China Cosmetics Market Report, 2014-2017

-

Feb.2015

- Hard Copy

- USD

$2,550

-

- Pages:150

- Single User License

(PDF Unprintable)

- USD

$2,400

-

- Code:

CYH032

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,700

-

- Hard Copy + Single User License

- USD

$2,750

-

China’s cosmetics market has been booming in recent years and already become the world’s second largest cosmetics consumer market second only to America, with annual volume of retail sales approximating RMB200 billion. In 2014, influenced by such factors as the economic slowdown, China’s cosmetics market registered the lowest growth rate (12.3%) since 2005; the total volume of retail sales of enterprises (each with annual revenue of above RMB20 million) dropped to RMB172.47 billion.

However, as consumers are in constant pursuit of beauty, cosmetics marketing channels are increasingly mature plus the unceasing release of demand from second- and third-tier cities in China, the Chinese cosmetics market will continue to maintain steady growth in the future, with the total volume of retail sales of enterprises (each with annual revenue of above RMB20 million) expected to be RMB245.3 billion by 2017.

Skin care and make-ups account for the largest share of cosmetics consumption in China, with total volume of retail sales representing a combined 61.2% in 2013, of which skin care products ranked first with a proportion of 48.0%. In addition, the change of men’s skin care concept has led to a constant release of men’s cosmetics market with total volume of retail sales accounting for 4.6% in 2013, and in the future the proportion will be further raised.

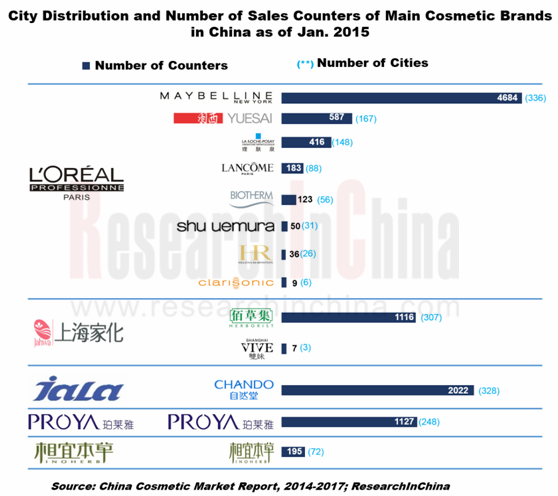

So far, foreign-funded enterprises still play a dominant role in China’s cosmetics market, accounting for roughly 86% of the total volume of retail sales. To cater to the demand of Chinese cosmetics consumers and improve their market share in the China, L'Oreal, Estee Lauder, Procter & Gamble, Shiseido and other foreign companies have constantly adjusted brand strategies and intensified the building of channels. Meanwhile, Chinese domestic companies led by Jahwa and Marubi are also stepping up the layout of cosmetics market.

L'Oreal is the world’s largest cosmetics company. In 2013 it recorded revenue of EUR21.288 billion in cosmetics business, a yr-on-yr rise of 2.3%. In recent years, L'Oreal has constantly adjusted its brand strategy in China: re-introduction of Inneov oral medical cosmetics which was withdrawn from China in early 2013; a full suspension of Garnier in China in 2014.

As one of the world’s major cosmetics companies, Estee Lauder is engaged in skin care and make-ups. As of January 2015, it has 124 counters in 51 Chinese cities. Besides, it authorized T-mall, an e-commerce website, for the first time in May 2014 to develop China’s e-commerce channel market.

?

Shanghai Jahwa, a major listed cosmetics company in China, has SIX GOD, MAXAM, HERBORIST, gf and other priority brands. In early 2015 it embarked on the Qingpu Base Removal Project worth a total of RMB1.355 billion, expected to be put into production in 2018; the new plant can undertake an estimated 130,000-ton configuration production and 600-million-piece filling production.

As one of China’s leading cosmetics companies, MARUBI focuses on facial and eye skin care products, in possession of MARUBI and HARUKI brand. In July 2013, it received LCapitalAsia investment from Louis Vuitton Mo?t Hennessy (LVHM); in June 2014, it planned IPO placement and implementation of cosmetics production and construction project, which could expand the company’s existing capacity by 160% once reaching designed capacity.

China Cosmetics Market Report, 2014-2017 highlights the followings:

China’s cosmetics market size, import and export, product structure, channel structure, regional structure, tariff policy, etc.;

China’s cosmetics market size, import and export, product structure, channel structure, regional structure, tariff policy, etc.;

Development status, market size and development trend of major cosmetics channels e.g. department store, supermarket, franchised store, e-commerce, direct marketing;

Development status, market size and development trend of major cosmetics channels e.g. department store, supermarket, franchised store, e-commerce, direct marketing;

Market size, competition pattern, channel development of major cosmetics segments e.g. skin care, make-ups, perfume, men’s cosmetics, infant & child care products;

Market size, competition pattern, channel development of major cosmetics segments e.g. skin care, make-ups, perfume, men’s cosmetics, infant & child care products;

Operation and development-in-China of 4 global cosmetics companies;

Operation and development-in-China of 4 global cosmetics companies;

Operation, development strategy, etc. of 12 Chinese cosmetics companies.

Operation, development strategy, etc. of 12 Chinese cosmetics companies.

1. Overview

1.1 Definition

1.2 Classification

2. Development of China Cosmetics Market

2.1 Market Size

2.2 Import and Export

2.2.1 Export

2.2.2 Import

2.3 Product Structure

2.4 Channel Structure

2.5 Regional Structure

2.6 Enterprise Pattern

2.7 Duties and Policies

3. Cosmetics Market Channels

3.1 Department Store

3.1.2 Characteristics

3.1.2 Mode of Operation

3.1.3 Development Trend

3.2 Supermarket

3.2.1 Development Status

3.2.2 Development Trend

3.3 Franchised Store

3.3.1 Development Status

3.3.2 Mode of Channel Development

3.3.3 Development Trend

3.4 E-commerce

3.4.1 Market Size

3.4.2 E-commerce Pattern

3.4.3 Main E-commerce

3.5 Others

3.5.1 Direct Marketing

3.5.2 Drugstore

4. Cosmetics Market Segments

4.1 Skin Care

4.1.1 Market Size

4.1.2 Market Structure

4.1.3 Competition Pattern

4.1.4 Mass Products

4.2 Make-ups

4.2.1 Market Status

4.2.2 Brand Pattern

4.2.3 Developments of Multinational Enterprises

4.3 Perfume

4.3.1 Consumption Status

4.3.2 Competition Pattern

4.3.3 Import and Export

4.3.4 Channel

5. Other Emerging Market Segments

5.1 Men's Cosmetics

5.1.1 Market Size

5.1.2 Market Structure

5.1.3 Competition Pattern

5.1.4 Channel

5.1.5 Market Characteristics

5.2 Cosmeceuticals

5.2.1 Market Status

5.2.2 Major Enterprise

5.2.3 Channel

5.3 Infant & Child Care Product

5.3.1 Development Status

5.3.2 Industry Structure

5.3.3 Channel

6. Major Cosmetics Companies Worldwide

6.1 L'Oreal

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 R&D

6.1.5 Cosmetics Business

6.1.6 Development in China

6.2 Estee Lauder

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 R&D

6.2.5 Distribution Channel

6.2.6 Development in China

6.3 Procter & Gamble

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 R&D

6.3.6 Cosmetics Business

6.3.7 Channel

6.3.8 Development in China

6.4 Shiseido

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Channel

6.4.5 R&D

6.4.6 Cosmetics Business

6.4.7 Development in China

7. Major Cosmetic Companies in China

7.1 Shanghai Jahwa United Co., Ltd. (600315)

7.1.1 Profile

7.1.2 Operation

7.1.3 Revenue Structure

7.1.4 Gross Margin

7.1.5 Channel

7.1.6 Brand

7.1.7 Development Prospect

7.2 Jiangsu LONGLIQI Bio-Science Co., Ltd. (Longrich)

7.2.1 Profile

7.2.2 Operation

7.2.3 Channel

7.3 Shanghai Inoherb Cosmetics Co., Ltd.

7.3.1 Profile

7.3.2 Operation

7.3.3 Revenue Structure

7.3.4 Gross Margin

7.3.5 Channel

7.3.6 Production and Sales

7.4 JALA Corporation

7.4.1 Profile

7.4.2 Operation

7.4.3 Channel

7.4.4 Chcedo

7.5 Zhejiang Osmun Group

7.5.1 Profile

7.5.2 Operation

7.5.3 Channel Construction

7.5.4 Brand

7.6 Zhejiang Proya Cosmetics Co., Ltd

7.7 Tianjin Yumeijing Group Co., Ltd.

7.8 Softto Co., Ltd. (000662)

7.8.1 Profile

7.8.2 Operation

7.8.3 Revenue Structure

7.8.4 Gross Margin

7.8.5 Developments

7.9 BaWang International (Group) Holding Limited

7.9.1 Profile

7.9.2 Operation

7.9.3 Revenue Structure

7.9.4 Brand

7.9.5 Channel

7.9.6 Development Prospect

7.10 Guangzhou Huanya Cosmetics Technology Co., Ltd.

7.10.1 Brand and Channel

7.10.2 Investment and Project Construction

7.11 Guangdong Marubi Biotechnology Co., Ltd.

7.11.1 Profile

7.11.2 Operation

7.11.3 Revenue Structure

7.11.4 Channel

7.11.5 Production and Sales

7.11.6 Brand

7.11.7 Construction Project

7.12 KOSé Corporation

8. Conclusion and Forecast

8.1 Enterprise and Brand

8.1.1 Enterprise

8.1.2 Brand

8.1.3 Foreign-Capital Development in China

8.2 Forecast

Classification of Cosmetics

Retail Sales and YoY Growth of Cosmetics in China, 2005-2014

Import Volume and Value of Cosmetics in China, 2011-2014

Export Volume and Value of Cosmetics in China, 2011-2014

Retail Sales Structure of Cosmetics in China (by Product), 2013-2014

Total Retail Sales Structure of Cosmetics in China (by Channel), 2010-2014

Retail Sales Structure of Cosmetics Consumption in China (by Region), 2014

Cosmetics Enterprise Structure in China, 2013

Customs Duty Rates of Main Cosmetics in China, 2015

Policies Regarding Cosmetics in China, 2007-2015

Comparison of Distribution Channels of Cosmetics in China

Channel Distribution of Cosmetics in China (by Enterprise / Brand), 2014

Operation Model of Department Store as a Sales Channel for Cosmetics

Number of Major Cosmetics Franchise Stores and Shops in Mainland China, 2012&2015

Stage of Multinational Brand Penetrating Franchised Store Channel, 2003-2014

Transaction Size and YoY Growth of China Cosmetics Online Shopping Market, 2008-2017E

Cost Structure of Cosmetics E-commerce in China, 2013

Consideration of Purchasing Cosmetics Online in China, 2014

Online Marketing Channel of Cosmetics in China

Direct Selling Income of Top Chinese Directing Selling Cosmetics Companies in China, 2011-2013

China’s Skin Care Market Size and YoY Growth, 2009-2017E

China’s Skin Care Market Sales Structure (by Product), 2013

Proportion of Whitening Product in China, 2013

Classification of China Facial Mask Market (by Price), 2014

Leading Brands of China Facial Mask Market, 2009-2014

Retail Sales and Market Share of Top 10 Skin Care Brands in China Cosmetics Market, 2012

Brand Distribution of China Cosmetics Market (by Price) (RMB)

Representative Brands of Mass Skin Care

China’s Make-up Market Size, 2006-2017E

Make-up Use Attention of Chinese Consumers, 2013

Digital Asset Value of Top 10 Chinese Make-up Brands, 2014

Top 10 Chinese Perfume Enterprises and Their Market Share, 2013

China’s Import Volume and Value of Perfume and Floral Water, 2008-2014

China’s Export Volume and Value of Perfume and Floral Water, 2008-2014

China Men’s Cosmetics Market Structure, 2013

China Men’s Cosmetics Brand Pattern

Channel Pattern of Men’s Product, 2013

China’s Cosmeceuticals Sales Structure (by Field), 2013

Products of Chinese Companies Involved in Cosmeceuticals Production

Industry Pattern of Children’s Product

Channel Pattern of Infant & Child Cosmetics, 2010-2014

Revenue and Net Income of L'Oreal, 2006-2014

Revenue Breakdown and Structure of L'Oreal (by Business), 2011-2014

Revenue Breakdown and Structure of L'Oreal (by Region), 2011-2014

R&D Costs and % of Total Revenue of L'Oreal, 2008-2014

Cosmetics Revenue and Operating Income of L'Oreal, 2009-2014

Cosmetics Revenue Breakdown and Structure of L'Oreal (by Department), 2011-2014

Cosmetics Revenue Structure of L'Oreal (by Business), 2010-2013

Cosmetics Revenue Breakdown and Structure of L'Oreal (by Region), 2011-2014

Cosmetics Production Structure of L'Oreal (by Region), 2012

Revenue of L'Oreal in China, 2007-2013

Distribution of L'Oreal Counters in China (by Brand/City) as of Jan 2015

Net Revenue and Operating Income of Estee Lauder, FY2008-FY2015E

Net Revenue Breakdown of Estee Lauder (by Product), FY2008-FY2015E

Revenue Breakdown of Estee Lauder (by Region), FY2008-FY2015E

R&D Costs and % of Total Revenue of Estee Lauder, FY2010-FY2014

Net Revenue Structure of Estee Lauder (by Dealer Channel), FY2014

Main Events of Estee Lauder in China

Number of Estee Lauder Counters in China as of Jan 2015

Brand Distribution of Procter & Gamble by Department, 2015

Net Revenue and Net Income of Procter & Gamble, FY2008-FY2015E

Net Revenue Breakdown and Structure of Procter & Gamble (by Business), FY2012-FY2014

Net Income Structure of Procter & Gamble (by Region), FY2011-FY2014

Gross Margin of Procter & Gamble, FY2008-FY2014

R&D Costs and % of Total Revenue of Procter & Gamble, FY2008-FY2014

Cosmetics Classification and Brand of Procter & Gamble

Net Revenue and Net Income of Cosmetics Business of Procter & Gamble, FY2010-FY2014

Brand Distribution of Procter & Gamble in China

Distribution of SK-II Counters in China as of Jan 2015

Net Revenue and Net Income of Shiseido, FY2007-FY2014

Revenue Breakdown and Structure of Shiseido (by Product), FY2010-FY2014

Net Revenue Breakdown of Shiseido (by Region), FY2008-FY2014

Overseas Revenue and % of Total Revenue of Shiseido, FY2008-FY2014

Sales Channel Distribution of Shiseido in Japan

Channel Distribution of Shiseido (by Brand), FY2014

R&D Costs and % of Total Revenue of Shiseido, FY2008-FY2013

Distribution of Shiseido’s Research Institutes (by Country)

Cosmetics Classification of Shiseido

Brand Distribution of Shiseido (by Country)

Net Revenue of Shiseido in China, 2010-2014

Subsidiaries of Shiseido in China, FY2014

Revenue and Net Income of Shanghai Jahwa, 2008-2014

Operating Revenue Breakdown of Shanghai Jahwa (by Business), 2013-2014

Operating Revenue Breakdown of Shanghai Jahwa (by Region), 2013-2014

Gross Margin of Shanghai Jahwa (by Business), 2012-2014

Positioning (by Brand) and Main Sales Channels of Shanghai Jahwa

Sales Structure of Shanghai Jahwa (by Channel), 2013-2014

Gross Profit of Shanghai Jahwa (by Brand), 2012-2013

Main Cosmetics Brand of Shanghai Jahwa

Main Brand Price of Shanghai Jahwa

Market Share of SIX GOD (by Product), 2012&2014

Market Share of MAXAM Hand Care, 2001-2009

HERBORIST Brand Product

Revenue and Net Income of Shanghai Jahwa, 2013-2017E

Main Brand of Longrich

Development of Longrich, 2002-2015

Global Research Center of Longrich

Revenue of Longrich, 2009-2014

Revenue and Net Income of INOHERB, 2009-2014

Revenue Breakdown and Structure of INOHERB (by Product), 2009-2012

Revenue Breakdown of INOHERB (by Region), 2009-2012

Gross Margin of INOHERB (by Product), 2009-2012

Revenue Structure of INOHERB (by Channel), 2011&2013

Channel Model and Sales Terminal of INOHERB Product

Distribution of INOHERB Counters in Mainland China as of Jan 2015

Production Capacity of INOHERB Product (by Factory), 2009-2011

Output and Sales Volume of INOHERB (by Product), 2009-2011

Production Base of JALA Corporation

Sales of JALA Corporation, 2011-2014

Distribution of Chcedo Counters in Mainland China as of Jan 2015

Sales of Osmun, 2010-2014

Retail Sales Growth of Department Store Channel of Proya (by Brand), Jan-Nov 2014

Number of Proya Counters in Mainland China (by City) as of Jan 2015

Revenue of Tianjin Yumeijing Group, 2007-2014

Revenue and Net Income of Softto, 2008-2014

Operating Revenue Breakdown of Softto (by Product), 2008-2014

Gross Margin of Softto (by Product), 2008-2014

Revenue and Net Income of BaWang, 2008-2014

Revenue Breakdown and Structure of BaWang (by Product), 2012-2014

Revenue Breakdown and Structure of BaWang (by Region), 2012-2013

Brand Distribution of BaWang

Revenue Breakdown and Structure of BaWang (by Brand), 2011-2014

Channel Distribution of BaWang (by Brand), 2013-2014

Development Target of BaWang International (Group) Holding Limited

Cosmetics Brand and Product Development of Guangzhou Huanya Cosmetics Technology, 2012-2015

Brand of Guangzhou Huanya Cosmetics Technology

Revenue and Net Income of Guangdong Marubi Biotechnology, 2011-2013

Revenue Breakdown and Structure of Marubi (by Product), 2011-2013

Revenue Breakdown and Structure of Marubi (by Region), 2011-2013

Revenue Breakdown and Structure of Marubi (by Channel), 2011-2013

Dealers of Marubi (by Sales) as of end-2013

Terminal Sales Points of Marubi (by Region/Form) as of end-2013

Capacity and Capacity Utilization of Marubi, 2011-2013

Output, Sales Volume and Sales-Output Ratio of Marubi (by Product), 2011-2013

Revenue Breakdown and Structure of Marubi (by Brand), 2011-2013

Revenue Breakdown and Structure of Marubi? (by Product), 2011-2013

Revenue Breakdown and Structure of CAC? (by Product), 2011-2013

Fundraising Project Overview of Guangdong Marubi Biotechnology, 2014

Brand Distribution of KOSé Cosmetics (by Channel), 2014

Operating Revenue of KOSé Corporation, 2007-2010

Revenue of Cosmetics Companies in China, 2013-2014

Local Cosmetics Financing Events in China, 2013-2014

Counters of Main Cosmetics Brands in China (by City) as of Jan 2015

Comparison of Development-in-China of Multinational Cosmetics Companies, 2013-2014

M&A of Local Cosmetics Brands by Foreign Companies and Developments, 2013-2014

Total Retail Sales and YoY Growth of Chinese Cosmetics Companies above Designated Size, 2013-2017E

China Ceramic Tile Industry Report, 2015-2018

After thirty years of rapid development, China's economy has entered a new normal state, in which real estate investment and development slows down, construction area declines and the demand for decor...

China Cosmetics Market Report, 2014-2017

China’s cosmetics market has been booming in recent years and already become the world’s second largest cosmetics consumer market second only to America, with annual volume of retail sales approximati...

Global and China Luxury Apparel Industry Report, 2014-2017

With the improvement of people’s income as well as the prosperity of agent purchasing and gifting, the luxury market in China (especially Mainland China) has achieved steady growth over the recent yea...

China Ceramic Tile Industry Report, 2014-2018

With economic growth, increasing urbanization rate and people's disposable income, the requirement on housing quality and comfort is augmenting, China’s ceramic tile market is also booming, with marke...