China Ceramic Tile Industry Report, 2015-2018

-

Dec.2015

- Hard Copy

- USD

$2,300

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZJF081

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

After thirty years of rapid development, China's economy has entered a new normal state, in which real estate investment and development slows down, construction area declines and the demand for decoration falls. As a result, the architectural ceramics industry witnesses a lower growth rate. In 2015, the full-year revenue of the industry will reach RMB447 billion, a year-on-year increase of 4.9%.

China architectural ceramics industry has been booming nationwide through decades of development and several rounds of industrial transfer. There are now 1,452 ceramics enterprises and 3,621 production lines (including 181 Spanish tile production lines) in China except Beijing, Tianjin, Hong Kong, Macao and Taiwan, with the daily ceramic tile capacity of 45.036 million square meters, according to statistics of China Building Ceramics & Sanitaryware Association.

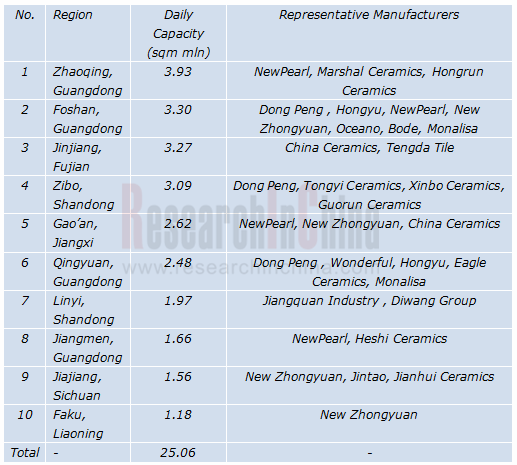

Capacity Distribution of China’s Top 10 Ceramic Tile Origins

Source: China Building Ceramics & Sanitaryware Association; ResearchInChina

In terms of competition pattern, China building ceramics industry features a low market concentration rate. The top ten manufacturers have total annual capacity of 676 million square meters, only occupying 4.12% of the whole industry. With the implementation of new environmental protection laws, some of backward capacity will be phased out; meanwhile, the slow development of China’s economy and real estate industry will lead to the fiercer market competition in the architectural ceramics industry, and mergers and acquisitions will be the mainstream of the industry.

As for manufacturers:

China's largest architectural ceramics enterprise NewPearl Group is made up of Guangdong NewPearl Ceramics Group, Guangdong Summit Ceramics Group and Jiangxi NewPearl Ceramics Group, with the ceramic tile capacity of more than 200 million square meters;

China's largest architectural ceramics enterprise NewPearl Group is made up of Guangdong NewPearl Ceramics Group, Guangdong Summit Ceramics Group and Jiangxi NewPearl Ceramics Group, with the ceramic tile capacity of more than 200 million square meters;

The second-ranked New Zhongyuan has nine production bases located in Foshan, Gao’an and other places, with the capacity of 100 million square meters;

The second-ranked New Zhongyuan has nine production bases located in Foshan, Gao’an and other places, with the capacity of 100 million square meters;

The third-ranked Nabel has set up its five production bases in Hangzhou, Jiujiang and Deqing, with the investment of more than USD425 million and the capacity of over 78 million square meters.

The third-ranked Nabel has set up its five production bases in Hangzhou, Jiujiang and Deqing, with the investment of more than USD425 million and the capacity of over 78 million square meters.

Currently, Wonderful has the capacity of 58 million square meters. It plans to invest RMB3 billion in a project with the capacity of 40 million square meters in Chongqing. Once the project is completed in 2018, Wonderful’s capacity will hit 100 million square meters and rank among top three.

Currently, Wonderful has the capacity of 58 million square meters. It plans to invest RMB3 billion in a project with the capacity of 40 million square meters in Chongqing. Once the project is completed in 2018, Wonderful’s capacity will hit 100 million square meters and rank among top three.

China Ceramic Tile Industry Report, 2015-2018 studies the following:

Overview of China ceramic tile industry, including product definition, classification, development process and major policies;

Overview of China ceramic tile industry, including product definition, classification, development process and major policies;

Analysis of factors about China ceramic tile industry, such as real estate development and decoration industries;

Analysis of factors about China ceramic tile industry, such as real estate development and decoration industries;

Overview of China ceramic tile industry, embracing market size, capacity, output, import and export, competitive landscape, etc.;

Overview of China ceramic tile industry, embracing market size, capacity, output, import and export, competitive landscape, etc.;

Profile, financial condition, flagship products, capacity / output, R & D, distribution of production bases, technical characteristics and so on of 14 ceramic tile companies, namely Dong Peng, Wonderful, New Zhongyuan, NewPearl, Nabel, Eagle Ceramics, China Ceramics, Hongyu, Oceano, Bode, Monalisa, Shanghai Everjoy (formerly Cimic), Champion and Huida Sanitary Ware.

Profile, financial condition, flagship products, capacity / output, R & D, distribution of production bases, technical characteristics and so on of 14 ceramic tile companies, namely Dong Peng, Wonderful, New Zhongyuan, NewPearl, Nabel, Eagle Ceramics, China Ceramics, Hongyu, Oceano, Bode, Monalisa, Shanghai Everjoy (formerly Cimic), Champion and Huida Sanitary Ware.

1. Introduction of Ceramic Tile

1.1 Definition & Classification

1.2 Development History

1.3 Standards & Policies

2. China Ceramic Tile-related Industries

2.1 Residence

2.2 Home Decoration

2.3 Other Market Drivers

2.3.1 Urbanization

2.3.2 Per Capita Disposable Income

3. China Ceramic Tile Market

3.1 Market Scale

3.2 Capacity

3.3 Output

3.4 Competition Pattern

3.5 Import & Export

3.5.1 Export

3.5.2 Import

3.6 Forecast

4 Regional Markets

4.1 Market Structure

4.2 Output by Province

4.2.1 Guangdong

4.2.2 Jiangxi

4.2.3 Fujian

4.2.4 Liaoning

4.2.5 Shandong

4.2.6 Henan

4.2.7 Guangxi

4.2.8 Hubei

4.2.9 Sichuan

4.2.10 Hebei

5. Key Players in China

5.1 Dong Peng

5.1.1 Profile

5.1.2 Key Financial Data

5.1.3 Revenue Breakdown

5.1.4 Main Products

5.1.5 Production Capabilities

5.1.6 Retail Outlets

5.1.7 Warehouse Location

5.1.8 Ceramic Tiles Sales Channel

5.2 Marco Polo (Wonderful Ceramics Group)

5.2.1 Profile

5.2.2 Main Products

5.2.3 Production Base

5.3 Hongyu

5.3.1 Profile

5.3.2 Technologies & Products

5.4 NewPearl (Guanzhu, Summit)

5.4.1 Profile

5.4.2 Technologies & Products

5.4.3 Production Base

5.5 New Zhongyuan

5.5.1 Profile

5.5.2 Technologies & Products

5.5.3 Production Base

5.6 Oceano

5.6.1 Profile

5.6.2 Operation

5.6.3 Revenue Structure

5.6.4 Gross Margin

5.6.5 Technologies & Products

5.6.6 Production Layout

5.7 Nabel

5.7.1 Profile

5.7.2 Main Products

5.7.3 Main Production Bases

5.8 Bode

5.8.1 Profile

5.8.2 Main Products

5.8.3 Mass Production of Yangxi Base

5.9 Eagle Ceramics

5.9.1 Profile

5.9.2 Main Products

5.9.3 Production Layout

5.10 Monalisa

5.10.1 Profile

5.10.2 Main Products

5.10.3 Production Layout

5.10.4 Strategic Adjustment and Preparation for IPO

5.11 Shanghai Everjoy (Formerly Cimic)

5.11.1 Profile

5.11.2 Key Financial Data

5.11.3 Revenue and Gross Margin Breakdown

5.11.4 Gross Margin

5.11.5 Output, Sales Volume and Inventory

5.11.6 Cost Structure and R&D Investment

5.11.7 Clients and Suppliers

5.11.8 Production Bases and Subsidiaries

5.12 China Ceramics

5.12.1 Profile

5.12.2 Key Financial Data

5.12.3 Revenue Breakdown

5.12.4 Sales Price & Volume

5.12.5 Gross Margin

5.12.4 Technologies & Products

5.12.5 Sales Network

5.12.6 R&D

5.12.7 Key Customers & Suppliers

5.12.8 Production Base & Capacity Utilizing

5.13 Champion

5.13.1 Profile

5.13.2 Key Financial Data

5.13.3 Revenue Breakdown

5.13.4 Production

5.13.5 Sale

5.13.6 Production Layout in Mainland China

5.14 Huida Sanitary Ware

5.14.1 Profile

5.14.2 Key Financial Data

5.14.3 Revenue Breakdown

5.14.4 Gross Margin

5.14.5 Production

5.14.6 Sale

5.14.7 Customers & Suppliers

5.14.8 Capacity Expansion Plan

Definition Standards of China Ceramic Tile Market Segments

Development History of China Ceramic Tile Industry

Gross Floor Area of Residential Properties under Construction in China, 2008-2018

China Home Decoration and Improvement Market Size, 2008-2015

Urban Population and Urbanization Rate in China, 2008-2015

Per Capita Annual Disposable Income in China, 2008-2017

Total Retail Sales of Consumer Goods in China, 2008-2018

Revenue of China Architectural Ceramics Industry, 2007-2015

Capacity Distribution of China’s Top 10 Ceramic Tile Origins

China’s Ceramic Tile Output, 2009-2015

China’s Porcelain Tile Output, 2010-2015

Ranking of China's Top 10 Ceramic Tile Manufacturers by Capacity, 2015

China's Ceramic Tile Export Volume, 2010-2015

China's Ceramic Tile Export Value, 2010-2015

China's Average Export Price of Ceramic Tile, 2010-2015

Ranking of China’s Ceramic Tile Export Destinations and Export Volume, 2012-2014

Ranking of China’s Ceramic Tile Import Sources, 2012-2014

China's Ceramic Tile Import Volume, 2010-2014

China's Ceramic Tile Import Value, 2010-2014

China's Average Import Price of Ceramic Tile, 2010-2014

China's Architectural Ceramics Market Size, 2014-2018E

China's Ceramic Tile Output, 2014-2018E

China's Top 10 Ceramic Tile Producing Regions by Output, 2014-2015

Guangdong’s Ceramic Tile Output, 2009-2015

Distribution of Main Ceramic Tile Manufacturers in Guangdong Production Base

Jiangxi’s Ceramic Tile Output, 2009-2015

Distribution of Main Ceramic Tile Manufacturers in Jiangxi Production Base

Fujian’s Ceramic Tile Output, 2009-2015

Liaoning’s Ceramic Tile Output, 2009-2015

Shandong’s Ceramic Tile Output, 2009-2015

Henan’s Ceramic Tile Output, 2009-2015

Guangxi’s Ceramic Tile Output, 2009-2015

Hubei’s Ceramic Tile Output, 2009-2015

Sichuan’s Ceramic Tile Output, 2009-2015

Hebei’s Ceramic Tile Output, 2009-2015

Revenue and Net Income of Dongpeng, 2010-2015

Revenue and Net Income Forecast of Dongpeng, 2014-2018

Revenue Structure of Dongpeng by Product, 2013-2015

Revenue Structure of Dongpeng by Region, 2012-2015

Key Ceramic Tile Product of Dongpeng

Ceramic Tile Production Capacity of Dongpeng, 2010-2015

Distribution of Retail Outlets of Dongpeng by End of 2015 H1

Distribution of Warehouses of Dongpeng, 2015

Revenue Structure of Dongpeng by Channel, 2013-2015

Main Tile Products of Wonderful Group

Distribution of Wonderful’s Main Production Bases

Main Tile Products of Hongyu

Main Tile Products of New Zhongyuan

Revenue and Net Income of Oceano, 2011-2015

Revenue Structure of Oceano by Product, 2013-2015

Revenue Structure of Oceano by Region, 2013-2015

Main Products and Consolidated Gross Margin of Oceano, 2011-2015

Main Ceramic Tile Products of Oceano

Capacity of Oceano’s Main Products

Main Tile Products of Nabel

Investment and Capacity Distribution of Nabel's Main Ceramic Tile Production Bases

Body's Main Ceramic Tile Products

Main Ceramic Tile Products of Eagle Ceramics

Main Ceramic Tile Products of Monalisa Ceramics

Sales Network around Globe of Monalisa Ceramics

Revenue and Net Income of Cimic, 2010-2015

Revenue and Net Income of Cimic, 2013-2018E

Revenue Structure of Cimic by Product, 2012-2015

Revenue Structure of Cimic by Region, 2009-2015

Gross Margin of Cimic by Business, 2009-2015

Output, Sales Volume and Inventory of Cimic, 2012-2015

Cost Structure of Ceramic Tile Business of Cimic, 2012-2014

R&D Investment of Cimic, 2012-2015

Cimic’s Sales from Top Five Clients and % of Total Sales, 2013-2014

Cimic’s Procurement from Top Five Suppliers and % of Total Procurement, 2013-2014

Operation of Cimic’s Major Ceramic Tile Manufacturing Factory, 2014

Revenue and Net Income of China Ceramics, 2009-2015

Revenue and Net Income Forecast of China Ceramics, 2014-2018

Revenue Structure of China Ceramics by Product, 2011-2014

Revenue Structure of China Ceramics by China Ceramics, 2012-2014

Average Selling Price and Sales Volume of Ceramic Tiles of China Ceramics, 2013-2015

Ceramic Tiles Gross Profit and Profit Margin of China Ceramics, 2013-2014

Key Ceramic Tile Product of China Ceramics

Overseas Distribution of China Ceramic

Domestic Distribution of China Ceramic

Revenue of China Ceramics from Main Clients and % of Total Revenue, 2012-2014

Procurement of China Ceramics from Main Suppliers and % of Total Procurement, 2010-2012

Revenue and Net Income of Champion, 2010-2015

Revenue Structure of Champion by Segment, 2012-2015

Revenue Structure of Champion by Product, 2012-2014

Revenue Structure of Champion by Region, 2012-2014

Champion's Ceramic Tile Capacity, Output and Capacity Utilization, 2010-2014

Champion's Ceramic Tile Sales Volume, Output and Sales-Output Ratio, 2010-2014

Main Product Structure of Huida Sanitary Ware

Revenue and Net Income of Huida, 2012-2014

Revenue Structure of Huida by Product, 2012-2014

Revenue Structure of Huida by Region, 2012-2014

Main Products and Consolidated Gross Margin of Huida Sanitary Ware, 2012-2014

Ceramic Tile Capacity, Output and Capacity Utilization of Huida Sanitary Ware, 2012-2014

Ceramic Tile Sales Volume, Output and Sales-Output Ratio of Huida Sanitary Ware, 2012-2014

Ceramic Tile Price Trends of Huida Sanitary Ware, 2012-2014

Revenue of Huida Sanitary Ware from Top 5 Clients and % of Total Revenue, 2012-2014

Procurement of Huida Sanitary Ware from Top 5 Suppliers and % of Total Procurement, 2012-2014

China Ceramic Tile Industry Report, 2015-2018

After thirty years of rapid development, China's economy has entered a new normal state, in which real estate investment and development slows down, construction area declines and the demand for decor...

China Cosmetics Market Report, 2014-2017

China’s cosmetics market has been booming in recent years and already become the world’s second largest cosmetics consumer market second only to America, with annual volume of retail sales approximati...

Global and China Luxury Apparel Industry Report, 2014-2017

With the improvement of people’s income as well as the prosperity of agent purchasing and gifting, the luxury market in China (especially Mainland China) has achieved steady growth over the recent yea...

China Ceramic Tile Industry Report, 2014-2018

With economic growth, increasing urbanization rate and people's disposable income, the requirement on housing quality and comfort is augmenting, China’s ceramic tile market is also booming, with marke...