Global and China Automotive Connector Industry Report, 2014-2015

-

Dec.2014

- Hard Copy

- USD

$2,200

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZYW192

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,400

-

Global and China Automotive Connector Industry Report, 2014-2015 contains the followings:

1. Overview of Global and Chinese Automotive Market

2. Analysis on Automotive Connector Industry and Market

3. Research on 13 Major Automotive Connector Companies

As the most potential segment in the connector industry, automotive connectors will trigger the market value of USD12.7 billion (up 5.3% from 2013) in 2014, whilst the global connector market is expected to hit USD50.2 billion (representing a slight increase of 2.6% compared with 2013). The growth of the automotive connector market is attributed to: First, the intensified automotive electronization (especially PEVs and PHEVs) generates more demand for connectors. Second, Chinese and American automotive markets grow strongly, particularly luxury cars and SUVs featured with higher electronization degree and higher requirements on quality grow aggressively.

Although the Chinese sedan market underperforms, the SUV market has maintained the growth rate of more than 40% and the luxury car market has also performed well. In 2015, the global automotive connector market is expected to grow 3.5% and reach USD13.1 billion; the overall connector market is expected to grow slightly by 2.2%.

Automotive connector companies can be divided into three types, namely versatile connector companies, automotive wiring harness companies and professional automotive connector companies. Although covering a broad business scope, numerous versatile connector companies lack growth potentials. Automotive wiring harness companies and professional automotive connector companies have more potentials and high profitability. For example, Taiwan Hu Lane Associate mainly serves BYD, Changan Automobile and Great Wall Motors, and has entered the supply chain of Shanghai GM successfully recently. The gross margin of Hu Lane Associate always remains at above 40% and its operating margin has seen growth for consecutive five years, which large companies even can not compare with. Hu Lane Associate not only maintains stable performance, but also absorbs new customers every year.

Three automotive wiring harness giants are strengthening connector business. Japanese companies are trying to improve their supply capacity, while American and European counterparts are acquiring small firms actively. Delphi acquired FCI’s MVL Division in 2012, and took over North America's largest automotive window connector company – Antaya in September 2014.

1. Global Automobile Market

1.1 Global Automobile Market

1.2 Global Automobile Industry

2. China Automobile Market

2.1 Overview

2.2 Passenger Vehicle Market Status

2.3 Passenger Vehicle Market Analysis

2.4 Commercial Vehicle Market

2.5 Monthly Sales Volume of Major Automakers

2.6 China Automobile Industry

3. Automotive Connector Market and Industry

3.1 Introduction to Connector

3.2 Examples of Connector

3.3 Classification of Connector

3.4 Connector Market Size

3.5 Automotive Connector Market

3.6 Automotive Wiring Harness Industry

3.7 Automotive Connector Rankings

4. Automotive Connector Manfuacturers

4.1 TE CONNECTIVITY

4.2 MOLEX

4.3 AMPHENOL

4.4 JAE

4.5 JST

4.6 HIROSE

4.7 SUMITOMO ELECTRIC INDUSTRIES

4.8 DELPHI

4.9 YAZAKI

4.10 KET

4.11 KYOCERA

4.12 HU LANE ASSOCIATE INC.

4.13 ROSENBERG

Automobile Output and Growth Rate in China, 2001-2014

Monthly Sales Volume of Cars in China, Jan. 2010-Oct. 2014

Monthly Sales Volume Growth of Cars in China, Jan. 2010-Oct. 2014

Monthly Sales Volume and Growth of Passenger Cars in China, Jan. 2011-Oct. 2014

Monthly Sales Volume of Sedans in China, Jan. 2010-Oct. 2014

Monthly Sales Volume of SUV in China, Jan. 2010-Oct. 2014

Distribution of Passenger Cars by Displacement, Jan.-Oct. 2014

Distribution of Passenger Cars by Type of Transmission, Jan.-Oct. 2014

Market Share of Different Branded Automakers

Monthly Sales Volume and Growth of Commercial Vehicles in China, Jan. 2011-Oct. 2014

Monthly Sales Volume of Medium/Heavy Duty Trucks in China, Oct. 2012-Oct. 2014

Monthly Sales Volume of Light Duty Trucks in China, Oct. 2012-Oct. 2014

Monthly Sales Volume and Growth of BYD Passenger Cars, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of Great Wall Passenger Cars, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of Geely Passenger Cars, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of GAC Passenger Cars, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of DFG Passenger Cars, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of CNHTC Heavy Duty Trucks, Jan. 2011-Oct. 2014

Monthly Sales Volume and Growth of BMW Brilliance Passenger Vehicles, Jan. 2011-Oct. 2014

Economic Indicators for Key Enterprise Groups in China, Jan.-Sep. 2014

Revenue Scale of Global Connector Companies, 2007-2017E

Downstream Distribution of Global Connector Market, 2014

Product Distribution of Global Connector Market, 2010

Global Automotive Connector Market Size, 2012-2017E

Global Automotive Connector Market Size by Geography, 2009/2014/2017E

Distribution of Automotive Connectors by Application, 2014

Revenue of Major Global Automotive Wiring Harness Companies, 2009-2014

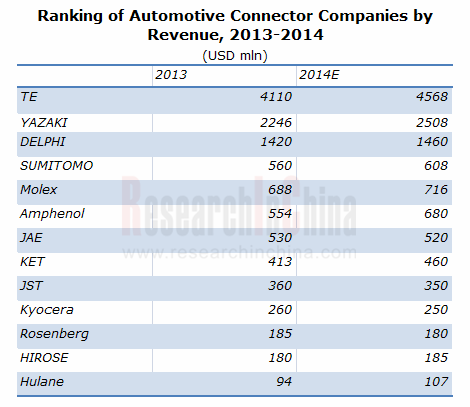

Ranking of Automotive Connectors Companies by Revenue, 2013-2014

Revenue and Operating Margin of TE Connectivity, FY2006-FY2014

Revenue of TE Connectivity by Division, FY2011-FY2014

Revenue and Operating Margin of TE Connectivity’s Automotive Division, FY2011-FY2014

Operating Income of TE Connectivity by Division, FY2011-FY2014

Operating Margin of TE Connectivity by Division, FY2011-FY2014

Revenue Breakdown of TE Connectivity by Application, FY2013\FY2014

Revenue Breakdown of TE Connectivity by Geography, FY2011-FY2014

Supporting Models of Products of TE Connectivity, 2012-2015

Employees of TE Connectivity by Geography, 2011-2013

R&D Costs of TE Connectivity, 2011-2013

Revenue and Operating Margin of Molex, FY2006-FY2014

Revenue Breakdown of Molex by Division, FY2013

Revenue Breakdown of Molex by Division, FY2011-FY2014

Revenue Breakdown of Molex by Geography, FY2006-FY2014

Revenue Breakdown of Molex by Business, FY2011-FY2013

Operating Income of Molex by Business, FY2011-FY2013

Clients of Molex by Geography, FY2011-FY2013

Net Property, Plants and Equipment of Molex by Geography, FY2011-FY2013

Cost Structure of Molex, 2013

Capital Expenditure of Molex, 2001-2013

Manufacturing Footprints of Molex by Geography, 2007 \2013

Revenue and Operating Margin of Amphenol, FY2006-FY2014

Revenue Breakdown of Amphenol by Geography, 2010

Revenue Breakdown of Amphenol by Application, 2010\2013

Revenue and Operating Margin of JAE, FY2007-FY2015

Revenue Breakdown of JAE by Division, FY2007-FY2015

Revenue Breakdown of JAE by Geography, FY2007-FY2015

Oversea Production Breakdown of JAE, FY2007-FY2015

Revenue Breakdown of JAE by Application, FY2011-FY2015

Global Presence of JAE

Global Presence of JST

Revenue and Operating Margin of HIROSE, FY2000-FY2015

Revenue Breakdown of HIROSE by Application, FY2013-FY2014

Overseas Capital-Output Ratio of HIROSE, FY2009-FY2015

Employee Distribution of HIROSE, 2011-2014

Shareholder Distribution of HIROSE, 2011-2014

Revenue and Operating Margin of Sumitomo Electric Industries, FY2008-FY2015E

Revenue Breakdown of Sumitomo Electric Industries by Product, FY2009-FY2015E

Revenue Breakdown of Sumitomo Electric Industries by Geography, FY2013-FY2015E

Automotive Wiring Harness Revenue of Sumitomo Electric Industries, FY2009-FY2015E

Revenue Breakdown of Sumitomo Electric Industries’ Automotive Division by Geography, FY2012

Revenue and Operating Margin of Tianjin Jinzhu Wiring Systems, 2006-2011

Financial Situation of Fujian Yuanguang Wiring Systems, 2012-2014H1

Revenue and Gross Margin of Delphi, 2004-2014

Revenue and Operating Margin of Delphi, 2007-2014

Revenue Breakdown of Delphi by Product, 2009-2014Q3

Operating Income of Delphi by Division, 2012-2014Q3

Distribution of Delphi Clients, 2010-2013

Revenue Breakdown of Delphi by Geography, 2010-2013

Net Property of Delphi by Geography, 2011-2013

Employees of YAZAKI by Geography, FY2011-FY2014

Revenue of YAZAKI, FY2006-FY2014

Revenue Breakdown of YAZAKI by Geography, FY2011-FY2013

Client Distribution of YAZAKI

Supporting Models of YAZAKI Wiring Harness, 2013-2015

Production Base Layout of YAZAKI in China

Revenue and Operating Margin of KET, 2006-2014

Major Automotive Connector Products of KET

Major Electronic Connector Products of KET

Global Distribution of KET

Organizational Structure of Hu Lane

Revenue and Operating Margin of Hu Lane, 2009-2015E

Monthly Revenue of Hu Lane, Oct. 2012-Oct. 2014

Plant Distribution of Hu Lane

Client Distribution of Hu Lane by Geography, 2011-2014

Organizational Structure of Rosenberg

Subsidiaries of Rosenberg

Revenue of Rosenberg, 2009-2014

Revenue Breakdown of Rosenberg by Geography, 2014

Revenue Breakdown of Rosenberg by Application, 2014

Major Clients of Rosenberg

Number of Employees of Rsenberg, 1998-2011

Major Automotive Connector Products of Rsenberg

Global Distribution of Rosenberg

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...