Global and China Automotive Steering System Industry Report, 2014-2018

-

Feb.2015

- Hard Copy

- USD

$2,500

-

- Pages:120

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

YSJ083

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,700

-

With the expansion of the automotive market, the demand for steering system has showed steady growth. In 2014, the global automotive steering system market size exceeded 90 million sets with the revenue of USD31.1 billion. EPS has become the dominance of the steering system market, with a share of over 50%.

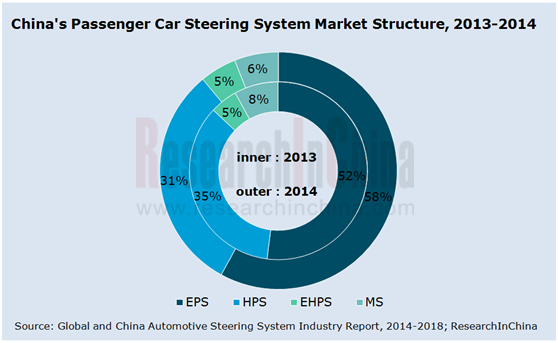

In 2014, Chinese automotive steering system market size increased to 23.89 million sets, of which the demand for passenger car steering system rose to 19.92 million sets. In China, the EPS technology of mainstream companies has been more mature, the product demand has been growing rapidly, and EPS is replacing HPS to be the main role in the automotive steering system market.

The global automotive steering system market is highly concentrated in six big producers – JTEKT, ZF Lenksysteme, TRW, NSK, Mando and Nexteer, in which JTEKT and ZF Lenksysteme act as leaders with the respective market share of more than 15%. In 2014, the 100% stake of the world's second largest steering system manufacturer – ZF Lenksysteme was taken over by Bosch, while ZF acquired the third-ranked TRW; the fifth largest producer Mando became an independent company focusing on EPS and other parts.

In the Chinese market, JTEKT, ZF Lenksysteme and other foreign manufacturers still occupy dominating positions; at the same time, Chinese local enterprises such as CAAS, Zhejiang Shibao, FAWER Automotive Parts, AVIC-Xihang Yubei and ELITE represent huge potentials with higher market share.

As China's largest steering system group, CAAS operates its business through its eight subsidiaries. In 2013, CAAS sold up to 4.27 million sets of steering system, representing a year-on-year increase of 22% and the market share of 19.3%, 1.2 percentage points higher than 2012. In China, CAAS mainly serves Geely, Great Wall Motors, Brilliance Jinbei, BYD, Beiqi Foton, Dongfeng Motor, FAW Group and Chery.

ZF Shanghai Steering Systems is a joint venture set up by Huayu Automotive Systems (49%) and ZF Lenksysteme (51%), with more than 1,500 employees. In 2013, the company sold 2.64 million sets of steering system and held the market share of 11.9%, 3.1 percentage points higher than 2012. Wherein, the company sold 2.12 million sets of EPS with the market share of 23%. The company has established two branches in Yantai and Wuhan, serving customers in North and South China respectively. Wuhan Branch began production in October 2014 and supported Shanghai GM (Wuhan), FAW-Volkswagen Chengdu, Shanghai Volkswagen Changsha, Dongfeng Peugeot Citroen, Changan Ford and other customers.

The report includes the following aspects:

Global and Chinese automotive steering system market size, market structure and competitive landscape; relationship between leading manufacturers and suppliers;

Global and Chinese automotive steering system market size, market structure and competitive landscape; relationship between leading manufacturers and suppliers;

Global and Chinese electric steering system (EPS) and hydraulic steering system (HPS) market size, market structure and supply;

Global and Chinese electric steering system (EPS) and hydraulic steering system (HPS) market size, market structure and supply;

Financial status, product types, capacity building, output and sales volume of major steering system companies in the world and China.

Financial status, product types, capacity building, output and sales volume of major steering system companies in the world and China.

1. Overview of Automotive Steering System

1.1 Classification

1.2 Development History

1.3 Technological Level

1.4 Business Model

2. Automotive Steering System Market

2.1 Global Market

2.1.1 Market Size

2.1.2 Competition Pattern

2.1.3 Supply Relationship

2.2 Chinese Market

2.2.1 Market Status

2.2.2 Market Size

2.2.3 Competition Pattern

2.2.4 Supply Relationship

2.3 Import and Export

2.3.1 Import

2.3.2 Export

2.4 Development Prospect

2.4.1 Industry Barriers

2.4.2 Influence Factors

2.4.3 Development Trend

3. Electric Power Steering Market

3.1 Global Market

3.1.1 Classification

3.1.2 Market Size

3.1.3 Market Structure

3.1.4 Supply Relationship

3.2 Chinese Market

3.2.1 Market Size

3.2.2 Market Structure

3.2.3 Assembly Rate

3.2.4 Key Companies

3.2.5 Supply Relationship

3.2.6 Development Trend

3.3 Steering-by-wire System

4. Hydraulic Steering System Market

4.1 Global Market

4.1.1 Market Size

4.1.2 Supply Relationship

4.2 Chinese Market

4.2.1 Market Size

4.2.2 Assembly Rate

4.2.3 Key Companies

5. Key International Manufacturers

5.1 JTEKT

5.1.1 Profile

5.1.2 Operation

5.1.3 Development in China

5.2 ZF Lenksysteme

5.2.1 Profile

5.2.2 Operation

5.2.3 Development in China

5.3 NSK

5.3.1 Profile

5.3.2 Operation

5.3.3 Steering Business

5.3.4 Development in China

5.4 TRW

5.4.1 Profile

5.4.2 Operation

5.4.3 Steering Business

5.4.4 Development in China

5.5 Mando

5.5.1 Profile

5.5.2 Operation

5.5.3 Steering Business

5.5.4 Development in China

5.6 Nexteer Automotive

5.6.1 Profile

5.6.2 Operation

5.6.3 Steering Business

5.6.4 Development in China

5.7 Showa

5.7.1 Profile

5.7.2 Operation

5.7.3 Steering Business

5.7.4 Development in China

5.7.5 Guangzhou SHOWA Absorber Limited Company

5.8 KYB

5.8.1 Profile

5.8.2 Operation

5.8.3 Steering Business

5.8.4 Development in China

5.9 Hitachi Automotive Systems

5.9.1 Profile

5.9.2 Operation

5.9.3 Steering Business

5.9.4 Development in China

6. Key Chinese Manufacturers

6.1 Zhejiang Shibao Company Limited

6.1.1 Profile

6.1.2 Revenue and Gross Margin

6.1.3 Cost of Revenue

6.1.4 Production Base

6.1.5 Production and Sales Volume

6.1.6 Major Clients and Suppliers

6.1.7 Development Planning

6.2 China Automotive Systems, Inc.

6.2.1 Profile

6.2.2 Operation

6.2.3 Production Capacity

6.2.4 Sales Status

6.2.5 Major Clients

6.3 FAWER Automotive Parts Limited Company

6.3.1 Profile

6.3.2 Revenue and Gross Margin

6.3.3 Production and Sales Volume

6.3.4 Subsidiaries with Steering Business

6.3.5 Major Clients and Suppliers

6.4 Zhuzhou ELITE Electro Mechanical Co., Ltd

6.4.1 Profile

6.4.2 Operation

6.4.3 Supply Relationship

6.5 Zhejiang Wanda Steering Gear Co., Ltd

6.6 Hubei Tri-Ring Motor Steering Gear Co., Ltd.

6.7 Jiangmen Xingjiang Steering Gear Co., Ltd.

6.8 AVIC-Xihang Yubei Steering System Co., Ltd.

6.9 Tianjin Jinfeng Automobile Chassis Parts Co., Ltd.

6.10 Zhejiang Fulin Guorun Auto Parts Co., Ltd.

6.11 Chongqing Changfeng Machinery Co., Ltd.

6.12 Anhui Finetech Machinery Co., Ltd

6.13 Hafei Industrial Group Automobile Redirector Obligate Co., Ltd.

6.14 Donghua Automotive Industrial Co., Ltd.

Classification of Automotive Steering System

Comparison among Power Steering Systems by Energy Consumption

Development History of Automotive Steering System

Market Size of Global Automotive Steering System (Quantity), 2011-2018E

Market Size of Global Automotive Steering System (Amount), 2011-2018E

Market Share of Major Global Automotive Steering System Companies, 2013

Supply Relationship between Global Automotive Steering System Manufacturers and Vehicle Manufacturers

Market Size of China’s Automotive Steering System (Quantity), 2009-2018E

Market Size of China’s Automotive Steering System (Amount), 2011-2018E

Market Structure of China’s Passenger Vehicle Steering System, 2013-2014

Capacity and Planning of Major Chinese Automotive Steering System Manufacturers, 2014 vs. 2015E

Major International Competitors of China’s Automotive Steering System Industry

Market Share of Major Chinese Automotive Steering System Companies, 2013

Supply Relationship between Chinese Automotive Steering System Suppliers and Vehicle Manufacturers

Import Volume and Value of China’s Automotive Steering System Components, 2006-2014

Main Import Countries of China’s Automotive Steering System Components, 2014

Export Volume and Value of China’s Automotive Steering System Components, 2006-2014

Main Export Countries of China’s Automotive Steering System Components, 2014

Global EPS Market Size, 2011-2018E

Global EPS Market Structure (by Type), 2012-2018E

Global EPS Market Size, 2012-2018E

Supply Relationship between Global EPS Manufactures and Vehicle Manufacturers

EPS Component Suppliers of Toyota

EPS Component Suppliers of Nissan

EPS Component Suppliers of Honda

EPS Component Suppliers of Mazda

EPS Component Suppliers of Mitsubishi

EPS Component Suppliers of Subaru

EPS Component Suppliers of Daihatsu

EPS Component Suppliers of Suzuki

China’s EPS Market Size, 2011-2018E

Vehicle Models with EPS

China’s EPS Market Structure (by Type), 2009-2018E

EPS Assembly Rate of China’s Passenger Vehicle, 2011-2018E

Price Distribution of Cars Supporting China’s Electric Power Steering System, 2015

Capacity of China’s Leading EPS Manufacturers, 2015

Supply Relationship between Chinese EPS Manufacturers and Vehicle Manufacturers

Global HPS Market Size, 2011-2018E

Supply Relationship between Global Hydraulic Steering System Manufacturers and Vehicle Manufacturers

Hydraulic Steering System Component Suppliers of Toyota

Hydraulic Steering System Component Suppliers of Nissan

Hydraulic Steering System Component Suppliers of Honda

Hydraulic Steering System Component Suppliers of Mazda

Hydraulic Steering System Component Suppliers of Mitsubishi

Hydraulic Steering System Component Suppliers of Subaru

Hydraulic Steering System Component Suppliers of Daihatsu

Hydraulic Steering System Component Suppliers of Suzuki

Market Size of China’s Automobile Hydraulic Steering System, 2011-2018E

China’s HPS and EHPS Assembly Rate, 2011-2018E

Price Distribution of Cars Supporting China’s Hydro-mechanical Power Steering System, 2015

Price Distribution of Cars Supporting China’s Electro-hydraulic Power Steering System, 2015

Capacity of China’s Leading EHPS Companies

Steering System Products of JTEKT

Operational Indicators of JTEKT, FY2010-2014

Turnover of JTEKT, FY2010-2014

Net Income of JTEKT, FY2010-2014

Sales of JTEKT by Department, FY2014

Sales of JTEKT by Region, FY2014

Supported Vehicle Models of Steering System Products of JTEKT, 2013-2014

Steering System Production Bases of JTEKT in China

Sales Volume and Supported Vehicle Models of Steering System Products of JTEKT Automotive Parts (Tianjin), 2009-2013

Sales of ZF Lenksysteme, 2011-2013

Sales Structure of ZF Lenksysteme (by Region/Business), 2013

Supported Vehicle Models of Steering System Products of ZF Lenksysteme, 2013-2014

Automotive Steering System Production Bases of ZF Lenksysteme in China

Global Presence of NSK

Sales of NSK (by Department), FY2012-2016E

Sales of NSK (by Region), FY2014

Global Steering System Production Bases of NSK

Supported Vehicle Models of Steering System Products of NSK, 2013-2014

Sales of NSK in China, FY2011-2015E

R&D Center and Production Base of NSK in China

Operating Performance of TRW, 2013-2014

TRW by Business, 2011-2013

Major Clients of TRW, 2012-2013

Supported Vehicle Models of Steering System Products of TRW, 2013-2014

Sales of TRW in China, 2010-2013

Organizational Structure of Mando

Operating Performance of Mando, 2014

Client Distribution of Mando

Production Capacity of Mando, 2013-2014

Steering System Products of Mando

Supported Vehicle Models of Steering System Products of Mando, 2013-2014

Distribution of Mando in China

Financial Indicators of Nexteer Automotive, 2012-2014

Sales of Steering System of Nexteer Automotive, 2012-2014

Sales of Nexteer Automotive in China, 2012-2014

Production Bases of Nexteer Automotive in China

Auto Parts of Showa

Global Distribution of Showa

Operating Performance of Showa, FY2011-2014

Sales and Operating Income of Showa by Department, FY2014

Supported Vehicle Models of Steering System Products of Showa

Showa’s Branches in China

Automotive Steering Gear Production Equipments of Guangzhou SHOWA Absorber

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Guangzhou SHOWA Absorber, 2007-2013

Sales and Net Income of KYB, FY2013-2014

Sales of KYB by Business, FY2013-2014

Supported Vehicle Models of Steering System Products of KYB

KYB’s Branches in China

Revenue of Hitachi Automotive Systems, FY2011-2014

Client Architecture of Hitachi Automotive Systems, FY2013

Supported Vehicle Models of Steering System Products of Hitachi Automotive Systems

Sales of Hitachi Automotive Systems in China, FY2010/2013/2015

Distribution of Hitachi Automotive Systems in China

Revenue and Gross Margin of Zhejiang Shibao, 2008-2014

Revenue and Gross Margin of Main Products of Zhejiang Shibao, 2013-2014

Operating Cost of Zhejiang Shibao, 2009-2014

Production Cost of Main Products of Zhejiang Shibao, 2012-2013

Operational Indicators of Steering System Production Bases of Zhejiang Shibao, 2013

Operational Indicators of Steering System Production Bases of Zhejiang Shibao, H1 2014

Output, Sales Volume and Inventory of Zhejiang Shibao, 2011-2013

Top 5 Clients of Zhejiang Shibao, 2012-2014

Top 5 Raw Material Suppliers of Zhejiang Shibao, 2012-2013

Organizational Structure of CAAS

Subsidiaries of CAAS

Sales and Cost of Sales of CAAS, 2012-2013

Sales Structure of CAAS (by Region), 2012-2013

Capacity of CAAS Subsidiaries

Sales Volume of CAAS, 2010-2013

Major Clients of CAAS

Top 10 Clients of CAAS, 2013

Revenue, Net Income and Gross Margin of FAWER, 2013-2014

Revenue and Gross Margin of FAWER by Business, 2013-2014

Revenue and Gross Margin of FAWER by Region, 2013-2014

Output and Sales Volume of FAWER by Product, 2012-2013

FAWER Subsidiaries Specialized in Steering System, 2013

Major Clients of FAWER, 2013-2014

Major Suppliers of FAWER, 2013

Sales Volume of ELITE, 2009-2017E

Supported Vehicle Models of Steering System Products of ELITE

Supported Clients and Output and Sales Volume of Steering System Products of Tianjin ELITE, 2011-2013

Major Investment Projects of Zhejiang Wanda Steering Gear, 2011-2015E

Output and Sales Volume of Steering System Products of Hubei Tri-Ring Motor Steering Gear

Steering Gear Output and Sales Volume and Supported Vehicle Models of Jiangmen Xingjiang Steering Gear, 2006-2013

Organizational Structure of AVIC-Xihang Yubei Steering System

Output, Sales Volume and Supported Vehicle Models of Steering Gear of AVIC-Xihang Yubei Steering System, 2007-2013

Stake Structure of Yubei Koyo

Major Clients of Yubei Koyo Steering System

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Yubei Koyo, 2007-2013

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Chongqing Changfeng Machinery, 2006-2013

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Anhui Finetech Machinery, 2006-2013

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Hafei Industrial Group Automobile Redirector Obligate, 2006-2012

Output, Sales Volume and Supported Vehicle Models of Steering Gear of Donghua Automotive Industrial, 2008-2013

Capacity of Donghua Automotive Industrial, 2013

Product Sales Planning of Donghua Automotive Industrial, 2011-2015E

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...