Global and China Memory Industry Report, 2014-2015

-

May 2015

- Hard Copy

- USD

$2,300

-

- Pages:95

- Single User License

(PDF Unprintable)

- USD

$2,100

-

- Code:

ZYW207

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,300

-

- Hard Copy + Single User License

- USD

$2,500

-

Global and China Memory Industry Report, 2014-2015 covers the followings:

1. Memory technology trends

2. Memory market

3. Memory industry

4. 19 typical memory industry chain vendors

After two years of recession, the global memory market went forward by leaps and bounds in 2013-2014, with scale up more than 20% for two consecutive years i.e. 20.5% in 2013, 22.1% in 2014, the highest growth rate among all semiconductor products. In 2015, the growth rate slows evidently, only 2.3%, and the memory market size is expected to reach USD83.8 billion.

Causes for the decline in growth rate are the followings. The first comes to the falling prices of DRAM. DRAM price began to rise from October 2012, a trend lasting till June 2014, resulting in increased supply and a balance between supply and demand. However, spot prices of DRAM started falling in July 2014.

Second, the demand dropped. Smartphone growth slowed down, the shipment of tablet PC dived and that of desktop PC fell as well. As the world is just stuck in an ill-defined “economic recovery”, China’s economy has seen a slowdown in growth rate, with a sharper decline to occur in its demand in 2016, and so will smartphones then. With the commissioning of new capacities of major memory vendors, especially in the NAND field, the price will fall more than expected. The memory industry will probably suffer another recession in 2016, down 3.1%.

The memory industry can be divided into two camps: South Korean camp and Japanese/American/Taiwanese camp. Taiwan has good scientific research base, enjoying a sound relationship with Japan; technologically supported by the latter for a long time, Taiwan has the most complete industry chain of memory, especially in packing & testing, it sometimes helps South Korean peers. Japan boasts the most advanced technology but lacks strong financial support, mostly in association with US companies, and the two are willing to cooperate with Taiwanese companies. Japan, the United States and Taiwan formed an alliance – Toshiba with SanDisk, and Micron with Formosa Plastics. South Korean vendors still fade next to Japanese ones e.g. Samsung pays an about 3% patent fee to Toshiba each year, but they are competitive in financial strength and production technology.

Mainland China has been the world’s largest memory market, annually importing memory worth tens of billions of dollars from South Korea. China is trying to change this situation but beset with difficulties. The basic industry and basic scientific research strength are relatively backward in Chinese Mainland, even falling behind Taiwan by more than 10 years in field of semiconductor. Since the rate of return on industry is far lower than the monetary speculation, companies in the mainland are keen on capital operation instead of industrial investment. Chinese mainland enterprises may have some achievements in NorFlash sector from which large companies have retreated, but it is hard to make a big breakthrough in DRAM and NAND.

Currently, most of the new technical memories have low capacity, or else they may face bottlenecks of high costs and poor reliability when capacity is raised. It is projected that traditional DRAM and NAND will still occupy the dominant position from 2020 to 2025, NorFlash or SRAM may be replaced by new technologies in the low-capacity memory field. STT-MRAM now moves up fastest in commercialization.

Everspin had shipped 40 million STT MRAM before October 2014. Since then, it worked with GlobalFoundries in making STT MRAM (40 nm technology).

Intel, IBM, Samsung, SK Hynix and Qualcomm are developing MRAM storage technology while Japanese companies are pretty competitive in this area. In addition to Toshiba, TDK is also an important participant who showcased MRAM wafer with practical performance demonstration at CEATEC JAPAN for the first time.

1. Memory Technology Trends

1.1 TLC

1.2 3D NAND

1.3 Emerging NVM

2. Memory Market

2.1 Global Memory Market

2.2 DRAM Supply & Demand

2.3 NAND Supply & Demand

2.4 Global Mobile Phone Market and Industry

2.5 China Mobile Phone Market

2.6 Notebook Computer Market

2.7 Tablet PC Market

2.8 Server

2.8.1 Server Market

2.8.2 Server Industry

2.9 Enterprise SSD Market

3. Memory Industry

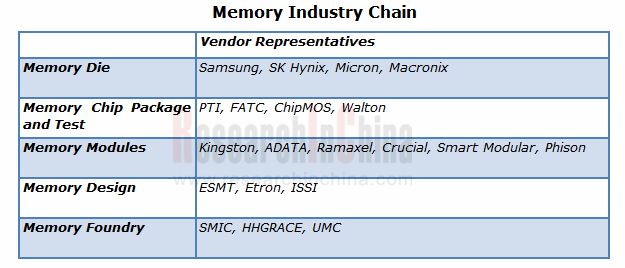

3.1 Memory Industry Chain

3.2 Memory Vendor Market Share

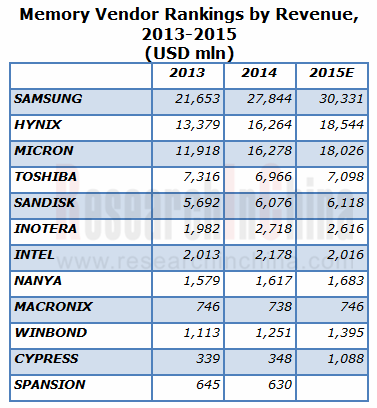

3.3 Memory Vendor Rankings

3.4 NorFlash Vendor Market Share

3.5 Chinese Mainland Vendors Beset with Difficulties into Mainstream Memory Areas

4. Memory Vendors

4.1 SAMSUNG

4.2 SK HYNIX

4.3 MICRON

4.4 INOTERA

4.5 NANYA TECHNOLOGY

4.6 SANDISK

4.7 MACRONIX

4.8 ESMT

4.9 ETRON

4.10 ISSI

4.11 WINBOND ELECTRONIC

4.12 CYPRESS

4.13 GIGADEVICE

4.14 TOSHIBA

5. Memory Industry Chain Vendors

5.1 PTI

5.2 CHIPMOS

5.3 FATC

5.4 ADATA

5.5 SILICON MOTION

Classification of Memory

Comparison between Various Types of Memory

Emerging NVM Time to Market by Application, 2014-2020

Comparison of Emerging Memory and Established Memory

Global Memory Market Size, 2009-2016E

Global Memory Market by Type, 2014

Automotive Memory Market Size, 2008-2015

Automotive Memory Market by Technology, 2010-2015

DRAM Industry CAPEX, 2008-2015

DRAM Oversupply Ratio, 2013-2016

DRAM Demand by Devices, 2013-2015

DRAM GB/SystemDRAM GB/System, 2013-2015

DRAM Oversupply Ratio, Q1/2014-Q4/2016

NAND Industry CAPEX, 2008-2015

Global Mobile Phone Shipments, 2007-2015

Global 3G/4G Mobile Phone Shipments by Region, 2011-2014

Worldwide Smartphone Sales to End Users by Vendor in 2014 (Thousands of Units)

Worldwide Smartphone Sales to End Users by Operating System in 2014 (Thousands of Units)

Shipments of Top 10 Mobile Phone Vendors Worldwide, 2014

Monthly Shipments of China Mobile Phone Market, Jan 2013-Dec 2014

Market Share of Major Smartphone Vendors in China, 2014

Market Share of Major 4G Mobile Phone Vendors in China, 2014

Notebook Computer Shipments, 2008-2015

Shipments of Major Notebook ODM Vendors Worldwide, 2010-2014

Global Tablet PC Shipments, 2011-2016E

Shipments of Top 5 Tablet PC Vendors, Q4/2014

Shipments, Market Share and Growth of Top 5 Tablet PC Vendors, 2014

Global Server Market Size, 2013-2018E

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, 2013

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, Q4/2014

Worldwide: Server Vendor Shipments, Q4/2014 (Units)

Worldwide: Server Vendor Revenue, Q4/2014 (U.S. Dollars)

EMEA Server Vendor Revenue, Q4/2014 (U.S. Dollars)

EMEA Server Shipment, Q4/2014 (Units)

Market Share of Server Brand Vendors Worldwide, 2015

Market Share of Server OEMs Worldwide, 2015

Supply Relationship between OEMs and Server Brand Vendors

Memory Industry Chain

Market Share of Branded DRAM Vendors, Q1-Q4/2014

Market Share of Branded NAND Vendors, Q1-Q4/2014

Market Share of Mobile DRAM Vendors, Q1-Q4/2014

Memory Vendor Rankings by Revenue, 2013-2015

Revenue and Operating Margin of Memory Design Companies

Operating Margin of Major Memory Vendors, 2013-2014

Market Share of Major NorFlash Vendors, 2012

Market Share of Major NorFlash Vendors, 2014

Revenue and Operating Margin of Samsung Memory Division, 2010-2015

Revenue Breakdown of Samsung Memory Division by Product, 2010-2015

Revenue Breakdown of Samsung Memory Division by Application, 2014

Samsung DRAM/NAND Operating Margin, 2010-2015

Samsung DRAM Shipments, 2012-2015

Samsung DRAM ASP, 2012-2015

Samsung DRAM Fab Input (12inch Wafer), 2013-2015

Samsung NAND Shipments, 2012-2015

Samsung NAND ASP, 2012-2015

Samsung NAND Fab Input (12inch Wafer), 2013-2015

Samsung System LSI Revenue vs Operating Margin, 2010-2015

SK Hynix Revenue vs Operating Margin, 2008-2015

SK Hynix EBITDA vs Net Margin, Q1/2013-Q4/2014

SK Hynix Assets vs Liabilities, 2008-2014

SK Hynix Revenue Mix by Product, 2008-2014

SK Hynix Revenue Mix by Application, Q1/2015

SK Hynix DRAM Shipments vs ASP, 2013-2016

SK Hynix NAND Shipments vs ASP, 2013-2016

Micron Revenue vs Operating Margin, FY2008-FY2015

Micron Revenue vs Net Income, FY2008-FY2015

Micron Revenue Mix by Segment, FY2012-FY2015

Micro Gross Margin by Segment, FY2012-FY2015

Micron Revenue Mix by Location, FY2012-FY2015

Micro Customers

Micron Roadmap

Inotera Revenue vs Gross Margin, 2008-2015

Inotera Balance Sheet & Key Indices, Q1/2015

Inotera Cash Flow, Q1/2015

Inotera Monthly Revenue, Mar 2013-Mar 2015

Framework of Nanya, Micron & Inotera

Nanya Revenue vs Gross Margin, 2008-2015

Nanya Quarterly Revenue vs Gross Margin, Q2/2012-Q1/2015

Nanya Mix by Application, Q1/2013-Q1/2015

Nanya Mix by Application, 2012-2015

Nanya CAPEX, 2011-2015

Nanya Shipments, 2011-2015

SanDisk Revenue vs Gross Margin, 2009-2015

Sandisk Revenue Mix by Application, 2009-2015

SanDisk Revenue by Location, 2011-2013

Macronix Organization

Macronix Revenue vs Gross Margin, 2008-2015

Macronix Revenue by Segment, 2013-2015

Macronix ROM Shipments, Q1/2011-Q1/2015

Macronix ROM Revenue Mix by Tech, 2013-2015

Macronix NOR Shipments, Q1/2011-Q1/2015

Macronix NOR Revenue Mix by Tech, 2013-2015

Macronix NOR Revenue Breakdown, Q1/2015

Macronix SLC NAND Shipments, 2013-2015

ESMT Revenue vs Gross Margin, 2009-2015

ESMT Monthly Revenue, Mar 2013-Mar 2015

Etron Revenue vs Gross Margin, 2009-2015

Etron Monthly Revenue, Mar 2013-Mar 2015

ISSI Revenue vs Gross Margin, 2008-2015

ISSI Revenue by Segment, 2014

ISSI Customers

ISSI Revenue by Product, FY2009\FY2014

ISSI Automotive Market Revenue, FY2009\FY2014

Winbond Organization

Winbond Revenue vs Gross Margin, 2009-2015

Winbond Quarterly Revenue vs Gross Margin, Q2/2013-Q1/2015

Winbond Revenue by Application, 2014-2015

Winbond Revenue by Geometry, 2013-2015

Winbond CAPEX, 2010-2015

Winbond Revenue by Segment, 2011-2015

Cypress Revenue vs Operating Margin, 2007-2014

Cypress Revenue by Business, 2009-2014

Cypress Revenue by Region, 2009-2014

Spansion Revenue vs Gross Margin, 2009-2013

Spansion Revenue by Region, 2011-2013

New Cypress Revenue by Application

GigaDevice Balance Sheet, 2011-2013

GigaDevice Revenue vs Operating Income, 2011-2013

GigaDevice Cash Flow, 2011-2013

GigaDevice Financial Indicators, 2011-2013

GigaDevice Customer Distribution, 2013

GigaDevice Supplier Distribution, 2013

Toshiba Revenue by Segment, FY2011-FY2015

Toshiba Electronic Devices & Components Segment Revenue by Product, FY2011-FY2015

PTI Organization

PTI Revenue vs Gross Margin, 2008-2015

PTI Monthly Revenue, Mar 2013-Mar 2015

PTI Revenue Mix by Application, Q1/2014-Q1/2015

ChipMOS Revenue vs Gross Margin, 2003-2014

ChipMOS Revenue vs Operating Margin, 2009-2014

ChipMOS Revenue by Business, 2010-2014

ChipMOS Revenue by Product, 2010-2014

ChipMOS Utilization Rate vs EBITDA Margin, 2010-2014

ChipMOS Cash Flow and CAPEX, 2009-2014

ChipMOS Roadmap, 2014-2016

ChipMOS Technology Development & Business Alignment

Formosa Plastics Organization

FATC Organization

FATC Revenue vs Operating Margin, 2006-2015

FATC Revenue vs Gross Margin, 2009-2015

FATC Monthly Revenue, Mar 2013-Mar 2015

ADATA Revenue vs Gross Margin, 2008-2015

ADATA Monthly Revenue, Mar 2013-Mar 2015

ADATA Revenue by Segment, 2011-2015

ADATA Worldwide

SIMO Revenue vs Gross Margin, 2010-2015

Global and China Semiconductor Equipment Industry Report, 2019-2025

The semiconductor industry with high technical threshold is advancing speedily. Every generation of products requires unique processes and equipment. With progresses in semiconductor manufacturing pro...

Global and China IGBT Industry Report, 2019-2025

IGBT finds wide application in fields ranging from home appliances and digital products to aviation & aerospace and high-speed rails, so does in the emerging sectors like smart grid and new energy...

Global and China Memory Industry Report, 2019-2025

In 2018, global memory market was worth USD153.4 billion, surging by 23.7% from a year earlier thanks to rising prices as a result of robust demand from mobile phones and cloud services and a higher s...

China IGBT (Rail Transit/Electric Vehicle/Wind Power/Photovoltaic/Home Appliance) Industry Report, 2016-2020

An IGBT is a complex device with the Darlington configuration. Using GTR as the dominant component and MOSFET as the drive component, IGBTcombines the merits of BJT and MOSFET, such as low drive power...

China Semiconductor Industry Report, 2014-2015

The report covers the followings:1. Global Semiconductor Market and Industry; 2. China Semiconductor Market and Industry;3. Eleven Chinese IC Design Companies4. Five Chinese Foundries5. Four Chinese P...

Global and China Memory Industry Report, 2014-2015

Global and China Memory Industry Report, 2014-2015 covers the followings:1. Memory technology trends2. Memory market 3. Memory industry4. 19 typical memory industry chain vendors

...

Global and China Semiconductor Equipment Industry Report, 2013-2014

After two years of recession, the semiconductor equipment market is projected to achieve growth in 2014. In 2011, the semiconductor equipment market size hit a record high of USD43.532 billion, but it...

China Digital TV Transmitter Industry Report, 2013

According to the planning of the State Administration of Radio, Film and Television (SARFT), China in 2015 will shut down analog TV and complete the integral transition of cable TV from analog to digi...

Global and China Memory Industry Report, 2013

Global and China Memory Industry Report, 2013 consists of the following contents: Brief introduction to global semiconductor industry Market analysis of DRAM and NAND Major memory vendors Majo...

Global and China Passive Component Industry Report, 2012-2013

The report highlights the followings: 1. Brief Introduction to Passive Components; 2. Passive Component Industry & Market Segments-Capacitor, Inductor and Resistor; 3. Main Downst...

Global and China GaAs Industry Report, 2012-2013

Global and China GaAs Industry Report, 2012-2013 covers the followings: 1 Brief introduction to GaAs2 Industry overview of GaAs3 Downstream market of GaAs4 Analysis on mobile phone RF system 5 Study o...

Global and China Advanced Packaging Industry Report, 2012-2013

Global and China Advanced Packaging Industry Report, 2012-2013 covers the followings: 1. Global Semiconductor Industry Overview;2. IC Manufacturing Industry Overv...

Global and China Touch Screen (Panel) Industry Report, 2012-2013

Global and China Touch Screen (Panel) Industry Report, 2012-2013 covers the followings:

Touch Screen Market Size Trends of Small, Medium and Large-sized Touch Screens Touch Screen Downstream Market...

Global and China Mobile PC Casing (Enclosure) Industry Report, 2012-2013

The report covers the followings: 1. Global and Chinese PC markets 2. Global and China Mobile PC industry 3. Notebook and tablet PC casing industr...

Global and China PC Cable Assembly Industry Report, 2012-2013

Global and China PC Cable Assembly Industry Report, 2012-2013 covers the followings: 1. Global and China PC Market; 2. Global and China Mobile PC Market;3. PC Cable Assembly Industry;4. 15 Major PC Ca...

Global and China Flexible Printed Circuit Board (FPCB) Industry Report, 2012

Global and China Flexible Printed Circuit Board (FPCB) Industry Report, 2012 includes the following contents:

1. Profile of FPCB2. Overview of FPCB Market and Industry3. Analysis of 22 Major FPCB Ma...

Global and China OLED Industry Report, 2012

Promoted by the display giants headed by Samsung and LG, OLED industry is still in the stage of steady development. In 2011, the OLED output value worldwide approximated USD3.3 billion, with year-on-y...

China Navigation Equipment Industry Report, 2012-2014

After forty years of development, the global satellite navigation system has developed into a “one plus three” pattern. And the “one” refers to GPS made in the USA, and the three refer to Chinese, Rus...