China Three-way Catalytic Converter Industry Report, 2014

-

Mar.2015

- Hard Copy

- USD

$2,600

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

ZN020

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$2,800

-

Three-way catalysis refers to the catalysis that converts harmful gases including CO, HC and NOx from automobile exhaust into harmless carbon dioxide, water and nitrogen via oxidization and reduction, mainly with a three-way catalytic converter, which is carried by a porous ceramic material and mounted on a special exhaust pipe. The reason it is called carrier is that it itself does not participate in catalytic reaction, but is covered with a layer of platinum, rhodium, palladium and other precious metals, and is the most important purification device outside the machine installed in an automobile exhaust system.

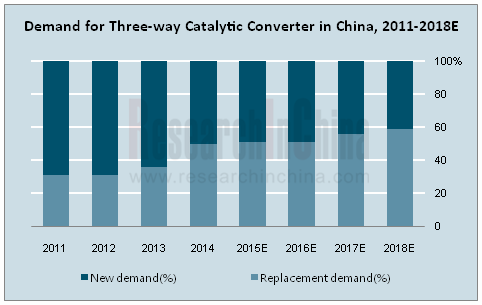

Chinese three-way catalytic converters for passenger cars are mainly divided into two parts, i.e. new demand and replacement demand. From the measured historical data, 2014 is the milestone year for three-way catalytic converter demand. Prior to that, the new demand, influenced by a large base of new cars and still not a replacement tide for three-way catalytic converter, had been significantly higher than the replacement demand, e.g. 17.93 million and 15 million respectively in 2013. However, the replacement demand (20.02 million) exceeded the new demand (19.92 million) in 2014. In the future, with a slowdown in domestic automobile production and sales and the arrival of peak demand for replacing automotive three-way catalytic converters, China's three-way catalytic converter and industry chain parts will be beneficiaries.

Source: China Three-way Catalytic Converter Industry Report, 2014 by ResearchInChina

With regard to catalyst, 26.41 million liters were needed by passenger cars in 2014, of which, over 80% were provided by foreign companies and the remaining 20% by domestic Chinese peers. According to China Internal Combustion Engine Industry Association, as of 2013, all catalysts for joint-venture passenger cars were made by foreign companies, and even for independent brand passenger cars, only 55% of catalysts thereof came from domestic companies.

As far as catalyst encapsulation is concerned, the main market is still dominated by foreign-funded or joint-venture enterprises represented by Faurecia and Tenneco which mainly occupy the middle and high-end market and support joint-venture vehicle manufacturers. Wuxi Weifu Lida Catalytic Converter Co., Ltd., a large-scale domestic manufacturer of automobile exhaust purifier, mainly supports self-owned brands.

The report highlights the followings:

Overview of three-way catalytic converter, including definition, structure, industry policies, etc.

Overview of three-way catalytic converter, including definition, structure, industry policies, etc.

Global three-way catalytic converter market demand, including global automobile production and sales, demand estimation, etc.;

Global three-way catalytic converter market demand, including global automobile production and sales, demand estimation, etc.;

China’s three-way catalytic converter market demand, consisting of the development status, competition pattern, market demand, etc. of China’s automobile industry;

China’s three-way catalytic converter market demand, consisting of the development status, competition pattern, market demand, etc. of China’s automobile industry;

18 manufacturers in three-way catalytic converter industry chain e.g. Implats, Kunming Sino-Platinum Metals, Heraeu, Cataler, BASF, Johnson-Matthey, Tianjin HySci Company, involving their revenue, net income, revenue structure, production base, catalyst business, etc.

18 manufacturers in three-way catalytic converter industry chain e.g. Implats, Kunming Sino-Platinum Metals, Heraeu, Cataler, BASF, Johnson-Matthey, Tianjin HySci Company, involving their revenue, net income, revenue structure, production base, catalyst business, etc.

1. Definition of Three-way Catalyst (TWC)

1.1 Definition

1.2 Composition and Structure

1.2.1 PGM

1.2.2 Catalyst

1.2.3 Ceramic Substrate

1.2.4 Liner

1.2.5 Sensor

2. Global TWC Market Size

2.1 Overview of Global Automobile Industry

2.2 Global TWC Market Size

3. Chinese TWC Market Size

3.1 Automobile Overview

3.1.1 Automobile Market

3.1.2 Passenger Car Market and Market Segments

3.1.3 Commercial Vehicle Market and Market Segments

3.2 Policies

3.3 TWC Market Size

3.4 Competition Pattern

3.5 Driving Factors of Catalytic Converter

4.PGM

4.1 Implats

4.1.1 Profile

4.1.2 Platinum Production and Sales

4.1.3 Operation

4.1.4 Development Planning

4. 2 Kunming Sino-Platinum Metals

4.2.1 Profile

4.2.2 Operation

4.2.3 By Product / Region

4.2.4 Gross Margin

4.2.5 R&D

4.2.6 Automotive Catalyst

4.2.7 Development Planning

4.3 Heraeus

4.3.1 Profile

4.3.2 Operation

4.3.3 Catalyst Business

5. TWC

5.1 Cataler

5.1.1 Profile

5.1.2 Major Clients and Production Bases

5.1.3 Cataler (Wuxi) Automotive Environment Technology Co., Ltd. [CCC]

5.2 BASF

5.2.1 Profile

5.2.2 Catalyst Business

5.3 Umicore (acquired Delphi’s automotive catalyst business in 2007)

5.3.1 Profile

5.3.2 Operation

5.3.3 Umicore Automotive Catalysts (Suzhou) Co., Ltd.

5.4 Johnson-Matthey

5.4.1 Profile

5.4.2 Operation

5.4.3 Johnson Matthey Shanghai Chemicals Ltd.

5.5 Tianjin HySci Company

5.6 Daiichi Kigenso Kagaku Kogyo Co., Ltd.

5.6.1 Profile

5.6.2 Operation

5.6.3 Catalyst Business

6. Substrate

6.1 Corning (Shanghai) Co., Ltd.

6.1.1 Profile

6.1.2 Operation

6.1.3 Corning (Shanghai) Co., Ltd.

6.2 NGK Insulators

6.2.1 Profile

6.2.2 Operation

6.2.3 NGK Insulators (Suzhou)

6.3 Ibiden

6.3.1 Profile

6.3.2 Operation

6.4 Jiangsu Province Yixing Nonmetallic Chemical Machinery Factory Co., Ltd.

6.5 Nanjing Kerui Special Ceramics Company Limited (a subsidiary of Gaochun Ceramics)

6.6 Weihai Pacific Industrial Development Corporation (PIDC), China

7. Gasket

7.1 3M (China) Co., Ltd.

7.2 Zhejiang Bondlye Motor Environmental Technology

7.3 Unifrax (Shanghai)

8. Sensor Companies

8.1 Bosch

8.1.1 Profile

8.1.2 Operation

8.1.3 Oxygen Sensor Business

8.2 Delphi

8.2.1 Profile

8.2.2 Operation

8.2.3 Oxygen Sensor Business

8.3 Denso

8.3.1 Profile

8.3.2 Operation

8.4 NGK

8.4.1 Global Sensor Production Base

8.4.2 NGK Spark Plug (Shanghai) Co., Ltd.

8.5 Kefico

8.5.1 Profile

8.5.2 Main Products

8.5.3 Operation

8.6 UAES

9. Leading TWC Integrated Manufacturers

9.1 Faurecia

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 R & D

9.1.5 Performance in China

9.1.6 Major Supporting Models

9.1.7 Faurecia (Changchun) Exhaust System Co., Ltd

9.1.8 Shanghai Faurecia Honghu Exhaust System

9.1.9 Wuhan Faurecia Tongda Exhaust System

9.1.10 Faurecia Exhaust System Qingdao

9.1.11 Faurecia Exhaust System Chengdu

9.1.12 Faurecia Exhaust System Chongqing

9.1.13 Faurecia Exhaust System (Ningbo Hangzhou Bay New Zone)

9.2 TENNECO

9.2.1 Profile

9.2.2 Financial Data

9.2.3 Business in China

9.2.4 Major Clients in China

9.2.5 TENNECO’s Major Supporting Models in China

9.2.6 Shanghai Tenneco Exhaust System Co. Ltd.

9.2.7 Tenneco Tongtai (Dalian) Exhaust System Co., Ltd.

9.2.8 Tenneco-Eberspaech (Dalian) Exhaust System Co., Ltd.

9.2.9 Tenneco Lingchuan (Chongqing) Exhaust System Co., Ltd.

9.3 J. Eberspaecher GmbH & Co. KG

9.3.1 Profile

9.3.2 Financial Data

9.3.3 Production Base

9.3.4 Major Supporting Models

9.3.5 R & D Costs

9.3.6 Eberspaecher Exhaust Technology (Shanghai) Co., Ltd.

9.3.7 Tenneco-Eberspaech (Dalian) Exhaust System Co., Ltd. (see 9.2.8)

9.3.8 Eberspaech Exhaust Technology (Xi’an) Co., Ltd.

9.4 Weifu Group

9.4.1 Profile

9.4.2 Financials

9.4.3 Exhaust Gas After-treatment System

Main Structure of Catalytic Converter

Average Prices of Exhaust Systems of Gasoline Engine and Diesel Engine, 2009 & 2014

Global TWC Market Size, 2013-2018E

Number of Automobile Makers and YoY Growth in China, 2003-2014

Revenue and YoY Growth of China’s Automobile Manufacturing Industry, 2003-2014

Total Profit and YoY Growth of China’s Automobile Manufacturing Industry, 2003-2014

Gross Margin of China’s Automobile Manufacturing Industry, 2003-2014

Chinese TWC Market Size, 2012-2014

China’s Demand of TWC, 2009-2018E

Implementation of National Standards for Pollutant Emission of Motor Vehicle

Ownership Structure of Implats

Mining Production of Implats, 2014

Financial Data of Implats, 2010-2014

Financial Data of Implats by Product, 2010-2014

Employees of Sino-Platinum Metals, 2010-2014

Gross Margin and Net Profit Margin of Sino-Platinum Metals, 2010-2014

Gross Margin of Sino-Platinum Metals by Product, 2010-2014

R&D Costs and % of Total Revenue of Sino-Platinum Metals, 2010-2013

Revenue of Heraeus, 2009-2013

Revenue Structure of Heraeus by Region, 2009-2013

Revenue from Metal Products of Heraeus, 2009-2013

Cataler’s Overseas Production Bases

Cataler’s Revenue, FY2002 -FY2014

BASF’s Global Mobile Emissions catalysts Capacity Expansion, 2011-2014

Umicore’s organization structure

Global Distribution of Umicore’s Automotive Catalyst Business

Umicore’s Layout in China

Revenue of Johnson-Matthey, 2013-2014

Revenue of Emission Control Technologies, 2014H1

Johnson Matthey’s Light Duty Catalyst Sales, 2014H1

Johnson Matthey’s Heavy Duty Diesel Catalyst Sales of 2014H1

Johnson Matthey’s Total R&D Costs and Segment R&D Spending Percentage, 2012-2014

Market Position of Johnson Matthey’s LDV Catalyst

DKKK’s Revenue, FY2013-FY2015

DKKK’s Operating Income and Operating Margin, FY2013-FY2015

DKKK’s Main Factories

DKKK’s Revenue from Catalyst, FY2014

Corning’s Product Application

Carrier/Filter Plants around the Globe

NGK’s Production Bases Worldwide

Revenue and Operating Margin of NGK, FY2007-FY2014

Revenue of NGK by Division, FY2007-FY2014

NGK’s Performance, FY2015E

Capital Expenditures of NGK by Division, FY2010-FY2014

Revenue and Operating Margin of NGK’s Ceramics Division, FY2008-FY2014

Revenue of NGK’s Ceramics Division by Product, FY2012-FY2014

Revenue of NGK’s Ceramics Division by Product, FY2004-FY2015

Ibiden’s Revenue by Segment, FY2014

Ibiden’s DpFs Revenue, 2011-2015

Main Sales Territories of Coral Ceramics

3M’s Regional Sales, 2011-2013

3M’s Financial Revenue, 2010-2014

3M’s Sales by Division, 2013-2014

Bosch’s Number of Employees, 2009-2013

Bosch’s Revenue Structure Division, 2012-2013

Sales & EBIT of Bosch's Automotive Division, 2012-2013

Bosch’s Revenue Structure by Region, 2012-2013

Delphi’s Number of Employees, 2011-2013

Delphi’s Revenue, Net Income and Gross Margin, 2010-2013

Delphi’s Top 5 Clients and Revenue Contribution, 2012-2013

Name List and Revenue Contribution of Top5 Clients of Delphi, 2012-2013

Delphi’s Oxygen Sensor Production Bases

Number of DENSO Employee, FY 2009-FY2013

Denso’s Sales and Profit, FY2013-FY2015

Denso’s Operation Profit and Net Income, FY2011-FY2015

Revenue Structure of Denso by Division, FY2011-FY2015Q1

Sales and Operation Profit of DENSO by Region, FY2013-FY2015

Denso’s Revenue by Customer, FY2010-FY2014

Denso’s Customer Structure, FY2013-2014

Kefico’s Main Customers

Kefico’s Revenue, 2012-2013

Faurecia's Number of Employees (by Business), 2011-2013

Faurecia's Number of Employees (by Region), 2011-2013

Faurecia’s Development Plan in China

Faurecia’s Production Base in China

Faurecia’s Future Five-year Plan in China

Revenue Structure of TENNECO by Business, 2013

Major Brands and Products of TENNECO’s Clean Air Business Unit

Production Bases of TENNECO Worldwide

Production Bases of TENNECO in China

Exhaust System Production Bases of J. Eberspaecher Worldwide

Gasoline-fueled Vehicle Exhaust Catalytic Converter of

World’s Output of Passenger Cars, YoY Growth and % in Automobile Output, 2007-2018E

Top 20 Countries (based on 2012-year rankings) by Cars Output, 2007-2014

Global Gasoline Exhaust System Accessible Market Size, 2009-2014

China’s Automobile Output and Sales Volume (by Passenger Vehicle and Commercial Vehicle), 2009-2017E

China’s Passenger Vehicle Output, YoY Growth, 2005-2017E

Market Share of Various Models by Sales Volume in China’s Passenger Vehicle Market, 2008-2014

China’s Top10 Manufacturers by Passenger Vehicle Sales Volume, 2008-2014

China’s Bus Output (by Model), 2009-2017E

China’s Bus Sales Volume (by Model), 2009-2017E

China’s Top10 Manufacturers Based on Bus Output and Sales Volume (by Model), 2012-2013

China’s Top10 Manufacturers Based on Bus Output and Sales Volume (by Model), 2014

China’s Truck Output (by Model), 2009-2017E

China’s Truck Sales Volume (by Model), 2009-2017E

China’s Top10 Manufacturers Based on Truck Output and Sales Volume (by Model), 2012-2013

China’s Top10 Manufacturers Based on Truck Output and Sales Volume (by Model), 2014

Key Policies about Environmental Control in China, 2012-2013

China’s Annual Average Demand for TWC, 2012-2014

Leading Chinese Manufacturers of Catalytic Converter and the Supported Vehicle Manufacturers, 2013-2014

Platinum Production of Implats, FY2010-FY2014

Key Financial Data of Sino-Platinum Metals, 2010-2014

Revenue Breakdown of Sino-Platinum Metals by Product, 2010-2014

Revenue Breakdown of Sino-Platinum Metals by Region, 2010-2014

Major Subsidiaries of Sino-Platinum Metals, 2014

Cataler’s Development History

Cataler’s Major Clients

Mobile Catalyst Revenue of BASF, 2007-2013

Umicore’s Revenue and EBIT Margin, 2005-2013

Umicore’s Revenue Breakdown by Segment, 2010-2013

Umicore’s Catalyst Revenue and EBITDA, 2008-2013

Corning’s Revenue and Gross Margin, 2006-2014

Corning’s Revenue Breakdown by Segment, 2011-2014

Corning’s Revenue and Net Income from Environmental Technologies, 2005-2013

Ibiden’s Financial Indicators, FY2010-FY2014

Bosch’s Financial Indicators, 2009-2014

Delphi’s Revenue (by Region), 2010-2013

Delphi’s Revenue (by Division), 2010-2013

Delphi’s Gross Margin (by Division), 2010-2013

Revenue Breakdown of Denso by Division, FY2011-FY2015Q1

Faurecia's Revenue and YoY Growth, 2009-2014

Faurecia's Net Income and YoY Growth, 2011-2013

Faurecia's Net Profit Margin, 2011-2013

Faurecia's Revenue Structure (by Business), 2011-2014

Faurecia's Revenue Structure (by Region), 2011-2013

Faurecia's Revenue Structure (by Client), 2011-2013

Faurecia's Investment (by Business), 2011-2013

Faurecia's Investment (by Region), 2011-2013

R&D Costs and % of Total Revenue of Faurecia, 2009-2013

Faurecia’s Sales in China, YoY growth, % of Total sales, 2009-2013

Major Supporting Models

Major Financial Data of TENNECO, 2008-2013

Revenue Contribution (%) of TENNECO’s Major Clients, 2011-2013

TENNECO’s Major Supporting Models, 2014

Financial Data of J. Eberspaecher, 2012-2013

Revenue of J. Eberspaecher by Segment, 2011-2013

Revenue of J. Eberspaecher by Region, 2011-2013

Major Supporting Models of J. Eberspaecher, 2014

R & D Costs of J. Eberspaecher, 2011-2013

Revenue, Net Income and Gross Margin of Weifu High-tech, 2014

Revenue Breakdown of WeiFu High-tech by Region, 2009-2013

Revenue Breakdown of WeiFu High-tech by Business, 2009-2013

Exhaust Gas After-treatment System Related Companies and Products of WeiFu High-tech

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...

Automotive Power Management ICs and Signal Chain Chips Industry Research Report, 2025

Analog chips are used to process continuous analog signals from the natural world, such as light, sound, electricity/magnetism, position/speed/acceleration, and temperature. They are mainly composed o...

Global and China Electronic Rearview Mirror Industry Report, 2025

Based on the installation location, electronic rearview mirrors can be divided into electronic interior rearview mirrors (i.e., streaming media rearview mirrors) and electronic exterior rearview mirro...

Intelligent Cockpit Tier 1 Supplier Research Report, 2025 (Chinese Companies)

Intelligent Cockpit Tier1 Suppliers Research: Emerging AI Cockpit Products Fuel Layout of Full-Scenario Cockpit Ecosystem

This report mainly analyzes the current layout, innovative products, and deve...

Next-generation Central and Zonal Communication Network Topology and Chip Industry Research Report, 2025

The automotive E/E architecture is evolving towards a "central computing + zonal control" architecture, where the central computing platform is responsible for high-computing-power tasks, and zonal co...

Vehicle-road-cloud Integration and C-V2X Industry Research Report, 2025

Vehicle-side C-V2X Application Scenarios: Transition from R16 to R17, Providing a Communication Base for High-level Autonomous Driving, with the C-V2X On-board Explosion Period Approaching

In 2024, t...

Intelligent Cockpit Patent Analysis Report, 2025

Patent Trend: Three Major Directions of Intelligent Cockpits in 2025

This report explores the development trends of cutting-edge intelligent cockpits from the perspective of patents. The research sco...

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...