Global and China Refractories Industry Report, 2018-2022

-

Jun.2018

- Hard Copy

- USD

$3,600

-

- Pages:3200

- Single User License

(PDF Unprintable)

- USD

$3,400

-

- Code:

BXM111

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,000

-

- Hard Copy + Single User License

- USD

$3,800

-

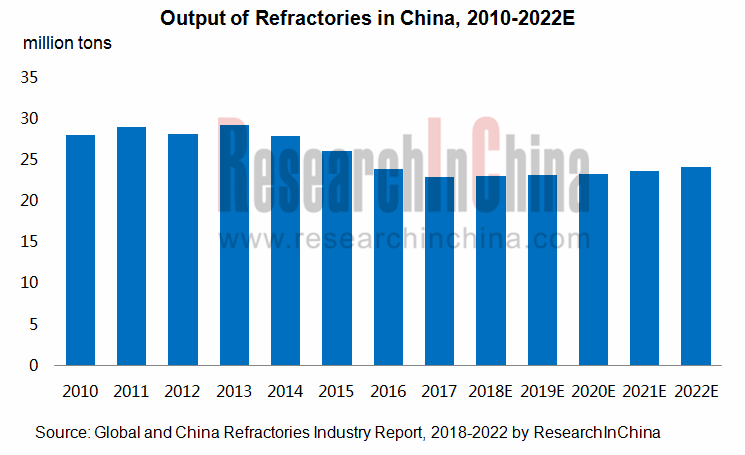

As the supply-side reform is carried out over the recent years, the demand for refractories used for infrastructure projects has dived and the output of refractories keeps falling. In 2017, China produced 22.9254 million tons of refractories, a year-on-year decrease of 4.13% (a drop of 4.13 percentage points on an annualized basis). The fall in output is because refractories for infrastructure construction was less needed since furnaces of some enterprises with substandard environmental work were forced to stop production whilst environmental protection campaign is being staged across China. The narrowed decline benefited from the recovery of downstream sectors like steel and building materials. It is expected that, in the next five years, the refractory market will witness moderate growth and the output of refractories will outnumber 24 million tons in 2022 in the wake of backward capacity being eliminated and the optimized structure of refractory industry.

As China tightens control on mineral resources and environmental pollution, the exploitation of raw materials such as magnesite was restricted in 2017 and the prices of magnesium refractory raw materials hiked. Thereupon, some suppliers of refractory raw materials and the refractory enterprises yielding proceeds from raw materials saw remarkable growth in profits, while refractory product enterprises are confronted with the amounting cost pressure and reap meager profits. Allured by the lucrative business, some enterprises in places like Liaoning province lifted their investments into high-purity magnesia projects in 2017.

In 2017, China’s export value of refractory raw materials and products surpassed USD3.0 billion and reached USD3.076 billion, soaring by 19.90% from a year earlier. Yet, the average price of refractory product exports surged by 11.85% year on year, putting an end to the downward mobility for two successive years; and the average export price of refractory raw materials started to fall from 2012 and dropped by 11.64% year on year in 2017.

The world-renowned giants in refractory business are represented by RHI Magnesita, Vesuvius, Imerys, Krosaki-Harima and Shinagawa, among which RHI Magnesita is grown from the merger of RHI and Magesita in 2017 and currently the largest producer of refractories around the globe, with its sales reporting EUR1.946 billion. Thus far, those companies without exception have operations in China. In 2017, RHI Magnesita garnered the revenue of EUR121 million in China, and it has already restarted its Chizhou-based company’s refractory material and mine production project in 2018.

There are more than 2,000 refractory manufacturers each with annual revenue of RMB20 million in China, and the Chinese market is in perfect competition due to low entry barrier and in consequence with low concentration. The top 10 refractory enterprises’ combined revenue occupied less than 20% of the total and the top 20 ones’ swept 25% or so in 2017, according to the data of the Association of China Refractories Industry. In the future, three to five large Chinese refractory groups with international competitiveness will emerge through mergers and acquisitions, integration of industrial chains, etc.

The report highlights the followings:

Demand and supply of refractories in global market and development in major countries;

Demand and supply of refractories in global market and development in major countries;

Policy climate, trade policy and industrial environment for refractories in China;

Policy climate, trade policy and industrial environment for refractories in China;

Demand and supply and import & export of refractories in Chinese market, competition among enterprises, the development of refractories in key provinces, etc.;

Demand and supply and import & export of refractories in Chinese market, competition among enterprises, the development of refractories in key provinces, etc.;

Markets of refractory raw materials (magnesite, bauxite, graphite, silicon carbide);

Markets of refractory raw materials (magnesite, bauxite, graphite, silicon carbide);

Current development and major manufacturers of basic refractories, unshaped refractories, ceramic fiber, etc.;

Current development and major manufacturers of basic refractories, unshaped refractories, ceramic fiber, etc.;

Demand for refractories from downstream sectors like steel, cement and glass;

Demand for refractories from downstream sectors like steel, cement and glass;

12 global and 20 Chinese refractory enterprises (operation, refractory business, etc.).

12 global and 20 Chinese refractory enterprises (operation, refractory business, etc.).

1. Overview of Refractories

1.1 Definition & Classification

1.1.1 Definition

1.1.2 Classification

1.2 Industry Chain

2. Development of Refractories Worldwide

2.1Market Supply and Demand

2.1.1 Production

2.1.2 Demand

2.2 Major Countries/Regions

2.2.1 Europe

2.2.2 United States

2.2.3 Japan

2.3.4 India

2.3.5 Australia

2.3.6 Brazil

2.3.7 Russia

2.3 Key Companies

3 Environments for Refractory Development in China

3.1 Policy Climate

3.2 Trade Environment

3.2.1 Export Quota and Tariff Rate

3.2.2 The US’ Anti-dumping Investigation on China-made Magnesia Carbon Bricks

3.3 Operation of Refractory Industry

4 Current Development of Refractories in China

4.1 Overview

4.2 Output & Structure

4.2.1 Output

4.2.2 by Product

4.2.3 by Region

4.3 Demand & Structure

4.3.1 Demand

4.3.2 By Application

4.3.3 By Product

4.4 Import & Export

4.4.1 Export

4.4.2 Import

4.5 Major Enterprises

4.5.1 Chinese Companies

4.5.2 Foreign Companies

4.6 Key Provinces

4.6.1 Henan

4.6.2 Liaoning

4.6.3 Shandong

5 Development of Main Refractory Raw Materials in China

5.1 Magnesite

5.1.1 Distribution of Resources

5.1.2 Magnesia

5.2 Bauxite

5.2.1 Distribution of Resources

5.2.2 Refractory Aluminum Clay

5.2.3 Brown Corundum and White Corundum

5.3 Graphite

5.3.1 Distribution of Resources and Market Demand and Supply

5.3.2 Magnesia Carbon Brick

5.4 Silicon Carbide

6 Development of Main Refractories in China

6.1 Basic Refractory

6.1.1 Development

6.1.2 Chrome-free Basic Refractory

6.1.3 Competitive Landscape

6.2 Unshaped Refractory

6.2.1 Development

6.2.2 Competition among Enterprises

6.3 Ceramic Fiber

6.3.1 Development

6.3.2 Key Companies

6.3.3 Development Prospects

7 Applied Markets of Refractories in China

7.1 Overview

7.2 Steel

7.2.1 Steel Market

7.2.2 Refractory for Steel

7.3 Glass

7.3.1 Glass Market

7.3.2 Refractory for Glass

7.4 Cement

7.4.1 Cement Market

7.4.2 Refractory for Cement

8 World-renowned Refractory Companies

8.1 RHI Magnesita

8.1.1 Profile

8.1.2 Operation

8.1.3 Progress in the Merger of RHI with Magnesita

8.1.4 Development in China

8.2 Vesuvius

8.2.1 Profile

8.2.2 Operation

8.2.3 Refractory Business

8.2.4 Development in China

8.3 Imerys

8.3.1 Profile

8.3.2 Operation

8.3.3 Refractory Business

8.3.4 Development in China

8.4 Krosaki Harima

8.4.1 Profile

8.4.2 Operation

8.4.3 Development in China

8.5 Shinagawa Refractories

8.5.1 Profile

8.5.2 Operation

8.5.3 Development in China

8.6 Magnezit

8.6.1 Profile

8.6.2 Operation

8.6.3 Development in China

8.7 Harbison Walker International (previously known as ANH Refractories)

8.7.1 Profile

8.7.2 Operation

8.7.3 Development in China

8.8 Morgan Advanced Materials (previously known as Morgan Crucible)

8.8.1 Profile

8.8.2 Operation

8.8.3 Development in China

8.9 Refratechnik

8.9.1 Profile

8.9.2 Operation

8.9.3 Development in China

8.10 Chosun Refractories)

8.10.1 Profile

8.10.2 Operation

8.10.3 Development in China

8.11 Minteq

8.11.1 Profile

8.11.2 Operation

8.11.3 Development in China

8.12 Saint-Gobain

8.12.1 Profile

8.12.2 Operation

8.12.3 Development in China

9 Key Enterprises in China

9.1 Puyang Refractories Group Co., Ltd.

9.1.1 Profile

9.1.2 Operation

9.1.3 Revenue Structure

9.1.4 Gross Margin

9.1.5 Customers and Suppliers

9.1.6 Development Strategy

9.2 Luyang Energy-Saving Materials Co., Ltd.

9.2.1 Profile

9.2.2 Operation

9.2.3 Revenue Structure

9.2.4 Gross Margin

9.2.5 Development Strategy

9.3 Ruitai Materials Technology Co., Ltd.

9.3.1 Profile

9.3.2 Operation

9.3.3 Revenue Structure

9.3.4 Gross Margin

9.3.5 Operation of Subsidiaries

9.3.6 Development Strategy

9.4 Beijing Lier High-temperature Materials Co., Ltd.

9.4.1 Profile

9.4.2 Operation

9.4.3 Revenue Structure

9.4.4 Gross Margin

9.4.5 Development Strategy

9.5 Henan Rongjin High Temperature Materials Co., Ltd.

9.5.1 Profile

9.5.2 Operation

9.5.3 Revenue Structure

9.5.4 Major Customers

9.6 Liaoning Zhongmei Co., Ltd.

9.6.1 Profile

9.6.2 Operation

9.6.3 Major Customers and Suppliers

9.7 Zhejiang Zili Corporation Limited.

9.7.1 Profile

9.7.2 Operation

9.7.3 Zhejiang Zili Advanced Materials Co., Ltd.

9.8 Yingkou Qinghua Group Co., Ltd.

9.8.1 Profile

9.8.2 Operation

9.9 Wugang Refractory Co., Ltd.

9.9.1 Profile

9.9.2 Operation

9.9.3 Development Strategy

9.10 Yingkou Jinlong Refractories Group Co., Ltd.

9.10.1 Profile

9.10.2 Operation

9.11 Shandong Refractories Group Co., Ltd.

9.11.1 Profile

9.11.2 Operation

9.11.3 Main Subsidiaries

9.12 Tongda Refractory Technologies, Co. Ltd.

9.12.1 Profile

9.12.2 Operation

9.13 Sinosteel Refractory Co., Ltd.

9.13.1 Profile

9.13.2 Operation

9.14 Jiangsu Sujia Group Co., Ltd.

9.14.1 Profile

9.14.2 Operation

9.15 Haicheng Houying Trade Group Co., Ltd.

9.15.1 Profile

9.15.2 Operation

9.15.3 Key Projects

9.16 Others

9.16.1 Shanxi Xixiaoping Refractories Co., Ltd.

9.16.2 Zhengzhou Zhendong Technology Co., Ltd.

9.16.3 Shandong Luqiao New Materials Co., Ltd.

9.16.4 Sinosteel Luoyang Institute of Refractories Research Co., Ltd.

9.16.5 Haicheng Magnesite Refractory General Factory

10 Summary and Forecast

10.1 Market

10.2 Enterprises

Classification of Refractories

Refractory Industry Chain

Refractory Consumption Structure by Sector

Global Refractory Output, 2011-2022E

Global Refractory Output Structure by Country/Region, 2017

Global Demand for Refractories, 2009-2022E

Production Structure of Refractories in Europe, 2013-2017

Output of Refractories in Japan, 2013-2017

Shipment of Refractories in Japan, 2013-2017

Output of Refractories in Russia, 2010-2016

Ranking of Major Refractory Suppliers Worldwide, 2017

Policies on Refractories in China, 2012-2018

Total Export Quota of Main Refractory Raw Materials in China, 2012-2018

China’s Magnesia Export Tariffs, 2017

Tentative Most-Favored-Nation Tariff Rate for Main Refractory Raw Materials, 2018

China’s Average Export Price of Main Refractory Raw Materials, 2016-2017

China’s Average Export Price of Refractory Products, 2011-2017

Main Economic Indicators of Key Refractory Companies in China, 2014-2017

List of Refractory Companies (1st Batch) with Production Lines Subject to Specifications for Refractories Industry

Output and YoY Growth of Refractories in China, 2010-2022E

Output of Refractories by Product in China, 2010-2017

Output of Refractories and % of Total Output by Province/Municipality in China, 2017

Demand for Refractories in China, 2013-2022E

Demand for Refractories by Sector in China, 2017

China’s Export Volume and Export Value of Refractories, 2011-2018

China’s Exports of Refractories by Product, 2009-2018

China’s Import Volume and Import Value of Refractories, 2011-2018

China’s Imports of Refractories by Product, 2011-2018

Revenue Structure of TOP10 Refractory Material Companies in China, 2016-2017

Presence of Major Global Refractory Companies in China, as of 2017

Output of Refractories in Henan Province, 2012-2017

Major Refractory Companies in Liaoning Province

Output of Refractories in Liaoning Province, 2012-2017

Newly-constructed High-purity Magnesia Projects in Liaoning Province, 2017

Output of Refractories in Shandong Province, 2012-2017

Classification of Refractory Raw Materials

Distribution of Magnesite Reserves Worldwide (kt), 2017

Distribution Chart of Magnesite Resources in China

Output of Magnesite in Major Countries, 2016-2017

Price Trend of Fused Magnesia in China, 2017

Price Trend of Sintered Magnesia in China, 2017

China’s Magnesia Output by Product, 2007-2017

China’s Magnesia Exports by Product, 2007-2018

Distribution of Bauxite Reserves Worldwide (kt), 2017

Output of Bauxite in Major Countries (kt), 2016-2017

Distribution of Bauxite in China

China’s Bauxite Imports, 2007-2017

China’s Bauxite Imports by Source Country, 2017

China’s Refractory Aluminum Clay Exports, 2009-2018

Price Trend of Bauxite Chamotte in China, 2017

China’s Output of Brown Corundum and White Corundum, 2012-2017

China’s Exports of Brown Corundum and White Corundum, 2013-2018

Price Trend of Brown Corundum and White Corundum in China, 2017

Natural Graphite Output and Reserve Distribution Worldwide (kt), 2017

China’s Natural Flake Graphite Exports, 2009-2018

Performance and Characteristics of Magnesia Carbon Bricks for Different Parts of Some Steel Plant’s Converter

China’s Silicon Carbide Output, 2014-2017

China’s Silicon Carbide Factory Price Including Tax, 2016-2017

China’s Export Volume and Value of Silicon Carbide, 2013-2017

Main Basic Refractory Raw Materials and Refractory Products

Typical Applications of Basic Refractory

Applications of Chromium-free Basic Refractory Bricks in Developed Countries

Alternative Product/Technology Roadmaps for and Representative Producers of Chromium-free Basic Refractory Bricks

Comparison between Unshaped Refractory and Shaped Refractory

Proportion of Unshaped Refractory in Major Countries/Regions, 2017

Unshaped Refractory Output Structure in China, 2010-2022E

Major Unshaped Refractory Producers in China and Their Capacity, 2017

Applications and % of Ceramic Fiber in China

China’s Ceramic Fiber Output, 2010-2022E

Subsidiaries of the World's Leading Ceramic Fiber Producers in China, as of 2017

Key Ceramic Fiber Enterprises in China and Their Capacity, 2017

Substitution Advantages of Ceramic Fiber

Consumption Sectors and Unit Consumption of Refractories

Output of Main Refractory Material Downstream Industries in China, 2014-2017

Global Crude Steel Output, 2010-2022E

TOP10 Crude Steel Countries by Output, 2017

TOP50 Crude Steel Companies by Output, 2017

Output and YoY Growth of Crude Steel in China, 2010-2022E

Electric Furnace Steel Output Structure in China, 2013-2022E

TOP10 Crude Steel Companies by Output in China, 2017

Refractories for Steel

Refractory Consumption per Ton of Steel in China, 2013-2022E

Major Steel-use Refractory Companies in China and Their Clients, 2017

New Demand for Refractories from Steel Industry, 2016-2020

China’s Plate Glass Output, 2012-2022E

TOP8 Glass Companies by Output/Sales in China, 2017

Distribution Chart of Refractories for Glass Melting Furnaces

Structure of Refractories Applied in Glass Melting Furnaces

Consumption of Fused Cast Aluminum Oxide for Various Glass Furnaces

Key Companies of Fused Cast Refractories in China and Their Leading Products

China’s Cement Output, 2012-2022E

Ranking of Top50 Cement Clinker Companies in China by Capacity, 2018

List of Refractories for Different Parts of Cement Kilns

RHI Magnesita’s Operating Results, 2016-2017

RHI Magnesita’s Revenue by Sector, 2017

RHI Magnesita’s Revenue by Product, 2016-2017

RHI Magnesita’s Revenue by Region, 2016-2017

Magnesita’s Operating Results, 2016

RHI Magnesita’s Major Companies in China, as of 2017

RHI Magnesita’s Sales in China, 2010-2017

Vesuvius’ Revenue and Profits, 2010-2017

Vesuvius’ Revenue and Profits by Business, 2010-2017

Vesuvius’ Global Presence, as of 2017

Vesuvius’ Revenue by Region, 2016-2017

Vesuvius’ Refractory Products

Vesuvius’ Revenue from Refractories, 2011-2017

Vesuvius’ Revenue from Refractories by Region and YoY Growth, 2013-2017

Vesuvius’ Refractory Companies in China

Imerys’ Global Operations

Imerys’ Major Events, 2010-2017

Revenue and Net Income of Imerys, 2011-2018

Revenue of Imerys (by Business), 2012-2018

Imerys’ Revenue from Four Major Businesses (by Product), 2015-2017

Revenue of Imerys (by Region), 2012-2018

Imerys’ Monolithic Refractories (Calderys) Products and Application

Imerys’ Monolithic Refractories (Calderys) Production Bases and Competitors

Calderys’ Milestones in Development, 2005-2017

Imerys’ Subsidiaries in China

Imerys’ Revenue Structure by Region, 2017

Krosaki’s Development Course

Revenue and Net Income of Krosaki, FY2009-FY2017

Revenue (by Business) of Krosaki, FY2012-FY2017

Applications and Percentage of Krosaki’s Refractories, FY2017

Revenue (by Region) of Krosaki, FY2012-FY2017

Krosaki’s Main Plants in China and Their Businesses

Shinagawa’s Development Course

Shinagawa’s Main Products

Selected Economic Indicators of Shinagawa, FY2012-FY2017

Revenue (by Business) of Shinagawa, FY2012-FY2017

Revenue (by Customer) of Shinagawa, FY2016

Shinagawa’s Global Operations

Shinagawa’s Overseas Sales, FY2009-FY2017

Presence of Shinagawa’s Companies in China

Magnezit’s Main Products and Services

Magnezit’s Global Operations

Magnezit’s Main Clients

Harbison Walker International’s Main Products

Harbison Walker International’s Main Plants and Their Products

Morgan Advanced Materials’ Main Products

Revenue and Profits of Morgan Advanced Materials, 2009-2017

Revenue of Morgan Advanced Materials (by Country/Region), 2016-2017

Revenue and Profit Margin of Morgan Advanced Materials (by Business), FY2015-FY2017

Revenue of Morgan Advanced Materials (by Applied Sector), FY2017

Key Companies of Morgan Advanced Materials in China

Refratechnik’s Main Business

Refratechnik’s Global Network

Refratechnik’s Plants in China

Chosun’s Main Products

Distribution of Chosun’s Key Bases Worldwide

Chosun’s Main Financial Indicators, 2010-2015

Production Bases of Chosun in China

Minteq’s Main Refractory Products

Revenue (by Business) of Minerals Technologies Inc., 2017

Main Subsidiaries of Minteq

Minteq’s Revenue from Refractory Business, 2012-2017

Revenue and Operating Income of Saint-Gobain, 2013-2018

Key Operations of Saint-Gobain

Application of Saint-Gobain’s Refractories and Competitors

Revenue of Saint-Gobain (by Business), 2013-2018

Revenue of Saint-Gobain (by Region), 2013-2018

Business Turnover of Saint-Gobain in China, 2008-2017

Saint-Gobain’s Refractory Companies in China

Revenue and Net Income of Puyang Refractories Group, 2009-2018

Puyang Refractories Group’s Output and Sales by Product, 2016-2017

Operating Revenue and YoY Growth (by Product) of Puyang Refractories Group, 2012-2017

Operating Revenue (by Region) of Puyang Refractories Group, 2009-2017

Puyang Refractories Group’s Operating Revenue Structure by Application Sector, 2016-2017

Puyang Refractories Group’s Operating Revenue Structure by Sales Model, 2014-2017

Gross Margin of Refractories of Puyang Refractories Group, 2009-2017

Gross Margin of Main Products of Puyang Refractories Group, 2012-2017

Puyang Refractories Group’s Revenue from TOP5 Clients and % of Total Revenue, 2016-2017

Puyang Refractories Group’s Procurement from TOP5 Suppliers and % of Total Procurement, 2016-2017

Puyang Refractories Group’s Mergers and Acquisitions, 2009-2017

Revenue and Net Income of Luyang Energy-saving Materials, 2009-2018

Operating Revenue (by Product) of Luyang Energy-saving Materials, 2010-2017

Operating Revenue (by Region) of Luyang Energy-saving Materials, 2010-2017

Consolidated Gross Margin of Luyang Energy-saving Materials, 2009-2018

Gross Margin (by Product) of Luyang Energy-saving Materials, 2009-2017

Business Development of Ruitai Materials Technology, 2008-2017

Revenue and Net Income of Ruitai Materials Technology, 2009-2018

Output and Sales Volume of Ruitai Materials Technology, 2011-2017

Operating Revenue (by Product) of Ruitai Materials Technology, 2011-2017

Operating Revenue (by Region) of Ruitai Materials Technology, 2009-2017

Gross Margin of Refractories of Ruitai Materials Technology, 2008-2017

Gross Margin (by Product) of Ruitai Materials Technology, 2011-2017

Revenue and Net Income of Ruitai Materials Technology’s Main Subsidiaries, 2017

Energy-saving and Environment-friendly High-temperature Material Intelligent Manufacturing Base Project and High-temperature Material Innovation Center Project of Ruitai Materials Technology

Business Development of Beijing Lier High-temperature Materials, 2011-2017

Revenue and Net Income of Beijing Lier High-temperature Materials, 2009-2018

Capacity and Capacity Utilization of Beijing Lier High-temperature Materials’ Refractory Materials by Product, 2016-2017

Output and Sales of Beijing Lier High-temperature Materials’ Refractory Materials by Product, 2016-2017

Operating Revenue (by Product) of Beijing Lier High-temperature Materials, 2012-2017

Operating Revenue (by Region) of Beijing Lier High-temperature Materials, 2010-2017

Gross Margin of Refractories of Beijing Lier High-temperature Materials, 2009-2017

Gross Margin (by Product) of Beijing Lier High-temperature Materials, 2012-2017

Main Products of Henan Rongjin High Temperature Materials

Revenue, Net Income and Gross Margin of Henan Rongjin High Temperature Materials, 2012-2017

Operating Revenue (by Product) of Henan Rongjin High Temperature Materials, 2013-2017

Henan Rongjin High Temperature Materials’ Revenue from TOP5 Clients and % of Total Revenue, 2017

Revenue and Net Income of Liaoning Zhongmei, 2014-2017

Liaoning Zhongmei’s Operating Revenue Structure by Business, 2016-2017

Liaoning Zhongmei’s Top 5 Clients and Top 5 Suppliers, 2017

Revenue and Net Income of Zhejiang Zili Advanced Materials, 2014-2017

Zhejiang Zili Advanced Materials’ Operating Revenue Structure by Business, 2016-2017

Main Products and Application of Yingkou Qinghua Group

Refractory Output of Yingkou Qinghua Refractories, 2012-2017

Refractory Output of Wugang Refractory, 2012-2017

Yingkou Jinlong Refractories Group’s Capacity by Product, 2017

Yingkou Jinlong Refractories Group’s Refractory Subsidiaries and Their Capacity of Main Products, 2017

Refractory Output of Yingkou Jinlong Refractories Group, 2013-2017

Development Course of Shandong Refractories Group

Refractory Output of Shandong Refractories Group, 2012-2017

Capacity of Shandong Refractories Group’s Main Subsidiaries/Branches

Refractory Output of Tongda Refractory Technologies, 2012-2017

Refractory Output of Sinosteel Refractory, 2012-2017

Output of Jiangsu Sujia Group New Materials Co., Ltd., 2012-2017

Main Refractory Products of Haicheng Houying Trade Group

Refractory Output of Haicheng Houying Trade Group, 2012-2017

Output of Shanxi Xixiaoping Refractories, 2012-2017

Refractory Output of Zhengzhou Zhendong Technology, 2012-2017

Refractory Output of Shandong Luqiao New Materials, 2012-2017

Refractory Output of Sinosteel Luoyang Institute of Refractories Research, 2012-2017

Capacity of Haicheng Magnesite Refractory General Factory by Product

China’s Refractory Output and Demand, 2017-2022E

Output and YoY Growth of Major Refractory Companies in China, 2017

Global and China Optical Fiber Preform Industry Report, 2021-2026

Optical fiber preforms play a key role in the optical fiber communication industry chain. The global construction of 4G and FTTH requires less optical fiber and cable, which has dragged down the deman...

Global and China Photoresist Industry Report, 2021-2026

Since its invention in 1959, photoresist has been the most crucial process material for the semiconductor industry. Photoresist was improved as a key material used in the manufacturing process of prin...

Global and China Needle Coke Industry Report, 2021-2026

Needle coke is an important carbon material, featuring a low thermal expansion coefficient, a low electrical resistivity, and strong thermal shock resistance and oxidation resistance. It is suitable f...

Global and China 3D Glass Industry Report, 2021-2026

3D curved glass is light and thin, transparent and clean, anti-fingerprint, anti-glare, hard and scratch-resistant, and performs well in weather resistance. It is applicable to terminals such as high-...

Global and China Graphene Industry Report, 2020-2026

Graphene, a kind of 2D carbon nanomaterial, features excellent properties such as mechanical property and super electrical conductivity and thermal conductivity. Its downstream application ranges from...

Global and China Optical Fiber Preform Industry Report, 2020-2026

Optical fiber preform as a hi-tech product and a crucial link in the optical fiber industry chain contributes to 70% or so of profit margin. Global 4G and FTTH construction at dusk leads to the shrink...

Global and China 3D Glass Industry Report, 2020-2026

Global 3D glass market has been enlarging over the recent years amid demetallization of smartphone back covers and popularity of smart wearables, to approximately $2.86 billion in 2019 and to an estim...

Global and China Photoresist Industry Report, 2020-2026

In 2019, global photoresist market was valued at $8.3 billion, growing at a compound annual rate of 5.1% or so since 2010, and it will outnumber $12.7 billion in 2026 with advances in electronic techn...

Global and China Synthetic Diamond Industry Report, 2020-2026

While its mechanical property is given full play in fields like grinding and cutting, diamond with acoustic, optical, magnetic, thermal and other special properties, as superconducting material, intel...

Global and China Needle Coke Industry Report, 2020-2026

With the merits like small resistivity, excellent resistance to impact and good anti-oxidation property, needle coke has been widely used in ultra-high power graphite electrodes, nuclear reactor decel...

Global and China Optical Fiber Preform Industry Report, 2019-2025

Optical fiber preform, playing an important role in the optical fiber and cable industry chain, seizes about 70% profits of optical fiber. Global demand for optical fiber preform stood at 16.2kt in 20...

China Silicon Carbide Industry Report, 2019-2025

Silicon carbide (SiC) is the most mature and the most widely used among third-generation wide band gap semiconductor materials. Over the past two years, global SiC market capacity, however, hovered ar...

Global and China Photoresist Industry Report, 2019-2025

Photoresist, a sort of material indispensable to PCB, flat panel display, optoelectronic devices, among others, keeps expanding in market size amid the robust demand from downstream sectors. In 2018, ...

Global and China Graphene Industry Report, 2019-2025

Graphene is featured with excellent performance and enjoys a rosy prospect. The global graphene market was worth more than $100 million in 2018, with an anticipated CAGR of virtually 45% between 2019 ...

Global and China 3D Glass Industry Chain Report, 2019-2025

The evolution of AMOLED conduces to the steady development of 3D curved glass market. In 2018, the global 3D glass market expanded 37.7% on an annualized basis and reached $1.9 billion, a figure proje...

China Wood Flooring Industry Report, 2019-2025

With the better standard of living and the people’s desire for an elegant life, wood flooring sees a rising share in the flooring industry of China, up from 33.9% in 2009 to 38.9% in 2018, just behind...

Global and China Photovoltaic Glass Industry Report, 2019-2025

In China, PV installed capacity has ramped up since the issuance of photovoltaic (PV) subsidy policies, reaching 53GW in 2017, or over 50% of global total. However, the domestic PV demand was hit by t...

Global and China ITO Targets Industry Chain Report, 2019-2025

Featured by good electrical conductivity and transparency, ITO targets are widely applied to fields of LCD, flat-panel display, plasma display, touch screen, electronic paper, OLED, solar cell, antist...