bosch’s Key Financial Indicators, 2009-2013

Bosch’s Sales Structure, 2013

Main Vehicle Models Supported by Bosch’s Car Window Regulators

Bosch’s Sales in Major Countries, 2012-2013

Aisin’s Revenue, Net Income and Gross Margin, FY2009-FY2014

Aisin’s Revenue Breakdown (by Division), FY2010-FY2014

Aisin’s Revenue Breakdown (by Region), FY2009-FY2014

Name List and Revenue Contribution of Aisin’s Top 5 Clients, FY2010-FY2014

Main Vehicle Models Supported by Aisin’s Car Window Regulators

Aisin’s Subsidiaries in China

Valeo’s Revenue Structure, 2011-2013

Valeo’s Gross Margin and Operating Margin, 2011-2013

Mitsuba’s Key Financial Indicators, FY2010-FY2014

Mitsuba’s Sales and Profit Structure, FY2010-FY2014

Main Vehicle Models Supported by Mitsuba’s Car Window Regulators

Shiroki’s Shareholder Structure, FY2013

Shiroki’s Organizational Structure

Shiroki’s Sales, FY2010-FY2014

Shiroki’s Sales Structure (by Product), FY2010-FY2014

Main Vehicle Models Supported by Shiroki’s Car Window Regulators

Hi-Lex’s Key Financial Indicators, FY2011-FY2013

Main Vehicle Models Supported by Hi-Lex’s Car Window Regulators

Hi-Lex’s Subsidiaries in China

Key Financial Indicators of Grupo Antolin, 2011-2013

Client Structure of Grupo Antolin, 2012-2013

Sales Structure of Grupo Antolin (by Product), 2012-2013

Sales Structure of Grupo Antolin (by Region), 2012-2013

Main Vehicle Models Supported by Car Window Regulators of Grupo Antolin

Subsidiaries of Grupo Antolin in China

Worldwide Distribution of Jonan Manufacturing

Main Vehicle Models Supported by Car Window Regulators of Johnan Manufacturing

F.tech’s Sales and Profit, FY2012-FY2014

F.tech’s Sales Structure (by Region), FY2013-FY2014

F.tech’s Distribution in China

Main Vehicle Models Supported by Car Window Regulators of F.tech (Zhongshan)

Main Vehicle Models Supported by Car Window Regulators of Lames

Window Regulator Output, Sales Volume and Clients of Shanghai Hongbao, 2010-2014

STEC’s Assets and Revenue, 2011-2013

STEC’s Window Regulator Output, Sales Volume and Clients, 2010-2014

Revenue and Net Income of Shenyang Jinbei Kwan Jin, 2013

Window Regulator Output, Sales Volume and Clients of Shenyang Jinbei Kwan Jin, 2010-2014

Guihang’s Key Financial Indicators, 2009-2014

Guihang’s Window Regulator Revenue and Gross Margin, 2009-2013

Guihang’s Window Regulator Output, Sales Volume and Clients, 2010-2014

Assets and Profit of Guiyang Wanjiang Aviation Electricalmechanical Co., Ltd., 2012-2013

Assets and Profit of Guizhou Huachang Auto Electric Co., Ltd., 2012-2013

Window Regulator Output, Sales Volume and Clients of Tri-Ring Group, 2010-2014

Window Regulator Output, Sales Volume and Clients of Shanghai Inteva, 2011-2014

Window Regulator Output, Sales Volume and Clients of Guangzhou Mitsuba, 2010-2014

Development Course of Aisin Tianjin Body Parts Co., Ltd.

Window Regulator Output and Sales Volume of Aisin Tianjin Body Parts Co., Ltd., 2011-2014

Window Regulator Output and Sales Volume of Shanghai Brose, 2011-2014

Proportion of Car Electric Window Regulators in China, 2011-2017E

Installation Rate of Passenger Car Electric Window Regulators in China, 2012-2017E

China’s Demand for Car Electric Window Regulators, 2011-2017E

Installation Rate of Cable, Flexible Axle and Cross-arm Electric Window Regulators in China, 2013

Market Share of Major Car Electric Window Regulator Enterprises in China, 2012-2014

Supply of Window Regulators in the World

Supply of Window Regulators in China

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...