Global and China Dissolving Pulp Industry Report, 2013-2016

-

May 2014

- Hard Copy

- USD

$2,450

-

- Pages:110

- Single User License

(PDF Unprintable)

- USD

$2,300

-

- Code:

HK044

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,600

-

- Hard Copy + Single User License

- USD

$2,650

-

Dissolving pulp refers to the pulp with cellulose content above 90%, mainly including wood pulp, bamboo pulp and cotton pulp (dissolving pulp in this report just involve wood and bamboo pulps), and finding application mainly in viscose fiber downstream.

In 2013, global dissolving pulp capacity approximated 6.3 million tons which were mainly produced in such countries where forest resources are abundant as North America, South Africa and Brazil. As the dissolving pulp industry is fairly profitable during 2009-2011 when a great number of dissolving pulp projects were built in China, the dissolving pulp capacity of China rose to about one million tons till 2013, holding the second place in the world.

Although with a rather large dissolving pulp capacity, China is in short of forest resources and Chinese dissolving pulp manufacturers has a higher production cost than international counterparts. In 2012-2013, China’s viscose fiber industry remained in the doldrums, hence a lower demand for dissolving pulp. This, coupled with the impact of the global low-priced dissolving pulp on the domestic market, led to a universally low operating rate for dissolving pulp devices, thus resulting in the overall loss-making of the industry. In 2013, the output of dissolving pulp in China was only around 360kt, with a mere 36% operating rate but export dependency ratio as much as 83.4%.

In April 2014, Ministry of Commerce People’s Republic of China announced final determination in anti-dumping investigation: starting from April 6, 2014, China would levy tariffs of 17%, 13% and 6.8% on the pulp produced in the United States, Canada, and Brazil, respectively. The implementation period would span 5 years since April 6, 2014. This is good for the sales of dissolving pulp in China and would hinder the impact of the imported dissolving pulp. Although the factors including destocking in distribution and weak demand from downstream market led to the fluctuation of the prices of dissolving pulp in the bottom, the dissolving pulp industry in China is expected to witness a turning point in 2014.

The world’s dissolving pulp industry features quite high concentration and key industrial players consist of Sappi, Aditya Birla, Lenzing, Sateri, Rayonier, etc. In 2013, the total dissolving pulp capacity of the aforesaid five producers accounted for roughly 54.5% of global total. In the forthcoming years, the world’s dissolving pulp capacity will continue to grow and the key increments will involve the successively expanded capacity of 300kt from Lenzing, the capacity of 190kt switched for production by Rayonier, the newly built capacity of 175kt from Thailand’s Double A, and otherwise.

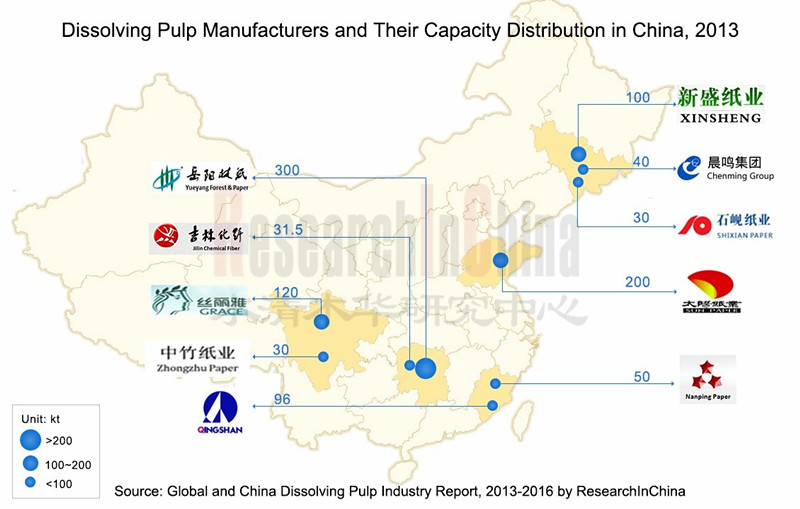

Chinese dissolving pulp manufacturers are mainly medium and large paper-making enterprises and chemical fiber enterprises; wherein, the paper-making enterprises is chiefly composed of Yueyang Forest & Paper, Sun Paper and Zhenlai Xinsheng Paper (putting into production in 2013), mainly producing wood dissolving pulp and with their capacities hitting 300 kt/a, 200 kt/a and 100 kt/a respectively; and chemical fiber enterprises include Jilin Chemical Fiber Group and Yibin Grace Group Company, producing bamboo dissolving pulp in the main, of which the 95 kt/a bamboo pulp project of Jilin Chemical Fiber Group is still under construction and expected to put into production in 2014.

As a large consumer of viscose fiber around the globe, China’s output of viscose fiber is anticipated to keep a growth rate of 10% or so in the upcoming years, which beyond doubt stimulate a rise in the demand for dissolving pulp. After anti-dumping tariff is levied by China on the imported dissolving pulp in 2014, the output of home-made dissolving pulp in China is expected to grow steadily, and it will get to around one million tons in 2016.

Global and China Dissolving Pulp Industry Report, 2013-2016 released by ResearchInChina resolves around the following:

Market size, competitive landscape, price analysis, etc of global dissolving pulp industry;

Market size, competitive landscape, price analysis, etc of global dissolving pulp industry;

Market size, competition pattern, import & export, price analysis, development forecast, etc of China dissolving pulp industry;

Market size, competition pattern, import & export, price analysis, development forecast, etc of China dissolving pulp industry;

Market size, competition pattern, import & export, price analysis, development forecast, etc of China viscose fiber industry;

Market size, competition pattern, import & export, price analysis, development forecast, etc of China viscose fiber industry;

Operation, dissolving pulp business analysis, prediction and prospects, etc of 13 global and Chinese dissolving pulp manufacturers.

Operation, dissolving pulp business analysis, prediction and prospects, etc of 13 global and Chinese dissolving pulp manufacturers.

1. Overview of Dissolving Pulp Industry

1.1 Definition & Classification

1.2 Industrial Chain

2. Global Dissolving Pulp Industry

2.1 Status Quo

2.2 Price Analysis

3. China Dissolving Pulp Industry

3.1 Status Quo

3.2 Anti-dumping Investigation

3.3 Supply

3.4 Demand

3.5 Import & Export

3.6 Competition Pattern

3.7 Price Analysis

4. Downstream Viscose Fiber Market

4.1 Capacity

4.2 Output

4.3 Import & Export

4.4 Price Analysis

5. Major Dissolving Pulp Companies Worldwide

5.1 Sateri

5.1.1 Profile

5.1.2 Operation

5.1.3 Revenue Structure

5.1.4 Gross Margin

5.1.5 Dissolving Pulp Business

5.1.6 Business in China

5.2 Sappi

5.2.1 Profile

5.2.2 Operation

5.2.3 Revenue Structure

5.2.4 Dissolving Pulp Business

5.2.5 Business in China

5.3 Rayonier

5.3.1 Profile

5.3.2 Operation

5.3.3 Revenue Structure

5.3.4 Dissolving Pulp Business

5.4 Aditya Birla Group

5.4.1 Profile

5.4.2 Operation of Grasim

5.4.3 Dissolving Pulp Business of Grasim

5.4.4 Business in China

5.5 Lenzing Group

5.5.1 Profile

5.5.2 Operation

5.5.3 Operation of Fiber Business Division

5.5.4 Dissolving Pulp Business

5.5.5 Business in China

6. Main Dissolving Pulp Producers in China

6.1 Sun Paper

6.1.1 Profile

6.1.2 Operation

6.1.3 Revenue Structure

6.1.4 Gross Margin

6.1.5 Clients & Suppliers

6.1.6 Dissolving Pulp Business

6.1.7 Prediction & Outlook

6.2 Jilin Chemical Fiber Group

6.2.1 Profile

6.2.2 Operation

6.2.3 Revenue Structure

6.2.4 Gross Margin

6.2.5 Clients & Suppliers

6.2.6 Dissolving Pulp Business

6.2.7 Prediction & Outlook

6.3 Fujian Nanping Paper

6.3.1 Profile

6.3.2 Operation

6.3.3 Revenue Structure

6.3.4 Gross Margin

6.3.5 Clients

6.3.6 Dissolving Pulp Business

6.3.7 Prediction & Outlook

6.4 Yanbian Shixian Bailu Papermaking

6.4.1 Profile

6.4.2 Operation

6.4.3 Revenue Structure

6.4.4 Gross Margin

6.4.5 Clients

6.4.6 Dissolving Pulp Business

6.4.7 Prediction & Outlook

6.5 Fujian Qingshan Paper Industry

6.5.1 Profile

6.5.2 Operation

6.5.3 Revenue Structure

6.5.4 Gross Margin

6.5.5 Dissolving Pulp Business

6.5.6 Prediction & Outlook

6.6 Yueyang Forest & Paper

6.6.1 Profile

6.6.2 Operation

6.6.3 Revenue Structure

6.6.4 Gross Margin

6.6.5 Clients

6.6.6 Dissolving Pulp Business

6.6.7 Prediction & Outlook

6.7 Shandong Chenming Paper Holdings

6.7.1 Profile

6.7.2 Operation

6.7.3 Dissolving Pulp Business

6.8 Yibin Grace Group Company

6.8.1 Profile

6.8.2 Operation

6.8.3 Dissolving Pulp Business

7 Conclusion & Prediction

7.1 Conclusion

7.2 Prediction

7.2.1 Supply & Demand Prediction

7.2.2 Downstream Prediction

Mainstream Industrial Chain of Dissolving Wood Pulp

Other Downstream Products and Applications of Dissolving Pulp

Dissolving Pulp Capacity Distribution Worldwide by Region, 2013

World’s Top Six Dissolving Pulp Manufacturers, Their Capacities and Markets, 2013

Major Dissolving Pulp Projects Planned or Under Construction Worldwide, 2014-2016

Average Annual Price of Dissolving Pulp Worldwide, 2007-2013

Price Tendency of Dissolving Pulp Worldwide, 2011-2014

Capacity and Output of Dissolving Pulp in China, 2010-2013

Capacities of Dissolving Pulp Manufacturers in China, 2013

Apparent Consumption of Dissolving Pulp in China, 2010-2013

Import & Export of Dissolving Pulp in China, 2009-2013

Average Import & Export Price of Dissolving Pulp in China, 2009-2013

Import Source Structure of Dissolving Pulp in China by Import Volume, 2013

Average Import Price of Dissolving Pulp in China by Country, 2013

Export Destination Distribution of Dissolving Pulp in China by Export Volume, 2013

Major Dissolving Pulp Import Provinces and Their Import Volume in China (%), 2013

Major Dissolving Pulp Export Provinces and Their Export Volume in China (%), 2013

Dissolving Pulp Manufacturers in China and Their Capacities (%), 2013

Dissolving Pulp Market Price in China, 2012-2014

Major Viscose Fiber Manufacturers in China and Their Capacities, 2013

Major Viscose Staple Fiber Manufacturers in China and Their Capacities (%), 2013

Major Viscose Filament Yarn Manufacturers in China and Their Capacities (%), 2013

Output and YoY Growth Rate of Viscose Fiber in China, 2006-2013

Percentage of Viscose Fiber Output in China by Product, 2011-2013

Import and Export Volume of Viscose Staple Fiber in China, 2008-2013

Average Import and Export Price of Viscose Staple Fiber in China, 2008-2013

Export Destinations of Viscose Staple Fiber in China by Export Volume, 2013

Import Sources of Viscose Staple Fiber in China by Import Volume, 2013

Major Viscose Staple Fiber Export Cities and Their Export Volume in China (%), 2013

Major Viscose Staple Fiber Import Cities and Their Import Volume in China (%), 2013

Market Price of Viscose Staple Fiber and Viscose Filament Yarn in China, 2008-2014

Sateri’s Product Chain and Product Application

Revenue and Net Income of Sateri, 2009-2013

Revenue of Sateri by Product, 2011-2013

Revenue Structure of Sateri by Product, 2011-2013

Revenue of Sateri by Region, 2011-2013

Revenue Structure of Sateri by Region, 2011-2013

Gross Margin of Primary Products of Sateri, 2011-2013

Dissolving Wood Pulp Categories and Applications of Sateri

Dissolving Wood Pulp Output and Sales Volume of Sateri, 2011-2013

Viscose Pulp Sales Volume and Shares in Dissolving Wood Pulp Sales Volume, 2011-2013

Special Pulp Sales Volume and Shares in Dissolving Wood Pulp Sales Volume, 2011-2013

Average Selling Price of Sateri’s Dissolving Wood Pulp Product, 2011-2013

Three Major Production Bases of Sappi and Capacities of Its major Products, 2013

Sales and EBITDA of Sappi, 2009-2013

Sales of Sappi by Branch, 2011-2013

Sales Structure of Sappi by Branch, 2011-2013

Sales Structure of Sappi by Product, 2013

Sales of Sappi by Region, 2011-2013

Sales Structure of Sappi by Region, 2011-2013

Major Products of Sappi Southern Africa and Their Capacities, 2013

Sales of Sappi’s Dissolving Pulp Business and YoY Growth Rate, 2009-2013

Producing Regions of Rayonier’s Major Products and Capacities, 2013

Sales and Net Income of Rayonier, 2009-2013

Sales of Rayonier by Segment, 2011-2013

Sales Structure of Rayonier by Segment, 2011-2013

Sales of Rayonier by Region, 2010-2012

Sales Structure of Rayonier by Region, 2010-2012

Sales Volume of Major Products of Rayonier’s High-Performance Fiber Business Division, 2009-2013

Sales of Rayonier’s High-Performance Fiber Business Division by Product, 2011-2013

Sales Structure of Rayonier’s High-Performance Fiber Business Division by Product , 2011-2013

Average Selling Price of Rayonier’s Dissolving Pulp Products, 2009-2013

Net Revenue and Net Income of Grasim, FY2009-FY2013

Net Revenue Structure of Grasim by Product, FY2011-FY2013

Production Plants of Grasim and Their Capacities, 2013

Net Revenue and Growth Rate from Viscose Staple Fiber & Dissolving Pulp Business of Grasim, FY2009-FY2013

Sales and EBITDA of Lenzing Group, 2009-2013

Sales Structure of Lenzing Group by Segment, 2011-2013

Sales Structure of Lenzing Group by Region, 2011-2013

Sales and EBITDA from Fiber Business Division of Lenzing Group, 2009-2013

Sales from Fibre Business Division of Lenzing Group by Product, 2011-2013

Sales Structure from Fibre Business Division of Lenzing Group by Product, 2011-2013

Viscose Subsidiaries under Lenzing Group and Their Capacities, 2013

Revenue and Net Income of Lenzing Group (Nanjing), 2009-2013

Revenue and Net Income of Sun Paper, 2009-2013

Revenue of Sun Paper by Product, 2011-2013

Revenue Structure of Sun Paper by Product, 2011-2013

Revenue of Sun Paper by Region, 2011-2013

Revenue Structure of Sun Paper by Region, 2011-2013

Gross Margin of Sun Paper’s Hit Products, 2011-2013

Sun Paper’s Revenue from Top Five Clients and % of Total Revenue, 2011-2013

Name List and Revenue Contribution of Sun Paper’s Top Five Clients, 2013

Sun Paper’s Procurement from Top Five Suppliers and % of Total Procurement, 2012-2013

Name List and Procurement of Sun Paper’s Top Five Suppliers, 2013

Revenue and Net Income of Sun Paper, 2012-2016E

Capacities of Jilin Chemical Fiber Group’s Hit Products, 2013

Revenue and Net Income of Jilin Chemical Fiber Group, 2009-2013

Revenue of Jilin Chemical Fiber Group by Product, 2011-2013

Revenue Structure of Jilin Chemical Fiber Group by Product, 2011-2013

Revenue of Jilin Chemical Fiber Group by Region, 2011-2013

Revenue Structure of Jilin Chemical Fiber Group by Region, 2011-2013

Gross Margin of Jilin Chemical Fiber Group’s Major Products, 2011-2013

Jilin Chemical Fiber Group’s Revenue from Top Five Clients and % of Total Revenue, 2011-2013

Name List and Revenue Contribution of Jilin Chemical Fiber Group’s Top Five Clients, 2013

Jilin Chemical Fiber Group’s Procurement from Top Five Suppliers and % of Total Procurement,

2011-2013

Name List and Procurement of Jilin Chemical Fiber Group’s Top Five Suppliers, 2013

Subsidiaries Engaging in Bamboo Pulp Business under Jilin Chemical Fiber Group, 2013

Revenue and Net Income of Jilin Chemical Fiber Group, 2012-2016E

Revenue and Net Income of Fujian Nanping Paper, 2009-2013

Revenue of Fujian Nanping Paper by Product, 2011-2013

Revenue Structure of Fujian Nanping Paper by Product, 2011-2013

Revenue of Fujian Nanping Paper by Region, 2011-2013

Revenue Structure of Fujian Nanping Paper by Region, 2011-2013

Gross Margin of Fujian Nanping Paper’s Main Products, 2011-2013

Fujian Nanping Paper’s Revenue from Top Five Clients and % of Total Revenue, 2011-2013

Name List and Revenue Contribution of Fujian Nanping Paper’ Top Five Clients, 2013

Dissolving Pulp Products and Features of Fujian Nanping Paper

Revenue and Net Income of Fujian Nanping Paper, 2012-2016E

Revenue and Net Income of Yanbian Shixian Bailu Papermaking, 2009-2013

Revenue of Yanbian Shixian Bailu Papermaking by Product, 2011-2013

Revenue Structure of Yanbian Shixian Bailu Papermaking by Product, 2011-2013

Revenue of Yanbian Shixian Bailu Papermaking by Region, 2011-2013

Revenue Structure of Yanbian Shixian Bailu Papermaking by Region, 2011-2013

Gross Margin of Yanbian Shixian Bailu Papermaking’s Main Products, 2011-2013

Yanbian Shixian Bailu Papermaking’s Revenue from Top Five Clients and % of Total Revenue,

2011-2013

Name List and Revenue Contribution of Yanbian Shixian Bailu Papermaking, 2013

Revenue and Net Income of Yanbian Shixian Bailu Papermaking, 2012-2016E

Revenue and Net Income of Fujian Qingshan Paper Industry, 2009-2013

Revenue of Fujian Qingshan Paper Industry by Product, 2011-2013

Revenue Structure of Fujian Qingshan Paper Industry by Product, 2011-2013

Revenue of Fujian Qingshan Paper Industry by Region, 2011-2013

Revenue Structure of Fujian Qingshan Paper Industry by Region, 2011-2013

Gross Margin of Fujian Qingshan Paper Industry’s Main Products, 2011-2013

Revenue and Net Income of Fujian Qingshan Paper Industry, 2012-2016E

Revenue and Net Income of Yueyang Forest & Paper, 2009-2013

Revenue of Yueyang Forest & Paper by Product, 2011-2013

Revenue Structure of Yueyang Forest & Paper by Product, 2011-2013

Revenue of Yueyang Forest & Paper by Region, 2011-2013

Revenue Structure of Yueyang Forest & Paper by Region, 2011-2013

Gross Margin of Yueyang Forest & Paper’s Main Products, 2011-2013

Yueyang Forest & Paper’s Revenue from Top Five Clients and % of Total Revenue, 2011-2013

Name List and Revenue Contribution of Yueyang Forest & Paper’s Top Five Clients, 2013

Revenue and Net Income of Hunan Juntai Pulp & Paper, 2011-2013

Revenue and Net Income of Yueyang Forest & Paper, 2012-2016E

Revenue and Net Income of Shandong Chenming Paper Holdings, 2009-2013

Capacities of Yibin Grace Group Company’s Main Products, 2013

Operating Revenue and Total Profit of Yibin Grace Group Company, 2007-2009

Operation Comparison among Major Dissolving Pulp Manufacturers in China and Worldwide, 2013

Supply and Demand of China Dissolving Pulp Industry, 2012-2016E

Supply and Demand of China Viscose Fiber Industry, 2012-2016E

Global and China Synthetic Rubber Industry Report, 2021-2027

Synthetic rubber is a polymer product made of coal, petroleum and natural gas as main raw materials and polymerized with dienes and olefins as monomers, which is typically divided into general synthet...

Global and China Carbon Fiber Industry Report, 2021-2026

Carbon fiber is a kind of inorganic high performance fiber (with carbon content higher than 90%) converted from organic fiber through heat treatment. As a new material with good mechanical properties,...

China Coal Tar Industry Report, 2020-2025

Coal tar is a thick dark liquid which is a by-product of the production of coke and coal gas from coal. It can be classified by the dry distillation temperature into low-temperature coal tar, medium-t...

Global and China Dissolving Pulp Industry Report, 2019-2025

In 2018, global dissolving pulp capacity outstripped 10 million tons and its output surged by 14.0% from a year ago to 7.07 million tons, roughly 70% of the capacity. China, as a key supplier of disso...

Global and China 1, 4-butanediol (BDO) Industry Report, 2019-2025

1,4-butanediol (BDO), an essential organic and fine chemical material, finds wide application in pharmaceuticals, chemicals, textile and household chemicals.

As of the end of 2018, the global BDO cap...

Global and China Carbon Fiber and CFRP Industry Report, 2019-2025

Among the world’s three major high performance fibers, carbon fiber features the highest strength and the highest specific modulus. It is widely used in such fields as aerospace, sports and leisure.

...

Global and China Natural Rubber Industry Report, 2019-2025

In 2018, global natural rubber industry continued remained at low ebb, as a result of economic fundamentals. Global natural rubber price presented a choppy downtrend and repeatedly hit a record low in...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2019-2025

Ultra high molecular weight polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million used as an engineering thermoplastic with excellent comprehensive p...

China Polyether Monomer Industry Report, 2019-2025

China has seen real estate boom and issued a raft of policies for continuous efforts in improving weak links in infrastructure sector over the years. Financial funds of RMB1,663.2 billion should be al...

Global and China Needle Coke Industry Report, 2019-2025

Needle coke with merits of good orientation and excellent conductivity and thermal conductivity, is mainly used in graphite electrodes for electric steelmaking and lithium battery anode materials.

A...

Global and China Viscose Fiber Industry Report, 2019-2025

Over the recent years, the developed countries like the United States, Japan and EU members have withdrawn from the viscose fiber industry due to environmental factor and so forth, while the viscose f...

China Coal Tar Industry Report: Upstream (Coal, coke), Downstream (Phenol Oil, Industrial Naphthalene, Coal Tar Pitch), 2019-2025

Coal tar is a key product in coking sector. In 2018, China produced around 20 million tons of coal tar, a YoY drop of 2.4% largely due to a lower operating rate of coal tar producers that had to be su...

Global and China Synthetic Rubber (BR, SBR, EPR, IIR, NBR, Butadiene, Styrene, Rubber Additive) Industry Report, 2018-2023

In 2018, China boasted a total synthetic rubber capacity of roughly 6,667kt/a, including 130kt/a new effective capacity. Considering capacity adjustment, China’s capacity of seven synthetic rubbers (B...

Global and China Dissolving Pulp Industry Report, 2018-2022

With the commissioning of new dissolving pulp projects, the global dissolving pulp capacity had been up to about 8,000 kt by the end of 2017. It is worth noticing that the top six producers including ...

Global and China Carbon Fiber and CFRP Industry Report, 2018-2022

As a new generation of reinforced fiber boasting intrinsic properties of carbon material and excellent processability of textile fiber, carbon fiber is the one with the highest specific strength and s...

Global and China Ultra High Molecular Weight Polyethylene (UHMWPE) Industry Report, 2017-2021

Ultra High Molecular Weight Polyethylene (UHMWPE), a kind of linear polyethylene with relative molecular weight of above 1.5 million and an engineering thermoplastic with excellent comprehensive prope...

China Coal Tar Industry Report, 2017-2021

Coal tar, one of by-products in raw coal gas generated from coal pyrolysis in coking industry, accounts for 3%-4% of the output of coal as fired and is a main raw material in coal chemical industry.

...

Global and China Aramid Fiber Industry Report, 2017-2021

Global aramid fiber output totaled 115kt with capacity utilization of 76.0% in 2016. As industries like environmental protection and military develop, the output is expected to rise to 138kt and capac...