Global and China Power Battery Management System (BMS) Industry Report, 2014-2017

-

Aug.2014

- Hard Copy

- USD

$2,150

-

- Pages:90

- Single User License

(PDF Unprintable)

- USD

$2,000

-

- Code:

HEJ001

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,100

-

- Hard Copy + Single User License

- USD

$2,350

-

BMS is a key component of electric vehicles and hybrid vehicles. To ensure safe and reliable operation of batteries, BMS needs to have various functions such as battery status monitoring and assessment, charging and discharging control, balancing and so forth.

The fire accidents of electric vehicles (particularly pure electric vehicles) since 2013 result in consumers’ concerns about the safety of electric vehicles. Compared with HEV, PHEV and BEV have more complex battery system structure, which requires more excellent battery endurance and safety; therefore, PHEV and BEV need more mature and reliable BMS. The BMS industry will benefit from the expansion of the electric vehicle market.

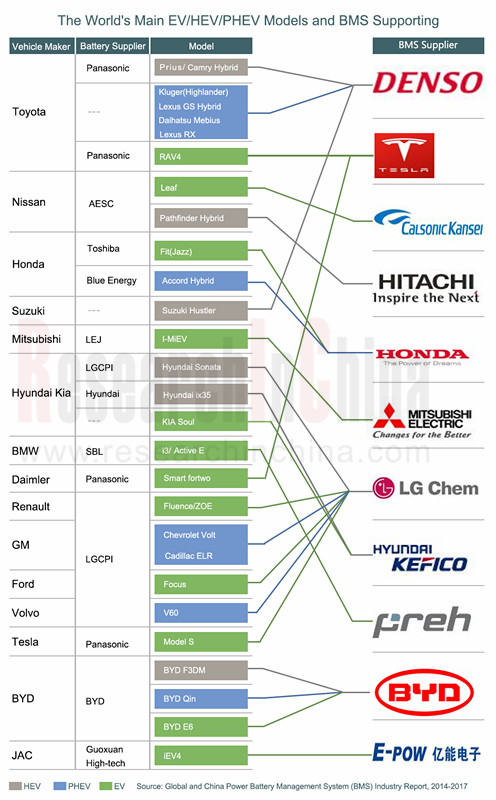

Throughout the global BMS market, traditional auto parts makers represented by Denso and Preh have seized opportunities by virtue of their important positions in the vehicle supply chain. As Toyota’s most important parts supplier, Denso has provided battery management modules for Prius, Camry Hybrid and other models. Preh mainly offers BMS for BMW I series pure electric vehicles.

Meanwhile, the battery vendor LGC has established cooperative relationship with GM, Ford, Volvo and many other enterprises by providing power battery packs and related BMS to them. As for automobile companies, Tesla performs remarkably with advanced BMS technology. In contrast, professional BMS firms develop relatively slower due to technical and financial factors.

In the first half of 2014, China produced 20,692 new energy vehicles and sold 20,477 ones, higher than the figures in 2013. In 2015, Chinese new energy vehicle market capacity will be quickly released, especially plug-in hybrid electric vehicles and mini pure electric vehicles will witness faster growth, which will drive the rapid development of the Chinese BMS market.

In the Chinese BMS market, there are three types of enterprises:

First, third-party BMS vendors, such as Epower Electronics, GuanTuo Power and LIGOO New Energy Technology. Among them, the products of Epower Electronics are used most widely and adopted by Changan, Dongfeng, BAIC, Foton, JAC, Zotye and so on.

Second, battery system packaging companies represented by Guoxuan High-tech and Winston Battery. Guoxuan High-tech serves JAC and Ankai Automobile with battery modules and BMS.

Third, vehicle manufacturers, including BYD and BAIC BJEV. BYD integrates batteries and BMS with electric vehicle R & D, and shows advantages in terms of cost and efficiency.

Overall, China BMS industry still lags behind foreign countries in technical specifications and business models. To narrow the gap, some companies hope to make progress by mergers and acquisitions. For example, BAIC BJEV enhances battery system performance and technological strength via the cooperation with SK, Atieva and other enterprises; Zotye meets its demand for BMS by holding Jieneng; Desai masters some share of Epower Electronics in order to upgrade its technology from consumer electronics to electric vehicle BMS.

The report includes:

Overview of global and Chinese electric vehicle market (including overview, market size, output, sales volume, etc.)

Overview of global and Chinese electric vehicle market (including overview, market size, output, sales volume, etc.)

Overview of global and China BMS industry (embracing status quo, forecast, market size, BMS supporting, etc.)

Overview of global and China BMS industry (embracing status quo, forecast, market size, BMS supporting, etc.)

Major vendors in global BMS industry (involving revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, latest developments, business in China, etc.)

Major vendors in global BMS industry (involving revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, latest developments, business in China, etc.)

Major vendors in China BMS industry (comprising revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, new projects, etc.)

Major vendors in China BMS industry (comprising revenue, revenue of subsidiaries, revenue structure, net income, R & D, products, supporting for vehicle plants, new projects, etc.)

Main enterprises in BMS chip industry (including revenue, revenue structure, net income, BMS chip solutions, etc.)

Main enterprises in BMS chip industry (including revenue, revenue structure, net income, BMS chip solutions, etc.)

1 Overview of BMS

1.1 Definition of Battery System

1.2 Definition of BMS

1.2.1 Definition

1.2.2 Classification

2 Overview of Global BMS Market

2.1 Overview of Global Electric Vehicle Market

2.2 Status Quo and Development Trend of Global BMS Market

3 Overview of Chinese BMS Market

3.1 Production and Sales Volume of Chinese Electric Vehicle Market

3.2 Chinese BMS Market Size

3.3 Status Quo and Development Trend of Chinese BMS Market

4 Global BMS Vendors

4.1 Denso

4.1.1 Profile

4.1.2 BMS Business

4.2 Preh

4.2.1 Profile

4.2.2 BMS Business

4.3 Calsonic Kansei

4.3.1 Profile

4.3.2 BMS Business

4.4 Hitachi Automotive Systems

4.4.1 Profile

4.4.2 BMS Business

4.5 Mitsubishi Electric

4.5.1 Profile

4.5.2 BMS Business

4.6 Hyundai Kefico

4.6.1 Profile

4.6.2 BMS Business

4.7 LG Chem

4.7.1 Profile

4.7.2 BMS Business

4.8 Tesla Motors

4.8.1 Profile

4.8.2 BMS Business

4.9 Lithium Balance

4.9.1 Profile

4.9.2 Product Description

4.9.3 Product Application

4.9.4 Layout in China

4.10 Vecture

4.10.1 Profile

4.10.2 Product Description

4.10.3 Product Application

4.10.4 Industrial Layout

4.11 Rimac Automobili

4.11.1 Profile

4.11.2 Product Description

4.11.3 Product Application

4.12 JustPower

4.12.1 Profile

4.12.2 Product Description and Application

4.13 Clayton Power

4.13.1 Profile

4.13.2 Product Description

5 Chinese Mainland BMS Vendors

5.1 Huizhou Epower Electronics Co., Ltd

5.1.1 Profile

5.1.2 BMS Business

5.2 Harbin GuanTuo Power Co., Ltd.

5.2.1 Profile

5.2.2 BMS Products

5.3 Anhui LIGOO New Energy Technology Co., Ltd.

5.3.1 Profile

5.3.2 BMS Business

5.4 BYD

5.4.1 Profile

5.4.2 BMS Business

5.5 BAIC BJEV

5.6 Winston Battery

5.6.1 Profile

5.6.2 BMS Products

5.7 Hefei Guoxuan High-tech Power Energy Co., Ltd

5.7.1 Profile

5.7.2 BMS Business

5.8 Hangzhou Jieneng Power Co., Ltd.

5.8.1 Profile

5.8.2 BMS Business

5.9 Ningbo Bate Technology Co., Ltd.

5.9.1 Profile

5.9.2 BMS Business

5.10 Ningbo Longway Electrical Co., Ltd.

5.10.1 Profile

5.10.2 BMS Products

5.11 Shenzhen Antega Technology Co., Ltd

5.11.1 Profile

5.11.2 BMS Products

5.12 Wuhu Tianyuan Automobile Electric Co., Ltd.

5.12.1 Profile

5.12.2 BMS Products

5.13 Shenzhen Battsister Tech. Co., Ltd.

5.13.1 Profile

5.13.2 BMS Business

6 Major BMS Chip Vendors

6.1 Analog Devices

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 BMS Solutions

6.2 Texas Instruments

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Current Situation and Prospect of BMS Chip Business

6.3 Infineon

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Current Situation and Prospect of BMS Chip Business

Storage Battery System

BMS Structure with the Basic Functions

Global HEV/EV Market Size, 2008-2017E

Major Global Electric Vehicle Models and Supporting BMS

China’s Pure Electric Vehicle Production and Sales Volume, 2012-2014H1

China’s Plug-in Hybrid Vehicle Production and Sales Volume, 2012-2014H1

China’s BMS Demand, 2012-2017E

Supply of Major Chinese BMS Vendors

Sales Structure of Denso’s Automotive-Related Business, FY2014

Sales of Denso’s Powertrain Equipment Division, FY2012-FY2014

Denso’s Sales Structure by Client, FY2014

Denso’s BMS Supply

Denso’s R & D Investment, FY2012-FY2014

Electronics Division and Products of Joyson Electronics

BMW’s i3BMS

Preh’s Revenue, 2004-2013

Preh’s Global Divisions

Calsonic’s Revenue and Net Income, FY2010-FY2014

Calsonic’s Revenue by Region, FY2014

BMS-related Products of Calsonic Kansei

Sales of Mitsubishi Electric by Business, FY2014

Kefico’s Revenue and Net Income, 2010-2013

Power Battery Business Framework of LG Chemical

BMS of LG Chemical

Power Batteries and BMS Application of LG Chemical

Tesla’s Revenue from Power System and Related Components, 2011-2013

Smart fortwo Electric Vehicles

Toyota’s RAV4 EV

Scalable BMS (s-BMS)

Integrated BMS (i-BMS)

Tennant’s 500ZE

TMHE Electric Forklifts

ECOTRUCK7500 Electric Garbage Collection Trucks

Customers of Lithium Balance

Overview of Lithium Balance’s Agents in China

Vecture's BMS

Application of Vecture's Products

Community Smart Grid Projects

"Eve" Project

Rimac’s R-BMS2

Rimac’s Concept_One

Application of JustPower’s BMS Products

JustPower’s Main Co-partners

Clayton’s BMS

BMS Products of Epower Electronics

Some Co-partners of Epower Electronics

Revenue and Net Income of Epower Electronics, 2011-2013

BF101 BMS

Waterproof Series (BC111 / BS111 / BS113 / BS313)

Some Customers of LIGOO New Energy Technology

EK-FT-12 Commercial Vehicle BMS (Enhanced)

BYD’s New Energy Vehicle Sales Volume, 2013-2016E

GTBMS005A-MC 11 Color-screen BMS

Guoxuan’s High-tech BMS

ABM-BMS Initiative Equalization BMS of Hangzhou Jieneng Power

Major Clients of Bate Technology

750HEVBMS of SAIC Roewe

BMS- 200 LF

24V100AH Power Lithium BMS

BMS of Wuhu Tianyuan

BMS-108 Electric Vehicle Battery Management Series

Battsister’s Co-partners

ADI’s Revenue and Gross Margin, 2007-2013

ADI’s Net Income and Net Profit Margin, 2007-2013

ADI’s Revenue (by Region), 2010-2013

ADI’s Revenue (by Industry), 2014Q2

ADI’s Gross Margin Growth, 2008-2014Q2

ADI’s HEV/ EV Lithium Battery Management Solutions (≤150 V)

ADI’s HEV/ EV Lithium Battery Management Solutions (≥300 V)

TI’s Revenue and Gross Margin, 2007-2013

TI’s Net Income and Net Profit Margin, 2007-2013

TI’s Revenue (by Product), 2007-2014Q1

TI’s Revenue (by Region), 2010-2013

TI’s Gross Margin Growth, 2007-2014Q1

Operating Margin of TI’s Main Products, 2007-2014Q1

TI’s Hybrid and Pure Electric Vehicle Solutions

TI’s BMS Solutions

TI’s BMS

IFX’s Revenue and Gross Margin, FY2009-FY2013

IFX’s Net Income and Net Profit Margin, FY2009-FY2013

IFX’s Revenue (by Division), FY2009-FY2013

IFX’s Revenue (by Region), FY2009-FY2013

IFX’s Gross Margin Growth, FY2009-FY2014

Market Share of Major Global Automotive Semiconductor Companies, 2013

Revenue of IFX’s Automotive Electronics Division, 2012Q1-2014Q2

Major Clients of IFX’s Automotive Electronics Division

IFX’s BMS Solutions

IFX’s Revenue in China, FY2009-FY2013

Foton’s Revenue and New Energy Vehicle Sales Volume, 2009-2013

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...