Global and China Memory Industry Report, 2019-2025

-

May 2019

- Hard Copy

- USD

$2,800

-

- Pages:121

- Single User License

(PDF Unprintable)

- USD

$2,600

-

- Code:

ZJF133

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$3,900

-

- Hard Copy + Single User License

- USD

$3,000

-

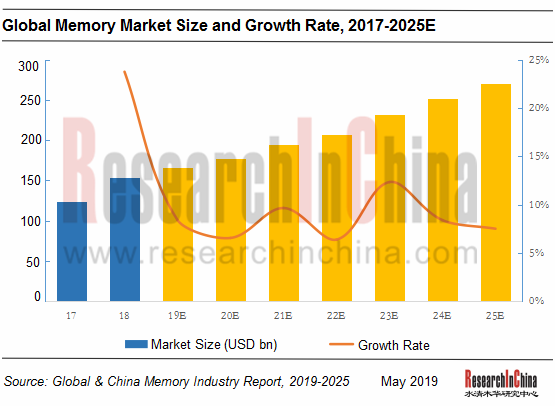

In 2018, global memory market was worth USD153.4 billion, surging by 23.7% from a year earlier thanks to rising prices as a result of robust demand from mobile phones and cloud services and a higher supplier concentration. Global memory demand will continue to increase as emerging technologies such as AI, AR/VR and internet of things (IoT) rise and downstream sectors like consumer and automotive electronics need much more. It is predicted that global memory market size will hit USD270.6 billion in 2025, at a CAGR of 8.4% between 2018 and 2025.

Memories are led by DRAM and Flash. Dynamic random access memory (DRAM) is used the most widely in systems for its excellent performance and lower cost than its peers in spite of volatility when powered down. In 2018, global DRAM market was valued at USD94.8 billion or so, a 30.2% jump on the previous year; Flash memory chip, the most common non-volatile memory, finds the broadest application in mass storage field because it is non-volatile even if power is turned off. In 2018, NAND Flash sales leaped by 14.4% to USD56.3 billon on an annualized basis; NOR Flash sales were approximately USD1.9 billion; market size of other memories (including static random-access memory (SRAM)) reached a combined roughly USD400 million.

Memory market segments vary in competitive pattern. In global DRAM market, Samsung Electronics remains the bellwether sweeping 46% market shares, and its four DRAM plants all with 12-inch production lines can produce 395,000 units a month; another Korean vendor SK Hynix branching out from Hyundai Technology, takes a 28% share, making itself the world’s second largest DRAM vendor, with an 8-inch wafer production line and two 12-inch lines in Korea, an 8-inch line in Oregon, the US and a 12-inch line in Wuxi, China; America’s Micron Technology is in the third place commanding 21% of the market and boasting a DRAM capacity of about 340,000 units per month after acquiring ELPIDA and Rexchip and integrating Inotera Memories’ capacity.

As for NAND Flash, the global market has been monopolized by five vendors, i.e., Samsung, Toshiba, Micron, SK Hynix and Western Digital, with the CR5 reaching a staggering 98%. Samsung Electronics whose NAND Flash capacity stands at 560,000 units per month has decided to expand Phase II of its plant in Xi’an city, China for a larger NAND Flash capacity. Toshiba and Western Digital will keep their partnership, with a collective capacity of 510,000 units per month; Toshiba’s Fab 6 still under construction will start 96-layer 3D NAND capacity expansion plan; also, its Fab 7 has been kicked off, and will become operational in the second half of 2019 for producing 96-layer-above 3D NAND and go into mass production in 2020. Micron has a monthly capacity of 350,000 units and proposes construction of Phase III of its fab. SK Hynix will build another new plant, M15, on the site of its existing plant in Cheongju, Korea, to produce 96-layer-above 3D NAND, and put it into use in 2019, with a monthly capacity of 50,000 units. Chinese player Yangtze Memory Technologies Co., Ltd. under Tsinghua Unigroup will see the capacity of its manufacturing base in Wuhan City reach 150,000 units at the end of 2019.

Global & China Memory Industry Report, 2019-2025 highlights the following:

Memory overview (definition and classification, industry chain and technology roadmap);

Memory overview (definition and classification, industry chain and technology roadmap);

Memory applications (mobile phone, tablet PC, notebook computer and server);

Memory applications (mobile phone, tablet PC, notebook computer and server);

Memory industry (market size and segments (DRAM, NAND Flash, NOR Flash, etc.));

Memory industry (market size and segments (DRAM, NAND Flash, NOR Flash, etc.));

14 memory vendors (Samsung Electronics, SK Hynix, Micron, etc.) (operation, main products, production layout, output and sales, development strategy, etc.).

14 memory vendors (Samsung Electronics, SK Hynix, Micron, etc.) (operation, main products, production layout, output and sales, development strategy, etc.).

1. Overview of Memory Industry

1.1 Definition and Classification

1.2 Memory Industry Chain

1.3 Technology Trends

1.4 Emerging NVM

2 Application Market of Memory

2.1 Mobile Phone Market

2.1.1 Global Mobile Phone Market

2.1.2 China Mobile Phone Market

2.2 Notebook Computer Market

2.3 Tablet PC Market

2.4 Server

2.4.1 Server Market

2.4.2 Server Industry

2.5 Enterprise SSD Market

3. Memory Industry

3.1 Global Memory Market

3.2 Segments

3.2.1 DRAM Supply & Demand

3.2.2 NAND

3.2.3 NOR Flash

3.3 Competitive Landscape

3.4 China Memory Market

4. Memory Vendors

4.1 Samsung

4.2 SK HYNIX

4.3 MICRON

4.4 Nanya Technology

4.6 Western Digital

4.7 Toshiba

4.8 MACRONIX

4.9 Winbond Electronics

4.10 INTEL

4.11 Yangtze Memory Technology Corp (YMTC)

4.12 CYPRESS

4.13 Gigadevice

4.14 Wuhan Xinxin Semiconductor Manufacturing Co.,Ltd.

Classification of Memory

Memory Industry Chain

Comparison between Various Types of Memory

Comparison between New Memory Technologies

Emerging NVM Time to Market by Application, 2015-2025E

Comparison of Emerging Memory and Established Memory

Global Mobile Phone Shipments, 2007-2018

Global 3G/4G Mobile Phone Shipments by Region, 2011-2018

Worldwide Smartphone Sales to End Users by Vendor in 2018

Worldwide Smartphone Sales to End Users by Operating System in 2018

Shipments of Top 10 Mobile Phone Vendors Worldwide, 2018

Mobile Phone Shipments in China, 2013-2018

Market Share of Major Smartphone Vendors in China, 2018

Market Share of Major 4G Mobile Phone Vendors in China, 2018

Notebook Computer Shipments, 2008-2018

Shipments of Major Notebook ODM Vendors Worldwide, 2010-2018

Global Tablet PC Shipments, 2011-2018

Shipments of Top 5 Tablet PC Vendors, 2018

Shipments, Market Share and Growth of Top 5 Tablet PC Vendors, 2018

Global Server Market Size, 2013-2018

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, 2018

Top 5 Corporate Family, Worldwide Server Systems Factory Revenue, 2018

Worldwide: Server Vendor Shipments, 2018

Worldwide: Server Vendor Revenue, 2018

EMEA Server Vendor Revenue, 2018

EMEA Server Shipment, 2018

Market Share of Server Brand Vendors Worldwide, 2018

Market Share of Server OEMs Worldwide, 2018

Supply Relationship between OEMs and Server Brand Vendors

Enterprise SSD Market Size, 2013-2018

Global Memory Market Size, 2017-2025E

Global Memory Market by Type, 2018

Automotive Memory Market Size, 2016-2025E

Automotive Memory Market by Technology, 2016-2025E

DRAM Industry Capex, 2013-2018

DRAM Oversupply Ratio, 2013-2018

DRAM Demand by Devices, 2013-2018

DRAM GB/System, 2013-2018

DRAM Oversupply Ratio, 2014-2018

Market Share of Branded DRAM Vendors, 2018

DRAM Prices, 2011-2018

Market Share of Mobile DRAM Vendors, 2018

NAND Industry Capex, 2008-2018

NAND Flash Prices, 2011-2018

Market Share of Branded NAND Vendors, 2018

Market Share of Major NorFlash Vendors, 2018

Market Share of Major NorFlash Vendors, 2018

Memory Vendor Rankings by Revenue, 2017-2018

Revenue and Operating Margin of Memory Design Companies

Operating Margin of Major Memory Vendors, 2017-2018

Revenue and Operating Margin of Samsung Memory Division, 2010-2018

Revenue of Samsung Memory Division by Product, 2010-2018

Revenue of Samsung Memory Division by Application, 2018

Samsung DRAM/NAND Operating Margin, 2010-2018

Samsung DRAM Shipments, 2012-2018

Samsung DRAM ASP, 2012-2018

Samsung DRAM Fab Input (12-inch Wafer), 2013-2018

Samsung NAND Shipments, 2012-2018

Samsung NAND ASP, 2012-2018

Samsung NAND Fab Input (12-inch Wafer), 2013-2018

Samsung System LSI Revenue vs Operating Margin, 2010-2018

SK Hynix Revenue vs Operating Margin, 2008-2018

SK Hynix EBITDA vs Net Margin, 2013-2018

SK Hynix Assets vs Liabilities, 2013-2018

SK Hynix Revenue Mix by Product, 2013-2018

SK Hynix Revenue Mix by Application, 2018

SK Hynix DRAM Shipments vs ASP, 2013-2018

SK Hynix NAND Shipments vs ASP, 2013-2018

Micron Revenue vs Operating Margin, FY2008-FY2018

Micron Revenue vs Net Income, FY2008-FY2018

Micron Revenue Mix by Segment, FY2012-FY2018

Micro Gross Margin by Segment, FY2012-FY2018

Micron Revenue Mix by Location, FY2012-FY2018

Micro Customers

Micron Roadmap

Framework of Nanya, Micron & Inotera

Nanya Revenue vs Gross Margin, 2008-2018

Nanya Revenue vs Gross Margin, 2013-2018

Nanya Mix by Application, 2013-2018

Nanya Mix by Application, 2017-2018

Nanya CAPEX, 2016-2018

Nanya Shipments, 2011-2018

Revenue vs Gross Margin of Western Digital, 2013-2018

Revenue Mix by Application of Western Digital, 2013-2018

Revenue by Location of Western Digital, 2013-2018

Macronix Organization

Revenue vs Gross Margin of Macronix, 2013-2018

Revenue by Segment of Macronix, 2013-2018

ROM Revenue Mix by Tech of Macronix, 2013-2018

NAND Shipments of Macronix, 2013-2018

Winbond Organization

Revenue vs Gross Margin of Winbond, 2013-2018

Revenue by Application of Winbond, 2013-2018

Revenue by Geometry of Winbond, 2013-2018

CAPEX of Winbond, 2013-2018

Revenue by Segment of Winbond, 2013-2018

Revenue vs Gross Margin of Intel, 2013-2018

Revenue by Segment of Intel, 2018

Customers of Intel, 2018

Revenue by Product of Intel, 2018

Revenue vs Operating Margin of Cypress, 2013-2018

Revenue by Business of Cypress, 2013-2018

Revenue by Region of Cypress, 2013-2018

GigaDevice Balance Sheet, 2016-2018

GigaDevice Revenue vs Operating Income, 2016-2018

GigaDevice Cash Flow, 2016-2018

GigaDevice Financial Indicators, 2016-2018

GigaDevice Customer Distribution, 2018

GigaDevice Supplier Distribution, 2018

Revenue by Segment, 2013-2018

Global and China Semiconductor Equipment Industry Report, 2019-2025

The semiconductor industry with high technical threshold is advancing speedily. Every generation of products requires unique processes and equipment. With progresses in semiconductor manufacturing pro...

Global and China IGBT Industry Report, 2019-2025

IGBT finds wide application in fields ranging from home appliances and digital products to aviation & aerospace and high-speed rails, so does in the emerging sectors like smart grid and new energy...

Global and China Memory Industry Report, 2019-2025

In 2018, global memory market was worth USD153.4 billion, surging by 23.7% from a year earlier thanks to rising prices as a result of robust demand from mobile phones and cloud services and a higher s...

China IGBT (Rail Transit/Electric Vehicle/Wind Power/Photovoltaic/Home Appliance) Industry Report, 2016-2020

An IGBT is a complex device with the Darlington configuration. Using GTR as the dominant component and MOSFET as the drive component, IGBTcombines the merits of BJT and MOSFET, such as low drive power...

China Semiconductor Industry Report, 2014-2015

The report covers the followings:1. Global Semiconductor Market and Industry; 2. China Semiconductor Market and Industry;3. Eleven Chinese IC Design Companies4. Five Chinese Foundries5. Four Chinese P...

Global and China Memory Industry Report, 2014-2015

Global and China Memory Industry Report, 2014-2015 covers the followings:1. Memory technology trends2. Memory market 3. Memory industry4. 19 typical memory industry chain vendors

...

Global and China Semiconductor Equipment Industry Report, 2013-2014

After two years of recession, the semiconductor equipment market is projected to achieve growth in 2014. In 2011, the semiconductor equipment market size hit a record high of USD43.532 billion, but it...

China Digital TV Transmitter Industry Report, 2013

According to the planning of the State Administration of Radio, Film and Television (SARFT), China in 2015 will shut down analog TV and complete the integral transition of cable TV from analog to digi...

Global and China Memory Industry Report, 2013

Global and China Memory Industry Report, 2013 consists of the following contents: Brief introduction to global semiconductor industry Market analysis of DRAM and NAND Major memory vendors Majo...

Global and China Passive Component Industry Report, 2012-2013

The report highlights the followings: 1. Brief Introduction to Passive Components; 2. Passive Component Industry & Market Segments-Capacitor, Inductor and Resistor; 3. Main Downst...

Global and China GaAs Industry Report, 2012-2013

Global and China GaAs Industry Report, 2012-2013 covers the followings: 1 Brief introduction to GaAs2 Industry overview of GaAs3 Downstream market of GaAs4 Analysis on mobile phone RF system 5 Study o...

Global and China Advanced Packaging Industry Report, 2012-2013

Global and China Advanced Packaging Industry Report, 2012-2013 covers the followings: 1. Global Semiconductor Industry Overview;2. IC Manufacturing Industry Overv...

Global and China Touch Screen (Panel) Industry Report, 2012-2013

Global and China Touch Screen (Panel) Industry Report, 2012-2013 covers the followings:

Touch Screen Market Size Trends of Small, Medium and Large-sized Touch Screens Touch Screen Downstream Market...

Global and China Mobile PC Casing (Enclosure) Industry Report, 2012-2013

The report covers the followings: 1. Global and Chinese PC markets 2. Global and China Mobile PC industry 3. Notebook and tablet PC casing industr...

Global and China PC Cable Assembly Industry Report, 2012-2013

Global and China PC Cable Assembly Industry Report, 2012-2013 covers the followings: 1. Global and China PC Market; 2. Global and China Mobile PC Market;3. PC Cable Assembly Industry;4. 15 Major PC Ca...

Global and China Flexible Printed Circuit Board (FPCB) Industry Report, 2012

Global and China Flexible Printed Circuit Board (FPCB) Industry Report, 2012 includes the following contents:

1. Profile of FPCB2. Overview of FPCB Market and Industry3. Analysis of 22 Major FPCB Ma...

Global and China OLED Industry Report, 2012

Promoted by the display giants headed by Samsung and LG, OLED industry is still in the stage of steady development. In 2011, the OLED output value worldwide approximated USD3.3 billion, with year-on-y...

China Navigation Equipment Industry Report, 2012-2014

After forty years of development, the global satellite navigation system has developed into a “one plus three” pattern. And the “one” refers to GPS made in the USA, and the three refer to Chinese, Rus...