Global and China RF Coaxial Cable Industry Report, 2014-2017

-

Dec.2014

- Hard Copy

- USD

$1,700

-

- Pages:69

- Single User License

(PDF Unprintable)

- USD

$1,600

-

- Code:

LT028

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,500

-

- Hard Copy + Single User License

- USD

$1,900

-

Benefiting from a surge in mobile phone users and gradual replacement of 2G by 3G and 4G in developing countries, global RF coaxial cable market size has been growing, registering an average annual growth rate of 8.4% during 2007-2013 and coming to USD 4.29 billion in 2013.

Powerfully driven by national policies, new businesses like broadband network, new generation mobile communications, cloud computing, and high-speed information transmission are accelerating the upgrading of China’s communications industry. 2G network has become very popular in China, and RF coaxial cable market in the country was worth RMB 39.63 billion in 2013.

The Ministry of Industry and Information Technology (MIIT) issued 3G licenses in 2010, TD-LTE 4G license and FDD-LTE trial license in 2013. China’s mobile communications industry is transiting from 2G to 3G/4G, and 4G subscribers in China are estimated to reach 440 million in 2017, which will push three major operators into building more LTE base stations, thus further promoting the demand for RF coaxial cable. In 2014, the demand for RF coaxial cable for mobile communications approximated 560,000 km, up 8% from the previous year.

At present, overall technological level of RF coaxial cable in China still desires to be much improved, highly homogenized in low end market and with price war as major means of competition. However, some local companies with strong R&D capabilities have achieved mass production in high-end fields, such as semi-flexible, low loss and corrugated, leading to a gradual increase in substitution for imported products.

Kingsignal Technology Co., Ltd. is a leader in the Chinese semi-flexible cable market, occupying nearly 40% market share and ranking second in low-loss cable market segment in 2013. Besides Kingsignal Technology, the Chinese semi-flexible cable market is largely dominated by foreign-funded companies.

Jiangsu Hengxin Technology Co., Ltd., the largest supplier in the Chinese corrugated cable market, took up 36.4% market share and posted revenue of RMB 933 million from RF coaxial cable business in 2013, over 3/4 of its total revenue. The company now has RF coaxial cable for mobile communications capacity of 148,770 km/a.

Global and China RF Coaxial Cable Industry Report, 2014-2017 by ResearchInChina focuses on the following:

Global RF coaxial cable market size, demand for RF coaxial cable in main countries (including Brazil, India and Russia);

Global RF coaxial cable market size, demand for RF coaxial cable in main countries (including Brazil, India and Russia);

Chinese RF coaxial cable market size, demand, market segments (including semi flexible, low loss, corrugated and phase-compensated) demand, and competitive landscape;

Chinese RF coaxial cable market size, demand, market segments (including semi flexible, low loss, corrugated and phase-compensated) demand, and competitive landscape;

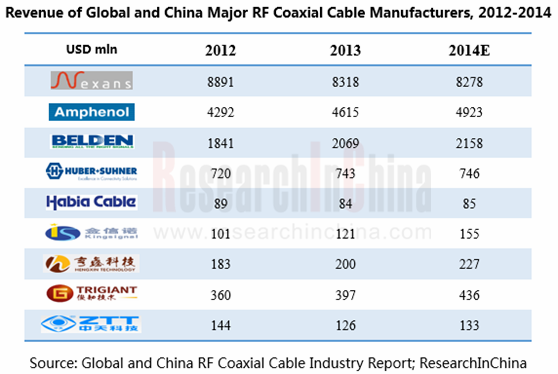

Operation and business in China of 8 global RF coaxial cable companies (covering Belden, Habia, Amphenol and Nexans);

Operation and business in China of 8 global RF coaxial cable companies (covering Belden, Habia, Amphenol and Nexans);

Operation and RF coaxial cable business of 8 Chinese RF coaxial cable companies (including Kingsignal, Hengxin Technology and Trigiant Group).

Operation and RF coaxial cable business of 8 Chinese RF coaxial cable companies (including Kingsignal, Hengxin Technology and Trigiant Group).

1. Industry Overview

1.1 Definition and Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2. RF Coaxial Cable Market

2.1 Global

2.2 China

2.2.1 Market Overview

2.2.2 Market Size

2.2.3 Demand

2.2.4 Characteristics of Market Competition

3. Market Segments

3.1 Semi-flexible Cable

3.1.1 Market Demand

3.1.2 Competitive Landscape

3.2 Low Loss Cable

3.2.1 Market Demand

3.2.2 Competitive Landscape

3.3 Corrugated Cable

3.3.1 Market Demand

3.3.2 Competitive Landscape

3.4 Phase-compensated Cable

3.4.1 Market Demand

3.4.2 Competitive Landscape

3.5 Micro Coaxial Cable

3.5.1 Market Demand

3.5.2 Competitive Landscape

4. Major Global RF Coaxial Cable Companies

4.1 Belden

4.1.1 Profile

4.1.2 Operation

4.1.3 Revenue Structure

4.1.4 Business in China

4.2 Gore

4.3 Habia

4.3.1 Profile

4.3.2 Operation

4.3.3 Revenue Structure

4.3.4 Business in China

4.4 Times Microwave Systems

4.5 Amphenol

4.5.1 Profile

4.5.2 Operation

4.5.3 Revenue Structure

4.5.4 Business in China

4.6 Andrew

4.6.1 Profile

4.6.2 Business in China

4.7 Nexans

4.7.1 Profile

4.7.2 Operation

4.7.3 Revenue Structure

4.7.4 Business in China

4.8 HUBER+SUHNER

4.8.1 Profile

4.8.2 Operation

4.8.3 Revenue Structure

4.8.3 Business in China

5. Major Chinese RF Coaxial Cable Companies

5.1 Kingsignal Technology Co., Ltd.

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Customers and Suppliers

5.1.6 RF Coaxial Cable Business

5.2 Jiangsu Hengxin Technology Co., Ltd.

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Gross Margin

5.2.5 Customers and Suppliers

5.2.6 RF Coaxial Cable Business

5.3 Trigiant Group

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Gross Margin

5.3.5 Customers and Suppliers

5.3.6 RF Coaxial Cable Business

5.4 Zhuhai Hanseng Technology Co., Ltd.

5.4.1 Profile

5.4.2 Operation

5.5 Zhongtian Hitachi RF Cable Co., Ltd.

5.5.1 Profile

5.5.2 Operation

5.5.3 RF Coaxial Cable Business

5.6 Other Companies

5.6.1 Acome Xintai Cables Co., Ltd.

5.6.2 Chengdu Zhongling Radio Communications

5.6.3 Tianjin 609 Cable Co., Ltd.

6. Summary and Forecast

6.1 Summary

6.2 Forecast

Structure of RF Coaxial Cable

Classification of RF Coaxial Cable

Global RF Coaxial Cable Market Size, 2007-2014

Global Market Size of RF Coaxial Cable for 2G Network, 2006-2014

Global Market Size of RF Coaxial Cable for 3G Network, 2006-2014

Demand for RF Coaxial Cable in India, 2006-2014

Demand for RF Coaxial Cable in Brazil, 2006-2014

Demand for RF Coaxial Cable in Russia, 2006-2014

Chinese RF Coaxial Cable Market Size, 2007-2014

Output of and Demand for RF Coaxial Cable for Mobile Communications in China, 2011-2015

Demand for RF Coaxial Cable for Mobile Phone and Notebook PC in China, 2007-2013

Global Market Capacity of Semi-flexible Cable for Mobile Communications, 2007-2014

Market Capacity of Semi-flexible Cable for Mobile Communications in China, 2007-2014

Market Share of Major Semi-flexible Cable Companies in China, 2013

Global Market Capacity of Low Loss Cable, 2007-2014

Market Capacity of Low Loss Cable in China, 2007-2014

Market Share of Major Low Loss Cable Companies in China, 2013

Global Market Capacity of Corrugated Cable, 2007-2014

Market Capacity of Corrugated Cable in China, 2007-2013E

Market Share of Major Corrugated Cable Companies in China, 2013

Global Market Capacity of Phase-compensated Cable, 2007-2014

Market Capacity of Phase-compensated Cable in China, 2007-2014

Market Share of Major Global Phase-compensated Cable Companies, 2013

Global Market Capacity of Micro Coaxial Cable, 2007-2014

Market Capacity of Micro Coaxial Cable in China, 2007-2014

Market Share of Major Micro Coaxial Cable Companies in China, 2013

Revenue and Operating Income of Belden, 2009-2014

Revenue Structure of Belden by Product, 2011-2013

Revenue Structure of Belden by Region, 2011-2013

Subsidiaries of Belden in China

Organizations of Gore in China

Net Revenue and Net Income of Habia, 2009-2013

Operating Margin of Habia, 2009-2013

Structure of Habia’s Revenue from Cable Products (by Sector), 2013

Revenue Structure of Habia by Region, 2013

Net Revenue and Net Income of Amphenol, 2009-2014

Revenue Structure of Amphenol by Product, 2011-2013

Revenue Structure of Amphenol by Region, 2011-2013

Revenue and Net Income of Nexans, 2009-2014

Revenue Structure of Nexans by Business, 2013

Revenue Structure of Nexans by Region, 2013

Development History of Nexans in China

Revenue and Net Income of HUBER+SUHNER, 2009-2014

Backlog Orders of HUBER+SUHNER, 2009-2014

Revenue Structure of HUBER+SUHNER by Product, 2013

Structure of Backlog Orders of HUBER+SUHNER by Product, 2013

Revenue Structure of HUBER+SUHNER by Region, 2013

Revenue and Net Income of Kingsignal, 2009-2014

Revenue Structure of Kingsignal by Region, 2009-2014

Revenue Structure of Kingsignal by Product, 2009-2013

Gross Margin of Kingsignal by Product, 2009-2013

Kingsignal’s Procurement from Top 5 Suppliers and % of Total Procurement, 2009-2014

Kingsignal’s Revenue from Top 5 Customers and % of Total Revenue, 2008-2014

RF Coaxial Cable Sales Volume of Kingsignal, 2009-2014

Kingsignal’s Revenue from Main RF Coaxial Cable Products, 2009-2013

Revenue and Net Income of Hengxin Technology, 2009-2014

Revenue Structure of Hengxin Technology by Product, 2009-2013

Revenue Structure of Hengxin Technology by Region, 2013

Gross Margin and Net Profit Margin of Hengxin Technology, 2009-2013

Hengxin Technology’s Revenue from Top 5 Customers and % of Total Revenue, 2009-2013

Hengxin Technology’s Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2013

Revenue and Net Income of Trigiant Group, 2009-2014

Revenue Structure of Trigiant Group by Product, 2010-2014

Gross Margin of Trigiant Group by Product, 2010-2014

Trigiant Group’s Revenue from Top 5 Customers and % of Total Revenue, 2010-2013

Trigiant Group’s Procurement from Top 5 Suppliers and % of Total Procurement, 2010-2013

RF Coaxial Cable Sales Volume of Trigiant Group, 2009-2014

RF Coaxial Cable Capacity of Trigiant Group, 2009-2013

Revenue and Net Income of Zhongtian Hitachi RF Cable, 2009-2014

Output and Sales Volume of Zhongtian Hitachi RF Cable, 2012-2013

Gross Margin of Zhongtian Hitachi RF Cable, 2009-2014

Gross Margin of Major Global and Chinese RF Coaxial Cable Companies, 2009-2013

Chinese RF Coaxial Cable Market Size, 2013-2017E

Global and China RF Coaxial Cable Industry Report, 2019-2025

Global market:As the rapid application of 5G to areas from internet of things (IoT) to wireless communications across the world fuels demand for RF coaxial cables (especially for fine/ultrafine produc...

Global and China RF Coaxial Cable Industry Report, 2018-2022

Benefitted from fast development of downstream sectors, and constant increase of category and technology requirement of RF coaxial cable from high-end equipment, the market size of RF coaxial cable sw...

Global and China RF Coaxial Cable Industry Report, 2015-2018

RF coaxial cable, a general term for coaxial cables that transmit electrical signal or energy within radio frequency range, is mainly used in communications equipment, communications terminals, aerosp...

Global and China RF Coaxial Cable Industry Report, 2014-2017

Benefiting from a surge in mobile phone users and gradual replacement of 2G by 3G and 4G in developing countries, global RF coaxial cable market size has been growing, registering an average annual gr...

Global and China Mobile Phone (Cell Phone) Assembly Industry Report, 2012-2013

The report highlights: 1. Global Mobile Phone Market and Industry 2. China Mobile Phone Market and Industry 3. China Mobile Phone Export &...

Global and China Mobile (Cell) Phone Assembly Industry Report, 2011-2012

In 2011, the mobile phone output in China increased by 15.5% over 2010 to 1.172 billion sets, among which, the export volume rose by 13.9% over 2010 to 885 million sets, with the export value climbed ...

Latin America Telecommunication Market Report, 2010-2011

Latin America is a potential market with a population and GNP over 580 million and USD2.3 trillion respectively. Telecommunication industry has started reformation since 1980s and gradually realized p...