China Automotive Rubber Hose Industry Report, 2014-2017

-

Sep.2014

- Hard Copy

- USD

$2,500

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,350

-

- Code:

YSJ078

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,700

-

Thanks to its huge automobile market base, China’s demand for automotive rubber hose is enormous, totaling 460 million meters and equaling RMB 17.4 billion in market scale in 2013. As automobile industry develops further, the demand for automotive rubber hose will maintain a steady growth trend, with demand expected to reach 640 million meters and market size at RMB 24.1 billion.

According to function, automotive rubber hose can be divided into engine hose, fuel hose, air conditioner hose, brake hose, power steering hose, etc. Seen from market demand, engine hose is the most prominent in terms of scale, accounting for nearly 28% of total market demand for hose in 2013 and estimated to exceed 170 million meters in 2017. From the perspective of market value, fuel hose is the largest segment as concerns scale, topping RMB 5 billion in 2013, more than 29% of total market value of automotive rubber hose and expected to hit RMB 7 billion by 2017, higher than that of other types of hoses.

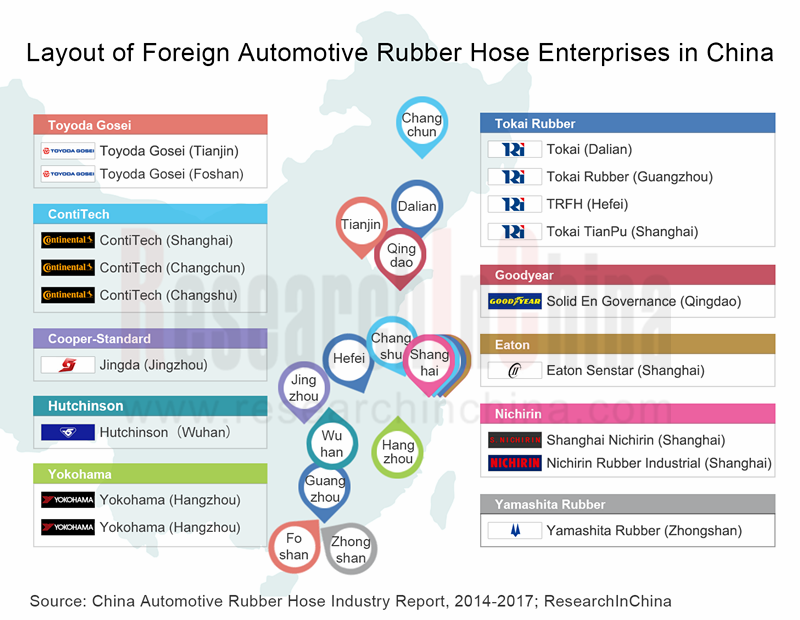

Competitors in the Chinese automotive rubber hose market consist mainly of two camps, namely, foreign companies and local ones, of which the former serves chiefly upscale and luxury car models, while local ones support low and medium-end car models.

Hutchinson, one of major French automotive rubber hose providers, entered Chinese market in 1995. The company now has one subsidiary in Wuhan and Suzhou respectively, with the former specializing in automotive rubber hose business and supplying its products to Dongfeng Peugeot Citroen, Ford, Shanghai GM, Volvo, Fiat, Nissan, Beijing Benz, BMW and Inergy.

Tianjin Pengling Rubber Hose Co., Ltd., one of major local automotive rubber hose manufacturers, mainly produces engine cooling system pipeline and fuel hose, which are offered to FAW-Volkswagen, Shanghai Volkswagen, Great Wall Motors, etc. The company took up a 5.66% market share in 2013, which is expected to surpass 8% by 2017, as capacity continues to be ramped up.

China Automotive Rubber Hose Industry Report, 2014-2017 by ResearchInChina focuses on the following:

Chinese overall automotive rubber hose market and market segments (engine hose, fuel hose, air conditioner hose, brake hose, power steering hose) scale and forecast;

Chinese overall automotive rubber hose market and market segments (engine hose, fuel hose, air conditioner hose, brake hose, power steering hose) scale and forecast;

Supporting models, regional landscape, major manufacturers of automotive rubber hose and supply relationship with complete vehicle makers in China;

Supporting models, regional landscape, major manufacturers of automotive rubber hose and supply relationship with complete vehicle makers in China;

Effect of changes in upstream raw material prices on automotive rubber hose, development of and forecast for downstream automobile industry in China;

Effect of changes in upstream raw material prices on automotive rubber hose, development of and forecast for downstream automobile industry in China;

Development, main products, output & sales volume, operation, supporting relationship of and development forecast for major foreign and local Chinese automotive rubber hose manufacturers.

Development, main products, output & sales volume, operation, supporting relationship of and development forecast for major foreign and local Chinese automotive rubber hose manufacturers.

1. Overview of Automotive Rubber Hose

1.1 Profile

1.2 Structure

1.3 Classification

2. Chinese Automotive Rubber Hose Market

2.1 Status Quo and Prospect of Automobile Industry

2.2 Overall Automotive Rubber Hose Market

2.3 Supporting Model

2.4 Market Landscape

2.4.1 Regional Landscape

2.4.2 Competitive Landscape

2.4.3 Supply Relationship

2.5 Market Segments

2.5.1 Radiator Hose

2.5.2 Fuel Hose

2.5.3 Air Conditioner Hose

2.5.4 Brake Hose

2.5.5 Power Steering Hose

3. Automotive Rubber Hose Raw Material Market

3.1 Rubber

3.2 Carbon Black

3.3 Braided Wire

3.4 Auxiliary Chemicals

4. Major Foreign Companies

4.1 Hutchinson

4.1.1 Profile

4.1.2 Operation

4.1.3 Supply Relationship

4.1.4 Business in China

4.2 Toyoda Gosei

4.2.1 Profile

4.2.2 Operation

4.2.3 Revenue Structure

4.2.4 Investment

4.2.5 R&D

4.2.6 Major Customers

4.2.7 Supply Relationship

4.2.8 Business in China

4.3 ContiTech

4.3.1 Profile

4.3.2 Operation

4.3.3 Supply Relationship

4.3.4 Business in China

4.4 Tokai Rubber

4.4.1 Profile

4.4.2 Operation

4.4.3 Supply Relationship

4.4.4 Business in China

4.5 Yamashita Rubber

4.5.1 Profile

4.5.2 Operation

4.5.3 Automotive Rubber Hose Products

4.5.4 Yamashita Rubber (Zhongshan) Co., Ltd.

4.6 Eaton

4.6.1 Profile

4.6.2 Operation

4.6.3 Business in China

4.6.4 Shanghai Eaton-Senstar Automotive Fluid Connector Co., Ltd

4.7 Cooper-Standard

4.7.1 Profile

4.7.2 Operation

4.7.3 Major Customers

4.7.4 Production Base

4.7.5 Supply Relationship

4.7.6 Business in China

4.7.7 Jingda (Jingzhou) Automotive Co. Ltd.

4.8 Yokohama Rubber

4.8.1 Profile

4.8.2 Operation

4.8.3 Supply Relationship

4.8.4 Business in China

4.8.5 Yokohama Hoses & Coupling (Hangzhou) Co., Ltd.

4.8.6 Shandong Yokohama Rubber Industrial Products Co., Ltd.

4.8.7 Yokohama Industrial Products-Hangzhou Co., Ltd.

4.9 Nichirin

4.9.1 Profile

4.9.2 Operation

4.9.3 Supply Relationship

4.9.4 Business in China

4.10 Goodyear

4.10.1 Profile

4.10.2 Operation

4.10.3 Automotive Rubber Hose Business

4.10.4 Veyance (Qingdao) Engineered Elastomers Co., Ltd.

5. Local Chinese Manufacturers

5.1 Shandong Meichen Science & Technology Co., Ltd.

5.1.1 Profile

5.1.2 Revenue and Gross Margin

5.1.3 Rubber Hose Business

5.1.4 Major Customers

5.1.5 Performance Forecast

5.2 Tianjin Pengling Rubber Hose Co., Ltd.

5.2.1 Profile

5.2.2 Revenue and Gross Margin

5.2.3 Rubber Hose Business

5.2.4 Major Customers

5.2.5 Subsidiaries

5.2.6 Performance Forecast

5.3 Lingyun Industrial Corporation Limited

5.3.1 Profile

5.3.2 Operation

5.3.3 Subsidiaries

5.3.4 Codan-Lingyun Automotive Rubber Hose Co., Ltd.

5.3.5 Changchun Chinaust Automobile Parts Co., Ltd.

5.4 Sichuan Ring Technology Co., Ltd.

5.5 Ningbo Fengmao Far-East Rubber Co., Ltd.

5.6 Chonche Group Nanjing No. 7425 Factory

5.7 Beijing Tian Yuan Ao Te Rubber and Plastic Co., Ltd.

5.8 Tianjin Dagang Rubber Hose Co., Ltd.

5.9 Shanghai Xinshangxiang Automobile Hose Co., Ltd.

5.10 Shanghai Sanda Automobile Parts Co., Ltd.

5.11 Shanghai Velle Auto Air Conditioning Co., Ltd.

6. Summary and Forecast

6.1 Average Growth Rate of 8.5% in Market Scale

6.2 Enormous Demand for Engine Hose; Highest Market Value for Fuel Hose

6.3 An 8% Market Share for Tianjin Pengling Rubber Hose by 2017

Classification of Automotive Rubber Hose

China’s Automobile Output, 2009-2017E

Average Consumption of Various Hoses by Each Vehicle

Chinese Automotive Rubber Hose Market Scale, 2012-2017E

Auto Parts Supporting Model in China

Major Foreign Automotive Rubber Hose Manufacturers and Their Products in China

Major Mainland Chinese Automotive Rubber Hose Manufacturers and Their Products

Customers of Major Foreign Automotive Rubber Hose Manufacturers in China

Customers of Major Mainland Chinese Automotive Rubber Hose Manufacturers

Chinese Automotive Engine Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Radiator Rubber Hose and Customers Supported in China

Chinese Automotive Fuel Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Fuel Rubber Hose and Customers Supported in China

Chinese Automotive Air Conditioner Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Air Conditioner Rubber Hose and Customers Supported in China

Chinese Automotive Brake System Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Brake Rubber Hose and Customers Supported in China

Chinese Automotive Power Steering System Rubber Hose Market Scale, 2012-2017E

Major Suppliers of Automotive Power Steering Rubber Hose and Customers Supported in China

Average Consumption of Rubber by Various Automotive Rubber Hoses

Market Prices of Natural Rubber on the Shanghai Futures Exchange (including a 17% tariff), 2010-2014

Average Consumption of Carbon Black by Various Automotive Rubber Hoses

Volume and Value of Imported Carbon Black into China, 2009-2014

Volume and Value of Exported Carbon Black from China, 2009-2014

Average Consumption of Braided Wire by Various Automotive Rubber Hoses

Average Price of Kevlar Line 1100-DP in China, 2010-2014

Average Prices of Main Auxiliary Chemicals for Hose, 2009-2014

Revenue Structure of Hutchinson (by Product), FY2013

Revenue Structure of Hutchinson (by Region), FY2013

Car Makers and Models Supported by Automotive Rubber Hoses of Hutchinson

Production Bases of Hutchinson in China

Revenue and YoY Growth of Toyoda Gosei, FY2009-FY2013

Net Income and YoY Growth of Toyoda Gosei, FY2009-FY2013

Net Profit Margin of Toyoda Gosei, FY2009-FY2013

Revenue Structure of Toyoda Gosei (by Product), FY2009-FY2013

Revenue Structure of Toyoda Gosei (by Region), FY2009-FY2013

Investment Structure of Toyoda Gosei (by Business), FY2009-FY2013

R&D Costs and % of Total Revenue of Toyoda Gosei, FY2009-FY2013

R&D Costs Structure of Toyoda Gosei (by Business), FY2009-FY2013

Sales Ratio to Major Customers of Toyoda Gosei, FY2012-FY2014

Main Car Makers and Models Supported by Automotive Rubber Hoses of Toyoda Gosei

Automotive Rubber Hose Production Bases of Toyoda Gosei in China

Sales, EBIT and Employees of ContiTech, 2012-2013

Sales Structure of ContiTech (by Division), 2013

Sales and Employees of Fluid Technology Division of ContiTech, 2010-2013

Main Car Makers and Models Supported by ContiTech’s Automotive Rubber Hoses

Automotive Rubber Hose Production Bases of ContiTech in China

Sales and Profit of Tokai Rubber, FY2009-FY2013

Sales Breakdown of Tokai Rubber by Region, 2013

Performance of Tokai Rubber by Division, FY2011-FY2012

Main Car Makers and Models Supported by Automotive Rubber Hoses of Tokai Rubber

Revenue of Tokai Rubber in China, FY2011-FY2012

Strongholds of Tokai Rubber in China

Sales and Profit of Yamashita Rubber, FY2009- FY 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Yamashita Rubber (Zhongshan)

Number of Employees in Eaton, 2009-2013

Revenue, Net Income and Gross Margin of Eaton, 2009-2013

Revenue Breakdown of Eaton (by Business), 2009-2013

Revenue Breakdown of Eaton (by Region), 2009-2013

Main Financial Indexes of Cooper-Standard, 2012-2013

Revenue Structure of Cooper-Standard (by Region), 2011-2013

Sales Ratio to Major Customers of Cooper-Standard, 2012-2013

Main Global Production Bases of Cooper-Standard, 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Cooper-Standard

Production Bases of Cooper-Standard in China, 2013

Number of Employees in Yokohama Rubber, FY2010-FY2013

Sales and Operating Profit of Yokohama Rubber, 2010-2013

Net Income of Yokohama Rubber, 2010-2013

R&D Costs of Yokohama Rubber, 2010-2013

Sales/Operating Profit Structure of Yokohama Rubber (by Business), 2013

Sales Structure of Industrial Products Division of Yokohama Rubber (by Product), 2013

Sales and Operating Profit of Industrial Products Division of Yokohama Rubber, 2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Yokohama Rubber

Subsidiaries & Affiliates of Yokohama Rubber in China

Sales of Nichirin, 2011-2013

Profit of Nichirin, 2011-2013

R&D Costs of Nichirin, 2011-2013

Main Car Makers and Models Supported by Automotive Rubber Hoses of Nichirin

Number of Employees in Goodyear, 2009-2013

Revenue, Net Income and Gross Margin of Goodyear, 2009-2013

Revenue Breakdown of Goodyear (by Region), 2009-2013

Number of Employees in Meichen S&T, 2009-2013

Revenue, Net Income and Gross Margin of Meichen S&T, 2009-2013

Revenue, Net Income and Gross Margin of Meichen S&T, 2014 H1

Revenue Breakdown of Meichen S&T (by Product), 2009-2014

Gross Margin of Meichen S&T (by Product), 2009-2014

Revenue Breakdown of Meichen S&T (by Region), 2009-2013

Revenue from and Gross Margin of Air Hose of Meichen S&T, 2009-2014

Revenue from and Gross Margin of Water Hose of Meichen S&T, 2009-2014

Revenue from and Gross Margin of Other Hoses of Meichen S&T, 2009-2014

Meichen S&T’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2014

Revenue, Net Income and Gross Margin of Meichen S&T, 2014-2017E

Number of Employees in Tianjin Pengling Rubber Hose, 2010-2013

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2010-2013

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2014 H1

Revenue Breakdown of Tianjin Pengling Rubber Hose (by Region), 2010-2014

Revenue Breakdown of Tianjin Pengling Rubber Hose (by Product), 2010-2014

Gross Margin of Tianjin Pengling Rubber Hose (by Product), 2010-2014

Tianjin Pengling Rubber Hose’s Revenue from Top 5 Customers and % of Total Revenue, 2012-2013

Operation of Tianjin Pengling Rubber Hose’s Subsidiaries, 2013

Key Construction Projects with Raised Funds of Tianjin Pengling Rubber Hose

Revenue, Net Income and Gross Margin of Tianjin Pengling Rubber Hose, 2014-2017E

Revenue, Net Income and Gross Margin of Lingyun Industrial, 2010-2014

Revenue, Operating Costs and Gross Margin of Lingyun Industrial, 2012-2014

Revenue Breakdown of Lingyun Industrial (by Region), 2012-2014

Main Car Makers and Models Supported by Automotive Rubber Hoses of Codan-Lingyun Automotive Rubber Hose

Main Car Makers and Models Supported by Automotive Rubber Hoses of Changchun Chinaust Automobile Parts

Organizational Structure of Sichuan Ring Technology

Major Customers of Ningbo Fengmao Far-East Rubber

Organizational Structure of Chonche Group Nanjing No. 7425 Factory

Major Customers of Beijing Tian Yuan Ao Te Rubber and Plastic

Major Customers of Tianjin Dagang Rubber Hose

Main Car Makers and Models Supported by Automotive Rubber Hoses of Shanghai Sanda Automobile Parts

Main Car Makers and Models Supported by Automotive Rubber Hoses of Shanghai Velle Auto Air Conditioning

Growth in Chinese Automotive Rubber Hose Market Scale, 2013-2017E

Structure of Chinese Automotive Rubber Hose Market

Market Shares of Tianjin Pengling Rubber Hose and Meichen S&T, 2012-2017E

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...